Eureka! Miners strike gold

In January 2025, the VanEck Gold Miners ETF (ASX: GDX) was one of the best-performing ETFs on ASX, returning 14.02% (Noting past performance is not a reliable indicator for future performance). We have been saying for some time that the miners were due to shine, most recently in our quarterly viewpoints. The miners’ current momentum, we believe, could continue should the gold price continue to rise.

Gold and gold miners have been among the better-performing asset classes so far in 2025 and they were among the strongest performers in 2024.

Last week the price of gold hit another record high, with LBMA PM price surpassing US$2,840 for the first time. Recent price rises have been attributed to Trump’s tariffs and the US Federal Reserve potentially pausing any more rate cuts. While this uncertainty and interest rate environment bodes well for gold, these elements were absent in 2024.

The price movements of gold in 2024 had many analysts scratching their heads, because normally when risky assets such as equities do well, as they did, defensive assets, such as gold, do poorly. In 2024, both ‘risky’ equities and ‘defensive’ gold performed well.

Also, when interest rates fall, as they started to in the US in the second half of 2024, gold has historically not done well.

It’s therefore worthwhile to understand what could have driven the price of gold and understand why demand for the yellow metal could continue. And why gold miners are profiting.

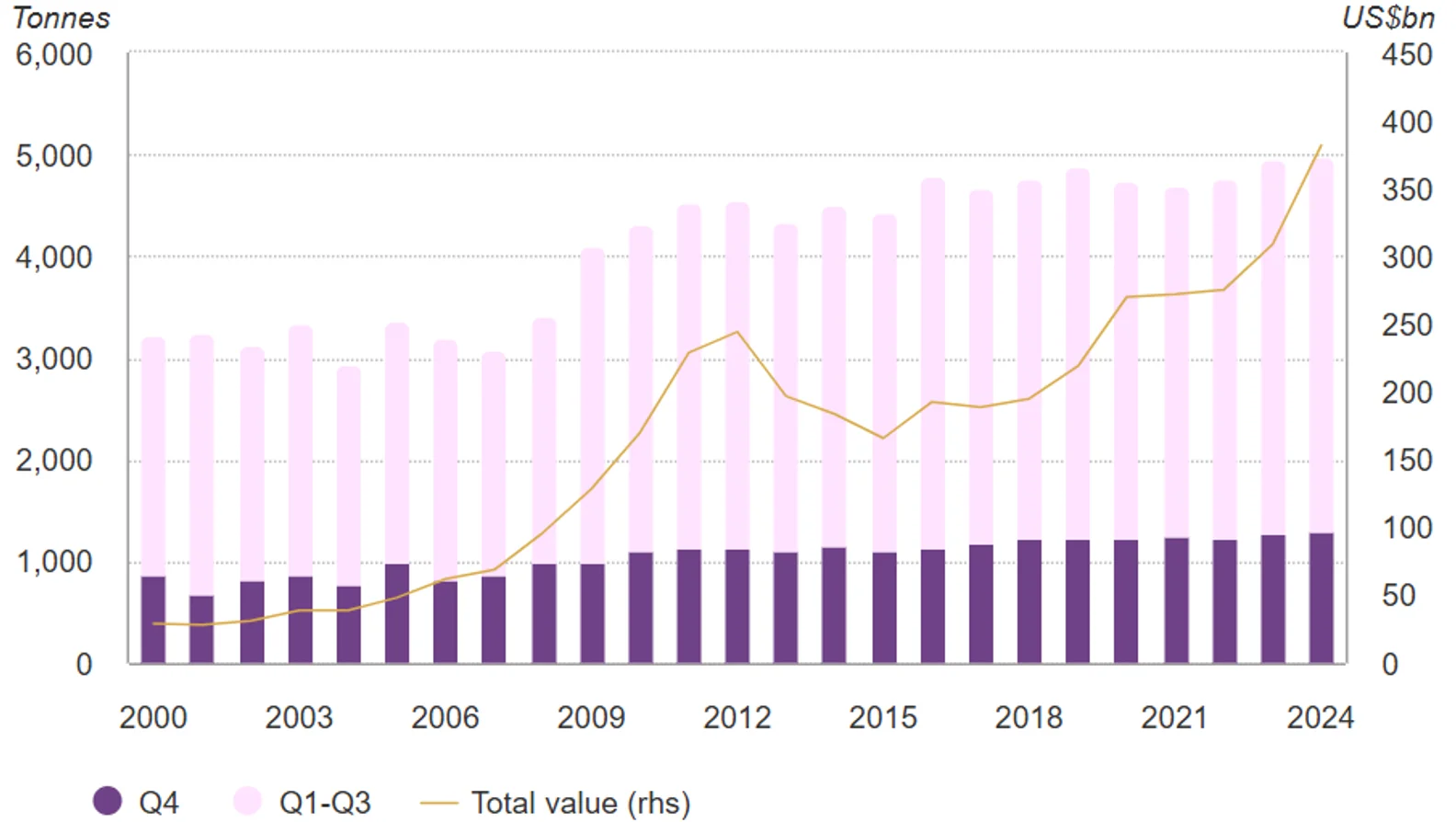

Firstly, central banks have been stockpiling gold. 2024 was a big year of central bank buying. According to the World Gold Council, ”Central banks continued to hoover up gold at an eye-watering pace: buying exceeded 1,000t for the third year in a row, accelerating sharply in Q4 to 333t.”

Chart 1: Gold demand at record levels for Q4 and full year, Quarterly gold demand in volume, tonnes, and value, (US$bn*)

Source: ICE Benchmark Administration, Metals Focus, World Gold Council, data to 31 December 2024.

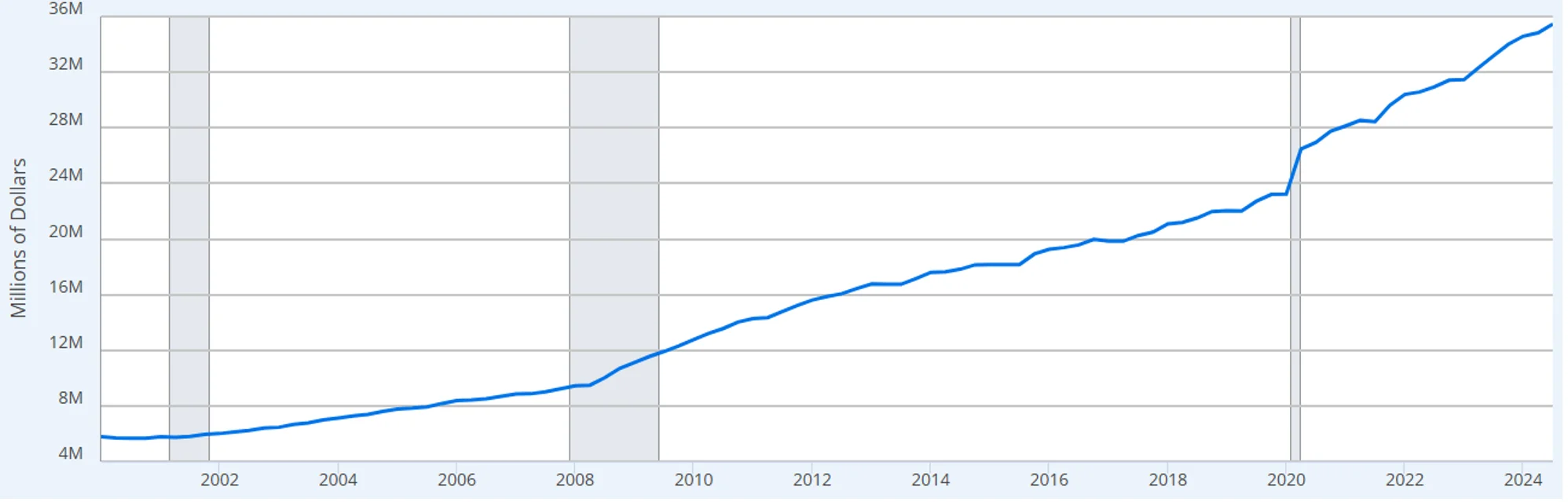

In addition to central bank buying, the other factor driving gold demand has been growing geopolitical uncertainty, the threat of tariffs and US debt. Tariffs lead to inflation. In addition, many investors are staying away from US treasury bonds as the American economy remains embroiled in heavy, seemingly uncontrolled debt. The rationale is that rising US debt often leads to concerns about inflation. When a government accumulates significant debt, it may resort to measures such as printing more money or increasing government spending, potentially leading to inflationary pressures.

With inflation at the forefront of investors’ minds, they may be buying gold as a hedge against the return of inflation.

Chart 2: US total public debt

Source: St Louis Federal Reserve, US Department of the Treasury. Fiscal Service. Shaded areas indicate US recessions.

Buying physical gold is not the only way to potentially benefit from a rising gold price.

Some investors buy gold miners. We highlight this on our page dedicated to gold investing here.

Gold miners

One of our predictions for 2025 was captured in the title of our blog, “Gold stocks seek to reconnect with gold in 2025.” We highlighted that the performance of gold miners had been lagging the performance of physical gold over the past few years. This was unusual and we expected the miners to reconnect.

In the past, gold miners tended to outperform gold bullion when the price of gold rose and underperform when the gold price fell. We think the connection may have restarted.

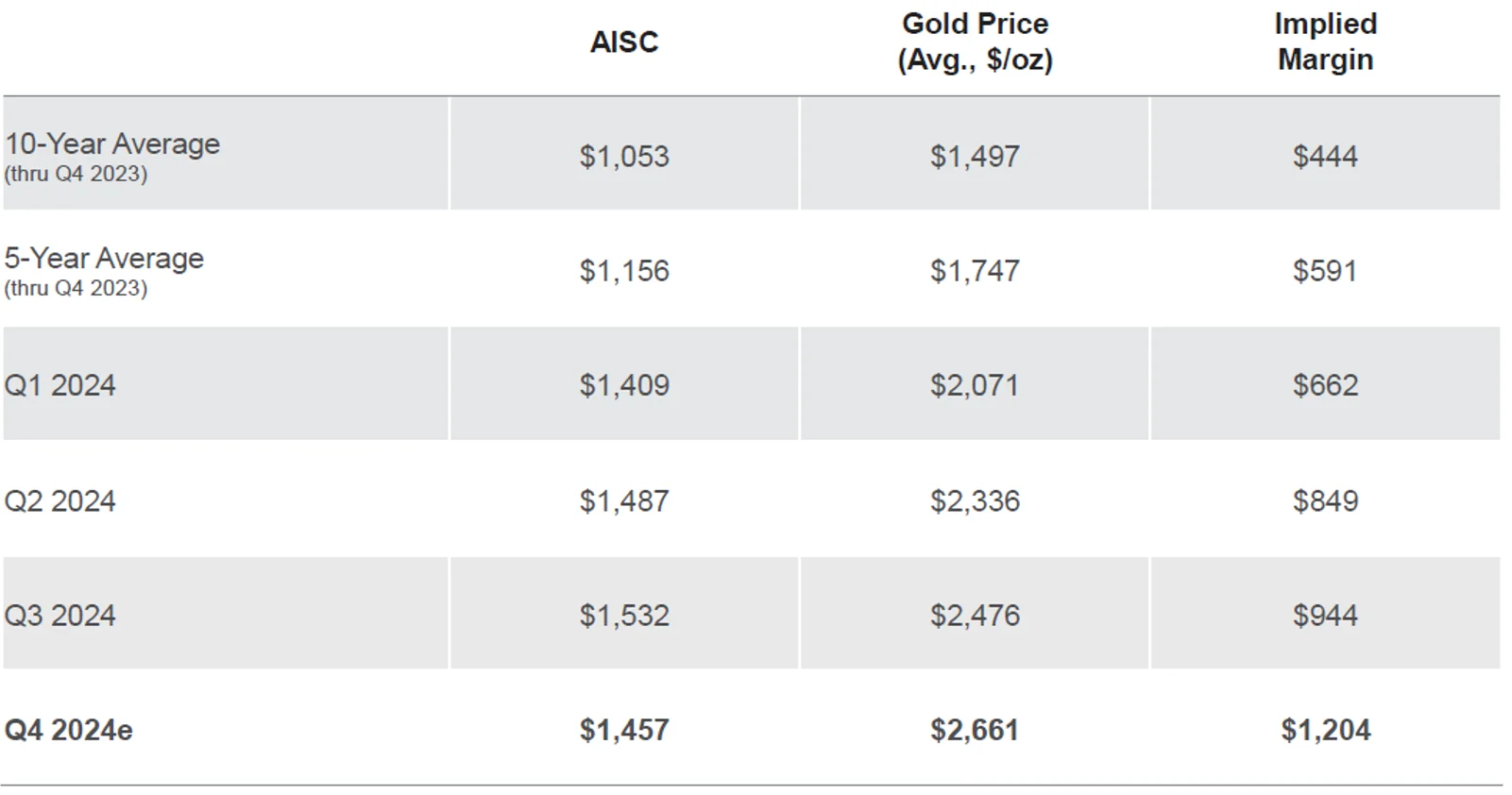

We think, fundamentally, that gold miners also have positive tailwinds. While gold miners were not immune from the recent inflation, and the all-in-sustaining costs for mining gold have risen since 2016, disciplined mining companies can now generate substantial margins with the price of gold so high.

Table 1: Gold industry all-in sustaining costs (AISC) vs. gold price (US$/oz)

Source: Scotiabank, VanEck. Data as of December 2024. *All-in sustaining costs (AISC) reflect the full cost of gold production from current operations, including adjusted operating costs, sustaining capital expenditure, corporate general and administrative expenses and exploration expenses. Past performance is not indicative of future results.

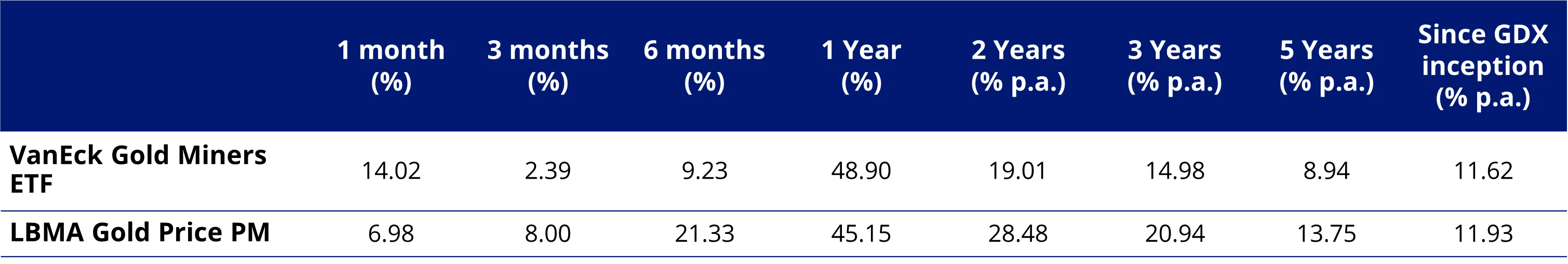

Investors are starting to take note. As mentioned above, GDX rose by 14.02% in January. This could be the beginning of a reversion-to-the-mean trend that sees gold mining equities again displaying their leverage to the gold price and outperforming bullion when gold prices rise. It still has a long way to go. You can see that over six months, the gold price has risen 21.33%, but GDX has only returned 9.23%.

Table 2: GDX performance and the LBMA Gold Price PM

Source: Morningstar Direct as at 31 January 2025. GDX inception date is 26 June 2015 and a copy of the factsheet is here. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. GDX results are net of management fees and costs, but before brokerage fees or bid/ask spreads incurred when investors buy/sell on the ASX. Returns for periods longer than one year are annualised. Past performance is not a reliable indicator of current or future performance which may be lower or higher. GDX invests directly in the underlying securities that comprise the GDX Index. GDX acted as a ‘feeder fund’ from 9th October 2019 – 11 May 2022 giving investors access to a fund domiciled in the United States. From 26 June 2015 – 8th October 2019, the fund operated as a CDI.

ETFs are an efficient way for investors to access gold investing.

There are gold miners ETFs and there are ETFs that invest in physical gold bullion.

Accessing gold with the specialists

VanEck’s global leadership in gold investing stretches more than 50 years, encompassing gold equites and bullion across ETFs and active funds.

Two ETFs for portfolio considerations:

- NUGG – accessing physical gold, that ‘delivers’

- GDX – investing in a diversified portfolio of gold mining companies

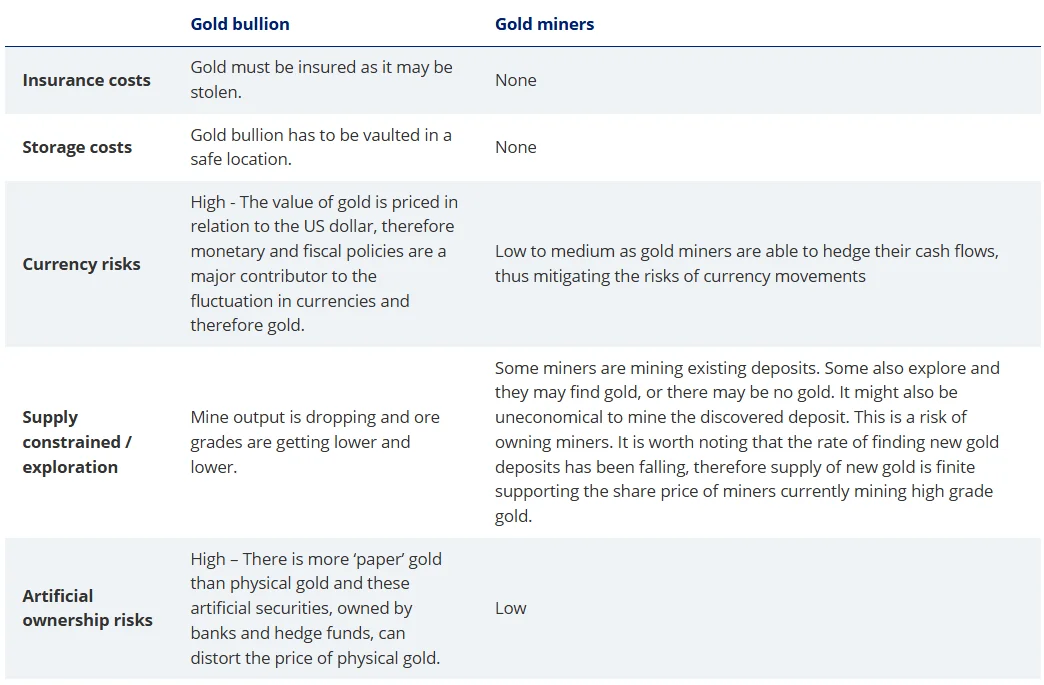

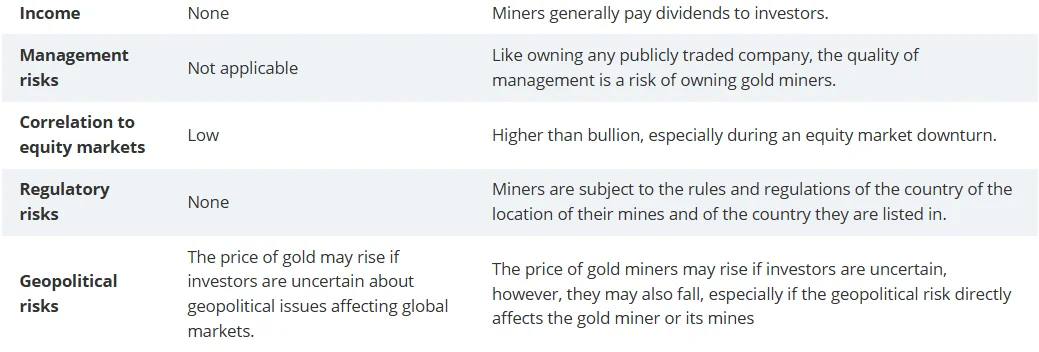

Below we outline the risks of each type of exposure to gold, owning gold bullion and owning gold miners:

Differences between gold miners and bullion

While each gold strategy has its merit for portfolio inclusion, you should assess all the risks and consider your investment objectives.

Past performance is no guarantee of future performance. The above is not a recommendation. Please speak to your financial adviser or stock broker.

For further information you can contact us via email or on +61 2 8038 3300.

Key risks

An investment in NUGG or GDX carries investment risk. These risks vary depending on the fund and may include gold pricing risk, currency risk, custody risk, Australian sourced gold bullion risk, ASX trading time differences, financial markets generally, individual company management, industry sectors, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDSs for details on risks.

Published: 07 February 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.