One of 2024’s best-performing asset classes no one is talking about

Activity in private equity has been heating up in 2024. Recently, Melbourne-based biotech startup exteRNA secured $11 million of funding from IP Group, a holding in VanEck Global Listed Private Equity ETF (GPEQ).

The exteRNA deal is hot on the heels of other GPEQ holdings’ activities including:

- Wendell’s acquisition of 75% of Monroe Capital LLC, a private credit lender in the US;

- Gimv joining the US$92 million investment round in Kivu Bioscience;

- Patria Private Equity Trust PLC selling 14 fund investments;

- KKR’s acquisition of 25% in Eni’s biofuel unit, EniLive, valuing it at US$13 billion;

- Bain Capital’s investment in the UK’s largest financial advice network, Openwork; and

- Apollo Group’s all-cash deal, valued at approximately US$3.6 billion in aerospace parts maker Barnes Group.

According to S&P Global Market Intelligence data, the total transaction value of global PE and VC deals surged year to date in August, reaching $419.43 billion, up 24% from the same period in 2023. As inflation started to fall and interest rates normalised, investors focused on listed markets. Geopolitical uncertainty and escalating conflicts resulted in investors diversifying into gold, and more recently, bitcoin after the US election.

Combined, these conditions also suit an alternate-asset class diversifier like private equity. As we near the end of 2024, a review of private markets’ data shows it appears to have reverted to pre-COVID levels in terms of fundraising, investment activity and deals. The asset class’ returns, as reflected by listed private equity, reflect these dynamics, and there are many reasons the momentum could continue into 2025.

It is expected that policy rates in the US and Europe will continue to fall, and recent stimulus measures in China continue to flow through. It is also anticipated that Trump’s policy agenda will be pro-business. These could all provide further tailwinds for listed private equity, which already has momentum.

A stellar 12 months for listed private equity

Listed private equity has been one of the quiet achievers on share markets over the past twelve months, avoiding the spotlight, even though returns and activity have been noteworthy.

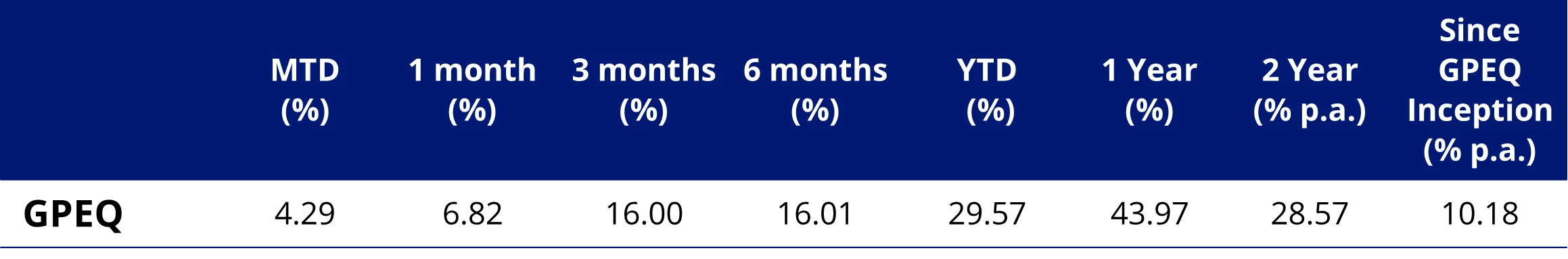

The VanEck Global Listed Private Equity ETF (GPEQ) has been reflecting this positive activity, returning 43.97% for the 12 months to 13 November 2024, though we would always caution, that past performance should not be relied upon for future performance.

Table 1: GPEQ trailing returns as at 13 November 2024

Source: VanEck, Morningstar, Bloomberg. Results are calculated daily and assume immediate reinvestment of all dividends. GPEQ results are net of management fees and other costs incurred in the fund but do not include brokerage costs and buy/sell spreads incurred when investing in GPEQ. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index.

GPEQ inception date is 23 November 2021 and a copy of the factsheet is here.

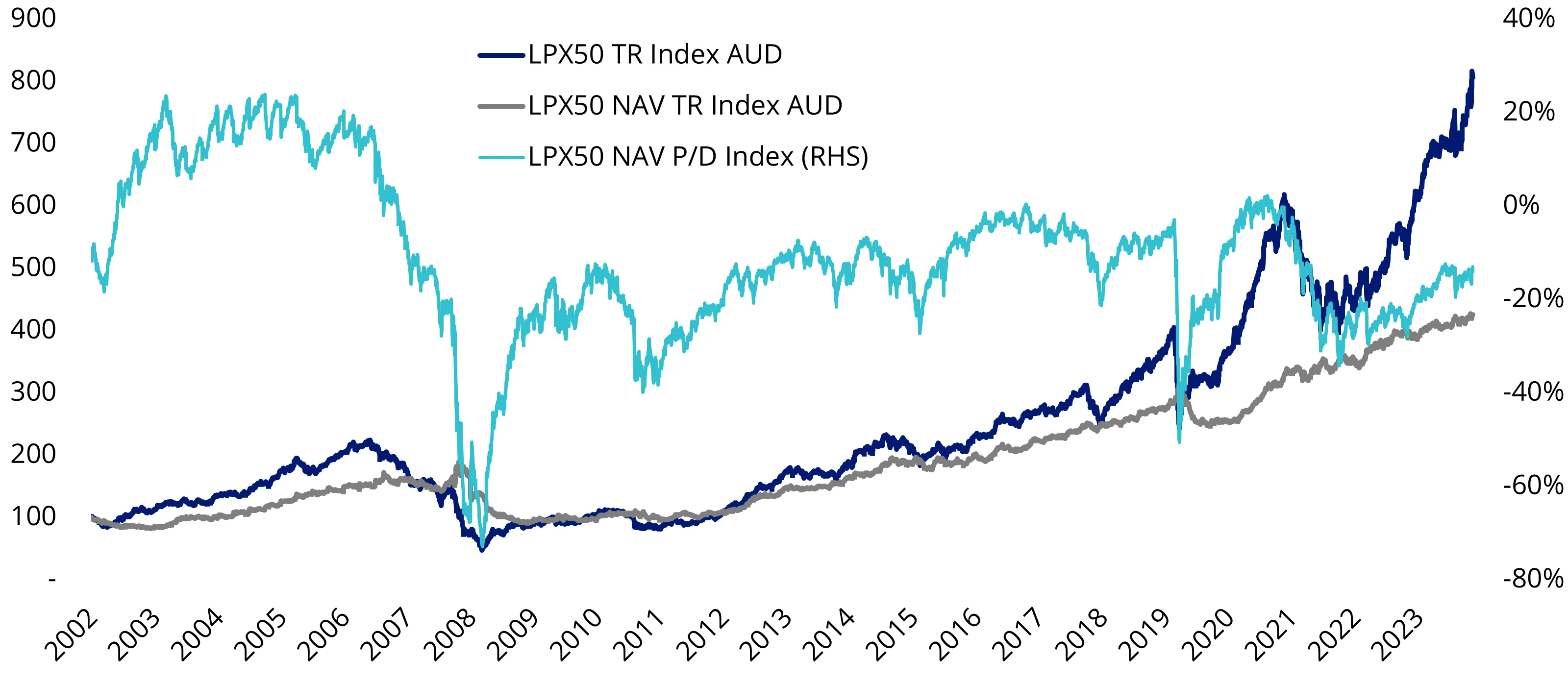

Listed private equity is still trading at a discount

Despite the past year’s price rises, listed private equity is still trading at a significant discount to the net asset value (NAV) of its underlying assets. As at 12 November 2024, the asset class was trading at a 14.0% discount to NAV.

LPX is a leading research house in the field of Listed Alternatives with a focus on Listed Private Equity and Listed Infrastructure. In addition to tracking the prices of listed private equity companies, LPX calculates the NAV performance development of the 50 largest Listed Private Equity companies based on the underlying portfolio of private equity investments owned by each listed company comprising the LPX50 Index - this is the LPX50 NAV index.

Chart 1: Correlation between market price and NAV Index

Source: LPX AG. To 12 November 2024. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

Why this is important

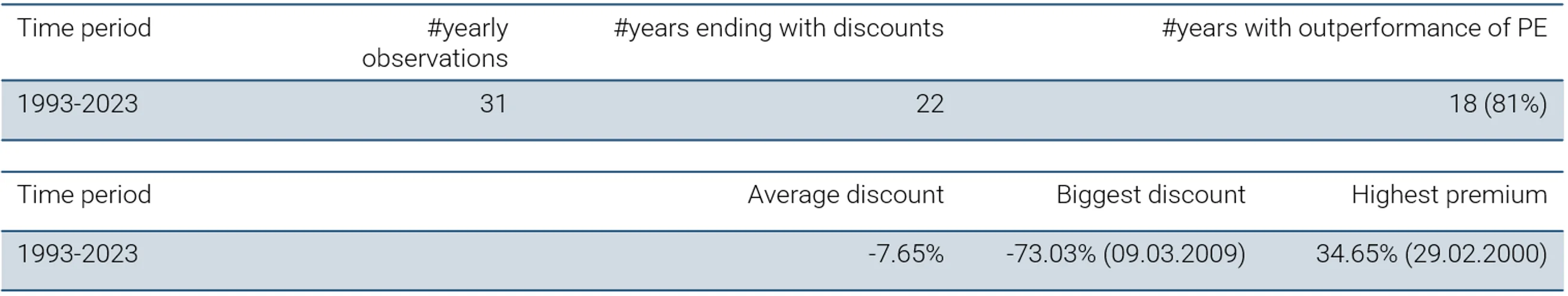

LPX has analysed the returns of its index from 1993 to the end of 2023.

The empirical results suggest that in 81% of all years since 1993, listed private equity has outperformed public markets when a discount was observed at the end of the year.

Table 2: Research suggests when discounts are high, consider private equity

Source: LPX AG, 31 December 2023

Short of a significant rally, it is likely that global listed private equity will also finish 2024 with a discount.

Private equity firm deals highlight the benefit of listed private equity investing

One of the deals noted above highlights the opportunities in private equity and discounts.

When Patria Private Equity Trust PLC (PPET) sold 14 fund investments on 24 October 2024, it sold them for c€216 million. This represented a 5% discount on the sold assets' carrying value, translating into a 1.9x multiple on invested capital and a 16% internal rate of return (IRR). The small discount was also well below the c30% discount to NAV which PPET’s shares were trading at the time.

VanEck Global Listed Private Equity ETF (ASX: GPEQ)

GPEQ is the only listed private equity ETF on the ASX, providing immediate access to a highly diversified group of the 50 largest/most liquid listed private equity companies, with a collective private equity portfolio of more than 3,300 private equity direct investments and 350 private funds.

Considering the list of deals noted above, it is worth noting that these listed funds are professionally managed by some of the biggest private equity companies, such as KKR, Bain and Apollo. Other names in GPEQ include Blackstone, Ares and Goldman Sachs.

Key risks

An investment in the GPEQ carries risks associated with listed private equity, ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for more details on risk.

Published: 18 November 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

LPX and LPX50 are registered trademarks of LPX AG, Zurich, Switzerland. The LPX50 Index is owned and published by LPX AG. Any commercial use of the LPX trademarks and/or LPX indices without a valid license agreement is not permitted. Financial instruments based on the index are in no way sponsored, endorsed, sold or promoted by LPX AG and/or its licensors and neither LPX AG nor its licensors shall have any liability with respect thereto.