All aboard the PE train

Private equity deals are heating up. Review our listed private equity update - a quiet stock market achiever over the past year - and why it’s interesting now.

- According to S&P Global Market Intelligence data, private equity deal value climbed 5.1% to US$130.61 billion for the first three months of 2024 from $124.30 billion for the same period in 2023.

- VanEck's Global Listed Private Equity ETF (GPEQ) performance has been reflecting this positive activity, over the past twelve months, it is up 43% (as at 22 May 2024). As always, past performance is not indicative of future performance.

- GPEQ tracks the LPX50 index and is Australia’s only listed private equity ETF strategy. LPX has a deep research pedigree and publishes updated valuations regularly – as at the 22 May 2024, the asset class was trading at a 13.5% discount to net asset value (NAV).

- According to LPX, the empirical results suggest that in 81% of all years since 1993, listed private equity outperformed public markets when a NAV discount was observed at the end of the year, as it was in 2023.

Private equity firms on the hunt for bargains

Recently, a holding in VanEck Global Listed Private Equity ETF (GPEQ) Alaris Equity Partners announced an initial investment of US$20 million in Cresa, a leading global commercial real estate advisory firm dedicated to exclusively representing tenants, with 50 offices across North America.

Alaris Equity Partners provides alternative financing to private companies with the principal objective of generating stable and predictable cash flows for dividend payments to its unit holders.

This follows the recent news that another GPEQ holding, KKR has announced the acquisition of a logistics property strategically located adjacent to Nashville International Airport. The terms of the transaction were not disclosed.

KKR is a leading global investment firm that offers alternative asset management as well as capital markets and insurance solutions. A testament to the companies’ growth, KKR is set to join the S&P 500 index as of Monday June 24. This inclusion comes as part of the index's regular rebalancing process.

Private equity firms are not only on the hunt for bargains, some are also realising profits. GPEQ holding Apax Global Alpha Limited (AGA) recently announced the sale of its investment in Healthium Medtech Limited.

According to Apax’s press release, this transaction values AGA's look-through investment in Healthium at approximately €22.7M. This represents an uplift of c.23% to the last Unaffected Valuation and an uplift of c.€4.3m (c.€0.01 per share / c.£0.01 per share) in the Adjusted Net Asset Value ("Adjusted NAV") of AGA at 31 March 2024. This transaction is expected to close in Q3 2024, subject to regulatory approvals.

These deals highlight why investors are considering boarding the private equity train and why it is important to diversify listed private equity.

A stellar 12 months for listed private equity

Listed private equity has been one of the quiet achievers on share markets over the past twelve months, avoiding the spotlight, even though its returns and, as noted above, activity have been noteworthy. The VanEck Global Listed Private Equity ETF (GPEQ) has returned 44.43% for the 12 months to 22 May 2024, though we would always caution, that past performance should not be relied upon for future performance.

Table 1: GPEQ trailing returns as at 22 May 2024

|

1 month |

3 months |

YTD |

6 months |

1 Year |

Since GPEQ Inception |

|

|

GPEQ |

2.63 |

4.83 |

13.62 |

21.73 |

44.43 |

6.50 |

Source: VanEck, Morningstar, Bloomberg. Results are calculated daily and assume immediate reinvestment of all dividends. GPEQ results are net of management fees and other costs incurred in the fund but do not include brokerage costs and buy/sell spreads incurred when investing in GPEQ. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index. GPEQ inception date is 23 November 2021 and a copy of the factsheet is here.

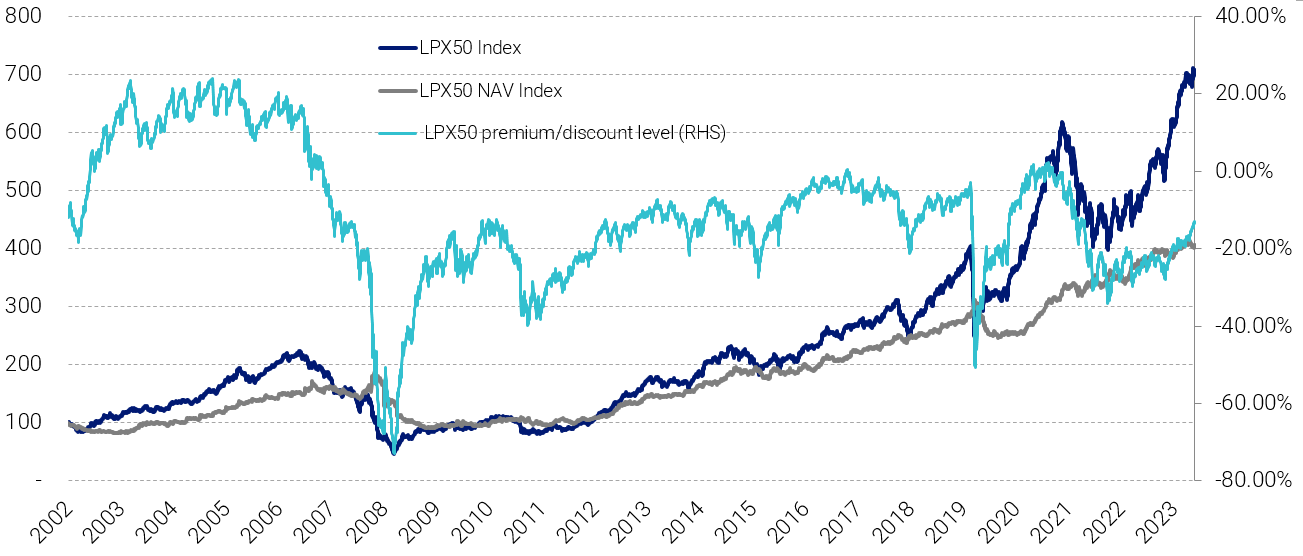

Listed private equity is still trading at a discount

Despite the past year’s price rises, listed private equity is still trading at a significant discount to the net asset value of its underlying assets. In addition to tracking the prices of listed private equity companies, LPX also calculates the Net Asset Value (NAV) performance development of the 50 largest Listed Private Equity companies based on the underlying portfolio of private equity investments owned by each listed company comprising the LPX50 Index - this is the LPX50 NAV index.

Chart 1: Correlation between market price and NAV Index

Source: LPX AG. To 22 May 2024. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

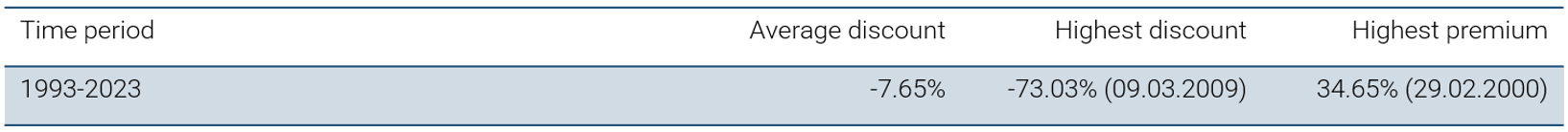

LPX has analysed the returns of its index since 1993 to the end of 2023.

The empirical results suggest that in 81% of all years since 1993, listed private equity has outperformed public markets when a discount was observed at the end of the year.

Table 2: Research suggests when discounts are high, consider private equity

Source: LPX AG, 31 December 2023.

We think the listed private equity provides better liquidity, and diversification across regions and investment categories than unlisted private equity.

GPEQ allows Australian investors to include private equity as a part of their alternative allocation of their portfolios via a single trade on ASX. The ETF provides immediate access to a highly diversified group of the 50 largest/most liquid listed private equity companies, with a collective private equity portfolio of more than 3,300 private equity direct investments and 350 private funds.

Key risks

An investment in the GPEQ carries risks associated with listed private equity, ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for more details on risk.

Published: 14 June 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.