Expert’s choice: You can invest like the Future Fund: Part 4.

Australia’s Future Fund is among the top 20 largest sovereign wealth funds globally. It was established in 2006 in response to our aging population and long-term pressure on the Commonwealth's finances. Each year, as required by the Future Fund Act 2006, an Annual Performance Statement is prepared for The Future Fund. A review of past reports highlights The Future Fund’s equity strategy and it is one that thousands of astute Australian investors are using too.

Each year, as required by the Future Fund Act 2006, an Annual Performance Statement is prepared for The Future Fund. Past reports are available at www.transparency.gov.au. A review of the reports indicates that, “In asset classes where manager skill is less evident (such as listed equities), we have been transitioning the portfolio to a cheaper, more passive approach.”

But the Future Fund does not take any ‘passive’ approach. They are smarter.

Earlier annual reports give interested readers an idea of what these “cheaper, more passive” approaches could be. According to the 2018/19 annual report the passive approach The Future Fund is taking “… systematically harvests equity risk premia through exposure to factors.” Wow!

But what does this mean? Simply, the Future Fund is using factor-based investing. So too, already, are lots of Australian investors, they just don’t refer to it as “harvesting risk premia”, or maybe they do.

Factors are identifiable, persistent drivers of risk and return over time. Factor-based investing can be implemented via rules-based, transparent indices. Passive funds, like ETFs, track indices, so as it can be surmised that The Future Fund’s cheaper passive approach is tracking factor-based indices, there are ETFs that track factor-based indices too.

Most traditional index providers have had the foresight to create factor-based indices in anticipation of increasing demand for low-cost passive investing alternatives.

MSCI, for example has created a range of factor-based indices that aim to isolate factors. And there is little wonder The Future Fund invests in these types of strategies. Over the past 25 years, according to MSCI, “Over time, individual factors have delivered outperformance relative to the market.”1That is factors have risen more than the market, as represented by the MSCI World ex Australia Index which is the benchmark index for international equities.

One example of MSCI’s factor-based indices is its Quality Index series. These target international companies with a high return on equity (ROE), low leverage/debt and stable earnings. These are fundamentals famous investor Benjamin Graham suggested investors should not ignore in his book “The Intelligent Investor” and, we would argue, are key components for many active managers’ processes.

Graham is known as the ‘Father of Value Investing’, and MSCI has also created an Enhanced Value Index Series too. These target companies with high value scores based on price to book value, price to forward earnings and enterprise value to cash flow from operations

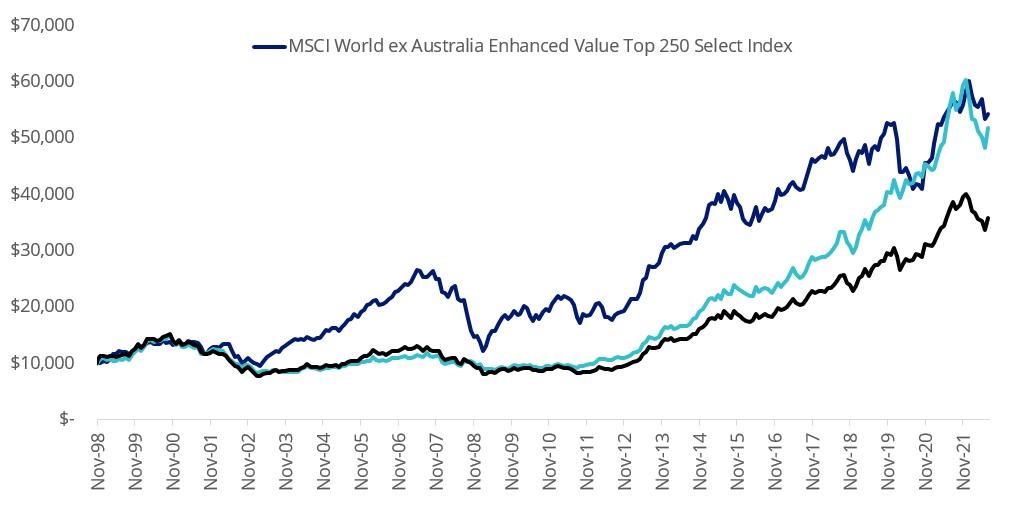

The chart below compares the long term returns of MSCI’s quality and enhanced value indices compared the market benchmark, MSCI World ex Australia Index. You can see, consistent with MSCI’s findings, these factors have delivered outperformance relative to the market over time. Prior to the GFC as economies were recovering and expanding during this time enhanced value outperformed. During the contraction and sluggish growth (slowdown) following the GFC and the COVID-19 lockdowns, quality came to the fore. Both have outperformed over the very long term.

Chart 1: Growth of $10,000: MSCI World ex Australia Index, MSCI World ex Australia Quality Index and MSCI World ex Australia Enhanced Value Top 250 Select Index

Source: Morningstar Direct, from 30 November 1998 (VLUE Index base date) to 30 July 2022. Past performance is not a reliable indicator of future performance. The above graph is a comparison of performance of MSCI World ex Australia Quality Index, MSCI World ex Australia Enhanced Value Top 250 Select Index and the MSCI World ex Australia Index, based to 10,000 from 30 November 1998. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and exclude fees and costs associated with investing in VLUE or QUAL. You cannot invest in an index. QUAL’s Index base date is calculated at 30 November 1994. QUAL Index performance prior to its launch on 15 October 2014 is simulated. VLUE’s Index base date is calculated at 30 November 1998. VLUE Index performance prior to its launch on 15 February 2021 is simulated.

The MSCI World ex Australia Index (“MSCI World ex Aus”) is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of developed market large- and mid-cap companies, weighted by market capitalisation. QUAL and VLUE’s index have fewer companies and different country and industry allocations than MSCI World ex Aus.

You can see why The Future Fund is using factor-based approaches for its equities.

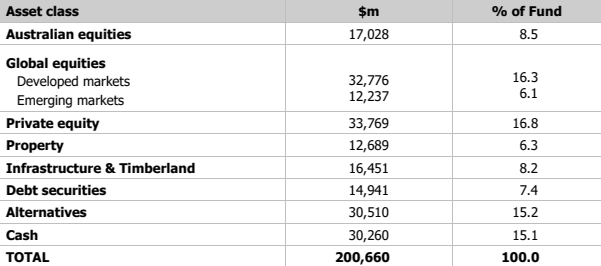

Global equities represent around 20% of the Future Funds’ asset allocation.

Table 1: Future Fund Asset allocation as at 31 March 2022

Source: Future Fund, portfolio update to 31 March 2022

What many investors are catching onto is that they can invest like the Future Fund too. ASX investors can access factor-based portfolios via an ETF. Examples include:

- VanEck MSCI International Quality ETF (QUAL)2which tracks the MSCI World ex Australia Index noted above

- VanEck MSCI International Value ETF (VLUE) which tracks the MSCI World ex Australia Enhanced Value Top 250 Select Index

- VanEck MSCI Multifactor Emerging Markets Equity ETF (EMKT) which tracks the MSCI Emerging Markets Multi-Factor Select Index

- VanEck MSCI International Small Companies Quality ETF (QSML) which tracks the MSCI World ex Australia Small Cap Quality 150 Index

Smart Beta ETFs have become the quintessential portfolio construction tool of choice for the financial adviser and broker community in Australia appeasing even the most discerning investors. You too can invest like The Future Fund.

You can learn about quality here – click here

You can learn about value here – click here

The pages include videos and flyers. They also highlight other investment approaches that capture the quality and value factors.

As always we recommend you speak to an investment professional to determine which investment is right for you.

Key risks

An investment in the funds carries risks associated with: financial markets generally, individual company management, industry sectors, ASX trading time differences, foreign currency, sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details

For further information you can contact us via info@vaneck.com.au or +61 2 8038 3300.

1 – Introducing MSCI Factor Indexes

2 – An A$ hedged version is available, VanEck MSCI International Quality (Hedged) ETF which trades under the ASX ticker QHAL.

Published: 24 August 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

QUAL, VLUE, EMKT and QSML are indexed to a MSCI index. The funds are not sponsored, endorsed or promoted by MSCI, and MSCI bears no liability with respect to QUAL, VLUE, EMKT and QSML or the MSCI Index. The PDSs contain a more detailed description of the limited relationship MSCI has with VanEck and the funds.