10 reasons fund managers underperform and 3 reasons they can be overcome

Last month Bank of America Research outlined 10 reasons why active managers underperform. There is a smarter way to invest when it comes to selecting funds.

Underperformance by active managers is not a recent phenomenon. According to the SPIVA scorecard produced by the S&P Dow Jones Indices, over the last 15 years almost 84 per cent of actively managed Australian equity general funds underperformed the S&P/ASX 200. (SPIVA | S&P Dow Jones Indices (spglobal.com)

It was reported in the Australian Financial Review, and subsequently in LiveWire that Bank of America (BOA) Sydney based quant strategist Nigel Tapper outlined 10 reasons why some active funds underperform:

- Incorrect assumptions about alpha generation

- Assumptions about how markets react to events

- Static allocation, that is sticking to one style

- Focus on bottom-up alone, or ignoring the economic cycle

- Risk aversion in an upturn

- Unintended exposures which BOA describe as focusing “on portfolio exposure to stocks, sectors, and countries” while ignoring exposures to things like style, the cycle and interest rates

- Extrapolating investment lessons from the United States

- Basis risk or not owning stocks (in the index) for liquidity reasons

- Holding cash

- Transaction costs

Nevertheless, many investors continue to invest in active funds, presumably because of the outperformance promises and despite the excessive fees of some these funds. However, there are ‘smarter’ options, that target similar outcomes but with lower fees.

Smart beta is the term given to ETFs (Exchange Traded Funds) which track an index that differs from the traditional market capitalisation approach of selecting shares, bonds or other assets. Smart beta combines the best of active and passive investing: having the potential for better investment outcomes while being rules-based, transparent and cost efficient.

Popular smart beta ETF strategies can focus on dividends, liquidity, equal weighting, or factor-based such as, value or quality.

There are three reasons these types of ETFs overcome the issues BOA identified are:

- Removal of the human element;

- Passive management, because smart beta is rules-based and index tracking, it generally has lower turnover than active management.

- Smart beta strategies are fully invested.

Smart Beta investing avoids common management mistakes as there is no human element involved. Personal biases which can result in incorrect assumptions about alpha generation aren’t involved in stock selection (issue #1). Other issues BOA identified that are purely human are numbers 2 and 5.

The second reason Smart Beta strategies don’t result in common fund manager mistakes is because passive smart beta investing operates according to a binary set of rules, overcoming issue 8.

These passive, smart beta strategies track indexes that don’t frequently buy and sell individual stocks, keeping transaction costs low (issue 10).

The final reason passive Smart Beta avoids active management mistakes is that a smart beta strategy is fully invested. While some active fund managers may rush to get out of riskier positions during times of volatility, transferring holdings to cash, they often miss opportunities when the market bounces back due to subjective risk aversion. Smart Beta ETFs overcome issue 9.

If you’ve been keeping score, Smart Beta has overcome 6 of the 10 issues.

Smart Beta ETFs, we believe can also help investors to overcome the remaining issues.

For example, in this Vector Insight, Investing through the seasons , we spoke about the performance of different Smart Beta factor-based approaches through the cycle. It is challenging for investors to navigate economic conditions and prevailing markets. Smart Beta is being used by savvy investors as tools, to either hold through the cycle, or blend, to help mitigate the troughs of the cycle.

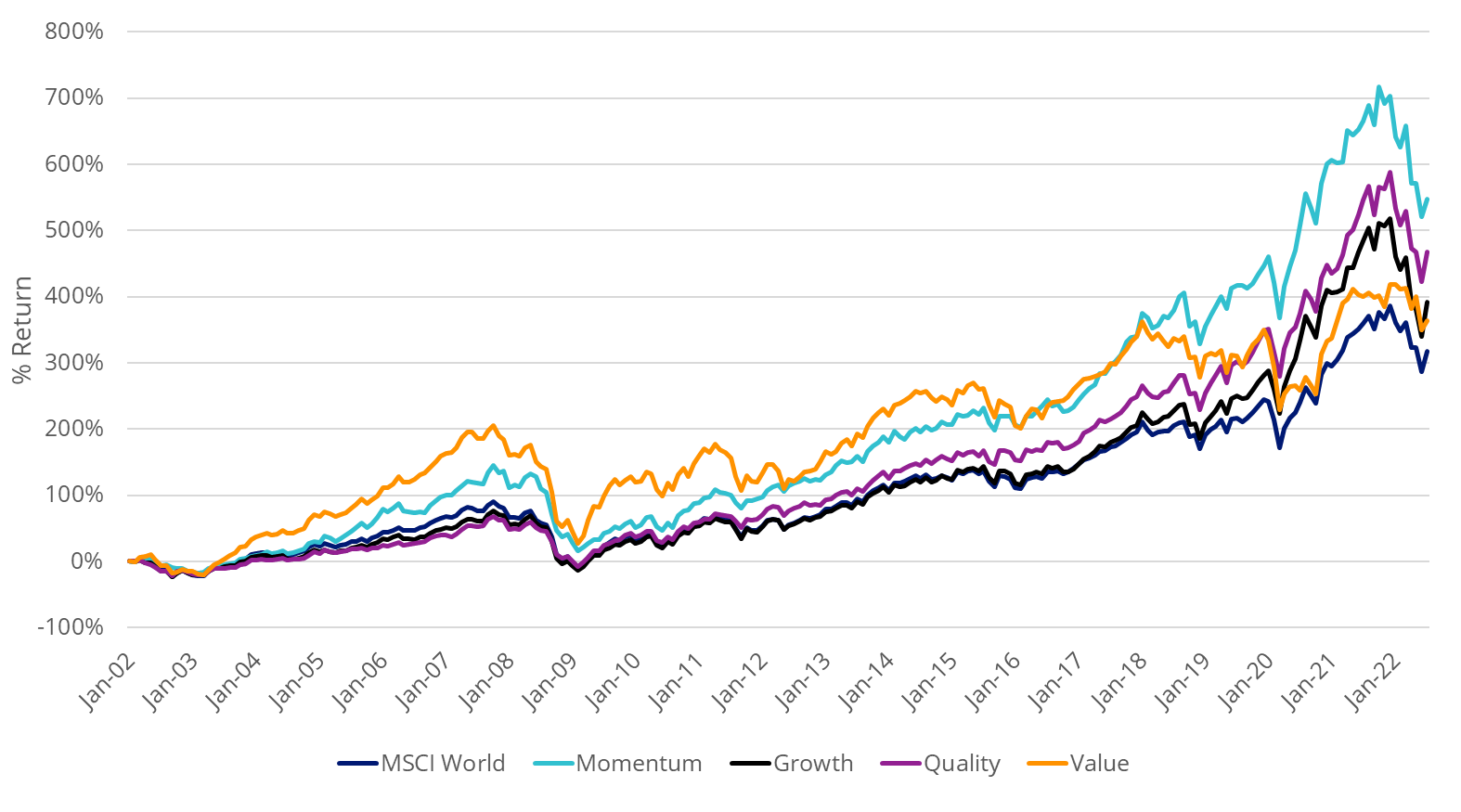

Factor based investing, according to MSCI, has historically achieved excess market returns over the long term in global equity strategies, with different factors performing well in different macroeconomic environments, but all have achieved outperformance over the very long term (Figure 1). Note: per issue 7, just because these approaches work globally they may not work everywhere, like Australia – see Banks may be weighing on your portfolio.

Figure 1: Global equity cumulative factor returns

Source: MSCI, USD returns, January 2002 to April 2022, MSCI World Factor Indices, Value as MSCI World Enhanced Value. Past performance is not a reliable indicator of future performance

It’s little wonder investors are flocking to Smart Beta ETFs, as an alternative to active managers.

In the US, Smart Beta ETFs now make up over US$1 trillion of the US$7 trillion-dollar ETF market. According to Bloomberg Intelligence’s Athanasios Psarofagis, “Things are working, values are working, dividends are working, high quality is working, so there is a lot of stuff in that category that’s really working right now so I think that’s why you’re seeing the flows spike up even more than normal.”

Mr Psarofigis’s Bloombergcolleague Eric Balchunas recently tweeted:

IMO smart-beta + ESG + themes + packaged trade ETFs are all forms of active that are stealing share from traditional discretionary active. In other words the active to passive trend is much more nuanced, a big chunk of passive is literally active.

— Eric Balchunas (@EricBalchunas) July 25, 2022

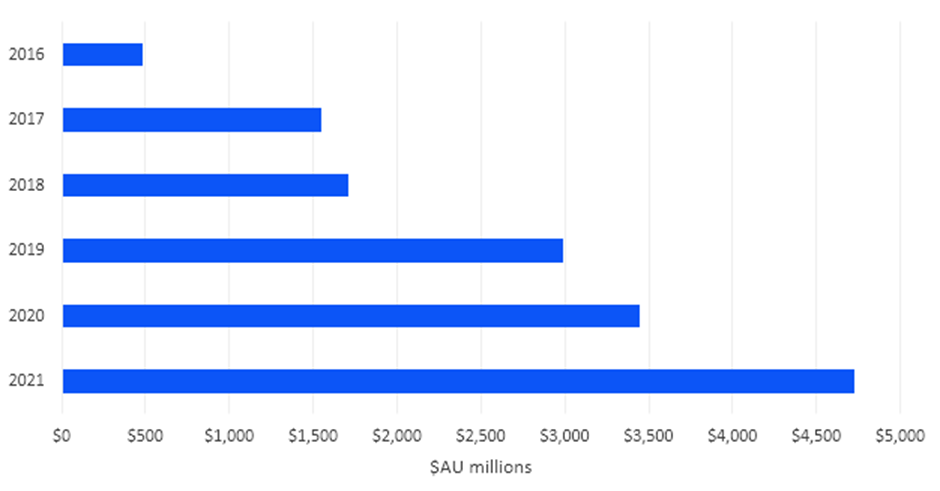

And, just like in the US, investors have also been flocking into Australian Smart Beta ETF’s in droves in recent years.

Figure 2: Australian Smart Beta Net Flows

Source: ASX, VanEck

According to Mr Psarofagis, “Smart beta is a pretty interesting category, 70 per cent of the category is beating the market this year. So that’s pretty impressive and the smart beta category in itself is so large - it’s over a trillion in assets. Because it’s so big in its own right you tend to see rotations within the category. For example, we were talking growth and value, that’s a very common trade, people will move out of growth and into value and vice versa. So, the assets actually tend to stay within smart beta they just sort of jump around to different categories.”

“That 70 per cent outperformance rate really caught my eye.” (Bloomberg Intelligence ETF IQ 09/01/2022 Bloomberg discussing the US Smart Beta ETF sector)

Learn more about smart beta and explore our smart beta range click here.

Published: 05 August 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.