A gold star in May

Gold hits seven year high in May

The gold market continued to garner support from the uncertainties and risks associated with the pandemic. The yellow metal trended to a new seven-year high of US$1,765 per ounce on May 18, as US Federal Reserve Chairman Jerome Powell warned of further risks that the coronavirus might pose to the economy and asset prices. Gold later retreated to US$1,694 per ounce as the stock market rallied to near-term highs amid the loosening of lock-down restrictions and news of progress in developing a COVID-19 vaccine. However, gold quickly snapped back on renewed protests in Hong Kong over China’s new national security law, which prompted the Trump administration to begin a process of revoking Hong Kong’s preferential trade status. The dollar trended lower at the month-end, and gold finished at US$1,730.27.

Adapted operations supports positive long-term outlook for miners

Gold companies logged another strong month, as the NYSE Arca Gold Miners Index advanced 4.2%. First quarter results were generally as expected, while the full impact of the COVID-19 related shutdowns will be felt in second quarter reporting. We estimate a maximum of about 12% of global production was idled in April, although nearly all has been restarted. Companies have quickly adjusted operating behaviour to minimise the pandemic's impact, including:

- Using more vehicles and planes to transport workers;

- Staggering work shifts and lengthening rotations;

- Universal COVID-19 testing and mitigation protocols;

- Increasing inventories and ore stockpiles;

- Building redundancies into supply chains; and

- Diversifying transport and refining has been diversified

These efforts do lead to increased costs. However, in the current environment, higher costs due to the coronavirus are more than offset by lower fuel prices and weak local currencies.

While many companies suspended yearly guidance in March and April these are now being reinstated. Early reports suggest that 2020 production guidance forecast for individual companies will decline between 0% and 5%, while cost projections will increase between 0% and 5%. The pandemic has not affected the long-term outlook for the industry.

Merger of equals leading to increase in value and shareholder returns

Merger and acquisition activity continues at a measured pace. In May, mid-tier producers SSR Mining and Alacer Gold announced a merger of equals to create a company that we believe will be much stronger than its predecessors. Alacer has a large, technically complex mine in eastern Turkey, while SSR has several smaller-scale mines in the Americas. We expect the combined company will have better access to capital, global diversification, technical depth and generate stronger shareholder returns. Most significantly, the new SSR will retain the best people from both companies. There was no entrenched management or boards looking to undermine a deal, which we believe is in the best interests of company owners.

Historically, acquisitions at a premium have dominated M&A activity. This led to too many companies overpaying for assets that failed to deliver the expected performance, in our view. However, in the current bull market, mergers of equals have become more common as companies find ways to increase value and shareholder returns, rather than overspending increase production to simply get bigger. As the gold price has trended higher, we found this shift in strategy and greater discipline to be firmly in place at the recent BofA Global Metals, Mining and Steel conference. Several observations included:

- A focus on stable production and margin improvement through reducing costs

- Generating free cash flow to return to shareholders and reduce debt

- Fund lower cost, higher return organic and brownfield expansions

- Continue using US$1,200 - US$1,250 gold prices to run reserve calculations, and not chasing marginal low-grade ounces

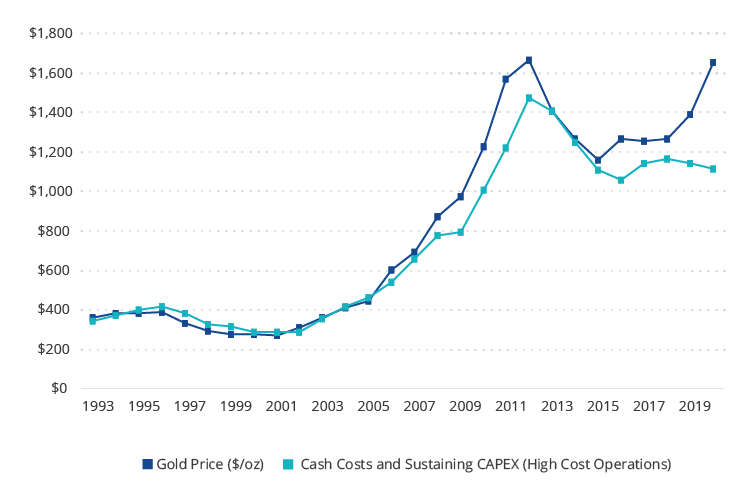

The benefits of these efforts are shown clearly in the chart where, unlike the 2001 – 2011 bull cycle, costs remain in check as the gold price rises, creating growing profits and cash flow for the gold companies.

Unlike 2001 – 2011 bull market, costs remain in check with rising gold price

Source: BMO Capital Markets. Data as of May 2020.

Gold bull expected to continue with gold stocks benefitting

We continue to believe gold may test US$2,000 per ounce in the next 12 months as the global recession plays out, the pandemic runs its course and while many businesses and households struggle to return to normal. Our view is social unrest in Hong Kong and the U.S. are new developments that place the recovery at risk with more government stimulus and spending likely. If all of this liquidity brings a cycle of inflation, gold may trend much higher in the coming years.

We believe gold stocks will stand out as the ultimate beneficiaries of a rising gold market. Despite strong performance in 2019 and 2020, gold stocks have yet to claw back the value that was lost in 2017 and 2018 when gold was stuck in a range and investor sentiment turned negative. RBC Capital Markets estimates the average Price/Cash Flow (P/CF) of the majors and mid-tier producers was 8.7 times as of May 8, up from a low of 5.3 times on March 13. This is below the 14-year average P/CF of 10.7 times and far below peak P/CF of 22.1 times in January 2008.

IMPORTANT DISCLOSURE

Published: 08 June 2020