It's got to be bonds

The current low interest rate environment means that term deposits, cash funds and cash management accounts are offering little in terms of yield. This is forcing yield-seeking investors up the risk curve – often into the unknown world of bonds. Bonds are hard to understand and difficult to explain. We try to clear up a few things here.

Fixed income investments such as bonds are widely used in portfolios to enhance income and compliment low risk interest paying investments such as cash and term deposits.

Bonds usually deliver a reliable income stream and for that reason they form a valuable part of a portfolio. Bonds are often referred to as defensive or low risk assets because they have historically usually delivered more stable returns than equities and their prices have been less volatile. However they are not ‘risk-free’ like cash, and different types of bonds have different types of risks that investors should understand.

Bonds are like loans

A bond is essentially a loan by the investor to the entity issuing the bond. The entity issuing the bond could be the Commonwealth Government of Australia, the State Government of New South Wales or a corporation like ANZ.

In return for the loan, the entity makes a promise, that is, it “gives its bond”, that it will repay the loan on a specified date (the maturity date) and will make interest payments at regular intervals during the term of the loan.

At issue, the entity determines the principal amount per bond, known as the face value of the bond, and a specified interest rate, called the coupon. Like a loan, a bond is issued for a specific term or maturity. This generally ranges from 12 months to 30 years. Most bonds have a fixed coupon which is paid periodically from the time the bond is issued through to its maturity.

As an example, a bond might be issued with a face value of $100 and a 5% fixed coupon and a term to maturity of 2 years. This means the bond will pay investors a $5 coupon per annum over the life of the bond. At the maturity date, the issuer has an obligation to repay the $100 principal plus the final $5 coupon to the bond holder.

A bond’s coupon is a reflection of:

- The bond’s term to maturity;

- The prevailing market interest rates at the time the bond is issued; and

- The issuer’s creditworthiness.

The return on bonds

Generally the higher risk you take with your capital the higher expected return you will reap over time.

However it’s important to be aware that a bond’s price, or capital value, may go up or down from the face value as a result of external market risk factors as well as its credit worthiness, whereas with cash, your principal is held by a bank and generally isolated from these types of risks.

Many factors determine the current price of a bond, the most important among them are interest rates and the creditworthiness of its issuer. We’ll discuss each of these in more detail below.

How a bond’s value changes with interest rates

In financial markets, interest rates go up and down. Bonds issued when interest rates are higher will pay higher coupons than bonds issued when interest rates are lower and changes in rates impact the market value of the bond. This is because existing bond holders will consider the ‘opportunity cost’ of their existing bond compared to new bonds issued at higher interest rates. Opportunity cost is the loss incurred by an investor when one alternative is chosen over another and it’s important when you consider bond prices and interest rates. Put simply, when rates are rising, investors don’t want to hold bonds with the old lower rate, they’d prefer to be rewarded for risk with the new higher rate. Conversely, when rates are falling, existing bonds with higher rates are more appealing.

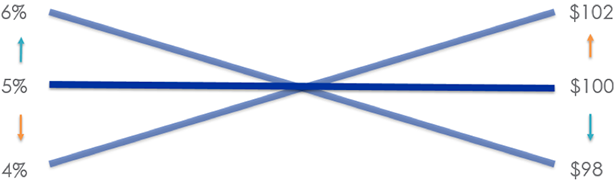

Figure 1: Interest rates and bond prices have an inverse relationship. When interest rates rise the value of a bond falls, conversely when interest rates fall, bond prices rise.1For illustrative purposes only.

Going back to our example above. An entity has issued a 2 year $100 bond carrying a 5% coupon. Let’s assume you liked this deal and bought the bond. What it means is that you receive $5 in year one and $5 in year two. At the end of year two you also receive the return of your $100 principal.

Let’s suppose that immediately after you bought that bond, interest rates rose. New bonds are being offered with a 6% coupon. This means new $100 bonds now pay $6 per year. The immediate impact in the market is that buyers of bonds will not pay $100 for your bond paying 5%. The opportunity cost is too high, they would prefer the new bond paying 6%. In order to sell your bond, you’d have to offer it at a lower price – a discount – that would enable it to generate about 6% to the new owner. In this case that would mean a price of around $98. In other words the 1% rise in interest rate has meant the market value of the bond has fallen by 2%.

Similarly, if rates dropped to below your original coupon rate of 5%, your bond would be worth more to buyers in the market than $100. It would be priced at a premium, since it would be carrying a higher interest rate than what was currently available on new bond issues.

How a bond’s value changes with credit ratings

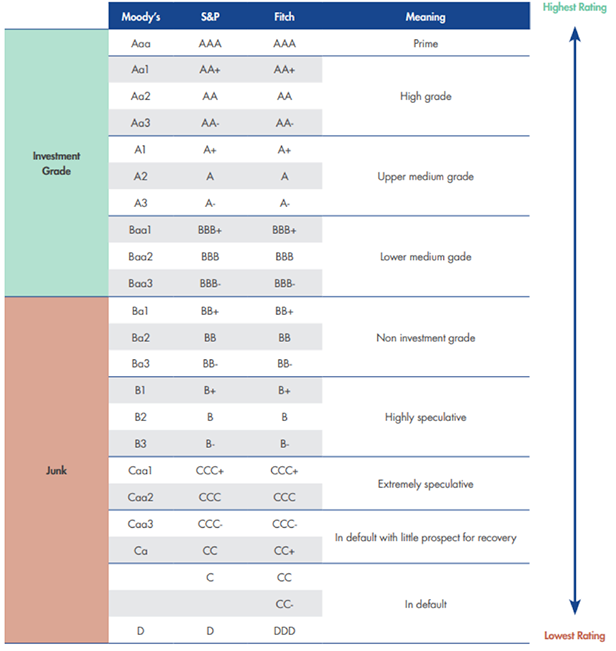

A bond and its issuer usually carry a credit rating determined by independent rating agencies which gives an indication of how risky the issuer and therefore its bond is. If a bond has a low rating, the company or government issuing it is considered to have a high risk of default. Conversely, if a bond has a high rating, it is considered to be a safer investment. Therefore when a bond is issued by a low rated issuer, to compensate the investor for the extra risk they are taking, it will have to offer a higher coupon compared to what a higher rated issuer would need to offer.

Like interest rates, the credit worthiness of issuers changes throughout the life of the bond. If a bond issuer’s credit rating goes down, or there is a perceived deterioration in its creditworthiness, then the price of its bonds will also fall. The table below lists the different credit ratings of Australian Bonds.

Source: VanEck

Why are bonds so important?

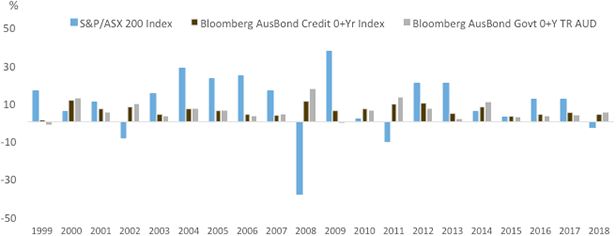

Bonds are defensive investments which means they tend to do well when the economy slows down or equity markets sell off. Over the last 15 years, there have been periods when some high quality fixed-rate corporate bonds have provided comparable and in some cases better returns than Australian and international equities. The graph below shows the strong outperformance of Australian bonds during the global financial crisis (GFC) compared to equities. A benchmark of Australian dollar corporate bonds, easily outperformed Australian equities during 2008 when the GFC hit and in 2011 and 2018, which were marked by high levels of equity market volatility. Australian and Semi Government bonds also outperformed over the same periods.

Calendar year returns for Australian equities and corporate bonds

Source Morningstar Direct, You cannot invest in an index. Past performance is not a reliable indicator of future performance.

For more information on fixed income see our flyer Explaining Fixed Income - here

1. This is a hypothetical illustration assumes a 5% coupon, $100 face value, and a 2 year maturity. Calculations for rate change:

- P(1.06)2= $110

- P=110/1.062

- P= 98

- P(1.04)2= $110

- P=110/1.042

- P= 102

The illustration is approximate and is not intended to represent the return of any particular bond or bond fund. Bond values fluctuate in response to the financial condition of individual issuers, changes in interest rates, and general market and economic conditions.

Published: 19 July 2019