Power up your portfolio

While assessing the global universe of investment opportunities, one of the asset classes most overlooked, and most uncorrelated with other sectors, has been listed global infrastructure securities.

While assessing the global universe of investment opportunities, one of the asset classes most overlooked, and most uncorrelated with other sectors, has been listed global infrastructure securities.

With a ‘lower for longer’ interest rate environment and increased volatility in equity markets, the pursuit of income and portfolio defence is now far more pronounced. Infrastructure is at the forefront of many institutional investors’ enviable returns and their basis for including infrastructure in a portfolio is straight forward:

- infrastructure assets have offered stable income due to steady cash flows often linked to inflation and protected by government regulation;

- returns have been uncorrelated to mainstream asset classes; and

- infrastructure offers relative defence during periods of market stress.

With market participants expecting low rates and a low growth environment, coupled with greater uncertainty about capital markets’ future returns, now could be the time to ‘power-up’ your portfolios and allocate to listed infrastructure securities globally.

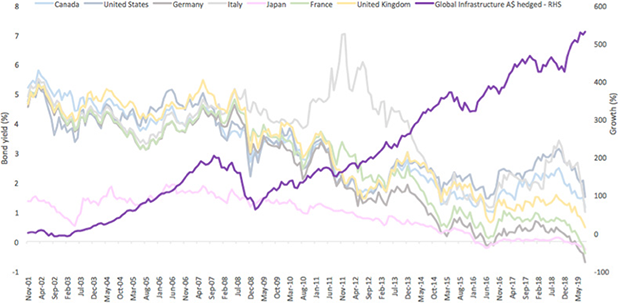

Lower for longer – G7 10 year yields over time

Rates around the world continue to hover around historic all-time lows. The outlook, if you believe the bond market is a good indicator, is not good. With bond yields tumbling here and offshore, investors are flocking to defensive assets anticipating a global economic slowdown. However bonds are not providing income to the same level investors have been used to. This is forcing investors to consider other asset classes with higher risk profiles. Infrastructure is one of these assets classes but it is one of the most overlooked by investors. In the current environment, compared to bonds, infrastructure offers higher income but with increased volatility, or risk, while relative to equities it has offered income with less volatility. It is also a great diversifier as it is uncorrelated with most other asset classes.

G7 nations – 10 year bong yields

Source: Bloomberg, Morningstar, November 2001 to August 2019. Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance. Global Listed Infrastructure index is FTSE Global Core Infrastructure 50/50 Index Hedged to AUD.

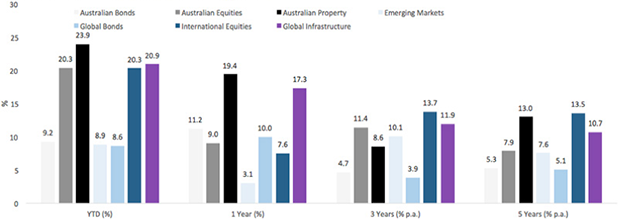

Many characterise infrastructure as a bond proxy and therefore defensive relative to equities but “there is more than meets the eye,” and it’s worthwhile considering the returns relative to volatility outlined below.

If you look at the numbers, global Infrastructure has returned over 10% p.a. for the last five years. In that time it has provided investors with growth above bonds and Australian equities, and just behind international equities. In the last 12 months it has outperformed both Australian and international equities.

Cumulative returns of asset classes to 31 August 2019

Source Morningstar Direct, All returns in Australian dollars. Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance. Indices used: Australian Bonds – Bloomberg AusBond Composite 0+ years; Australian Equities – S&P/ASX 200; Emerging Markets – MSCI Emerging Markets Index; Global Bonds – Barclays Global Aggregate Bond Index A$ Hedged; International Equities – MSCI World ex Australia Index; Global Infrastructure – FTSE Developed Core Infrastructure 50/50 Index Hedged into AUD.

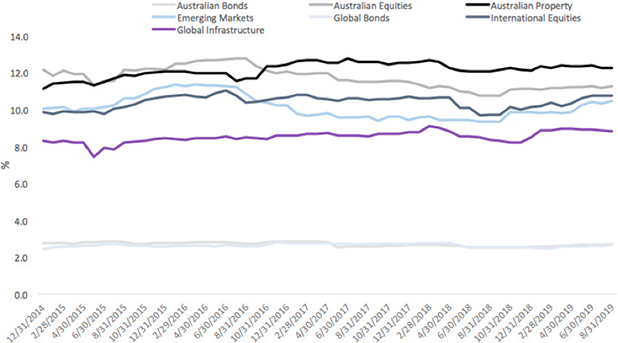

The chart below shows that over five year rolling periods covering the last ten years infrastructure has had significantly more volatility than bonds but has been less volatile than equities over the long term.

Five year rolling standard deviation of returns of asset classes

Source Morningstar Direct, 2009 to 2019. All returns in Australian dollars. Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

Indices used: Australian Bonds – Bloomberg AusBond Composite 0+ years; Australian Equities – S&P/ASX 200; Emerging Markets – MSCI Emerging Markets Index; Global Bonds – Barclays Global Aggregate Bond Index A$ Hedged; International Equities – MSCI World ex Australia Index; Global Infrastructure – FTSE Developed Core Infrastructure 50/50 Index Hedged into AUD

One trade access to 144 Global Listed Infrastructure securities

VanEck provides investors with the opportunity to access a portfolio of 144 global infrastructure securities simply via a single trade on ASX in the VanEck Vectors FTSE Global Infrastructure (Hedged) ETF (ASX: IFRA). IFRA was the first global infrastructure ETF on ASX.

Discover more about property and infrastructure investing.

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of the VanEck Vectors FTSE Global Infrastructure (Hedged) ETF (‘Fund’). This is general information only and not financial advice. It is intended for use by financial services professionals only. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision in relation to the Fund, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the Fund.

IFRA invests in international markets. An investment in IFRA has specific and heightened risks that are in addition to the typical risks associated with investing in the Australian market. These include currency/foreign exchange fluctuations, ASX trading time differences and changes in foreign regulatory and tax regulations.

The Fund is not in any way sponsored, endorsed, sold or promoted by FTSE International Limited or the London Stock Exchange Group companies (‘LSEG’) (together the ‘Licensor Parties’) and none of the Licensor Parties make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to (i) the results to be obtained from the use of the FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index (with net dividends reinvested) (‘Index’) upon which the Fund is based, (ii) the figure at which the Index is said to stand at any particular time on any particular day or otherwise, or (iii) the suitability of the Index for the purpose to which it is being put in connection with the Fund. None of the Licensor Parties have provided or will provide any financial or investment advice or recommendation in relation to the Reference Index to VanEck or to its clients. The Reference Index is calculated by FTSE or its agent. None of the Licensor Parties shall be (a) liable (whether in negligence or otherwise) to any person for any error in the Reference Index or (b) under any obligation to advise any person of any error therein. All rights in the Reference Index vest in FTSE. “FTSE®” is a trade mark of LSEG and is used by FTSE and VanEck under licence.

Published: 25 September 2019

Last week, Sydney Airports announced its first half results increasing its dividend to 34.5c following growth in retail (+14.3% yoy), airport traffic (+7.7% yoy) and parking and ground revenue (+2.2% yoy). The current interest rate and political environment is promising for infrastructure assets, but while Sydney Airport is good at what it does investors should diversify on geography, assets and management teams.