These equities are in for the long haul

Infrastructure assets are back in favour. These ‘long duration’ assets are critical for a functioning society, and with the market anticipating more US Federal Reserve (Fed) rate cuts, demand for global listed infrastructure has increased.

Infrastructure consists of a diverse range of assets including transport networks such as roads, bridges, railways, airports, canals and ports. It also includes other networks and facilities necessary for sustaining society such as utilities, towers and water. It has traditionally held up well during economic downturns. As a relative defensive asset class, these companies are generally monopolies with inelastic demand.

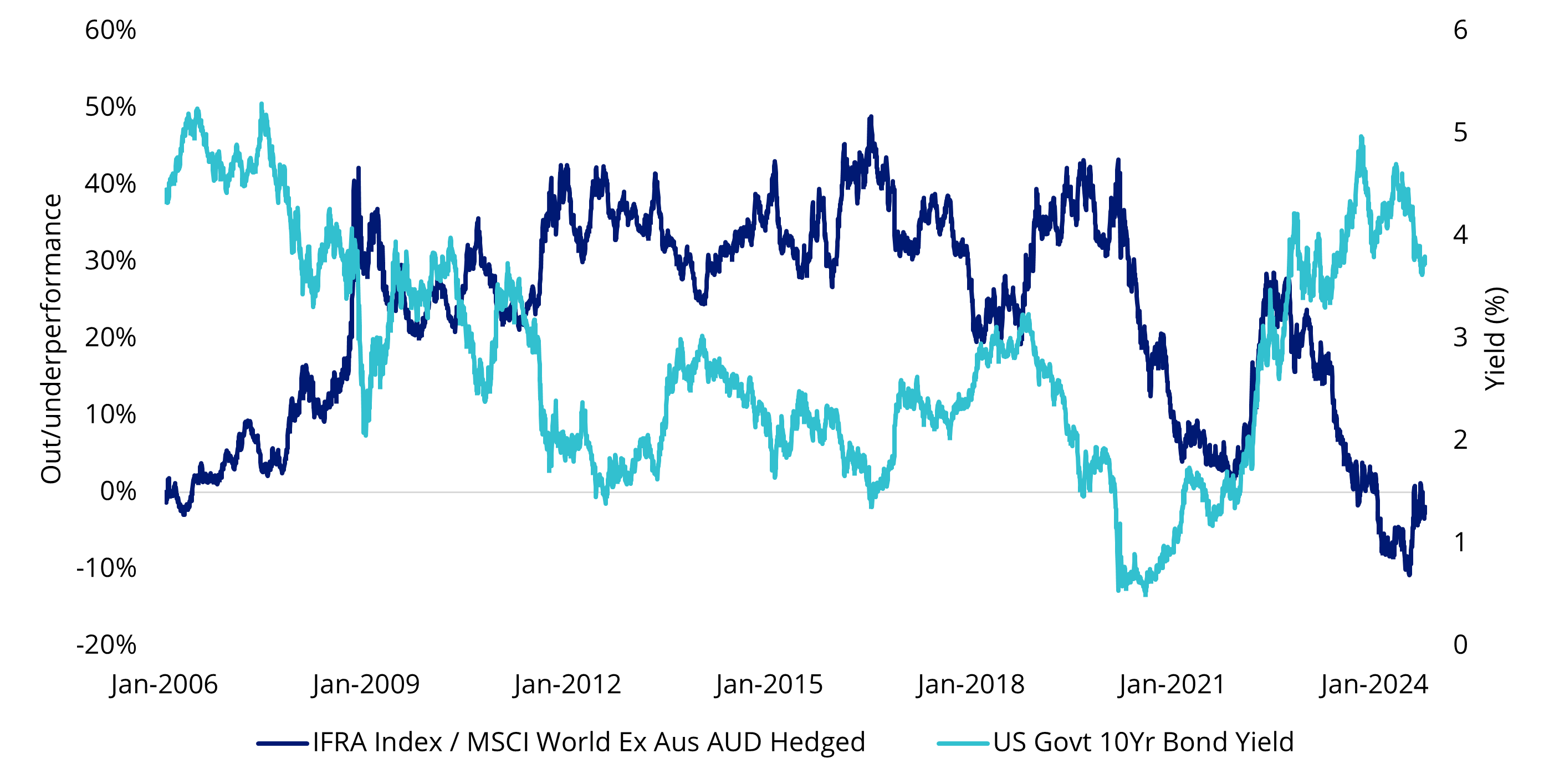

Global listed infrastructure companies have historically outperformed the broader market in a lower interest rate environment. You can see infrastructure has started to outperform as the US Government 10 year bond yield has fallen.

Chart 1: Relative performance for infrastructure assets compared to the market

Source: Bloomberg, VanEck as at 30 September 2024. Infrastructure is FTSE Developed Core Infrastructure 50/50 Hedged into AUD index. You cannot invest in an index. Past performance is not indicative of future performance.

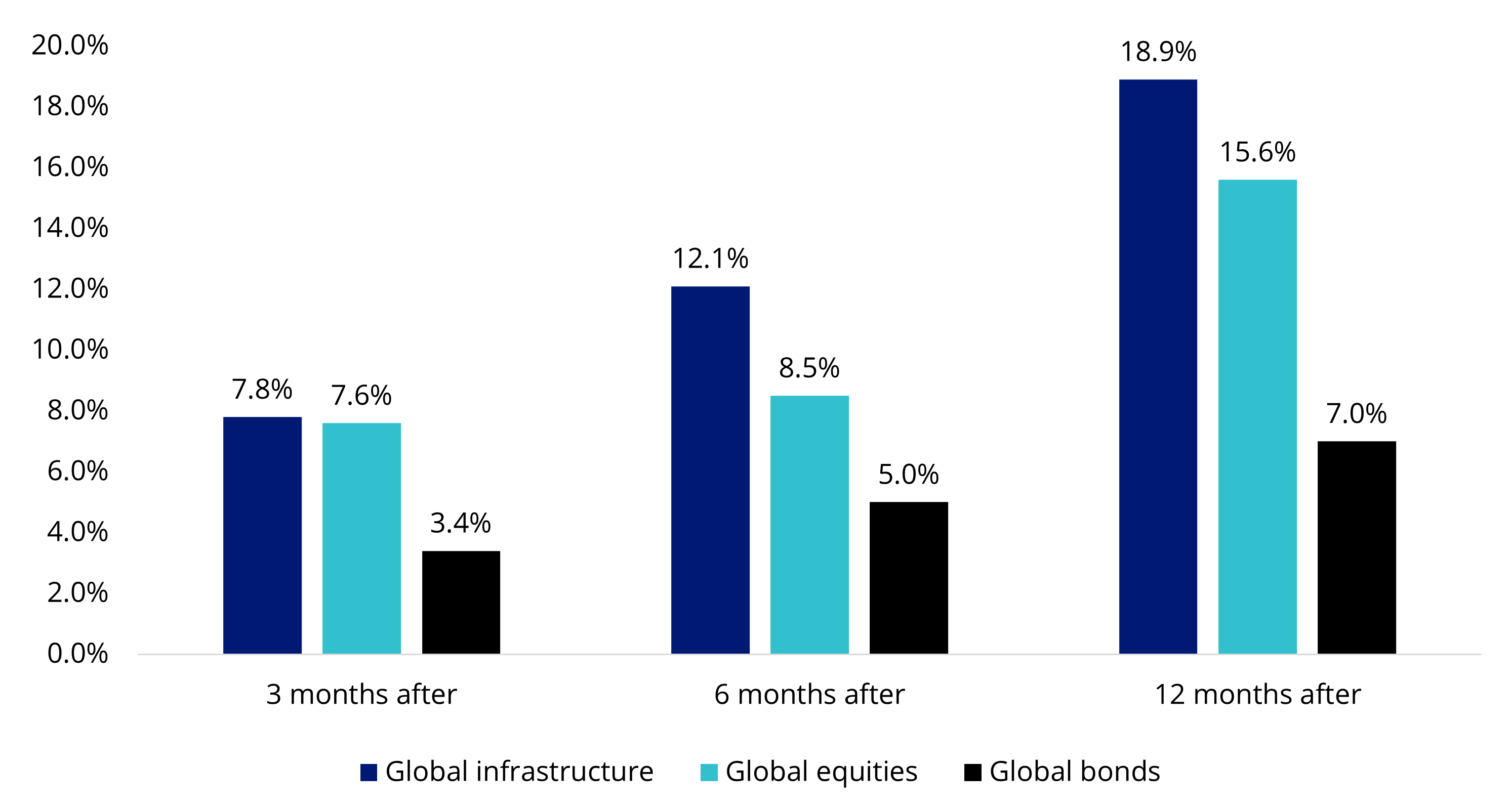

Analysing historical data, infrastructure has historically outperformed after previous Fed rate cuts.

Chart 2: US Federal Reserve monetary policy impact

Source: CBRE Investment Management. Historical average performance is calculated before and after dates when the Fed signaled a pause in rate hikes (28 February 1995, 31 May 2000, 30 June 2006, 31 December 2018 and 31 July 2023. Global infrastructure is UBS Global Infrastructure & Utilities 50/50 Index to 31 December 2009, from that date it is the FTSE DevelopedCore Infrastructure 50/50 Index. Global equities is MSCI World Index, Global bonds is Bloomberg Barclays Global Bond Aggregate Index. Past performance is not indicative of future performance.

Beyond the interest rate environment, we think there are positive fundamental and structural reasons infrastructure has a positive outlook into the rest of 2024.

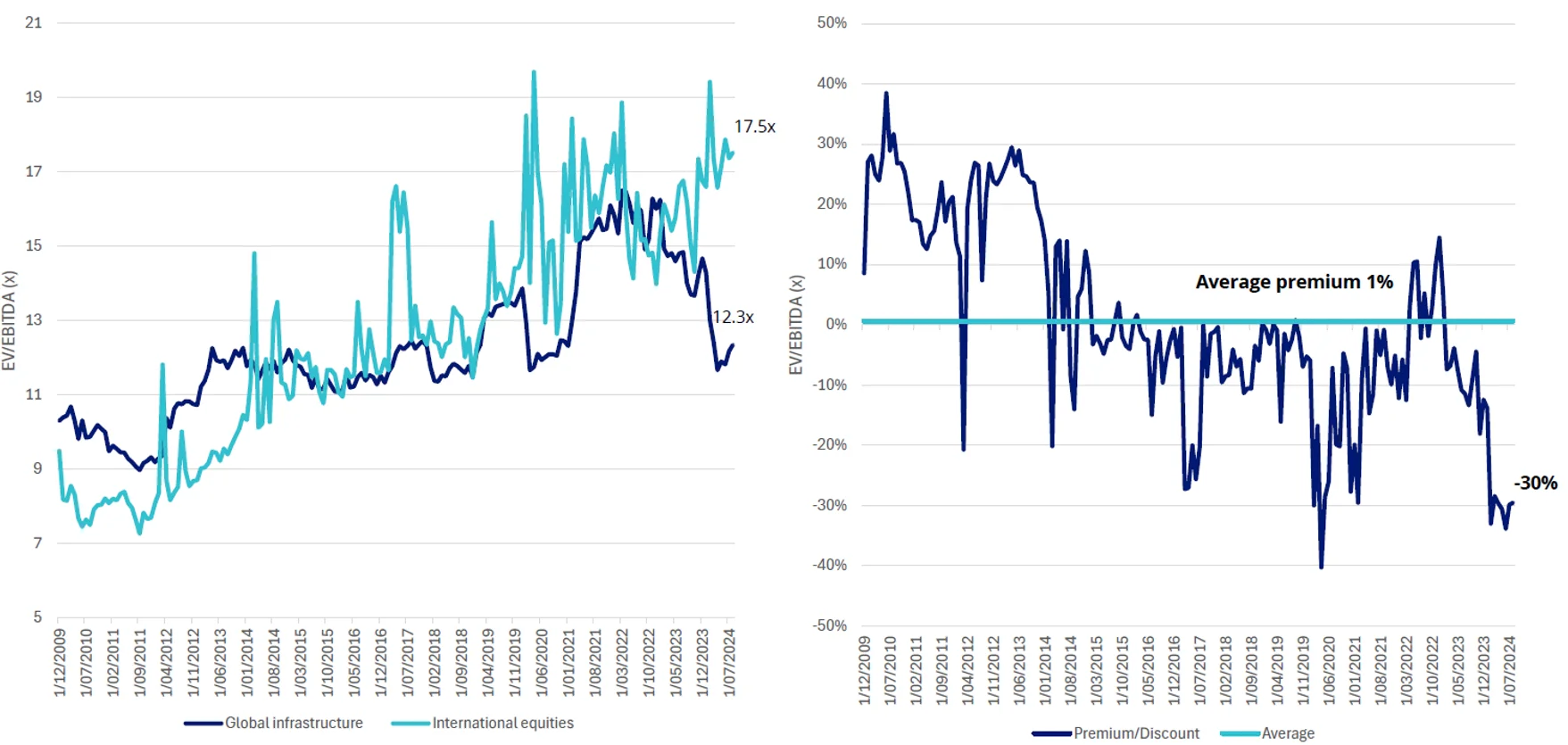

Fundamentals: Valuation and dividend

In terms of fundamentals, valuation metrics are currently favourable relative to international equities and compared to long-term averages. Many global listed infrastructure companies are trading at levels not observed since the global financial crisis.

Chart 3 and 4: EV/EBITDA Infrastructure versus international equities

Source: VanEck, FTSE, as at 31 August 2024. Global infrastructure is FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index, International equities is MSCI World ex Australia 100% Hedged to AUD Index. Past performance is not indicative of future performance.

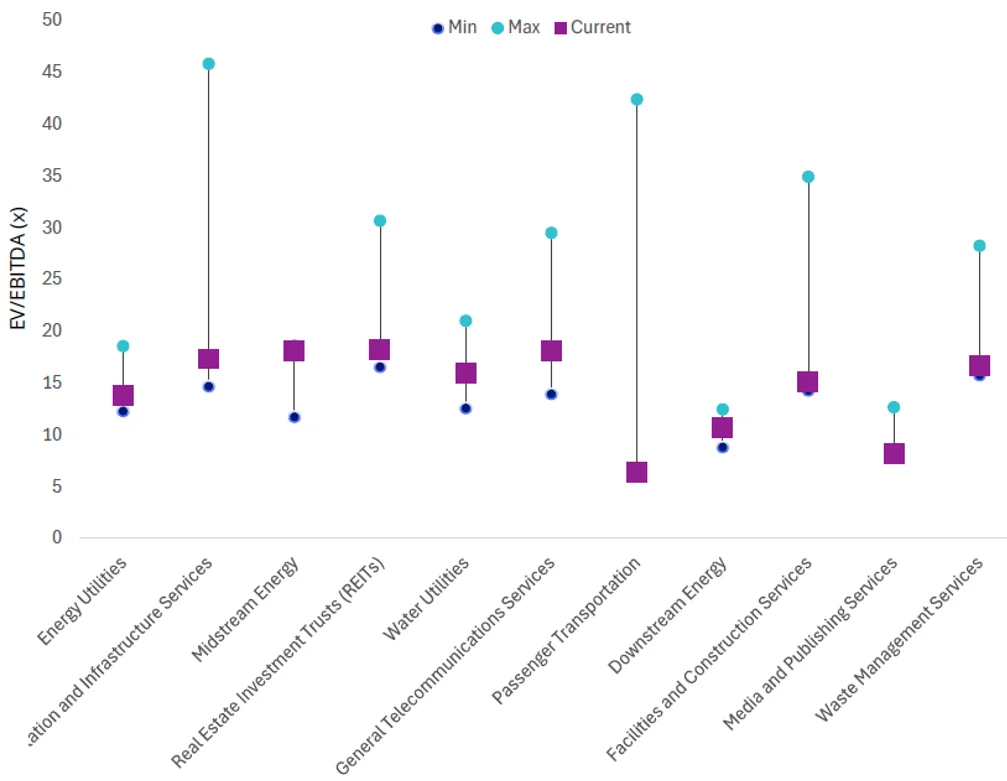

Chart 5: Infrastructure subsector EV/EBITDA

Source: VanEck, FTSE, Sub-sectors GICS level II, FactSet as at 31 August 2024.

Income from infrastructure assets is typically more stable compared to equities, as the cashflow is often inflation-linked and mandated by government regulation. Historically, infrastructure yields have outperformed traditional defensive assets such as bonds. Past performance is not indicative of future performance.

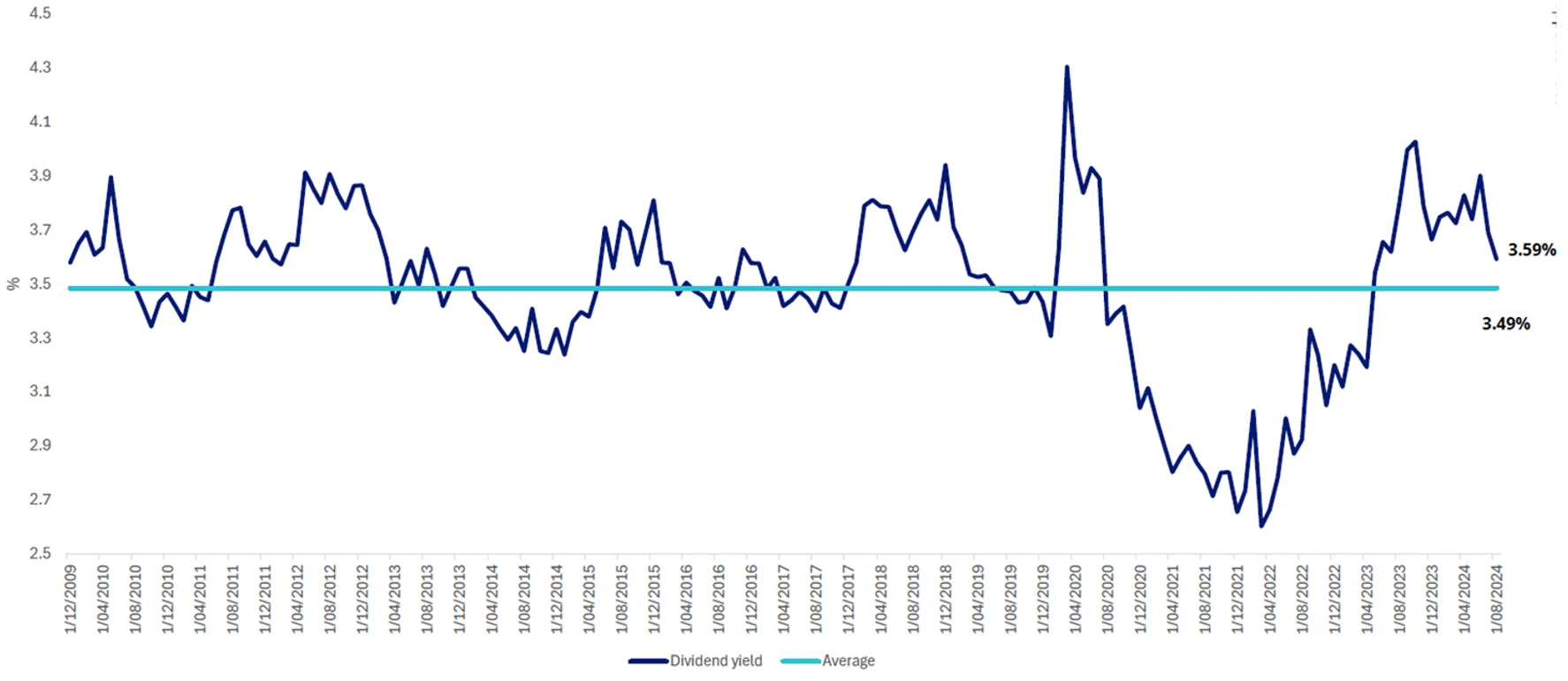

Chart 6: Dividend yield currently above long-term average

Source: VanEck. Dividend yield is not a guarantee of future dividends by IFRA.

Structural tailwinds

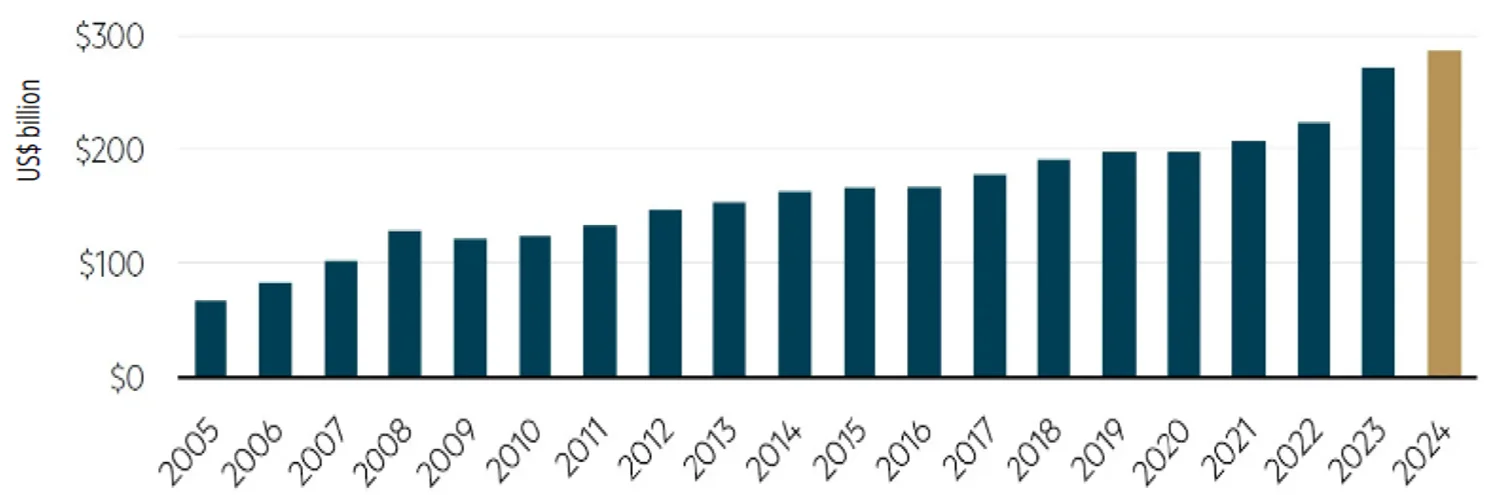

Mounting public debt in developed countries is fostering an environment that could see listed infrastructure equities thrive as governments ‘tighten their belts’ and private infrastructure companies gain greater investment opportunities off the public sector. Capex in 2024 is forecasted to reach US$296 billion including unlisted funds by asset owners and operators.

Chart 7: Total capex for global listed infrastructure

Source: Bloomberg, MBA GLI calculations as at 31 December 2023. Excludes M&A activity.

Earnings growth within global listed infrastructure is likely to be underpinned by several structural growth themes over the coming years, especially utilities benefiting from the energy transition, with significant infrastructure investment required to meet emission reduction goals by 20301.

Diversification is key

Over the past 20 years, infrastructure’s importance, as an asset class, has been driven by its use by large institutions attracted to its long-term risk-return profile. While we believe that long-run return expectations for infrastructure are now attractive, this environment still has significant risks for individual assets. As such, being diversified across a range of underlying sectors and stocks is key.

The VanEck FTSE Global Infrastructure (AUD Hedged) ETF (IFRA) gives investors exposure to a diversified portfolio of 133 global listed infrastructure securities. IFRA tracks the FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index which has sector and stock capping that improves diversification and reduces concentration risk at both a sector and stock level. It is also used as the global infrastructure benchmark by industry participants including consultants and fund managers.

Stable income advantage

IFRA is hedged into Australian dollars to limit the impact that currency movements could have on income. IFRA, unlike many other globally listed infrastructure funds, also makes beneficial choices under the tax rules, including adopting the ‘Taxation of Financial Arrangements’ (ToFA) currency hedging rules. These tax choices enable smooth income payments to be maintained over time.

Key risks: An investment in the ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, currency hedging, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

Source

Published: 10 October 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

Last week, Sydney Airports announced its first half results increasing its dividend to 34.5c following growth in retail (+14.3% yoy), airport traffic (+7.7% yoy) and parking and ground revenue (+2.2% yoy). The current interest rate and political environment is promising for infrastructure assets, but while Sydney Airport is good at what it does investors should diversify on geography, assets and management teams.