2025 investment trends: Australians seek international equities, tech and healthcare

October 2024

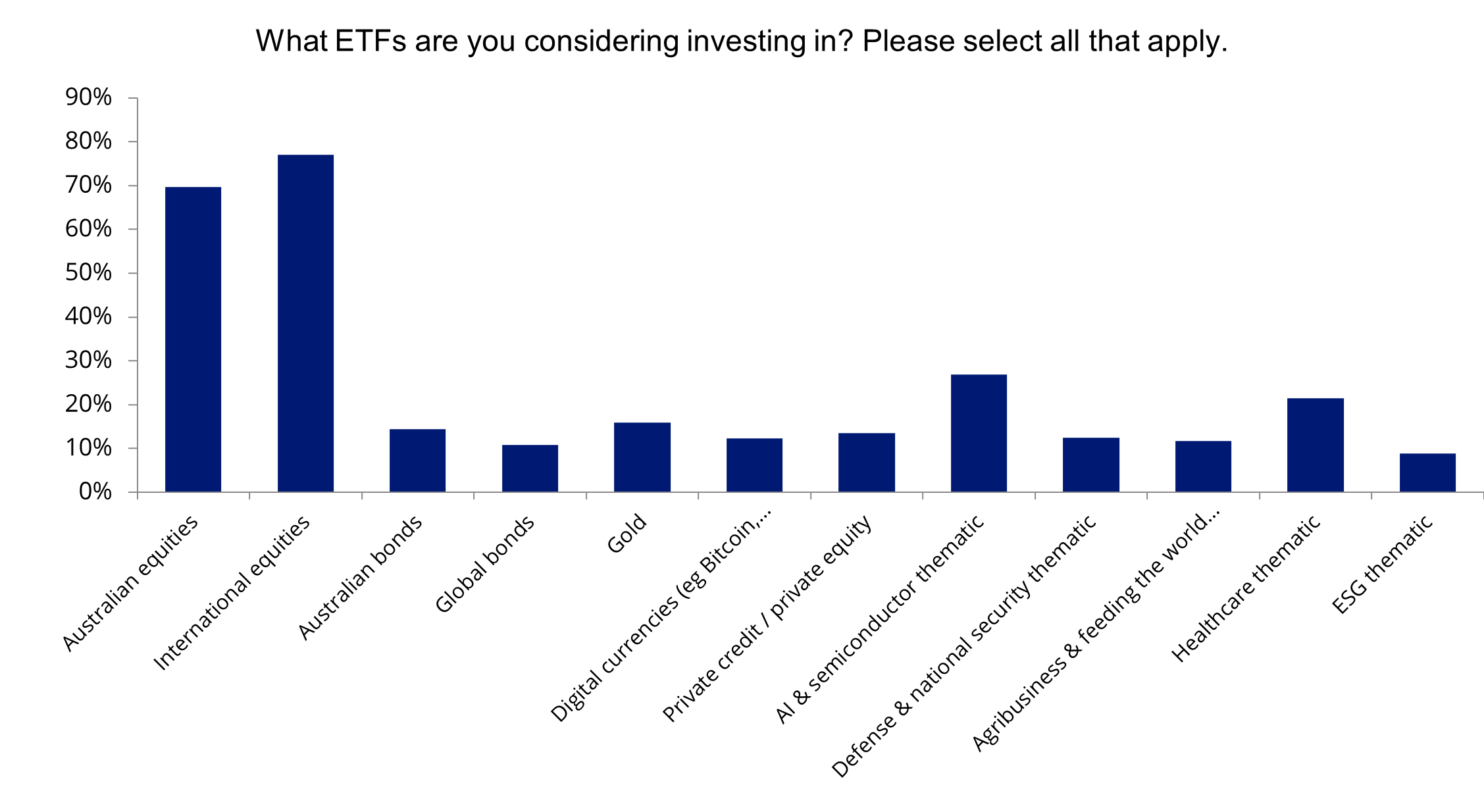

Three out of four Australians are planning to invest internationally next year according to new research from VanEck. The latest VanEck Australian Investor Survey revealed more Australians than ever are looking overseas to expand their portfolio, with international equities topping the consideration list for the first time, overtaking Australian equities. The data reveals 77% of respondents are planning to invest in international equity ETFs in the next 12 months – a sharp 27% increase over last year.

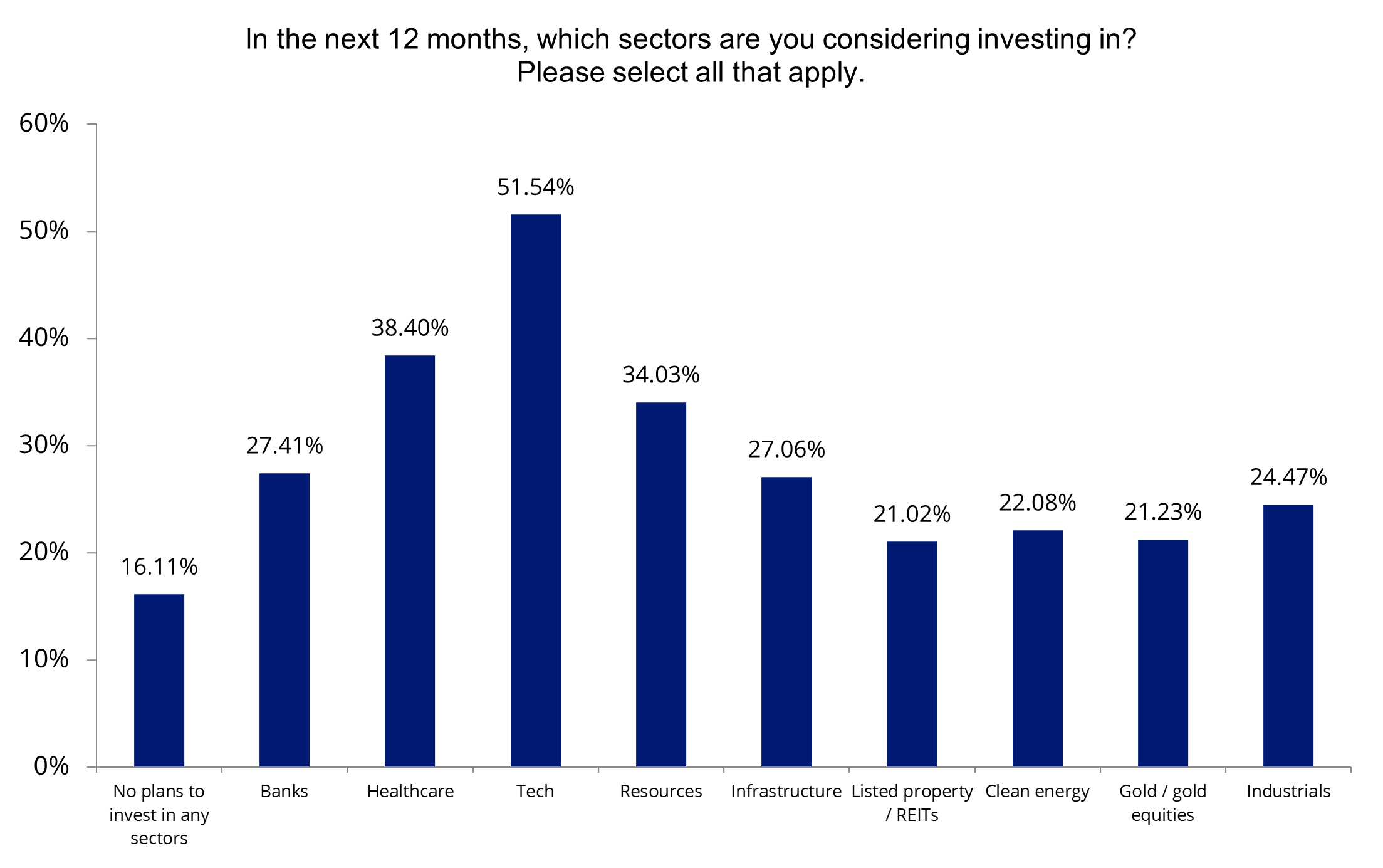

The survey identified technology and healthcare as the leading sectors that respondents are considering for future investments. Notably, interest in technology and gold/gold equities has seen a significant increase compared to last year.

VanEck Asia Pacific CEO and Managing Director, Arian Neiron said: “The Australian investor profile is changing. Australians have historically demonstrated a home bias in their portfolios, despite the domestic market representing only a small portion of the opportunities available in the global investment universe. The increasing desire to include offshore exposure aligns with the rapid growth of ETFs in the Australian market which offer access to nearly every asset class and market around the world.”

Demonstrating the increasing dominance of ETFs in Australia, the survey shows ETFs are Australia’s most popular investment vehicle. 60% of total respondents selected ETFs as their favourite investment product and the number jumps to 80% among investors aged under 40. Additionally, two-thirds of respondents plan to increase their ETF investments in the next 12 months, reflecting a rise from 59% in the previous year. 59% of SMSF investors plan on increasing their allocation to ETFs. One in three investors now use ETFs for more than half of their portfolio.

“The growth trajectory of the Australian ETF industry continues to accelerate with record-breaking flows to many of the leading funds. By the end of 2024, we expect the ETF market in Australia to reach $220 billion in real passive ETF funds under management (i.e. not including flows into unlisted funds),” said Neiron.

The annual VanEck Australian Investor Survey captures the opinions and intentions of Australian investors. More than 3,500 individual investors participated in the 2024 Survey.

Chart 1: Sectors that Australian investors are considering in the next 12 months

Chart 2: ETFs that Australian investors are considering investing in over the next 12 months

Source: VanEck Australian Investor Survey 2024.