The stars are aligning for emerging markets investors

When you consider valuations, emerging markets equities appear to be attractive. We believe emerging markets economies continue to be well placed to outgrow many developed markets by a significant margin on average. However not all emerging markets companies are desirable from an investment perspective and timing factors and cycles in emerging markets is near impossible.

Could the stars be aligning for emerging markets?

The market, despite the Fed’s warnings, is still pricing rate cuts in the US. US rate cuts have traditionally been a catalyst for US dollar weakness. As the trading currency, emerging markets tend to benefit from US dollar weakness. Within emerging markets, most have tamed inflation while its middle class flourishes and most recently China has been implementing, what initially seem to be, market-friendly growth initiatives such as an equity market stabilisation fund and monetary easing.The last time emerging markets experienced a sustained bull run was during the early 2000s, during the commodity super-cycle, of which Australia was also a beneficiary, so local investors did not need to consider diversifying into emerging markets to benefit from that macroenvironment. This time however the macroeconomic outlook between Australia and emerging markets differs, and as one of the reasons to invest internationally is to diversify your exposure to different economic cycles, now could be the time to consider emerging markets.

In addition, we would argue that the current geopolitical environment favours emerging markets, as emerging markets economies generally export more than they import, and they also benefit from high commodity prices/energy re-orientation. China’s reopening benefited its close neighbours such as Indonesia, Malaysia and Thailand. Thailand, for example, benefits from Chinese tourism (3% of GDP) and exports to China (24% of GDP).

On a valuation basis emerging markets look compelling. While emerging markets have historically always traded at a discount to developed markets, on a forward price to earnings (P/E) basis, emerging markets haven’t been this cheap since the start of 2022.

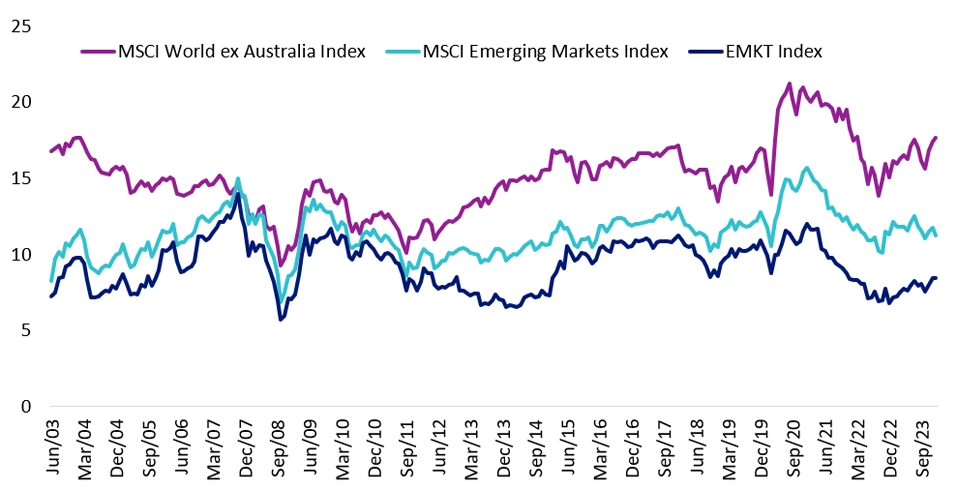

Below we compare global equities (MSCI World ex Australia Index) to the emerging markets benchmark (MSCI Emerging Markets Index) and the MSCI Emerging Markets Multi-Factor Select Index (AUD) (EMKT Index).

Chart 1: Forward P/E of emerging markets indices and the developed market index

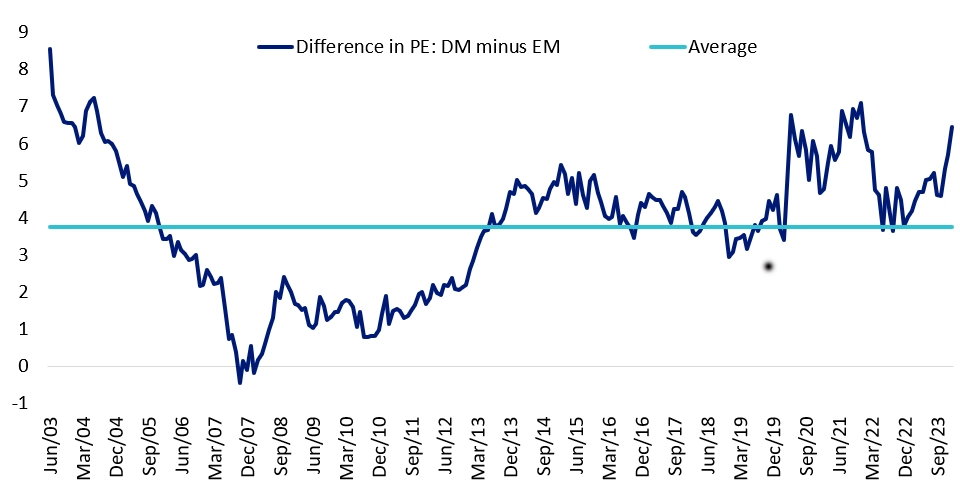

Chart 2: Forward P/E differential between developed markets (DM) and emerging markets (EM)

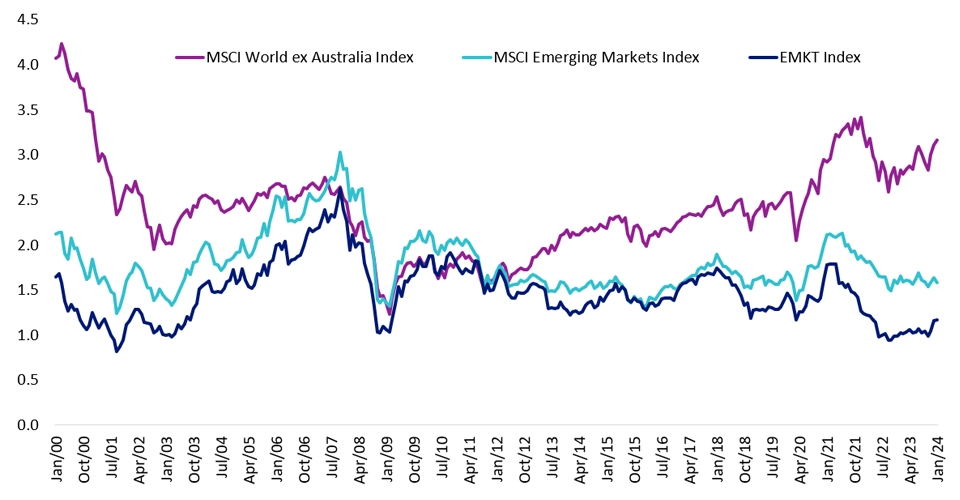

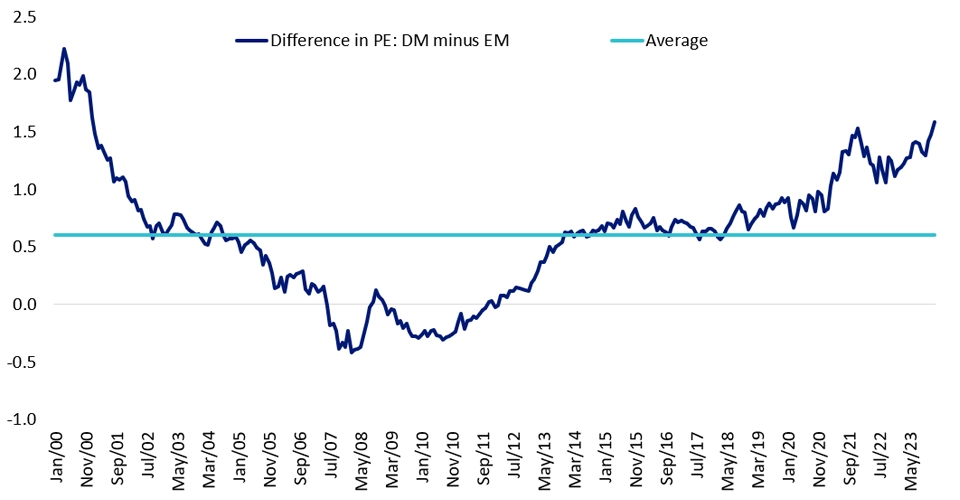

Charts 1 & 2: Source FactSet, MSCI to 31 January 2024. EMKT index is MSCI Emerging Markets Multi-Factor Select Index (AUD). Chart 2 shows the difference between the MSCI World ex Australia Index and the MSCI Emerging Markets Index. On a price-to-book basis, emerging markets haven’t been this cheap, relative to developed markets, since 2001.

Chart 3: Price to book emerging markets indices and the developed market index

Chart 4: Price to book differential between developed markets (DM) and emerging markets (EM)

Charts 3 & 4: Source FactSet, MSCI to 31 January 2024. EMKT index is MSCI Emerging Markets Multi-Factor Select Index (AUD). Chart 4 shows the difference between the MSCI World ex Australia Index and the MSCI Emerging Markets Index.

But it pays to be selective in emerging markets.

Being selective in emerging markets

Emerging markets are known to be inefficient, so ripe for active managers to add value. In addition to being expensive, returns among active managers vary significantly from year to year because it is almost impossible for them to time factors in emerging markets. There is another approach.

The VanEck MSCI Multifactor Emerging Markets Equity ETF (ASX: EMKT) tracks the MSCI Emerging Markets Multi-Factor Select Index (EMKT Index) which includes companies on the basis of four factors: Value, Momentum, Low Size and Quality. The four factors combined have demonstrated strong performance relative to the MSCI Emerging Markets Index.

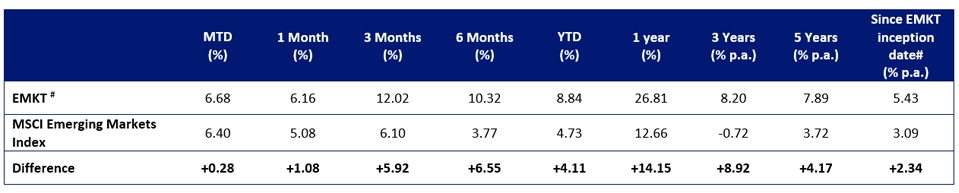

Table 1: Performance as at 28 February 2023

Source: VanEck, Morningstar Direct

# EMKT inception date is 10 April 2018 and a copy of the factsheet is here.

Performance is calculated net of management fees, calculated daily but does not include brokerage costs or buy/sell spreads of investing in EMKT. Past performance is not a reliable indicator of future performance.

The MSCI Emerging Markets Index (“MSCI EMI”) is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of emerging markets large- and mid-cap companies, weighted by market capitalisation. EMKT’s index measures the performance of emerging markets companies selected on the basis of their exposure to value, momentum, low size and quality factors, while maintaining a total risk profile similar to that of the MSCI EMI, at rebalance. EMKT’s index has fewer companies and different country and industry allocations than MSCI EMI. Click here for more details

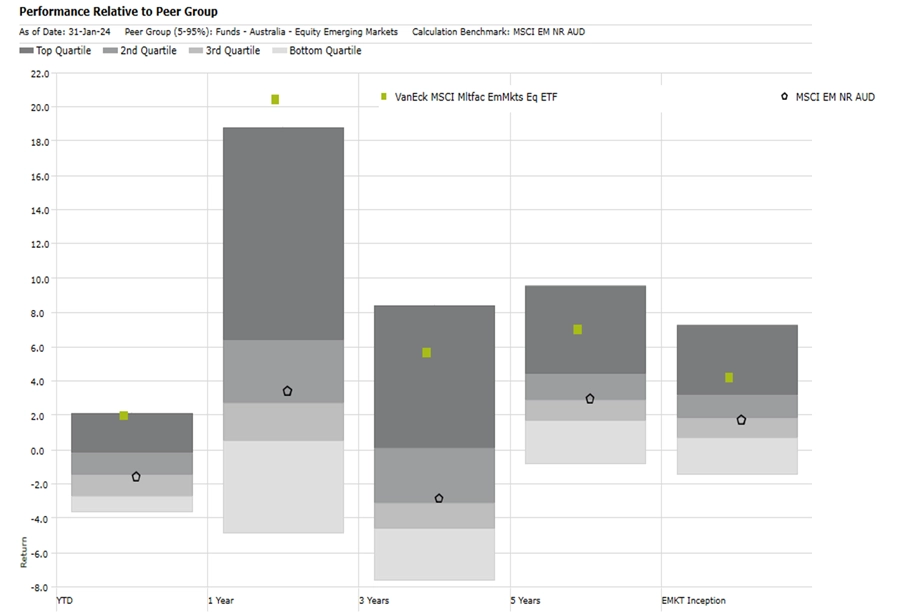

EMKT’s performance, to the end of last month, puts it in the top quartile of active peers over one, three and five years.

Chart 5: Performance relative to active manager peer group

Key risks

All investments carry risk. An investment in EMKT carries risks associated with ASX trading time differences, emerging markets, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.Published: 04 March 2024