Gold reaching new highs

Gold crossed the important US$2,000 level and closed November at US$2,036.41 per ounce. Review our latest insights on gold and gold companies.

Gold is being supported by expectations that the Federal Reserve (Fed) may soon start to cut rates, with markets implying a more than 50% chance of a rate reduction in March 2024, and a 68% chance of a cut in May 2024. Gold is also benefiting from continued safe haven buying as heightened global geopolitical risk persists.

After underperforming gold significantly in October, gold equities did what we expected them to do in November. The NYSE Arca Gold Miners Index was up 6.28% during the month, narrowing the valuation gap against the metal.

We have been calling attention to the low valuation metrics of the gold mining sector at present, both historically for the industry and relative to gold. We contrast these depressed market valuations and negative sentiment towards the sector, with gold companies that, as a group, financially and operationally are in good health today. We also have been highlighting the companies’ disciplined approach to growth, with a focus on value creation by optimising their portfolios, reducing costs, increasing mine lives, and finding and developing new deposits, all while maximising returns for stakeholders.

At around US$1,935 per ounce, the average gold price this year is the highest ever annual average. Gold companies on average are producing gold at all-in sustaining costs of around US$1,300 per ounce. While high inflation hit margins these last couple of years, costs appear to be under control. Gold companies are generating a lot of free cash flow. Yet, they remain disciplined, unwilling to chase production or reserve growth at any cost, reflected in muted M&A activity in the sector. We think this approach should lead to regaining market confidence and interest in the sector, and improved share price performance for gold mining companies.

Many traditional M&A activities have been replaced with creative transactions that transform companies to become better businesses. For example, we recently met with the management of one of the largest gold producers in the world, AngloGold Ashanti (3.5% of GDX). AngloGold produces about 2.5 million ounces of gold annually. For decades, it has traded at a discount relative to its North American and Australian peers, in great part due to its South African asset base, primary stock listing and domicile but also due to a large, complex, and high-cost portfolio of mines. The company has been focused over the last several years on streamlining its portfolio.

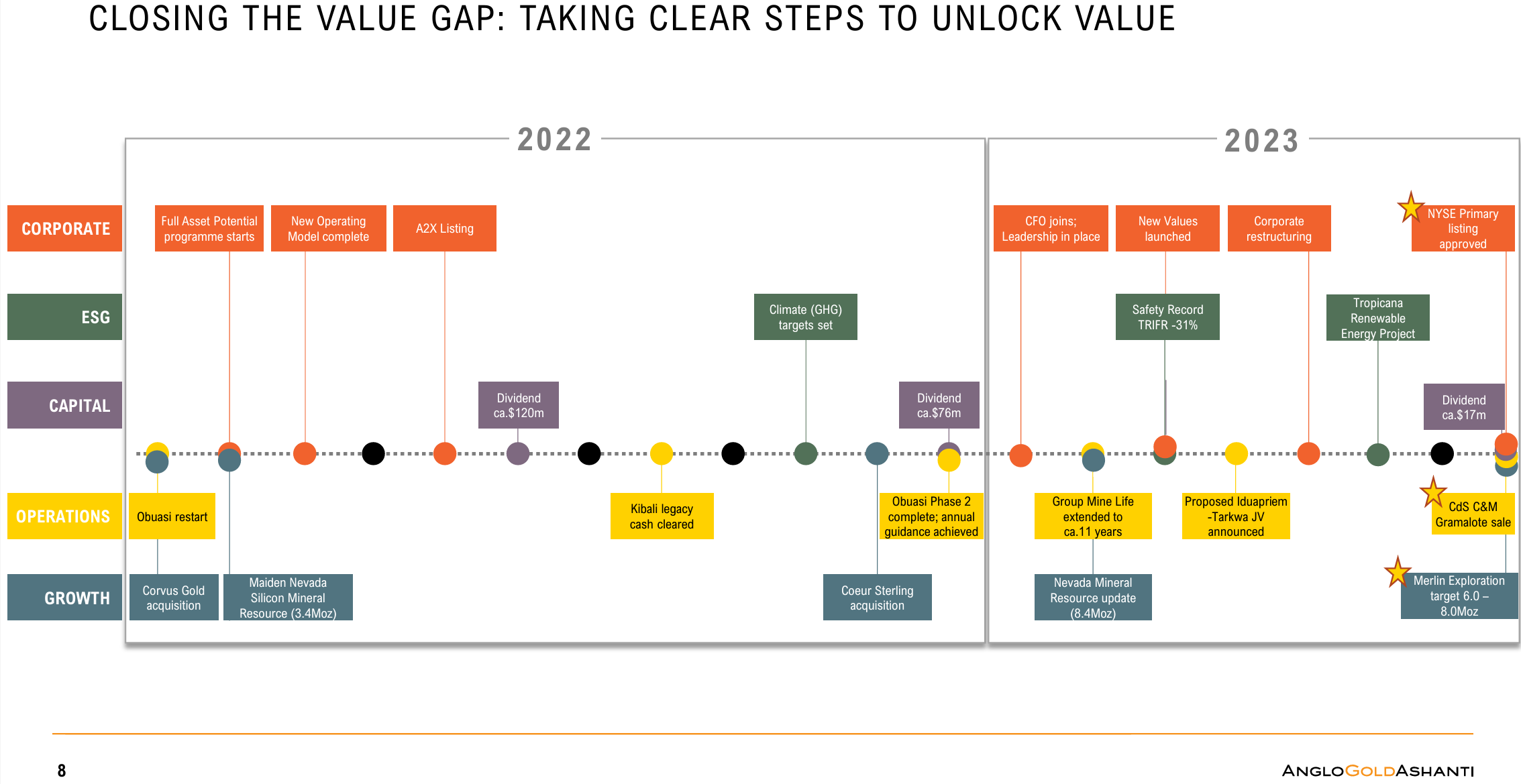

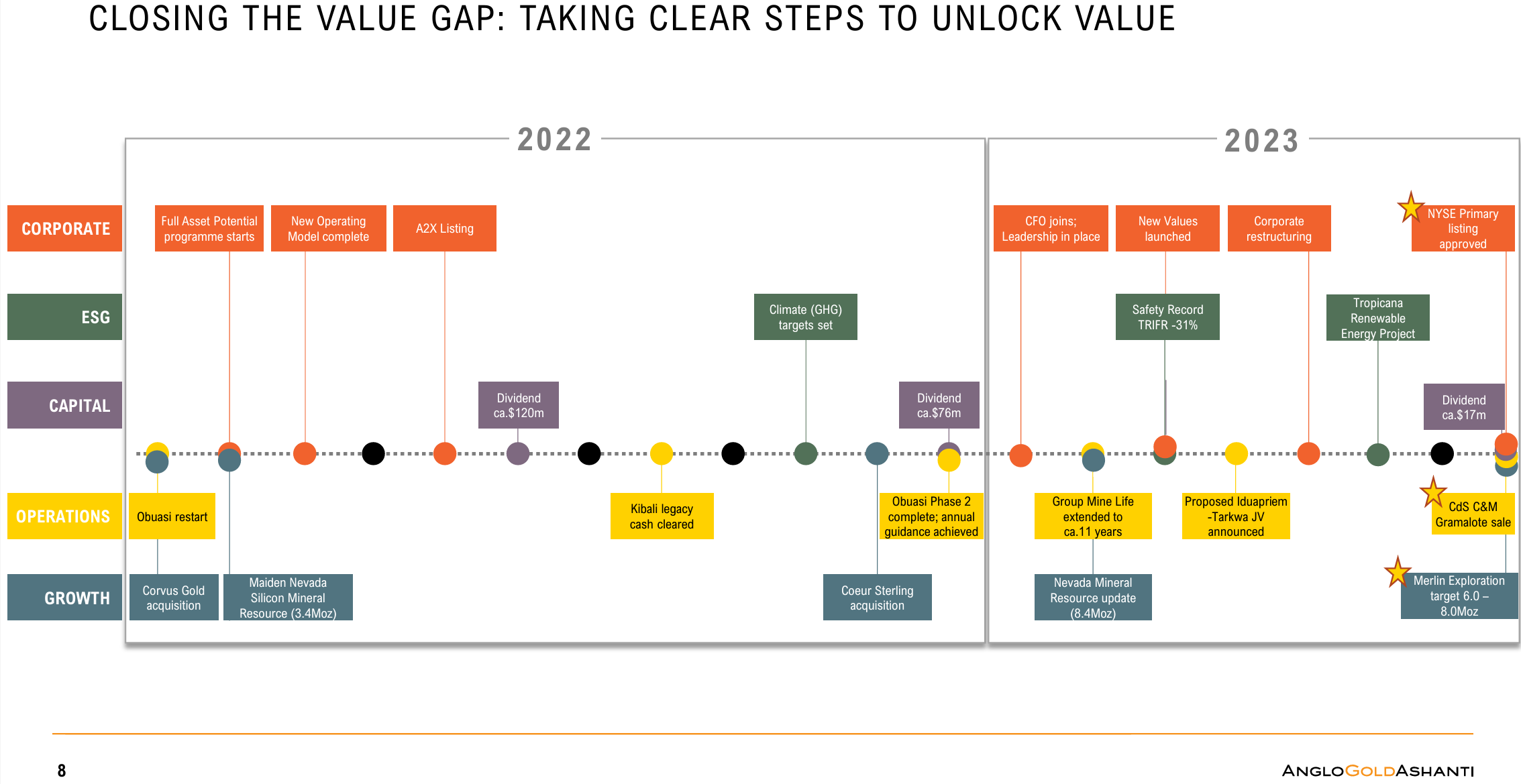

Chart 1: Value creation journey of AngloGold Ashanti

Source: https://thevault.exchange/?get_group_doc=143/1701200171-InvestorPresentationNovFINAL.pdf

In 2020, the company completed the sale of all its remaining South African assets. In 2022, it acquired junior developer Corvus Gold as well as some additional Nevada properties from Coeur Mining to increase its footprint in Nevada and further consolidate the Beatty District. In 2022, the company also achieved the restart of one of its flagship assets, the Obuasi mine in Ghana, marking what is expected to be the beginning of a new era for this Tier 1 asset. While the ramp up of the “new” Obuasi has not been trouble free, it has showcased the companies’ core values, with safety being one of them and always first. Due to poor ground conditions, the company decided to slow down Obuasi’s ramp up, negatively impacting 2023 and 2024 production estimates. The company is trialing a new mining method to address both production/economic and safety concerns. During our recent discussions with CEO Alberto Calderon, he did not hesitate, the company will always put safety ahead of production, he reaffirmed. In 2023, the company continued its value creation and portfolio optimisation journey, announcing the proposed combination of its Iduapriem mine in Ghana with Gold Field’s adjacent Tarkwa mine. The combination is expected to deliver mining and infrastructure synergies across the combined footprint, allowing significant flexibility in mine planning and scale. The culmination of AngloGold’s efforts over the last several years was the completion of its corporate restructuring on September 25 of this year, with a primary listing of its ordinary shares on the New York Stock Exchange, and a corporate domicile in the UK. The company, which now has its group headquarters in Denver, retains secondary listings on the Johannesburg Stock Exchange and the Ghana Stock Exchange. Today, we view AngloGold as a transformed, significantly better, lower risk company. The company’s strategy is well articulated by management and is now clear to us. A healthy balance sheet (Net Debt/ EBITDA under 1x; more than US$2 billion in liquidity); an asset base made up of five Tier 1 assets, four Tier 2 assets, and a growth pipeline supported by projects in the Americas (US and Colombia); a good track record of increasing reserves (up 26% since 2017); and a commitment to safety, reducing costs and delivering on their promises, position AngloGold well to achieve the market re-rating it has been working towards and help close the historical valuation gap relative to its peers.

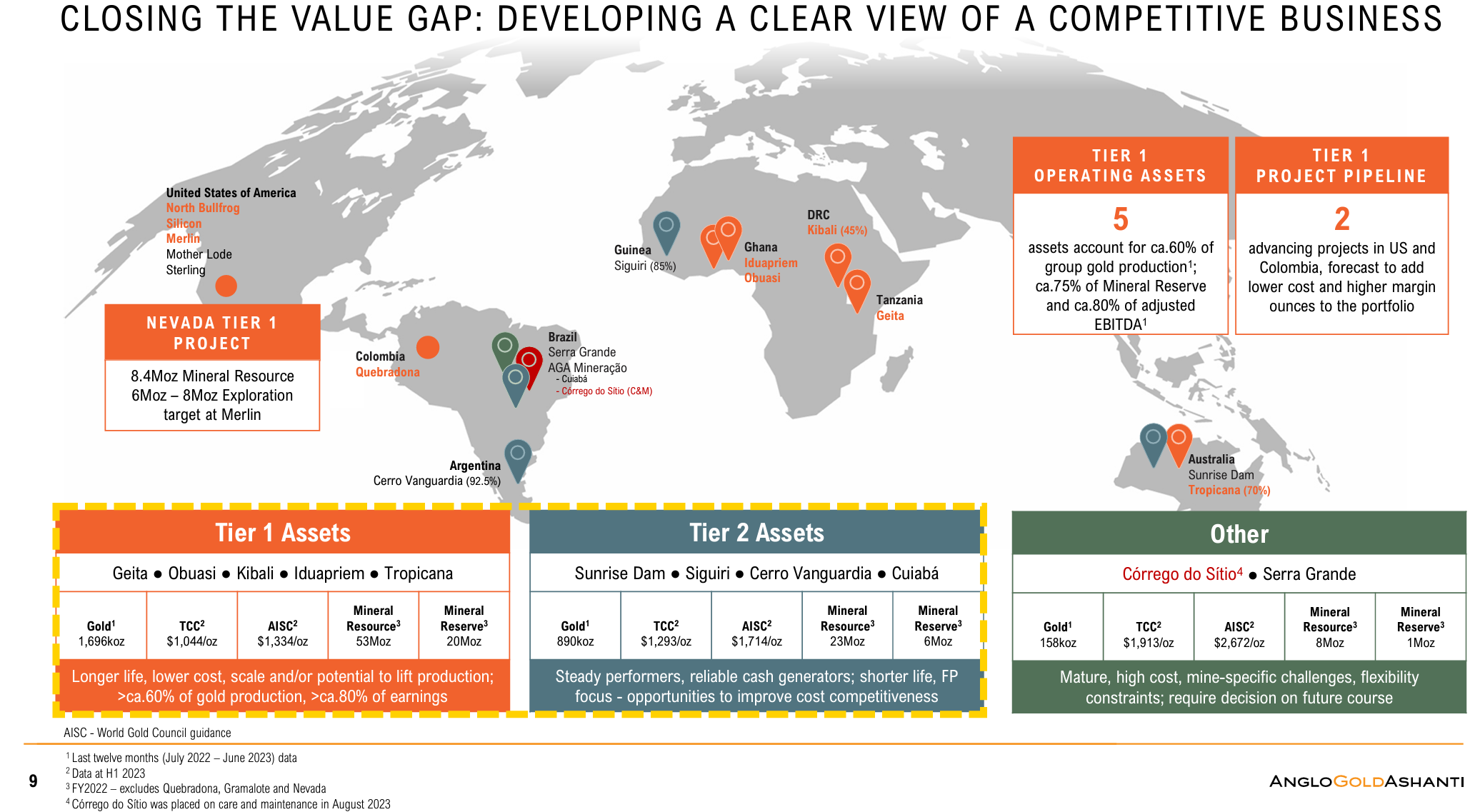

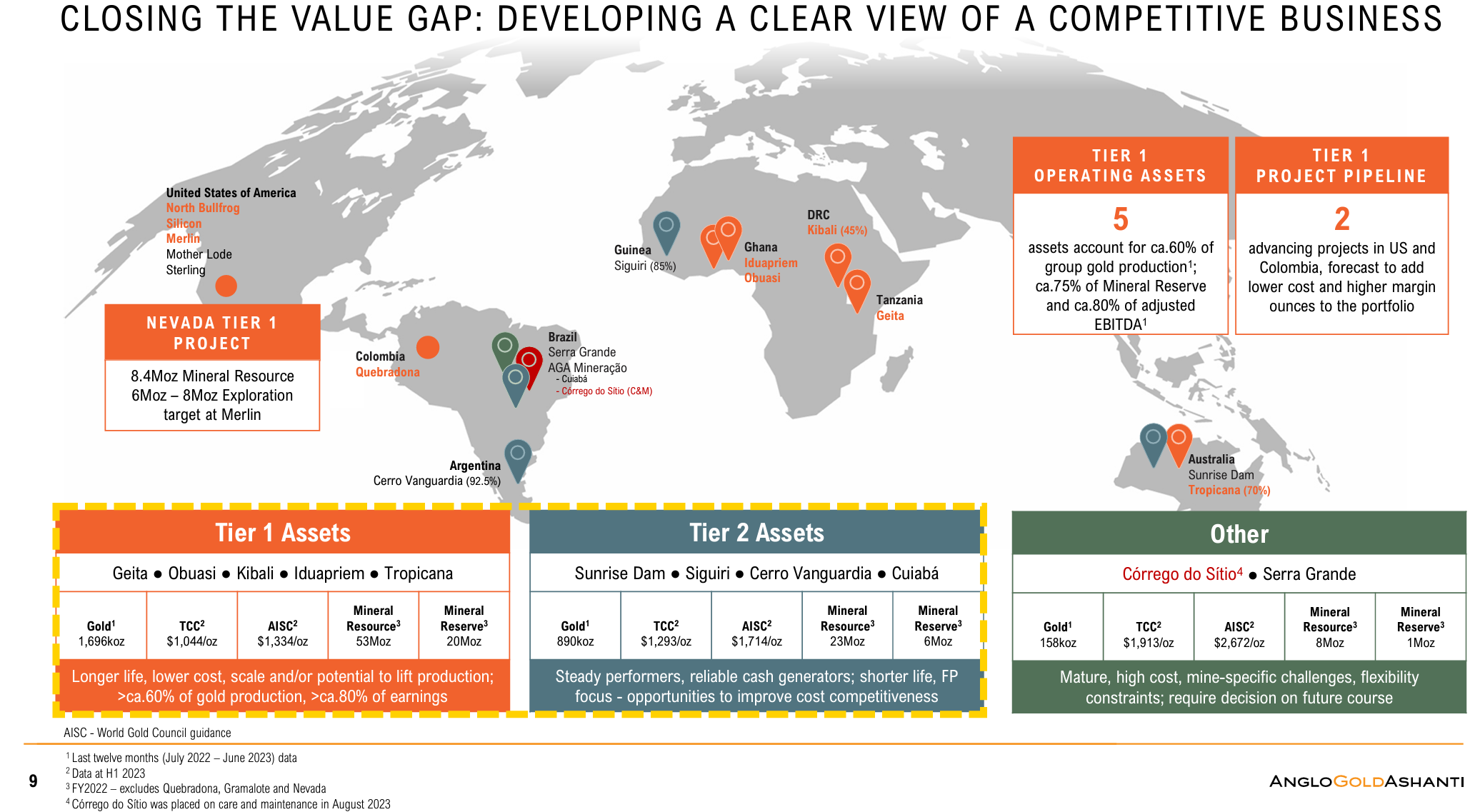

Chart 2: Overview of assets

Source: AngloGold Shanti

We have a positive outlook for the gold price in 2024 and beyond. Gold seems to have established strong support around the US$1,900 to US$2,000 level. This is remarkable when we consider that investment demand, as gauged by the holdings of gold bullion ETFs, has been declining. Daily, markets are trying to decide if a soft landing is still an option. We think we may be getting closer to a point where the US and global economy start to slow down more significantly under the stress imposed by high interest rates, and the strain of not one, but now, two wars. These should lead to a drop in corporate earnings followed by a correction of the equity markets, a weaker jobs market and higher unemployment rate. Inflation has eased, but it remains above the Fed’s 2% target, and continues to impact businesses and households. There is risk that bringing inflation back down to 2% could be a long process; historically that has been the case. We believe that when these risks become more visible to markets and even more likely to generate poor outcomes for the financial system, gold is positioned to benefit.

In 2024, we see opportunity for gold to test and break through the all-time highs of US$2,075 in 2020 and US$2,135 more recently, on December 4. Gold equities, such as AngloGold Ashanti, are positioned to benefit from sustained, record high gold prices as investors look for leveraged, and diversified exposure to gold.

We have been calling attention to the low valuation metrics of the gold mining sector at present, both historically for the industry and relative to gold. We contrast these depressed market valuations and negative sentiment towards the sector, with gold companies that, as a group, financially and operationally are in good health today. We also have been highlighting the companies’ disciplined approach to growth, with a focus on value creation by optimising their portfolios, reducing costs, increasing mine lives, and finding and developing new deposits, all while maximising returns for stakeholders.

At around US$1,935 per ounce, the average gold price this year is the highest ever annual average. Gold companies on average are producing gold at all-in sustaining costs of around US$1,300 per ounce. While high inflation hit margins these last couple of years, costs appear to be under control. Gold companies are generating a lot of free cash flow. Yet, they remain disciplined, unwilling to chase production or reserve growth at any cost, reflected in muted M&A activity in the sector. We think this approach should lead to regaining market confidence and interest in the sector, and improved share price performance for gold mining companies.

Many traditional M&A activities have been replaced with creative transactions that transform companies to become better businesses. For example, we recently met with the management of one of the largest gold producers in the world, AngloGold Ashanti (3.5% of GDX). AngloGold produces about 2.5 million ounces of gold annually. For decades, it has traded at a discount relative to its North American and Australian peers, in great part due to its South African asset base, primary stock listing and domicile but also due to a large, complex, and high-cost portfolio of mines. The company has been focused over the last several years on streamlining its portfolio.

Chart 1: Value creation journey of AngloGold Ashanti

Source: https://thevault.exchange/?get_group_doc=143/1701200171-InvestorPresentationNovFINAL.pdf

In 2020, the company completed the sale of all its remaining South African assets. In 2022, it acquired junior developer Corvus Gold as well as some additional Nevada properties from Coeur Mining to increase its footprint in Nevada and further consolidate the Beatty District. In 2022, the company also achieved the restart of one of its flagship assets, the Obuasi mine in Ghana, marking what is expected to be the beginning of a new era for this Tier 1 asset. While the ramp up of the “new” Obuasi has not been trouble free, it has showcased the companies’ core values, with safety being one of them and always first. Due to poor ground conditions, the company decided to slow down Obuasi’s ramp up, negatively impacting 2023 and 2024 production estimates. The company is trialing a new mining method to address both production/economic and safety concerns. During our recent discussions with CEO Alberto Calderon, he did not hesitate, the company will always put safety ahead of production, he reaffirmed. In 2023, the company continued its value creation and portfolio optimisation journey, announcing the proposed combination of its Iduapriem mine in Ghana with Gold Field’s adjacent Tarkwa mine. The combination is expected to deliver mining and infrastructure synergies across the combined footprint, allowing significant flexibility in mine planning and scale. The culmination of AngloGold’s efforts over the last several years was the completion of its corporate restructuring on September 25 of this year, with a primary listing of its ordinary shares on the New York Stock Exchange, and a corporate domicile in the UK. The company, which now has its group headquarters in Denver, retains secondary listings on the Johannesburg Stock Exchange and the Ghana Stock Exchange. Today, we view AngloGold as a transformed, significantly better, lower risk company. The company’s strategy is well articulated by management and is now clear to us. A healthy balance sheet (Net Debt/ EBITDA under 1x; more than US$2 billion in liquidity); an asset base made up of five Tier 1 assets, four Tier 2 assets, and a growth pipeline supported by projects in the Americas (US and Colombia); a good track record of increasing reserves (up 26% since 2017); and a commitment to safety, reducing costs and delivering on their promises, position AngloGold well to achieve the market re-rating it has been working towards and help close the historical valuation gap relative to its peers.

Chart 2: Overview of assets

Source: AngloGold Shanti

We have a positive outlook for the gold price in 2024 and beyond. Gold seems to have established strong support around the US$1,900 to US$2,000 level. This is remarkable when we consider that investment demand, as gauged by the holdings of gold bullion ETFs, has been declining. Daily, markets are trying to decide if a soft landing is still an option. We think we may be getting closer to a point where the US and global economy start to slow down more significantly under the stress imposed by high interest rates, and the strain of not one, but now, two wars. These should lead to a drop in corporate earnings followed by a correction of the equity markets, a weaker jobs market and higher unemployment rate. Inflation has eased, but it remains above the Fed’s 2% target, and continues to impact businesses and households. There is risk that bringing inflation back down to 2% could be a long process; historically that has been the case. We believe that when these risks become more visible to markets and even more likely to generate poor outcomes for the financial system, gold is positioned to benefit.

In 2024, we see opportunity for gold to test and break through the all-time highs of US$2,075 in 2020 and US$2,135 more recently, on December 4. Gold equities, such as AngloGold Ashanti, are positioned to benefit from sustained, record high gold prices as investors look for leveraged, and diversified exposure to gold.

Published: 07 December 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

Education

ETFs Explained

About Smart Beta

International Investing

Emerging Markets

Quality Investing

Moat Investing

Investing for Income

Property Investing

Investing in Infrastructure

Gold Investing

Expert Insights

ViewPoint Quarterly

ESG Investing

Investing in Healthcare

Video Gaming & Esports

Investing In Clean Energy