Three things to consider for a healthier portfolio

The Trump administration’s deregulation agenda and innovations in artificial intelligence are expected to be a shot in the arm for some, but not all, healthcare stocks.

Healthcare is poised for growth in 2025, fueled by regulatory changes and emerging technologies.

1. Trump’s deregulation of the healthcare sector

One of the most prominent issues on Trump’s agenda is fixing the US healthcare system.

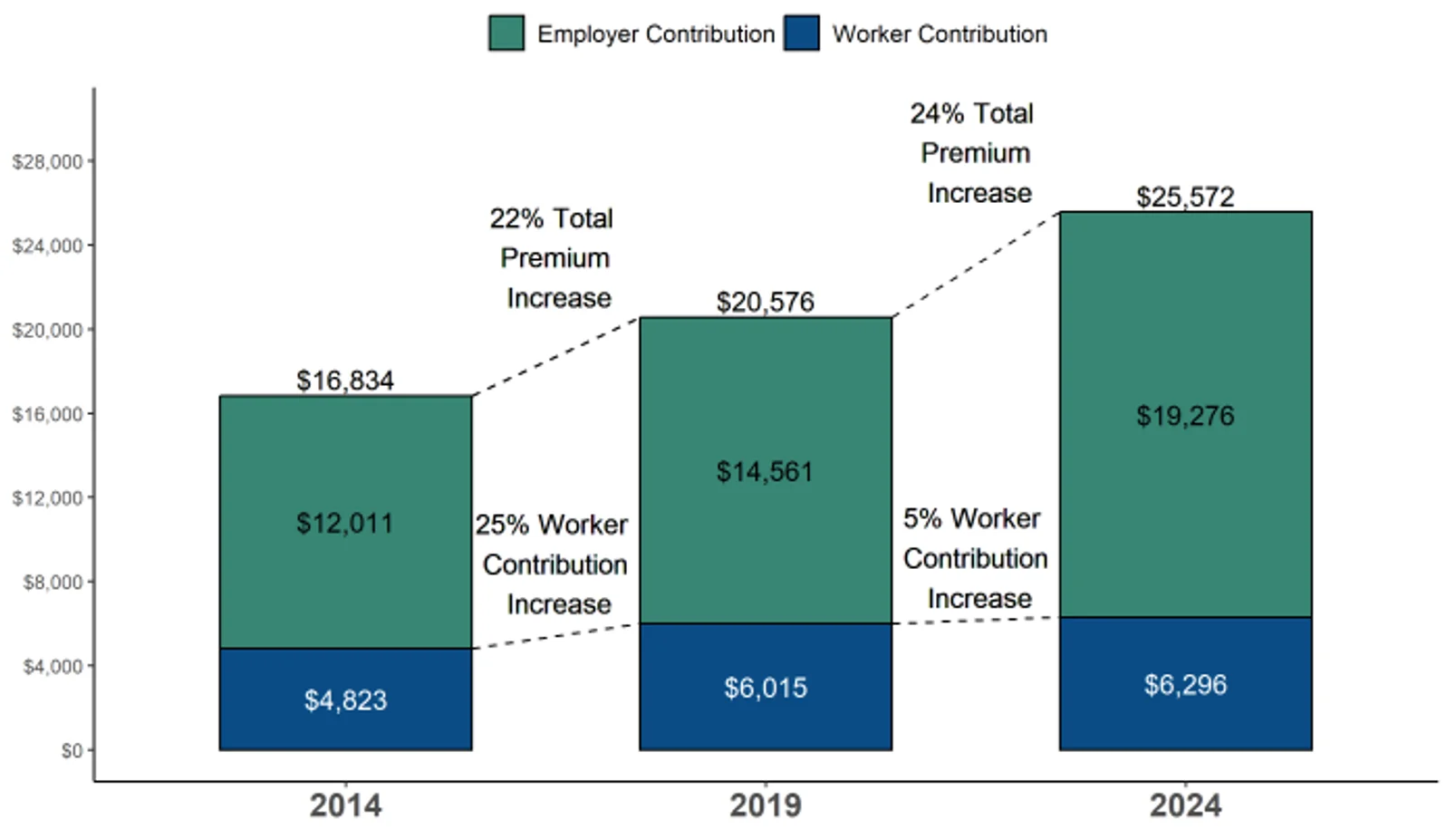

US healthcare consists of a third party-sponsored health insurance system where the cost is borne by employers rather than the policy beneficiary. This arrangement was designed to incentivise Americans to get healthcare, as employer contributions were tax free. However, it ended up creating more problems than it solved. A convoluted structure where third parties, such as consultants and middlemen, are used for collective bargaining power, enabling them to take large cuts on insurance policy deals and inflating costs for the end consumer.

Chart 1: Employer vs Workers Premium Contributions to Family Cover

Source: KFF, 2024 Employer Health Benefits Survey.

Healthcare is a part of Trump’s broader deregulation agenda, with the goal of increasing access and reducing healthcare costs for consumers. By banning ‘spread pricing’ (which is when PBMs charge payers like Medicaid a premium on top of the costs of medication and keeping the difference as profit, or “spread”) and other deceptive/unfair pricing practices, the new Pharmacy Benefit Manager (PBM) Transparency Act puts stronger controls on drug pricing.

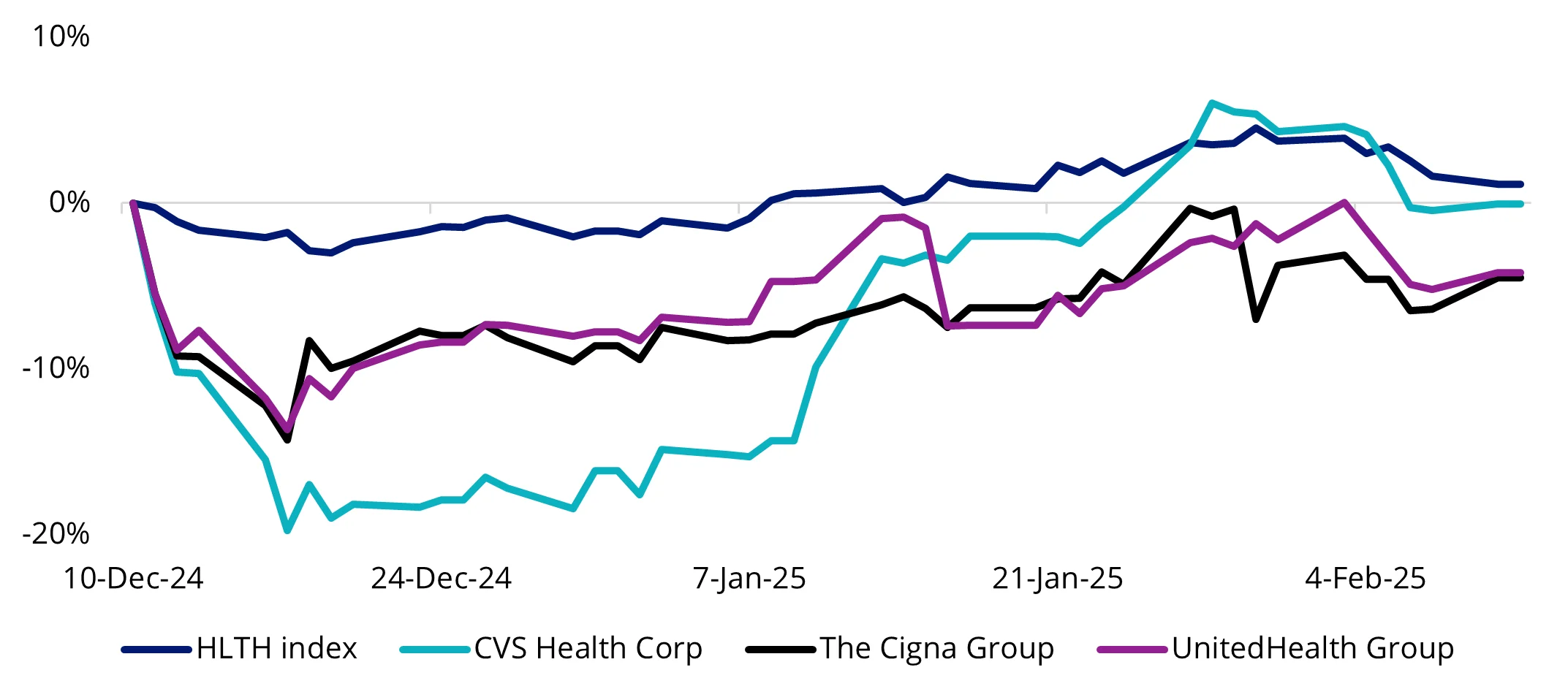

The largest including companies like CVS, Cigna, and UnitedHealth – all of which are either owned by or closely aligned with the insurers that rely on them. These companies control about 80% of all prescriptions in the US, and while they negotiate drug prices down, they often charge clients the full price.

A recent Federal Trade Commission (FTC) report found PBMs made roughly $1.4 billion on medicines through spread pricing alone. This doesn’t include the additional revenue PBMs make from marking up drug prices.

Chart 2: Performance of HLTH Index vs PBM Companies since news of potential legislation targeting PBMs

Source: Bloomberg as at 11 February 2025. HLTH index is MarketGrader Developed Markets Health Care Net Return AUD Index. Index performance is not illustrative of fund performance. You cannot invest in an index. Past performance is not indicative of future results.

2. AI innovations in healthcare

The market’s focus on artificial intelligence has been almost exclusively on companies developing AI solutions, particularly those involved in the infrastructure such as semiconductors, cloud storage, and data centres.

Less attention has been given to industries that stand to benefit from actually implementing these AI solutions, and this is potentially where the next wave of AI-powered revenue could come from.

AI has the potential to revolutionaise healthcare across a number of fronts. Healthcare stands to gain significantly from increased automation. Drug development, for instance, is a high-risk, multi-billion-dollar process that can take upwards of a decade to complete. Global AI leader Nvidia has been working on modernising the healthcare industry since 2018, when it launched its Clara platform to help speed up and improve several data- and time-intensive processes.

In 2024, Johnson & Johnson partnered with Nvidia to drive new innovations across healthcare. It is currently using AI to improve physician learning, improve surgical procedures, accelerate the process of discovering new treatments, identify candidates for drug trials, and provide more personalised patient care. Morgan Stanley research estimates that the R&D costs for drug discovery alone – which can range from $314 million to $4.46 billion – could reduce by 20-40% through the use of AI to mine patient data in digital health records

3. Healthcare stocks as a defensive asset

The healthcare sector has characteristics that tend to help it outperform during periods of economic uncertainty.

It has a relatively low correlation with the state of the global economy, as its products and services are generally in demand irrespective of changes in the economic cycle.

Structurally, the growth of the healthcare sector is underpinned by an expanding population that is getting older (over-65s are set to more than double by 2050 globally), increasingly middle class, and reporting a higher incidence of chronic diseases. Emerging economies are also spending more on healthcare.

The sector's long-term growth is driven by consistent consumer demand for new medications and treatments, which remains relatively steady even during recessions.

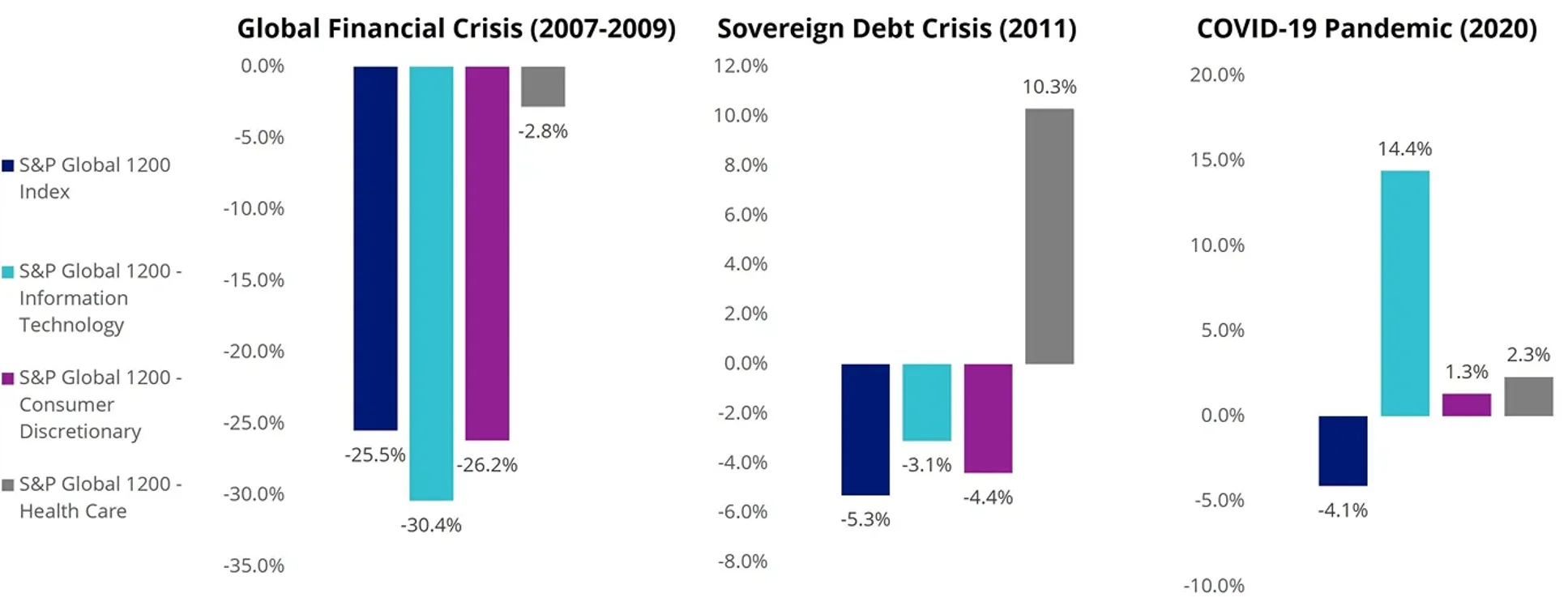

Throughout the last three down markets, for instance, healthcare was a sector offering the best relative performance. During the 2009 global recession, for example, the healthcare sector, particularly the drug and biotech industries, posted steady results with limited impact on sales and profits.

Chart 3: Healthcare as a defensive equity exposure

Source: Bloomberg, MarketGrader, Global Financial Crisis (2007-2009) period between 1 Jan 2007 to 31 December 2009, Sovereign Debt Crisis period between 1 Jan 2011 to 31 December 2011, COVID-19 Pandemic period between 1 Jan 2020 to 30 June 2020. Past performance is not indicative of future results. You cannot invest in an index.

This resilience is largely due to the essential nature of healthcare services and the high gross margins of many biopharmaceutical products, which help cushion the sector against inflationary pressures.

Since November, healthcare stocks have experienced a downturn due to the uncertainty around the impact of Trump’s incoming deregulation policies. Fundamentals have come under deeper scrutiny across the board, and for healthcare, this has seen several stocks across pharmaceuticals, health insurers, biotech and more underperform the broader equities market.

In a time of rapid change and persistent uncertainty, it’s important to be selective. The VanEck Global Healthcare Leaders ETF (HLTH) gives investors exposure to a diversified portfolio of the 50 largest international companies from the global healthcare sector. By applying a ‘Growth at a reasonable price’ strategy it is able to find the top 50 healthcare companies in the world that are attractively valued and offer the best growth prospects in the healthcare sector.

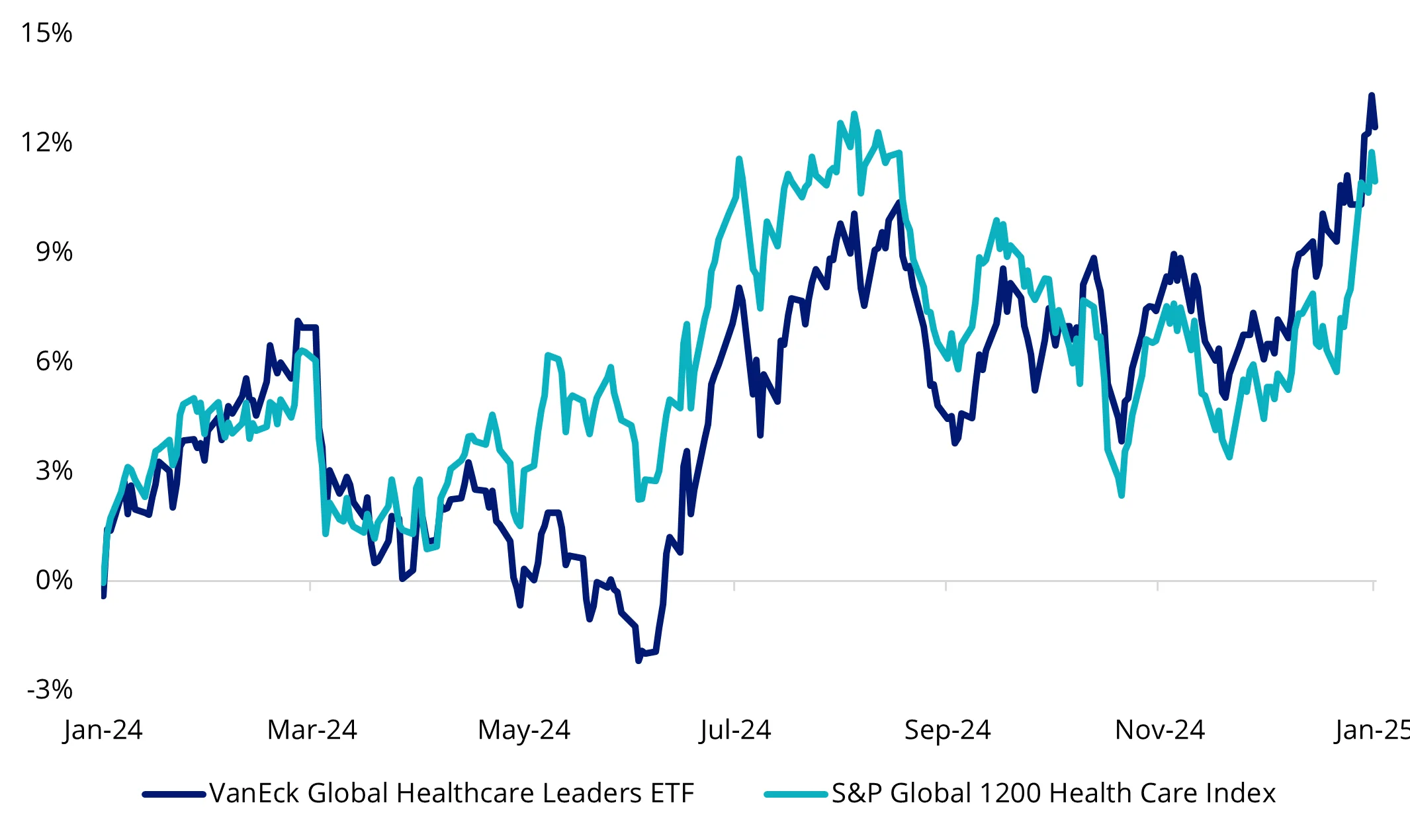

In the 12 months to January 2025, HLTH outperformed the S&P Global 1200 Health Care Index. Notably, HTLH does not hold any of the large Pharmacy Benefit Managers that Trump has targeted as part of his focus on fixing the US healthcare system, while the S&P 1200 Healthcare Index does include them.

Chart 4: One-year Performance of VanEck Global Healthcare Leaders ETF vs S&P Global 1200 Health Care Index

Source: Bloomberg as at 31 January 2025. Past performance is not indicative of future results. Results are calculated to the last business day of the month and assume immediate reinvestment of dividends. ETF results are net of management fees and costs incurred in the fund, but before brokerage fees or bid/ask spreads incurred when investors buy/sell on the ASX. The S&P Global 1200 Health Care Index (“Benchmark”) is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of the health care industry globally, weighted by market capitalisation. HLTH’s index measures the performance of 50 fundamentally sound companies with the best growth at a reasonable price (GARP) attributes in the health care industry from developed markets excluding Australia, weighted equally at rebalance. It has fewer companies and different country and industry allocations than the Benchmark. Click here for more details.

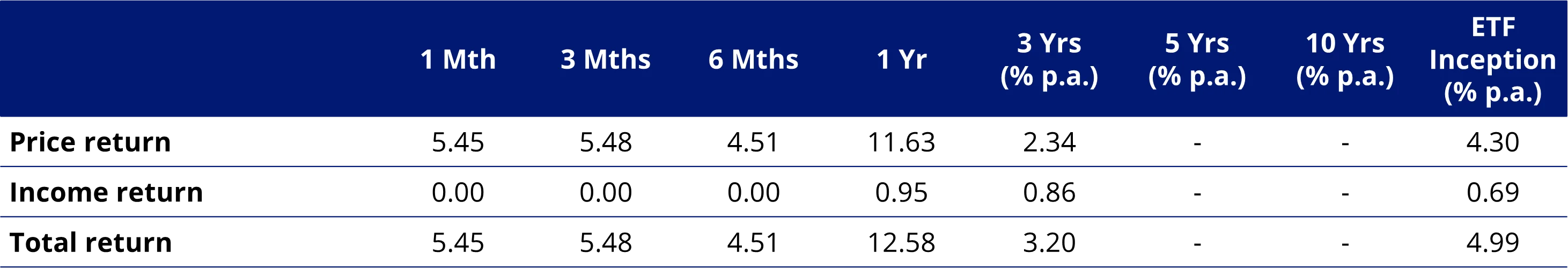

Table 1: HLTH trailing returns as at 31 January 2025

Source: Bloomberg as at 31 January 2025. Results are calculated to the last business day of the month and assume immediate reinvestment of dividends. HLTH results are net of management fees and costs incurred in the fund, but before brokerage fees or bid/ask spreads incurred when investors buy/sell on the ASX. Returns for periods longer than one year are annualised. Past performance is not a reliable indicator of current or future performance which may be lower or higher. HTLH inception date is 8 September 2020 and a copy of the factsheet is here.

Key risks

An investment in our global healthcare ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the VanEck Global Healthcare Leaders ETF PDS and TMD for more details.

Published: 21 February 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

"MARKETGRADER" and “MARKETGRADER DEVELOPED MARKETS (EX-AUSTRALIA) HEALTH CARE INDEX” are trademarks of MarketGrader.com Corp. and have been licensed for use for certain purposes by VanEck. HLTH is based on the MARKETGRADER DEVELOPED MARKETS (EX-AUSTRALIA) HEALTH CARE INDEX, but is not sponsored, endorsed, sold or promoted by MarketGrader, and MarketGrader makes no representation regarding the advisability of investing in HLTH.