European spending goes on the defence

Defence stocks have been in the spotlight recently, with companies such as Leonardo and Hensoldt rallying in mid-February. This surge follows reports that Europe will need to increase debt issuance to fund military investments, as US peace proposals suggest a waning appetite to continue supporting Ukraine.

According to Bloomberg Economics estimates, upgrading defence and protecting Ukraine may cost Europe’s major powers an additional US$3.1 trillion over 10 years. This policy shift is expected to benefit defence contractors, AI-driven military intelligence firms, and aerospace companies at the forefront of military modernisation.

Chart 1: Defence stocks surge

Source: Bloomberg, 25 February 2025. Not a recommendation to act. Past performance is not indicative of future results.

Outlook for AI and defence spending to drive further upside

In our view, the global defence sector will continue its upward growth trajectory. Government spending on defence is rising across Europe, the US, and Asia-Pacific, providing long-term revenue visibility for defence companies. In addition, we are seeing increased AI integration in military applications. As a result, companies like Palantir and Hensoldt are leveraging AI for battlefield intelligence, cybersecurity, and autonomous warfare, a key growth trend. Furthermore, the current geopolitical landscape continues to be marked by instability. Heightened uncertainty is contributing to recent outperformance of defence stocks.

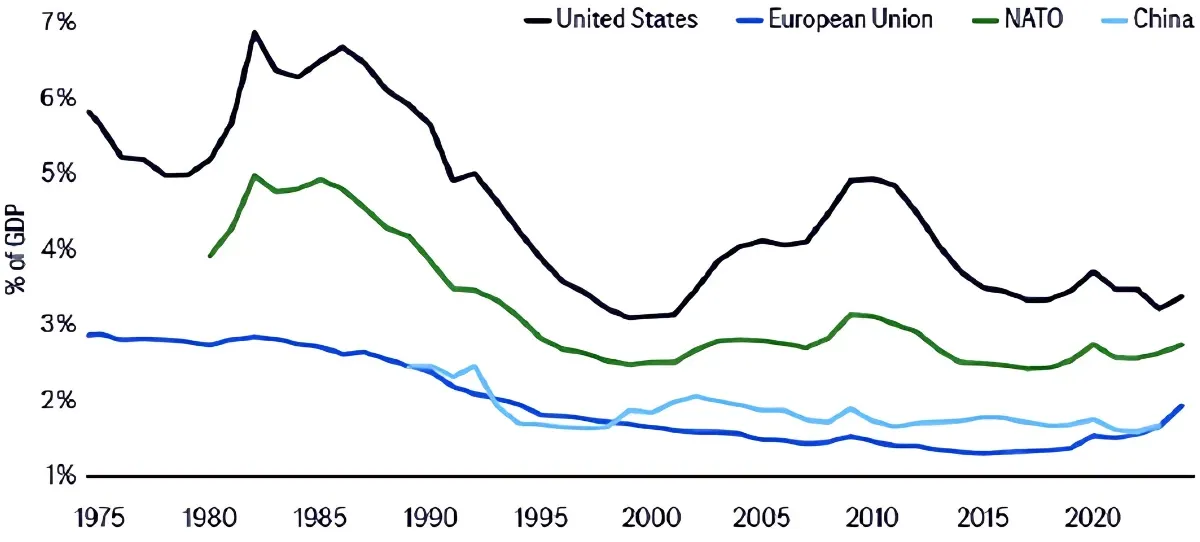

Even before Trump’s win, the theme of increased global defence spending has been present since 2015. Great power competition returned following the invasion of Crimea in 2015, and in that same year, the US founded the Defence Innovation Unit as it looked to leverage non-traditional sources of technological advantage. More recently, the conflicts in Ukraine and the Middle East have sharpened military and policymaker focus on defence spending.

According to a research report by Citibank ‘Money and Might – Financing the Future of Defence’, analysts cite a few factors that have been and will shape the defence sector going forward. First, great power competition will drive US defence spending. While in the past, spending was focused on wars of terror, this has shifted to a ‘warmer’ cold war, defined by nations competing for regional and global dominance. For example, the Ukrainian conflict, China’s continued expansion and potential invasion of Taiwan by decade’s end, as well as the Israel–Hamas conflict are recent developments motivating US policymakers to prepare to fight conflicts on these fronts. These have contributed to higher levels of defence spending since 2015.

Chart 2: Defence spending in recent decades (% of GDP)*

*Data for US, EU and NATO in 2023-24 are estimates from NATO.

Source: Citi Research, SIPRI, World Bank, Haver Analytics.

Second, Europe looks poised to fulfil its commitments to NATO. European countries are now reassessing capabilities and reinforcing the need for a much stronger European Defence Industrial base—an issue that has recently been recognised by the European Union in its Defence Industrial Strategy.

Third, while we expect the US and its allies to continue to invest in traditional weapon systems such as aircraft, ships, and tanks, the recent conflicts in Ukraine and the Middle East, as well as, a rising China, are prompting a shift toward new spending priorities.

As a result, our VanEck Global Defence ETF (DFND) has gained 9.02% year-to-date as of 28 February 2025, supported by strong momentum in defence and AI-driven military technologies. Defence companies Thales, Hensoldt and Leonardo are part of DFND’s holdings. Noting, of course, that past performance is not a reliable indicator of future performance.

The ETF’s performance has closely tracked rising policy uncertainty and there is no doubt that geopolitical tensions, shifting defence priorities, and increased government spending are a feature of current news cycles.

Chart 3: Defence spending priorities

Source: Citi Research.

Table 1: DFND trailing performance to 28 February 2025

*DFND Inception date is 10 September 2024 a copy of the factsheet is here. DFND is a newly traded fund on ASX with a short performance history and this should not be relied upon for future performance.

Table 1 source: Morningstar Direct. The chart and table above show past performance of DFND. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. DFND results are net of management fees and other costs incurred in the fund, but before brokerage fees and bid/ask spreads incurred when investors buy/sell on the ASX. Past performance is not a reliable indicator of future performance. Click here for more details.

Key risks

An investment in DFND carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS and TMD for more details on risk.

The Fund does not have an ESG investment objective, nor does the Fund promote ESG outcomes. For details about controversial weapons screening please - click here.

Published: 06 March 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

The MarketVector Global Defence Industry (AUD) Index (‘MVIS Index’) is the exclusive property of MV Index Solutions GmbH based in Frankfurt, Germany (‘MVIS’). MVIS is a related entity of VanEck. MVIS makes no representation regarding the advisability of investing in the Fund. MVIS has contracted with Solactive AG to maintain and calculate the MVIS Index. Solactive uses its best efforts to ensure that the MVIS Index is calculated correctly. Irrespective of its obligations towards MVIS, Solactive has no obligation to point out errors in the MVIS Index to third parties.