Expert’s choice: You can invest like the Future Fund - Part 1

Australia’s Future Fund is among the top 20 largest sovereign wealth funds globally. It was established in 2006 in response to our aging population and long-term pressure on the Commonwealth's finances. Like the biggest superannuation funds in Australia, the Future Fund is a large institutional investor, so it often has access to asset classes and investment opportunities beyond the reach of everyday investors. One asset class it invests in is infrastructure, but this is an asset class that is accessible to Australian investors too.

Australia’s Future Fund is among the top 20 largest sovereign wealth funds globally. It was established in 2006 in response to our aging population and long-term pressure on the Commonwealth's finances. Like the biggest superannuation funds in Australia, the Future Fund is a large institutional investor, so it often has access to asset classes and investment opportunities beyond the reach of everyday investors. One asset class it invests in is infrastructure, but this is an asset class that is accessible to Australian investors too.

According to the Online Etymology Dictionary, the word ‘infrastructure’ has been used in English since 1887 and is derived from the addition of the Latin prefix ’infra’, meaning ’below’, to ’structure’. The European Union says that Infrastructure is the backbone of development and social welfare. Roads and railways allow workers and goods to move faster and enable people to get access to public services; telecommunications allow them to communicate and learn; water supply systems enable drinking water and sanitation.

Throughout history, infrastructure has been the foundation of economic growth and the complexities and demand for infrastructure is increasing. Since the industrial revolution humans have migrated from rural to urban areas. Our population is growing fast, especially in cities. According to the UN in 1979 there were only three cities with a population over 10 million, in 2014 that number had grown to 23, in 2020 there were 34.

Demand for mobile telecommunications, lightning quick internet speeds, airports and transport continues to grow.

These changes as well as dynamic regulatory and commercial environments have made it difficult for governments to match the demands of their constituents. This has led to the privatisation of public assets and the necessity for private enterprise to create infrastructure which in turn has led to the development and growth of infrastructure investments. These investments have attracted institutional investors like Australia’s Future Fund.

At 31 March 2022, Australia’s sovereign wealth fund was valued at $201 billion. It has returned an impressive 10.0% per annum over the last 10 years, against a target annual benchmark return of 6.4%.

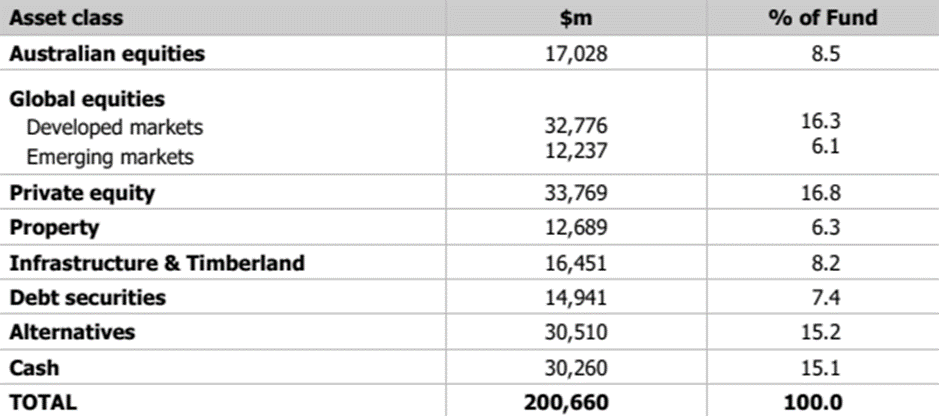

Infrastructure is around 8% of the Future Funds’ asset allocation.

Figure 1: Future Fund Asset allocation as at 31 March 2022

Source: Future Fund, portfolio update to 31 March 2022

Institutional investors like the future fund are attracted to infrastructure because it benefits from a number of key investment advantages being:

- High barriers to entry: There are limited places where a rail can be laid or a bridge can be built. The benefit of low competition, even if pricing is regulated, is significant as it results in a more stable income stream for investors compared to the earnings volatility of other equity investments.

- Protection from inflation: Unlike other income generating investments such as fixed income, investors in infrastructure securities also benefit from the link to inflation which is derived from:

- Regulated income which has annual CPI-based adjustments, as is often the case with airports or toll roads, or

- CPI-based increases on consumer prices, such as with utility companies.

- Low correlation to other asset classes: Infrastructure securities have demonstrated a low correlation to other asset classes providing diversification benefits for investors wishing to complement their existing asset classes. The table below shows the correlation of global infrastructure compared to other asset classes. In the table, a 1 is perfectly correlated. The lower the number, the lower the correlation.

Figure 2 – Correlation of infrastructure to other asset classes

|

Asset class |

Global Infrastructure |

Australian Equities |

International Equities |

Australian Property |

Australian Bonds |

Global Bonds |

|

Global Infrastructure |

1.00 |

|||||

|

Australian Equities |

0.68 |

1.00 |

||||

|

International Equities |

0.47 |

0.56 |

1.00 |

|||

|

Australian Property |

0.71 |

0.81 |

0.49 |

1.00 |

||

|

Australian Bonds |

0.15 |

0.09 |

0.22 |

0.32 |

1.00 |

|

|

Global Bonds |

0.40 |

0.24 |

0.14 |

0.46 |

0.74 |

1.00 |

Source Morningstar Direct, Ten year correlation 1 July 2012 – 30 June 2022. Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

Indices used Global Bonds – Barclays Global Aggregate Bond Index A$ Hedged, Australian Bonds - Bloomberg AusBond Composite 0+ years, Global Infrastructure – FTSE Index, International Equities – MSCI World ex Australia Index , Australian Equities – S&P/ASX 200 Accumulation Index; Australian property – S&P/ASX 200 A-REIT Index.

What many investors do not realise is that ASX investors can invest like the Future Fund and also access a diversified infrastructure portfolio via an ETF. The first infrastructure ETF on ASX was the VanEck FTSE Global Infrastructure (Hedged) ETF (ASX code: IFRA). It invests in global listed infrastructure securities around the world, with the additional benefits of ETFs which are transparency, liquidity and cost effectiveness.

The global listed infrastructure securities that are included in IFRA encompass the builders of roads, railways and bridges, toll road operators, telecommunication providers, satellite operators, companies involved in the storage and transportation of oil and gas reserves and airport operators to name just a few.

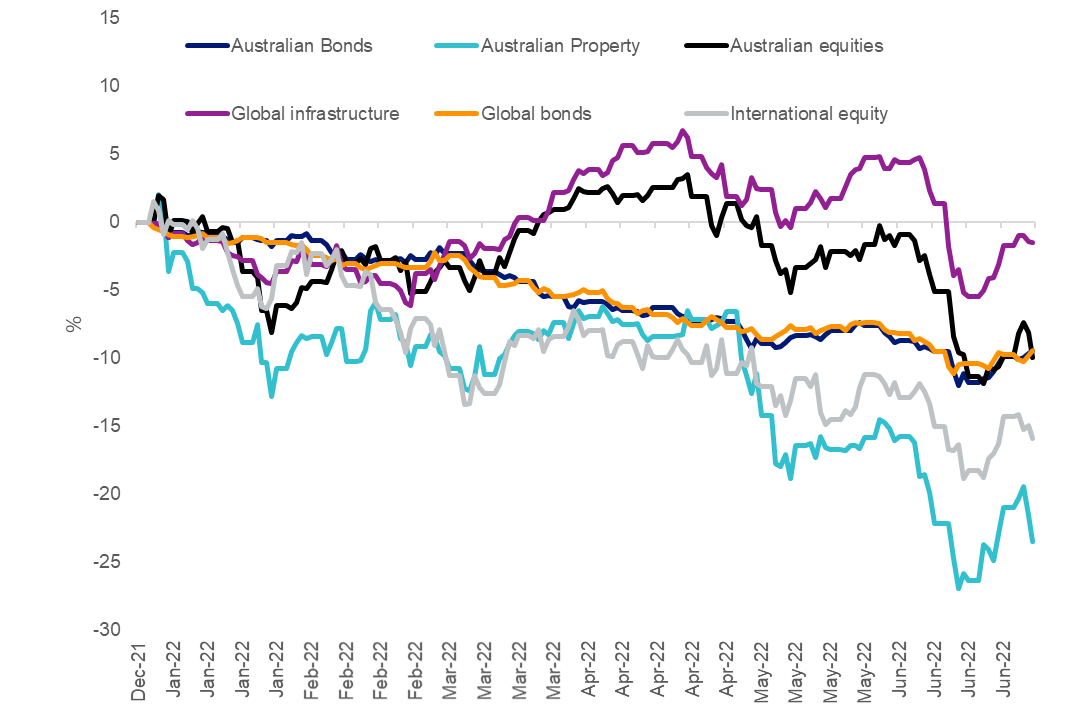

Infrastructure, as represented by its index FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index has been one of the better performing asset classes so far in 2022.

Figure 3: 2022 performance year-to- date. 1 January 2022 to 30 June 2022

Source Morningstar Direct, Results are calculated daily and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance. For IFRA performance click here.

Indices used Global Bonds – Barclays Global Aggregate Bond Index A$ Hedged, Australian Bonds - Bloomberg AusBond Composite 0+ years, Global Infrastructure – FTSE Index, International Equities – MSCI World ex Australia Index , Australian Equities – S&P/ASX 200 Accumulation Index; Australian property – S&P/ASX 200 A-REIT Index.

This year, infrastructure has benefitted from the reopening of global economies following pandemic lockdowns. As activity returns to pre-pandemic levels, demand increases for our airports, roads and railways and the recent passenger and traffic rebound has helped drive the 2022 performance of infrastructure assets.

What has also helped infrastructure assets so far in 2022 is high inflation. Infrastructure assets tend to be less impacted by rising costs as they are generally services with inelastic demand, we will always demand electricity to power our homes. This increases their pricing power and ability to maintain earnings, as they are able to pass on any increased costs that are arising from soaring commodity prices, labour costs and supply chain disruptions. Not only that, many infrastructure revenues are linked to inflation. You may have noticed this yourself with tolls increasing on motorways.

An additional benefit of IFRA is how it utilises tax rules to smooth income, with income being one of the reasons many investors consider global listed infrastructure. Not many fund managers utilise this strategy and are unable to pay income every period, consistently. We discuss this here. IFRA has maintained a steady quarterly income since inception.

IFRA tracks the FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index and provides investors with access to a portfolio of 135 of the world’s largest infrastructure securities in a single trade on ASX.

Key risks

IFRA invests in international markets. An investment in IFRA has specific and heightened risks that are in addition to the typical risks associated with investing in the Australian market. These include currency risks from foreign exchange fluctuations, ASX trading time differences and changes in foreign laws and regulations including taxation.

As always, if you are considering an investment in infrastructure, we recommend that you speak to your financial adviser or stock broker.

For further information you can contact us at +61 2 8038 3300.

Published: 13 July 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

The Fund is not in any way sponsored, endorsed, sold or promoted by FTSE International Limited or the London Stock Exchange Group companies (‘LSEG’) (together the ‘Licensor Parties’) and none of the Licensor Parties make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to (i) the results to be obtained from the use of the FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index (with net dividends reinvested) (‘Index’) upon which the Fund is based, (ii) the figure at which the Index is said to stand at any particular time on any particular day or otherwise, or (iii) the suitability of the Index for the purpose to which it is being put in connection with the Fund. None of the Licensor Parties have provided or will provide any financial or investment advice or recommendation in relation to the Reference Index to VanEck or to its clients. The Reference Index is calculated by FTSE or its agent. None of the Licensor Parties shall be (a) liable (whether in negligence or otherwise) to any person for any error in the Reference Index or (b) under any obligation to advise any person of any error therein. All rights in the Reference Index vest in FTSE. “FTSE®” is a trade mark of LSEG and is used by FTSE and VanEck under licence.

Last week, Sydney Airports announced its first half results increasing its dividend to 34.5c following growth in retail (+14.3% yoy), airport traffic (+7.7% yoy) and parking and ground revenue (+2.2% yoy). The current interest rate and political environment is promising for infrastructure assets, but while Sydney Airport is good at what it does investors should diversify on geography, assets and management teams.