VanEck survey reinforces active manager decline

October 2023

Active ETFs fail to gain traction with investors while smart beta strategies gain momentum.

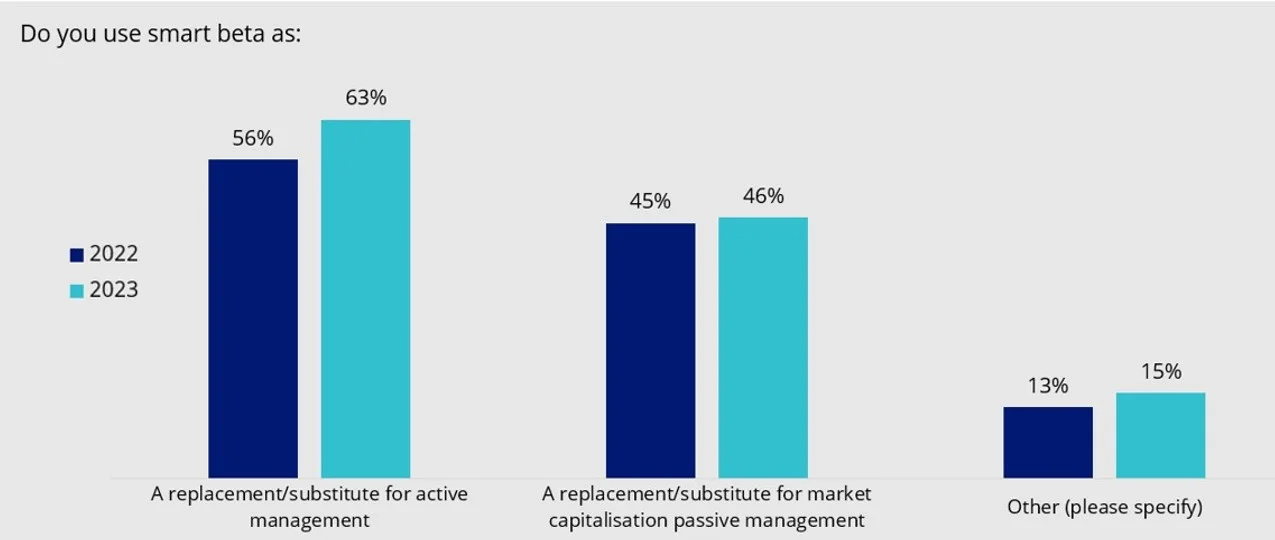

Usage of smart beta across the Australian financial advice landscape has been steadily increasing over the last three years, with the number jumping by 7% since 2022. Meanwhile, over 63% of financial professionals surveyed said they have been replacing active managers with smart beta strategies, up from 56% last year. The survey found the main reasons behind the switch are increased performance and improved portfolio diversification, followed by reduced costs.

The annual VanEck Australian Smart Beta Survey is the largest survey of its kind in the world, capturing investment trends in the Australian market. This year, the survey attracted a record 673 responses from financial advisers and brokers working in Australia. The survey reveals further displacement of active management through targeted smart beta outcomes as well as a significant increase in the adoption rate of smart beta strategies.

Smart beta refers to investment strategies that have a targeted outcome, they track an index that goes beyond simple market capitalisation and typically do so for a fraction of the cost of active strategies.

Arian Neiron, CEO & Managing Director – VanEck Asia Pacific, said: “This survey provides further evidence that active management is being disrupted. Smart beta ETFs are providing investors with targeted outcomes, full transparency, and low fees. Active managers can no longer afford to ignore the popularity or the features of smart beta ETFs.”

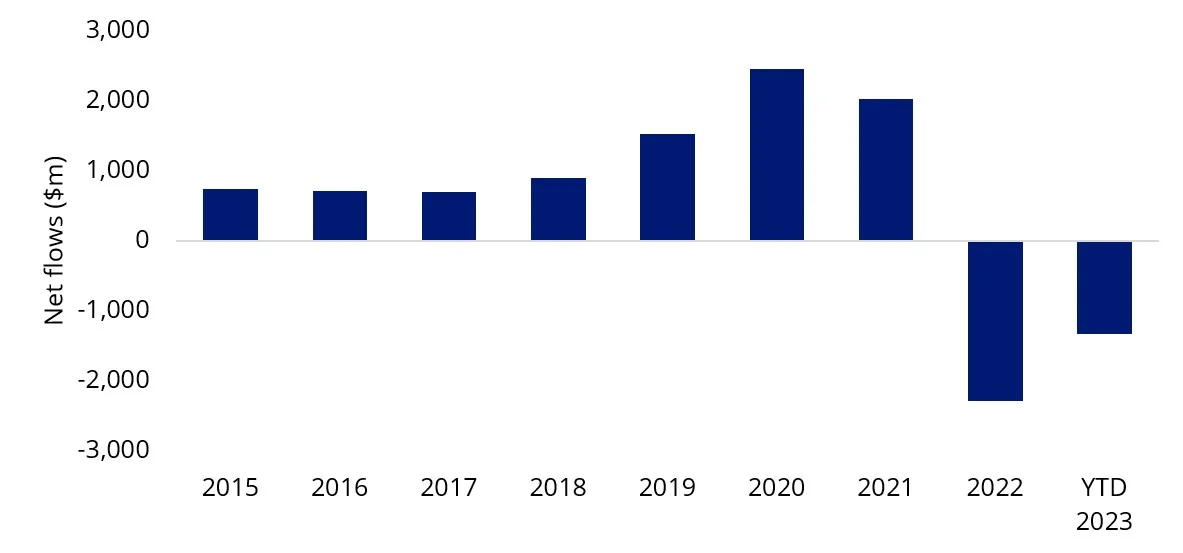

“If we consider active ETFs as a proxy for active management, net flows into active products have been negative over the past two years. Since 2015, the number of active ETFs has grown from just 6 to 90. Despite this growth in product offerings by active managers on the Australian exchange, their popularity has been dwarfed by the uptake of passive ETFs, which includes smart beta.

Active ETP Market – Net Flows ($m)

Source: ASX

“The proportion of net flows going into smart beta strategies rose to 31% as at 31 August 2023, up from 26.2% a year ago, with that gain outpacing both active and market capitalisation strategies. Smart beta strategies now make up 16.6% of the total ETP industry, up from 15.2% the prior year, again outpacing growth in active and market capitalisation strategies,” said Neiron.

Smart beta taking over active management share

Source: VanEck

The lack of popularity could be correlated to active manager underperformance, which is consistently evidenced in the SPIVA scorecards. By way of example, the most recent SPIVA Australia mid-year scorecard revealed more than half of Australian active equity fund managers failed to beat the market in the first six months of the year.

The 2023 VanEck Australian Smart Beta survey indicates this trend could continue. Of those advisers who use smart beta, 99% confirm they are satisfied with their smart beta investments, while 83% see smart beta investments as good value for money, up from 80% last year.

“The popularity of smart beta in Australia is part of a broader global trend, with professional investor take up of smart beta or ‘factor’ based products steadily increasing,” said Neiron.

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act. VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.