From strength to strength: The investment approach growing

The proliferation of smart beta ETFs in recent years has given passive investors a powerful choice, now they can achieve the best of both active and passive worlds: active outcomes for lower fees and with full transparency.

‘Smart Beta’ is the term given to ETFs which track an index that differs from the traditional market capitalisation approach of selecting shares, bonds or other assets.

The common thread among these products is that they seek to either improve their return profile or alter the risk profile relative to traditional market benchmarks. That is, smart beta ETFs take a “smarter” and more considered approach to what goes into the fund other than just the size of the company.

In 2016 there were 31 smart beta ETFs on ASX, today there are 58, which is an increase of almost 100 per cent. The trend reflects a broader global movement, with over 1,384 smart beta products offered worldwide.

And VanEck’s most recent smart beta survey points to the trend continuing.

Now in its eighth year, VanEck's smart beta survey was conducted in July and August 2023 among Australian financial professionals. We believe the survey is the largest of its kind worldwide. This year, 673 financial professionals working in an advisory capacity in Australia responded. One result was clear, financial advisers are increasingly turning away from active management and using smart beta as an alternative for improved control of portfolio outcomes, increased performance and lower costs.

Performance and diversification: the key drawcards

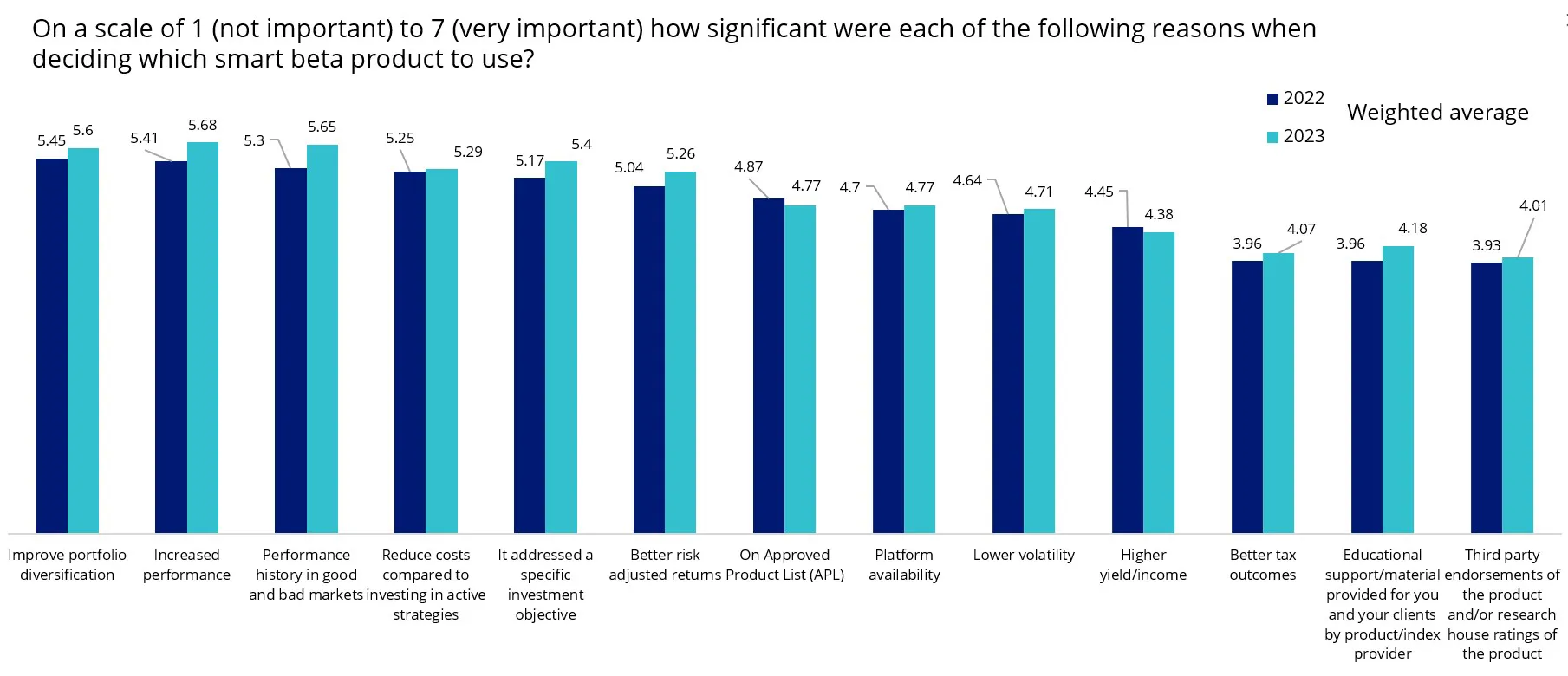

Diversification and strong performance are the major motivating factors for financial professionals when selecting smart beta strategies to use in portfolio construction. It seems investors and their advisers have come to the realisation that many actively managed funds underperform their benchmarks while continuing to charge higher fees. Savvy investors are shifting to smart beta to seek potential targeted performance outcomes, for lower fees. VanEck’s smart beta survey indicates among the motivating reasons to use smart beta are improved performance, portfolio diversification and lower costs.

Exhibit 1: Performance and diversifications driving decisions, above costs

Source: VanEck Eighth Annual Smart Beta Survey

International and Australian equities

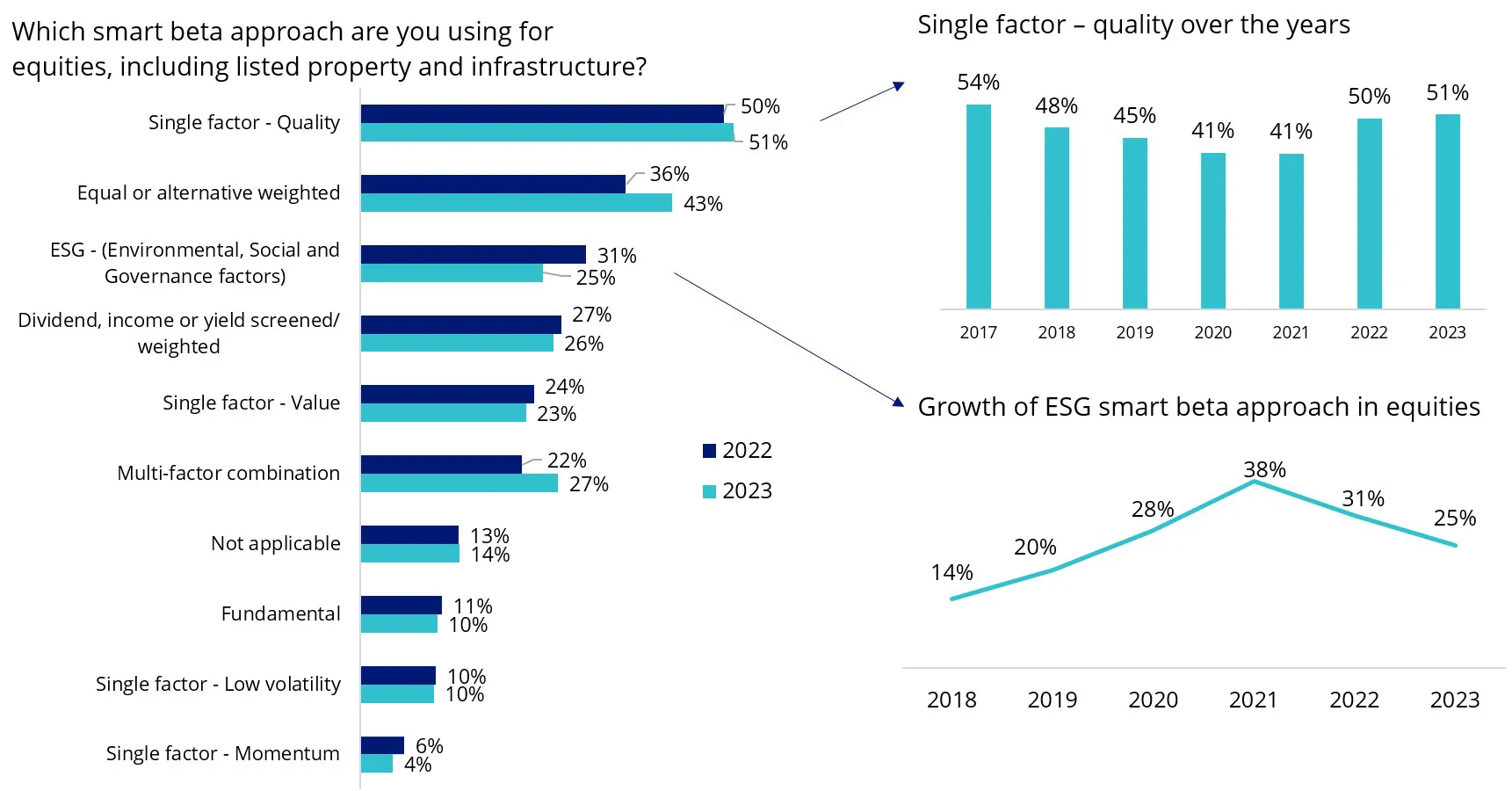

Most financial professionals use smart beta ETFs for international equities (71 per cent) and Australian equities (81 per cent) exposure. 51 per cent of advisers said they are currently using a single factor quality smart beta ETF approach, the second most popular approach was equal weighting, and ESG came in third. ESG’s popularity over the past two years has fallen, which could be due to increased regulatory scrutiny of ESG funds.

Moreover over 46 per cent of financial professionals are currently using two or three smart beta strategies, an increase from 42 per cent last year. We expect this number to continue to rise with the survey finding 1 in 2 of those financial professionals currently using smart beta are considering an additional allocation.

Exhibit 2: Single factor smart beta approaches lead in equities

Source: VanEck Eighth Annual Smart Beta Survey

High levels of satisfaction

The survey also reveals very high levels of satisfaction among smart beta users, with almost 99 per cent of advisers using smart beta strategies indicating they are satisfied with their smart beta investments. What is interesting is that following a difficult 2022, the number of advisers indicating they are either extremely satisfied or very satisfied increased in the 2023 survey compared to the year prior.

Smart beta taking over from active management share

The VanEck survey, we think, provides further evidence that active management is being disrupted.

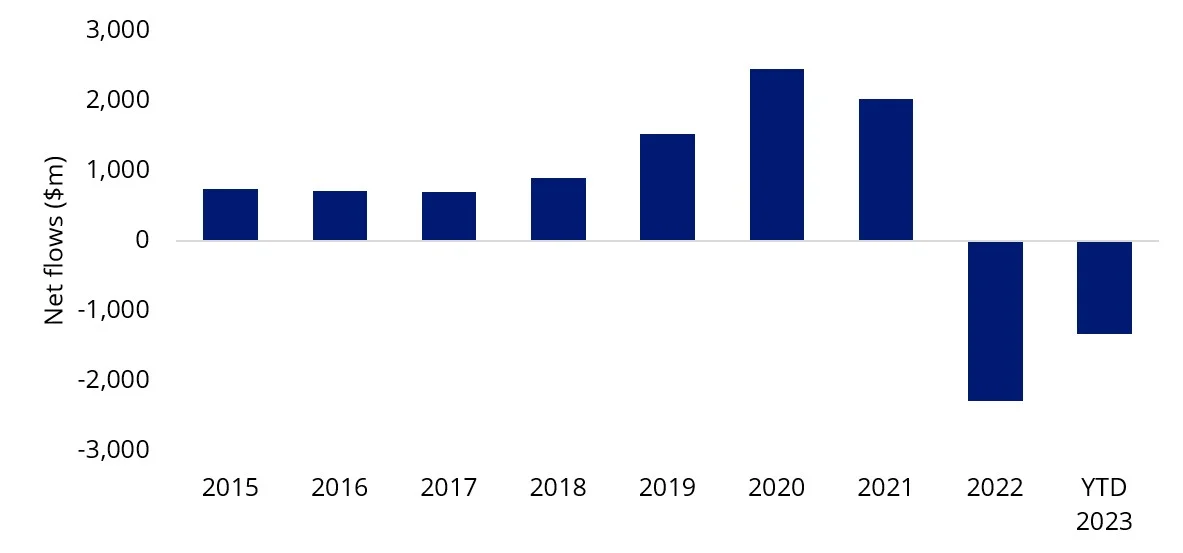

Additionally, if we consider active ETFs as a proxy for active management, net flows into active products on ASX have been negative over the past two years.

Active fund managers, lured by the rise of ETFs and products listed on exchange have been listing their strategies on the Australian exchange. Since 2015, the number of active ETFs has grown from just 6 to 90. Despite this growth in product offerings by active managers, their popularity has been dwarfed by the uptake of passive ETFs, which includes smart beta.

Exhibit 3: Active exchange traded product market – Net flows ($m)

Source: ASX

By way of contrast, the proportion of net flows going into smart beta strategies rose to 31per cent as at 31 August 2023, up from 26.2per cent a year ago, with that gain outpacing both active and passive market capitalisation strategies. Smart beta strategies now make up 16.6per cent of the total Australian Exchange Traded Product industry, up 15.2per cent from the prior year, again outpacing growth in active and market capitalisation strategies.

Published: 07 October 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.