Finding balance in global healthcare

Healthcare is in focus, but CSL’s dominance on the sector locally highlights the need for global exposure. Like a healthy diet, finding balance is important.

The latest VanEck Australian Investor Survey revealed more Australians than ever are looking overseas to expand their portfolio. The survey identified healthcare as one of the leading sectors that respondents are considering for future investments.

The appeal of the asset class is understandable.The healthcare sector has significant, long-term growth potential for investors.

Global healthcare expenditures account for 10.2% of the world’s GDP and are set to grow, creating opportunities for investors.

Australian investors are generally underweight healthcare stocks relative to international benchmarks. The local sector is relatively small and is dominated by CSL, therefore an allocation to global healthcare is an important diversifier. In terms of long-term returns, the performance of global healthcare has been very attractive. At the time of writing, only the technology sector has performed better since 2008.

One of the most popular ways Australian investors access a dedicated global healthcare strategy is via a passive fund tracking an index constructed using a traditional market capitalisation approach. The only criteria for a company to get into these indices is size with the biggest companies making up a bigger part of the index.

When investing in the healthcare sector, selectivity is important, we think. Taking a broad market capitalisation approach to global healthcare potentially leaves investors with a long tail and concentration risks.

Active managers make bets on who they think might be tomorrow’s winners based on complex and risky factors such as drug trials, novel science and winning regulatory approvals. And for this selectivity, active managers charge a hefty fee.

We believe a smart beta, or rules-based approach, that targets companies that consistently deliver growth can potentially deliver greater rewards to investors over the longer term. Smart beta combines the best of active and passive management: the best of active in that it can reward investors over the long term and the best of passive in that it is low-cost. The VanEck Global Healthcare Leaders ETF (HLTH) uses a smart beta approach.

HLTH’s ‘smarter’ approach

HLTH tracks the MarketGrader Developed Markets (ex-Australia) Health Care Index, which targets stocks that deliver growth at a reasonable price (GARP) and generate long-term shareholder value. Companies are selected on the basis of the strength of 24 fundamental indicators across four factor categories:

- Growth;

- Value;

- Profitability; and

- Cash flow.

The HLTH Index identifies the top 100 companies with the best GARP attributes, selects only the top 50 by market capitalisation, and then equally weights the constituents. The result is a portfolio of 50 fundamentally sound and attractively valued companies with the best growth prospects in the healthcare sector.

So, let’s walk through the difference between HLTH and one of the market capitalisation indices, the S&P Global 1200 Healthcare Sector Index.

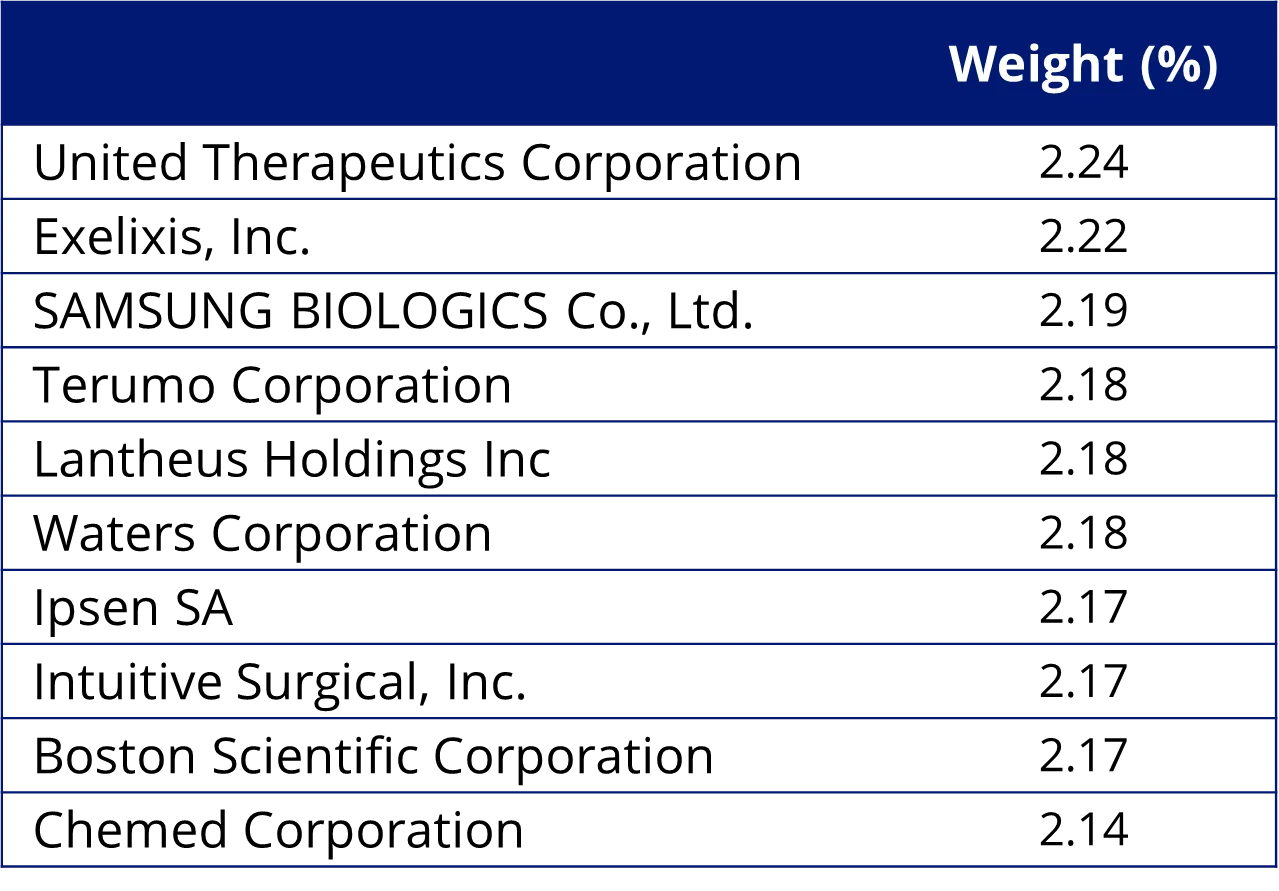

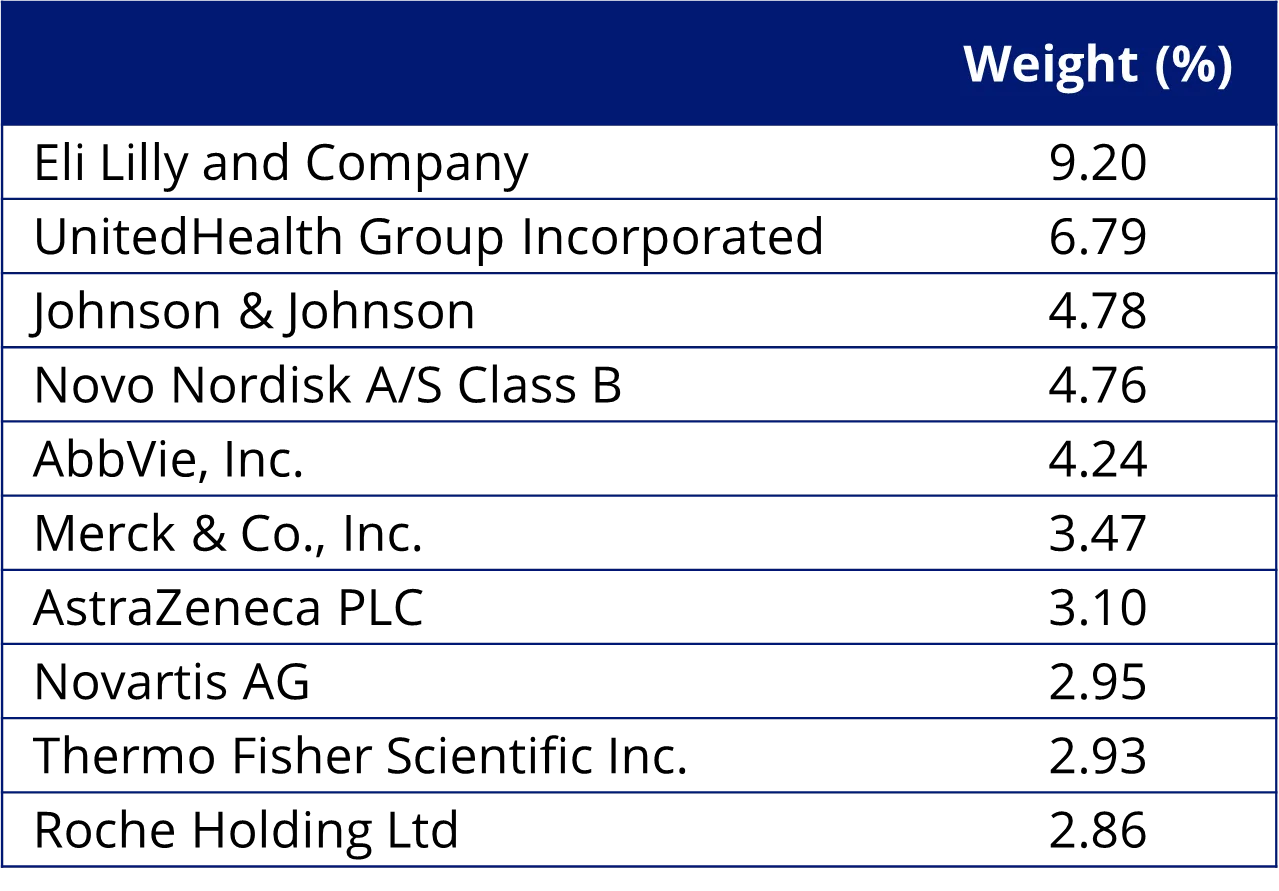

HLTH vs S&P Global 1200 Healthcare Sector Index - Top 10 holdings

Below you can see the top 10 companies. In the S&P Global 1200 Healthcare Sector Index one company, Eli Lilly and Company makes up almost 10%, its top ten is over 45% of the index. What this means is that many, smaller-sized healthcare companies do not contribute much to the portfolio performance of the S&P Global 1200 Healthcare Sector Index. Compare this to HLTH, which is equally weighted, so all its companies have the potential to contribute meaningfully to the performance of the index.

In addition, HLTH’s constituents have been selected using MarketGrader’s GARP approach, whereas for the S&P index, the only criteria for inclusion, apart from being a healthcare company, is being big enough. Big is not always better. To see all the holdings in HLTH and their weightings click here.

Table 1: Top 10 holdings HLTH

Source: VanEck, S&P, MarketGrader as at 21 October 2024. Not a recommendation to act.

Table 2: Top 10 holdings S&P Global 1200 Healthcare Sector Index

Source: VanEck, S&P, as at 21 October 2024. Not a recommendation to act.

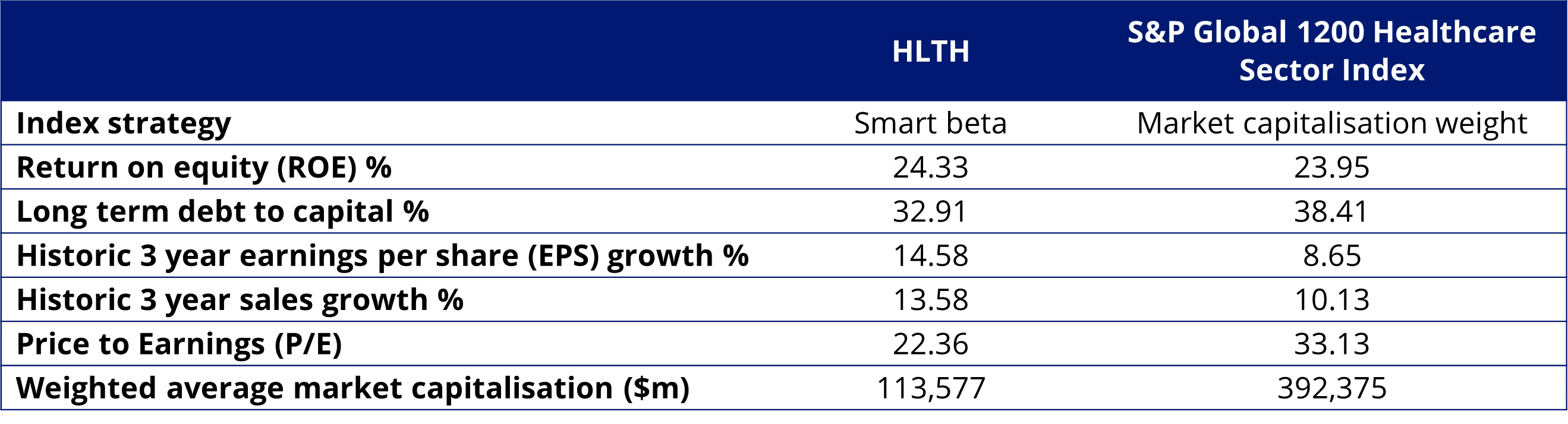

HLTH vs S&P Global 1200 Healthcare Sector Index – Fundamentals

Table 3: Statistics and fundamentals

Source: VanEck, S&P, VanEck, S&P, MarketGrader as at 21 October 2024. Past performance is not a reliable indicator of future performance.

As you would expect, HLTH has a higher ROE and a higher EPS growth rate because of the growth part of the GARP methodology. The other aspect of GARP is ‘at a reasonable price’, and HLTH is also more attractive from a price-to-earnings perspective.

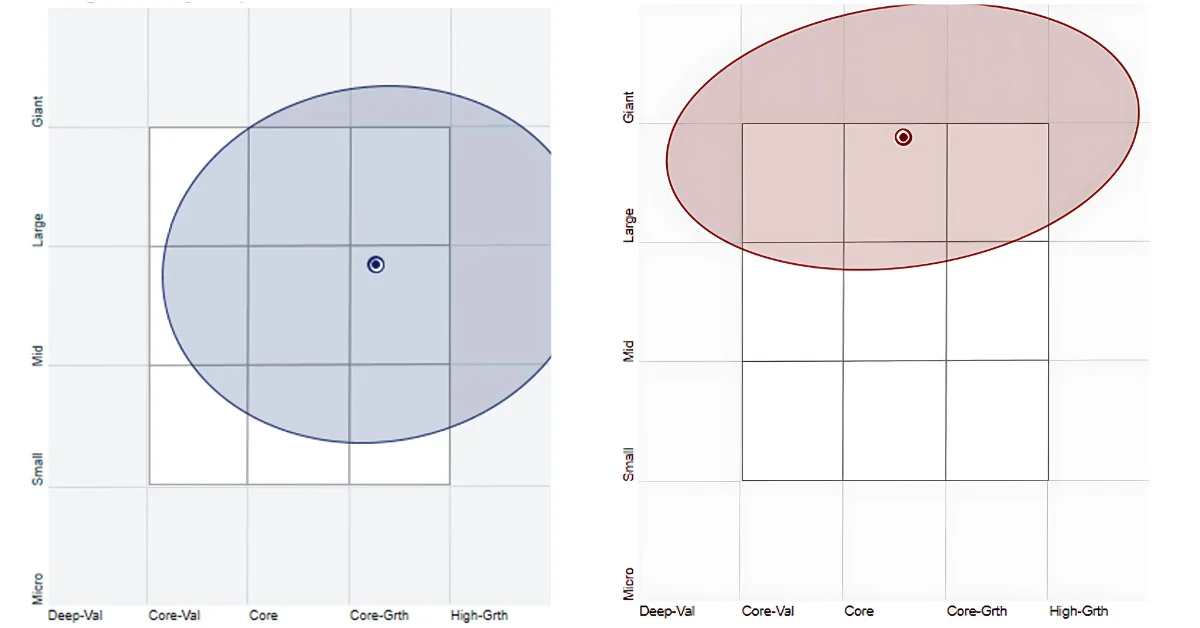

HLTH vs S&P Global 1200 Healthcare Sector Index - Style

When looking at portfolios it is important to determine which style (e.g. value or growth) and which size bias a portfolio holds (e.g. giant, large, mid or small). Below we can see HLTH’s style map. Importantly HLTH holds large companies with a core-growth orientation while the S&P Global 1200 Healthcare Sector Index is skewed toward giant companies.

Chart 1 & 2: HLTH holdings based style map, S&P Global 1200 Healthcare Sector Index style map

Source: Morningstar Direct, as at 30 September 2024

A dedicated global healthcare strategy has its merit for portfolio inclusion, and you should assess all the risks and consider your investment objectives. HLTH is an Australian first, utilising a state-of-the-art smart beta strategy.

You can find out more about investing in healthcare – here and about HLTH – here.

Past performance is no guarantee of future performance. The above is not a recommendation. Please speak to your financial adviser or stock broker.

For further information, contact us via email or call us on +61 2 8038 3300.

Key risks

An investment in HLTH carries risks associated with: financial markets generally, individual company management, industry sectors, ASX trading time differences, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details. No member of the VanEck group of companies guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.

Published: 24 October 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

"MARKETGRADER" and “MARKETGRADER DEVELOPED MARKETS (EX-AUSTRALIA) HEALTH CARE INDEX” are trademarks of MarketGrader.com Corp. and have been licensed for use for certain purposes by VanEck. HLTH is based on the MARKETGRADER DEVELOPED MARKETS (EX-AUSTRALIA) HEALTH CARE INDEX, but is not sponsored, endorsed, sold or promoted by MarketGrader, and MarketGrader makes no representation regarding the advisability of investing in HLTH.