Bond, Government Bond.

Large super funds are increasing their fixed income investments, reflecting a broader trend towards favouring bonds in the current environment.

But don’t take our word for it, according to Reuters Australia’s $1.5 trillion superannuation sector has been growing its investments in local and foreign debt “by more than A$20 billion over the past year as higher yields burnished an asset class overlooked in a country where equities traditionally rule.”

AustralianSuper told Reuters it had doubled debt assets to A$40 billion over the past year while Australian Retirement Trust, which manages A$240 billion, lifted its fixed income allocation to 13.7% from 12.5%, according to filings.

Big super’s allocation to fixed income is part of a broader trend, the popularity of fixed income investments. Fixed income exchange traded products (ETPs) have continued to increase in popularity with the industry growing to $23.4 billion from $16.2 billion in 2022. Fixed income ETPs now make up 15% of the total fixed income industry. In 2023, Fixed income strategies have taken the lion’s share of ETP flows.

Using fixed income to play the yield curve

One way fixed income investors can add relative value to their bond portfolio is to ‘play’ the yield curve.

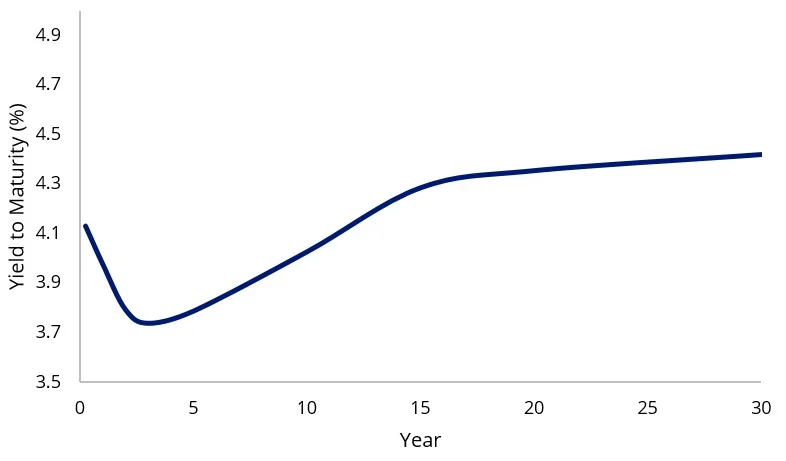

The yield curve is a line that plots the yields of Australian Government Bonds (AGBs) with differing maturity dates.

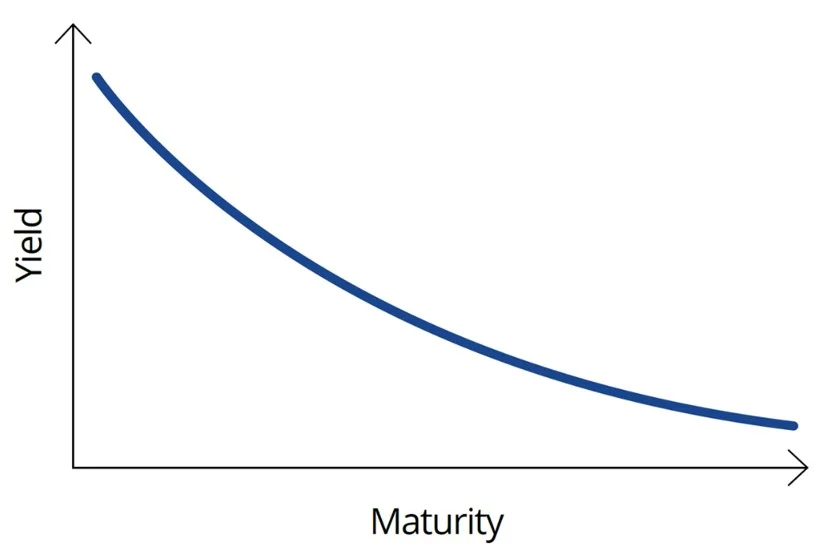

Chart 1: The Australian Government Bond yield curve

Source: Bloomberg, as at 31 August 2023.

The slope of the yield curve reflects the difference between yields on short-term bonds and long-term bonds. The yields on short and long-term bonds can be different because investors have expectations, which are uncertain, that the cash rate in the future might differ from the cash rate today.

For example, the yield on a ten-year bond reflects investors' expectations for the cash rate over the next ten years, along with the uncertainty associated with this. Because longer-term yields are more difficult to predict, their yields tend to move more than shorter-term bonds.

The yield curve is an important economic indicator because it is a source of information about investors' expectations for future interest rates, economic growth and inflation.

It is therefore possible for investors to take a view of the slope of the curve and position their portfolios for this.

There are several scenarios that cater for a bond portfolio exposure to be either overweight or underweight the short, medium or long end of the yield curve. Here are some examples.

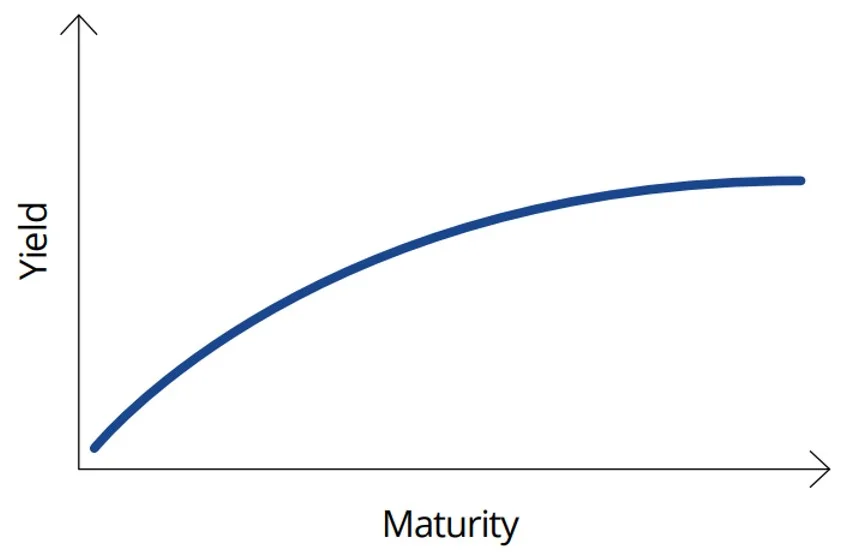

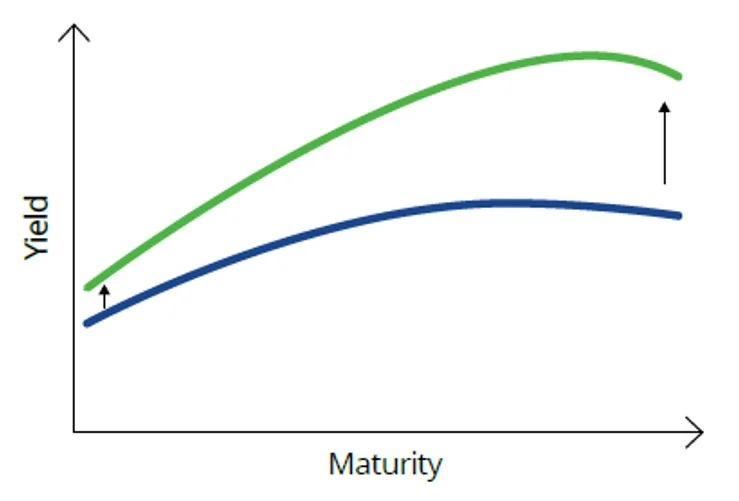

First, it’s important to understand the shape of the curve. A ‘normal’ yield curve is upward sloping where short-term yields are lower than long-term yields. Typically, this type of yield curve is seen during periods of economic expansion. In this environment, investors demand higher yields on longer-term bonds as compensation for inflation and future rate rises.

Chart 2: Normal Yield Curve

Source: VanEck. For illustrative purposes.

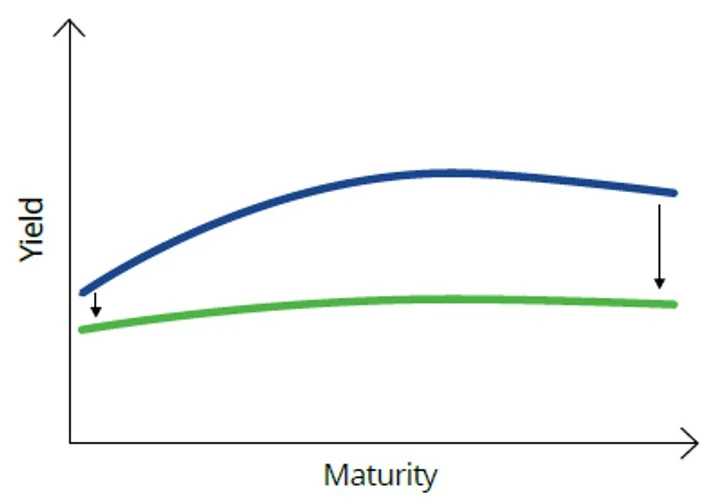

So, in the event bond markets forebode economic conditions and interest rates deteriorate, the long end of the curve typically decreases, resulting in a ‘flattening’ of the curve.

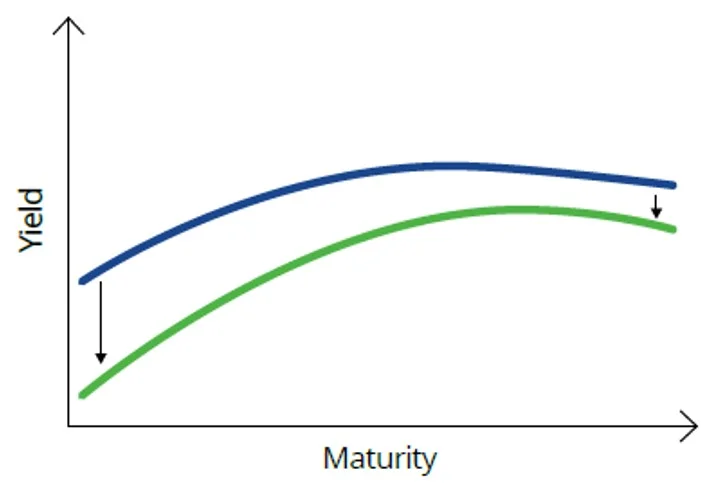

Chart 3: Normal to flat yield curve

Source: VanEck. For illustrative purposes.

A more extreme scenario is where bond markets forecast the economy to enter a recession or slowdown, such that the yield curve inverts where short-dated yields are higher than long-dated. In the US, when this happens it is often a leading indicator of an impending recession. At the very least, an inverted curve may indicate that economic growth is going to slow and that central banks will need to cut rates in the near term to stimulate economic growth.

Chart 4: Inverted yield curve

In both scenarios, investors with long-dated yield exposure benefit from bond price increases as yields fall. Investing in long-dated bonds is considered a defensive strategy as prices typically increase when forecast economic conditions deteriorate.

In another scenario, the yield curve can steepen at the long end, higher than it does at the short end is known as a 'bear steepen'. Bear, because rises in yields are bad, or ‘bearish’, for bonds. Typically, this type of yield curve movement is associated with an environment in which investors think interest rates and economic activity are expected to rise. Shortest duration exposure is preferred here, to minimise the negative impact of rising yields on bond prices.

Chart 5: Normal to bear steepen

Source: VanEck. For illustrative purposes.

Sometimes yields fall, but short-term yields by more than long-term yields. This may occur in a falling-rate environment where the market thinks there will be near-term rate cuts and they will be few or temporary. The jargon for this is a ‘bull steepen’ (bull – because falls in yields are good, or bullish, for bonds). Exposure to the short and middle parts of the curves is preferred to benefit more from the impact of falling yields on bond prices.

Chart 6: Normal curve to bull steepens

Source: VanEck. For illustrative purposes

Accessing different parts of the Australian yield curve

On Thursday September 28, VanEck will launch three new Australian government bond ETFs that will provide investors with a way to ‘play’ the yield curve:

- VanEck 1-5 Year Australian Government Bond ETF (ASX code: 1GOV)

- VanEck 5-10 Year Australian Government Bond ETF (ASX code: 5GOV)

- VanEck 10+ Year Australian Government Bond ETF (ASX code: XGOV)

VanEck’s three new ETFs will help investors target those parts of the curve that exhibit the greatest differences in volatility.

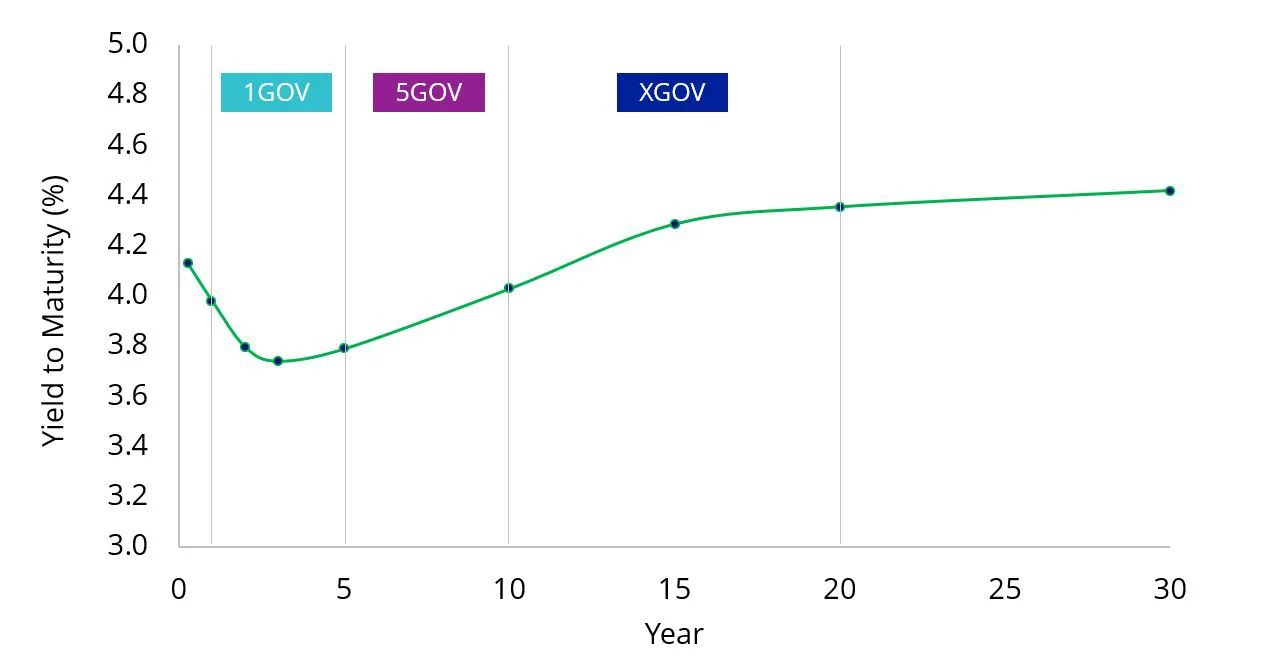

Chart 7: VanEck’s new ETFs target three parts of the curve

Source: VanEck, 31 August 2023. Yield measures are not a guarantee of future dividend income from the funds.

Defensive characteristics

Each ETF will be a portfolio of Australian government and semi-government bonds. The Australian Government and its state and territories’ treasury corporations are highly rated, and their bonds generally offer capital stability in periods of significant equity market weakness.

Income and yield premium

Each ETF has the potential to provide steady and reliable income, paid monthly.1GOV - Targeted access to the short-end of the curve

Access to a portfolio of Australian government bonds which have maturity dates between 1 and 5 years.

5GOV - Targeted access to the mid-end of the curve

Access to a portfolio of Australian government bonds which have maturity dates between 5 and 10 years.

XGOV - Targeted access to the long-end of the curve

Access to a portfolio of Australian government bonds which have maturity dates between 10 and 20 years.

As always, we would recommend you speak to your financial adviser to determine which fixed-income investment is right for you.

An investment in the ETFs carry risks associated with: interest rate movements, bond markets generally, issuer default, credit ratings, country and issuer concentration, liquidity, tracking an index and fund operations. See the PDS for more details.

Published: 21 September 2023

This information is prepared in good faith by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of units in VanEck ETFs traded on the ASX. Units in 1GOV, 5GOV and XGOV are not currently available. 1GOV, 5GOV and XGOV have been registered by ASIC and is subject to ASX and final regulatory approval. The Product Disclosure Statement and the Target Market Determination will be available at vaneck.com.au.

You should consider whether or not any VanEck fund is appropriate for you. Investing in ETFs has risks, including possible loss of capital invested. See the relevant PDS for details. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.

The S&P/ASX Government Bond 1-5 Year Index, S&P/ASX Government Bond 5-10 Year Index and S&P/ASX Government Bond 10-20 Year Index (“Indices”) are products of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and have been licensed for use by VanEck. S&P®, S&P 500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). ASX, ALL ORDINARIES are trademarks of ASX Operations Pty Ltd. and have been licensed for use by S&P Dow Jones Indices. It is not possible to invest directly in an index. The VanEck 1-5 Year Government Bond ETF, VanEck 5-10 Year Government Bond ETF and VanEck 10+ Year Government Bond ETF (“Funds”) are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, any of their respective affiliates (collectively, “S&P Dow Jones Indices”). S&P Dow Jones Indices does not make any representation or warranty, express or implied, to the owners of the Funds or any member of the public regarding the advisability of investing in securities generally or in the Funds nor do they have any liability for any errors, omissions, or interruptions of the Indices.

© 2023 Van Eck Associates Corporation. All rights reserved.