Gold – ’Til debt do us part

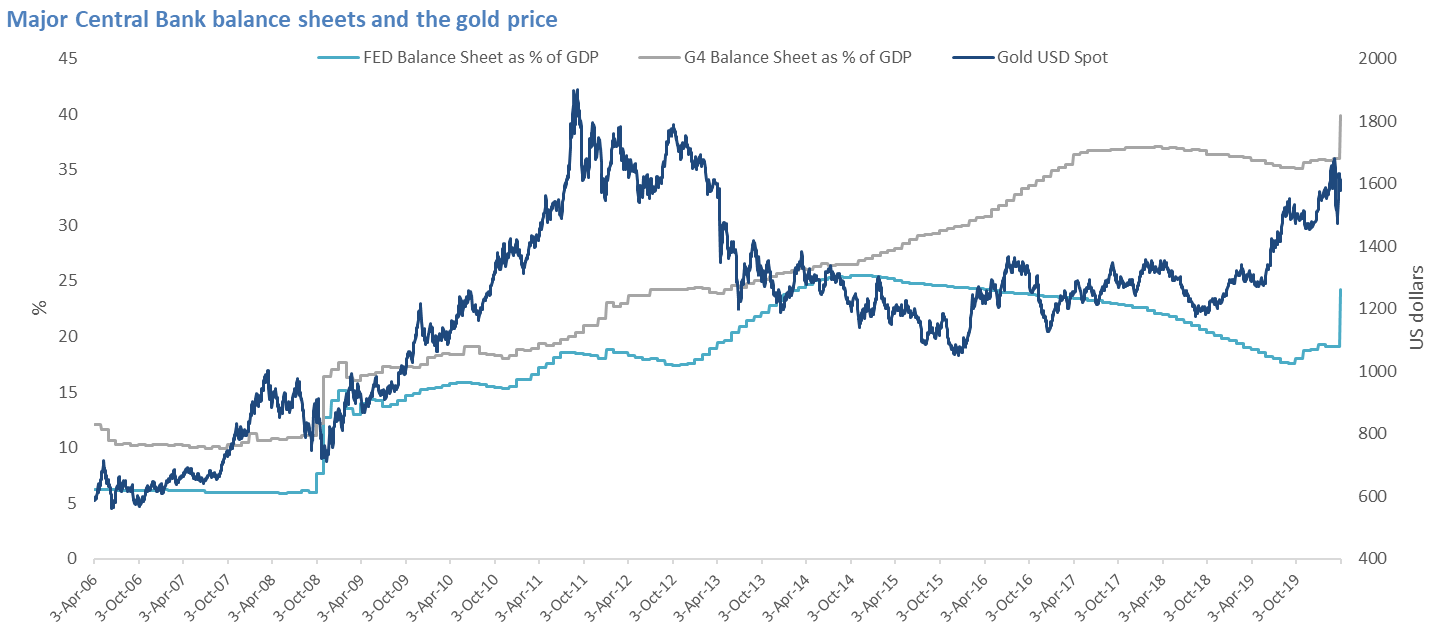

During the past few weeks Central Bank’s balance sheets around the world have blown out as they implement unorthodox policy to keep the economy afloat. This is a tailwind for gold as the precious metal is correlated to central bank’s balance sheet.

“Buying gold is just buying a put against the idiocy of the political cycle. It's that simple."

– Kyle Bass

Kyle Bass, founder and principal of Hayman Capital Management, is perhaps most famous as being one of the few investors to successfully predict and benefit from the subprime mortgage crisis.

Bass made his gold comment in 2011 while the US Federal Reserve was implementing its second round of quantitative easing which took the US Central Bank’s balance sheet to, then, unprecedented levels.

During the past few weeks Central Bank’s balance sheets around the world have blown out as they implement unorthodox policy to keep the economy afloat.

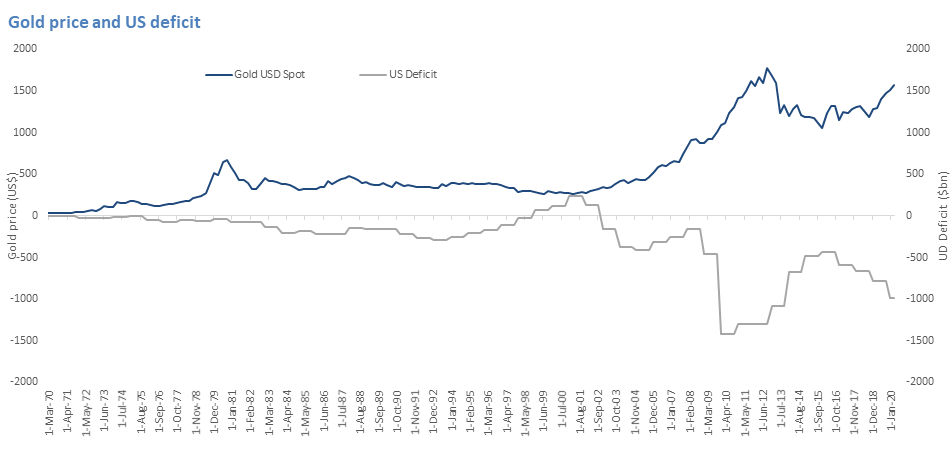

This is a tailwind for gold as the precious metal is correlated to central bank’s balance sheet. Another tailwind for gold is government spending. Gold is negatively correlated to US government deficits and it’s been well documented which direction that is heading.

Central bank balance sheets have exploded

Central banks have responded to the COVID-19 crisis with alarming altruism, pumping up economies to limit risks. You can see the vertical rise of the blue and the red line over the past few weeks in the graph below.

Source: Bloomberg

Source: Bloomberg

You can also see in the graph above, the vertical rise that was first round of quantitative easing in response to the GFC. It led to a gold bull market from 2008 to 2011.

While central banks have been stimulating the economy with expansionary policies, so too governments have been pumping money into the economy. Historically, gold has a negative correlation to the US deficit, as can be seen in the chart below.

Source: Bloomberg

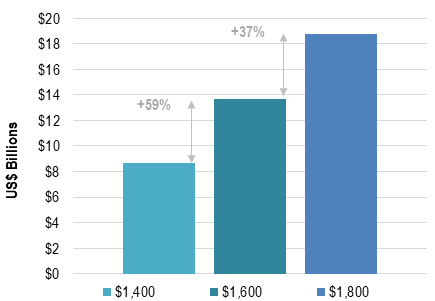

Relative to the gold price, gold miners also look attractive and will benefit more if the price of gold rises.

Gold miners benefit when the price of their metal rises. Gold equities are currently relative cheap. An analysis of the ratio of Gold equities relative to the Gold price shows it remains near historic lows.

Ratio of the cost of gold miners to the gold price

Source: Bloomberg; as at 13 April 2020

Further, since the GFC, gold companies have been implementing changes to address mistakes of the past which, in our opinion, should lead to outperformance by gold equities relative to bullion in a gold bull market. We expect no credit problems in these companies. On the contrary, we believe their reductions in costs and capital expenditures could translate to an additional near 40% increase in free cash flow, on average, for a gold price move from $1,600 to $1,800 (for seniors and mid-tiers).

Cash Flow Leverage to Gold Price (Seniors/Mid-Tiers)

Source: VanEck, Bloomberg. Data as of March 2020. “Senior” miners defined by production levels of approximately 1.5-6.0 million ounces of gold per year (“Mid-Tier” approximately 0.3-1.5 million ounces per year).

Investors can access this opportunity on ASX with

VanEck Vectors Gold Miners ETF (ASX: GDX).

IMPORTANT NOTICE:

Published: 26 April 2020