A guide to ETF investment strategies

ETFs select securities that are in the index and changes to the portfolio generally only occur when the index changes. The contrast to this are ‘actively managed funds’ where the fund manager picks the shares that they think are going to perform the best.

In consultation with a financial adviser or stock broker, investors may adopt various investment strategies using ETFs in their portfolios. These include:

| Investment strategy | Description |

| Core and satellite | Use a broad based strategy as a core investment with satellite strategies such as sector ETFs to potentially enhance overall portfolio performance, provide diversification or control risk. |

| Strategic asset allocation | Maximise diversification benefits with strategic allocations to a variety of asset classes. |

| Tactical asset allocation | Establish tactical short term overweight or underweight positions in an effort to outperform the market and/or reduce risk. |

| Sector tilts | Similar to tactical asset allocation by using a sector ETF to tilt a strategy towards a given sector. |

| Cash equitisation | Gain instant short-term market exposure while refining a longer-term investment view. |

| Completion strategies | Gain exposure to specific sectors or asset classes easily by ‘filling the holes’ in the portfolio. |

| Sector rotations | Use key macroeconomic trading signals to take advantage of cyclical market movements. |

| Pairs trading | Take long position in an ETF and a short position in one of the constituents in the ETF. |

| Diversification / risk management | Adding an ETF to a direct equities portfolio can enable increased diversification by reducing stock specific risk. |

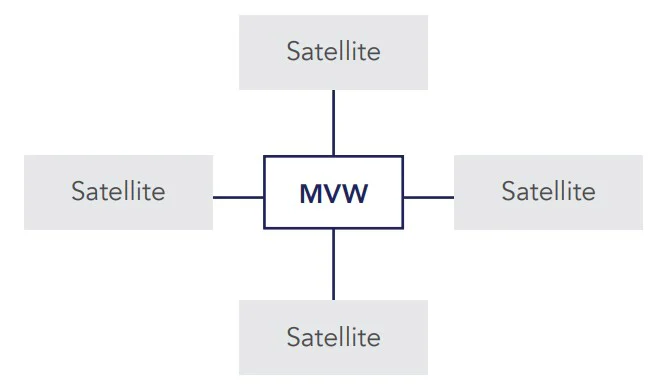

Core and satellite approach

As the name suggests, this involves building a portfolio by investing in a fund that comprises a core strategy and adding individual positions or satellites around that core. A core strategy can be achieved by investing in a broad based index fund, for example VanEck Australian Equal Weight ETF (ASX code: MVW). MVW is passively managed to track an underlying index of highly liquid ASX listed securities. It does this by investing in the same companies in equal proportions, as contained in the MVIS Australia Equal Weight Index. MVW provides a sound core around which ‘active’ satellite positions could be added. For satellites you could take positions in sector specific index funds and/or individual stocks that reflect your current views on markets. For example, if you think that the resources sector was going to outperform you could put a percentage of the portfolio allocated to satellites into a resources sector ETF such as VanEck Australian Resources ETF (ASX code: MVR). If you also think a security in your core fund is undervalued and you want to have a larger exposure to it, you can then also buy that security directly. ETFs can be used as both core and satellite investments within that portfolio. Your adviser can help you build a portfolio that contains core and satellite positions to suit your individual circumstances.

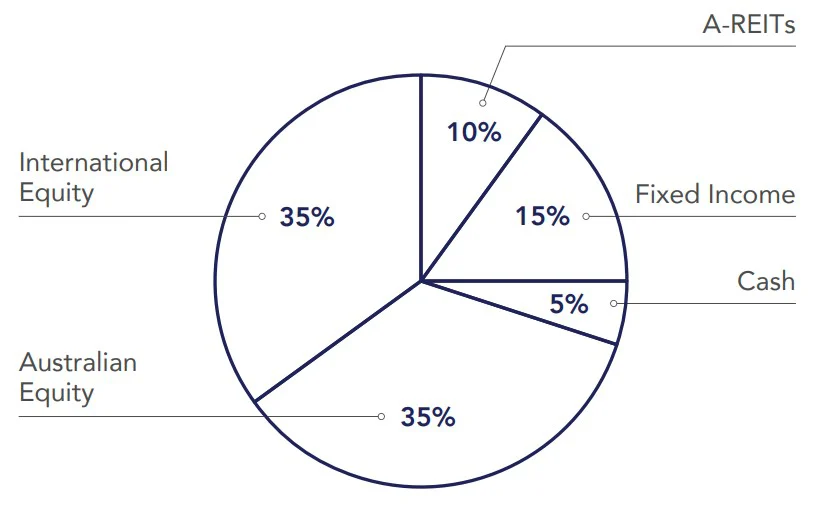

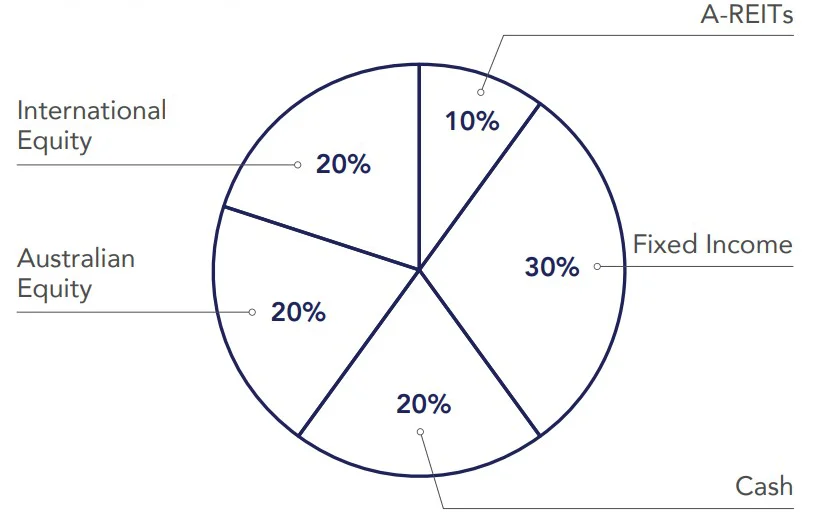

Strategic Asset Allocation (SAA)

Strategic Asset Allocation (SAA) is generally a long term portfolio strategy that involves setting target allocations for various asset classes for the long term and rebalancing the portfolio back to the target allocations periodically when the allocations change due to market movements. Your financial adviser may recommend a Strategic Asset Allocation strategy across a number of asset classes. You can achieve the recommended exposure to each asset class via investing in different ETFs. The benefit of ETFs is that they provide investors with a simple and cost effective way to obtain diversified exposure to an asset class via a single trade on ASX. Using ETFs also means that a SAA portfolio can easily be rebalanced by selling or buying the required percentage of each ETF via simple ASX trades to return the portfolio to the target allocations. ETFs provide investors with an efficient, cost-effective solution for executing a Strategic Asset Allocation strategy.

Growth portfolio example

Balanced portfolio example

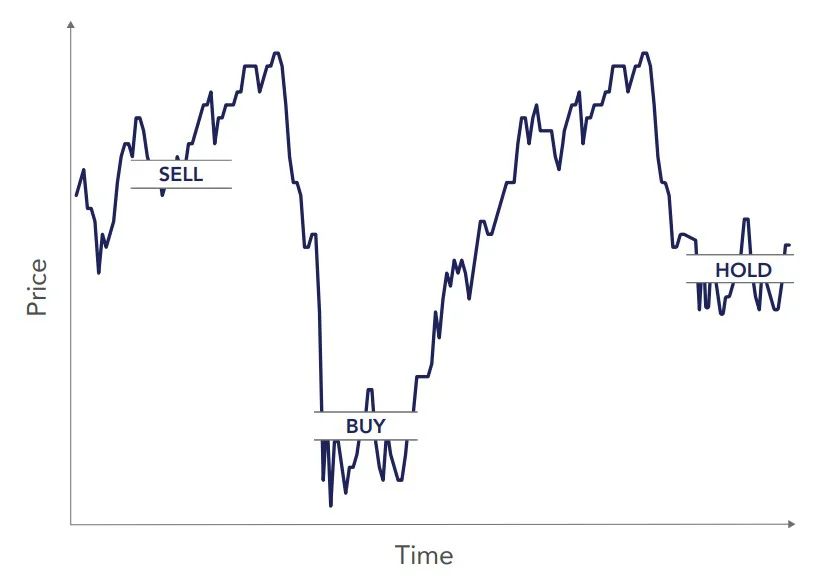

Tactical Asset Allocation (TAA)

Tactical Asset Allocation (TAA) is an active portfolio strategy that takes advantage of short term opportunities in the market with a view to actively generate trading profits. Tactical Asset Allocation may be implemented at the portfolio level or could be used within the asset allocation of a Strategic Asset Allocation strategy. For example, a Strategic Asset Allocation that allocates 70% to growth assets comprising Australian equities. If you think that banks are undervalued today, you may decide to tactically allocate some of that 70% to banks. You can use ETFs to do this type of trading. In this example you could buy VanEck Australian Banks ETF (ASX code: MVB) for the additional exposure to banks. If you later decide that banks are overvalued and think property is undervalued, you could switch your Tactical Asset Allocation from banks to property by selling out of MVB and buying VanEck Australian Property ETF (ASX code: MVA).

The intention of all of these portfolio strategies is to diversify your portfolio. Diversification has been shown to reduce volatility (risk) and improve performance (return). ETFs may be used in each portfolio construction technique above to take active or passive positions and mitigate risk. Each portfolio construction technique may be used individually or with others. In each case, ETFs can provide a liquid, diversified and cost effective tool to build an investment portfolio that gives you exposure to many different assets classes and markets to assist you to achieve your investment goals.

Published: 04 February 2024

Key Risks: An investment in any of the Funds carries risks. These risks vary and are generally more pronounced in equities funds when compared to fixed income funds. It is important that you read the relevant PDS for details about the risks associated with each of the Funds.

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.