Expert’s choice: GDX - Gold miners

Gold has been used in commerce as a currency since the Bronze Age. In 560 B.C., the first minted gold coins were produced in Lydia, a Kingdom of Asia Minor1. Because gold is a currency, its price does not behave like other commodities. It is also why gold equities do not behave like other mining shares. So far, 2022 has been a stellar year for the shiny metal and those that dig it from the ground. Here we provide some insightful analysis for our popular gold miners ETF compared to buying gold bullion.

Gold has been used in commerce as a currency since the Bronze Age. In 560 B.C., the first minted gold coins were produced in Lydia, a Kingdom of Asia Minor1. Because gold is a currency, its price does not behave like other commodities. It is also why gold equities do not behave like other mining shares. So far, 2022 has been a stellar year for the shiny metal and those that dig it from the ground. Here we provide some insightful analysis for our popular gold miners ETF compared to buying gold bullion.

1 – Katz, J and Holmes, F (2008). The Goldwatcher: Demystifying Gold Investing Wiley, New York

Ancient history

While the Lydians were the first to mint gold coins for trade in 560 B.C., the Egyptians 3,000 years earlier were the first to smelt gold. It was a feature of their adornments. Think King Tutankhamen’s funeral mask. Today, some of the techniques used by the ancient Egyptians are still in use.

In addition to its rarity, gold became useful to use as currency because it is easy to press into coins. It is also easy to identify because of its colour and density. Unlike other metals, gold does not tarnish. Gold gave rise to the concept of currency, fitting the three generally accepted conditions of money:

- Medium of exchange

- Unit of account

- Store of value

The gold standard

Over time, countries tied their currency to the amount of gold they physically held. This was ‘the gold standard’. Great Britain was the first to do this and because of their economic might during the 1800s, other countries soon followed suit. By the 19thCentury, all major countries other than China used the gold standard.

During the outbreak of World War 1, Britain abandoned the gold standard when Treasury notes replaced the circulation of gold and gold sovereigns. The immediate impact was the doubling of prices. In 1925, Great Britain resumed the gold standard. It did not last long this time as The Great Depression forced countries to abandon the standard.

In 1944 saw the establishment of the Bretton Woods system to assist with trade. Growing public debt incurred by the war in Vietnam, and inflation prompted President Nixon to undertake a series of economic measures known as ‘the Nixon Shock’. Within a few years a number of other countries including Japan half floated their currencies. The Jamcai Accords ratified the end of the Bretton Woods in 1976 and by the early 1980s, all industrialised nations were using floating currencies.

Today

Gold is one of the most traded asset classes in the world. According to the World Gold Council[i], “Gold ranks higher than all European sovereign debt markets and trails only US Treasuries and Japanese government bonds.” For investors, gold has been seen as a safe haven for portfolios however gold does not pay dividends and there are costs for storage and insuring gold.

A higher gold price largely correlates to investors’ increasing unease about a weakening global financial system. Currently investors are worried about government indebtedness, geopolitical risks and inflation. Investors fear central bank policies are having little impact.

This type of uncertainty continues to fuel investor’s demand for gold as a safe haven asset.

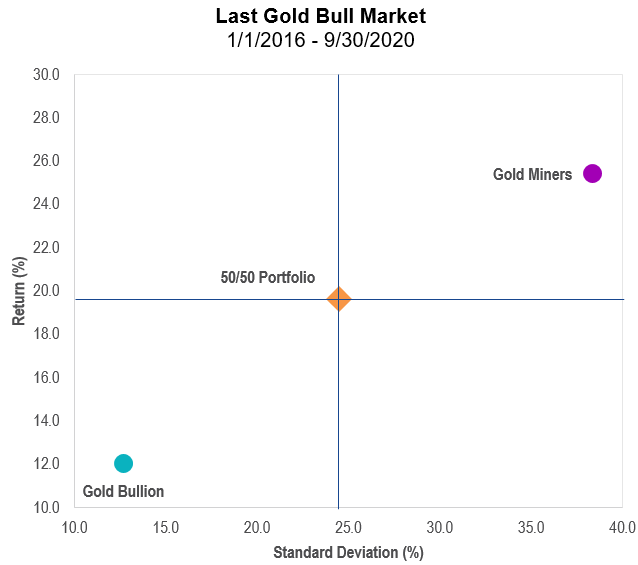

One way investors can get exposure to fluctuations in the gold price is to invest in gold miners. The accepted relationship between the two is best described in a Wall Street Journal article, “If bullion continues to rally, then gold-mining stocks should continue to do even better. But if the rally in bullion stalls even temporarily or reverses, then miners might not be such a good risk compared with bullion.” [ii]

Source: Morningstar; VanEck. Standard Deviation is a historical measure of the variability of returns relative to the average annual return. A higher number indicates higher overall volatility. Past performance is not a reliable indicator of future performance. Returns in US dollars. Gold Miners is NYSE Arca Gold Miners Index, Gold Bullion is LBMA Gold Price PM.

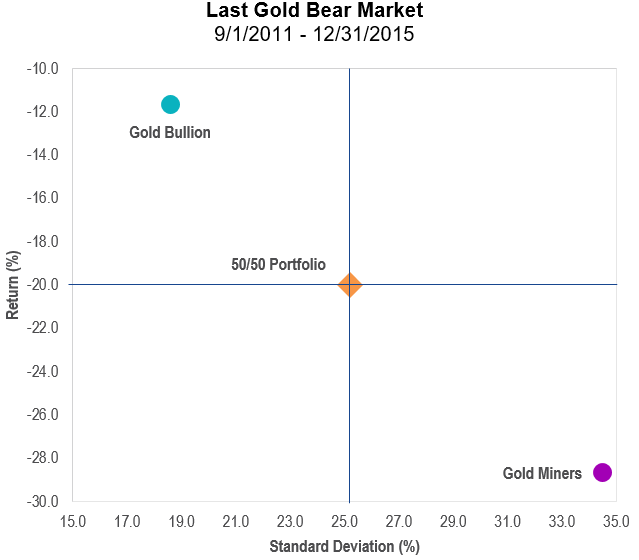

However, if you look at the most recent significant market period in which the price of gold fell, you can see that gold bullion had a lower volatility profile and fell far less than its miners fall.

Source: Morningstar; VanEck. Standard Deviation is a historical measure of the variability of returns relative to the average annual return. A higher number indicates higher overall volatility. Past performance is not a reliable indicator of future performance. Returns in US dollars. Gold Miners is NYSE Arca Gold Miners Index, Gold Bullion is LBMA Gold Price PM.

It is worth noting that while traditionally the price of gold price and the equity performance of gold miners has been correlated, there has been periods since the onset of the GFC in which gold equities have gone in a direction opposite to the price of gold.

During the most recent market turmoil, gold miners have been outperformed the yellow metal. Since the beginning of the year, the price of gold bullion is up 3.7%, while gold miners are up, 17.2%. (Returns in Australian dollars, as at 23rdMarch 2022, source Morningstar. Gold price is LBMA Gold Price PM, Gold Miners is VanEck Gold Miners ETF)

Below we outline the risks of each type of exposure to gold, owning gold bullion and owning gold miners:

Differences between gold miners and bullion

|

|

Gold bullion |

Gold miners |

|

Insurance costs |

Gold must be insured, as it can be stolen |

None |

|

Storage costs |

Gold bullion has to be vaulted in a safe location. |

None |

|

Correlation to currencies |

High - The value of gold is priced in relation to the US dollar, therefore monetary, fiscal and - as we are finding out now - defence, policies are a major contributor to the fluctuation in currencies and therefore gold. |

Low to medium as gold as miners are able to hedge their cash flows, thus mitigating the risks of currency movements. |

|

Supply constrained / exploration |

Mine output is dropping and ore grades are getting lower and lower. |

Some miners are mining existing deposits. Some also explore and they may find gold, or there may be no gold. It might also be uneconomical to mine the discovered deposit. This is a risk of owning miners. It is worth noting that the rate of finding new gold deposits has been falling, therefore supply of new gold is finite supporting the share price of miners currently mining high grade gold. |

|

Artificial ownership risks |

High – There is more ‘paper’ gold than physical gold and these artificial securities, owned by banks and hedge funds, can distort the price of physical gold. |

Low |

|

Income |

No |

Miners pay dividends to investors |

|

Management risks |

Not applicable |

Like owning any publically traded company, The quality of management, is a risk of owning gold miners. |

|

Correlation to equity markets |

Low |

Higher than bullion, especially during an equity market downturn |

|

Regulatory risks |

No |

Miners are subject to the rules and regulations of the country of the location of their mines and of the country they are listed in. |

|

Geopolitical risks |

The price of gold may rise if investors are uncertain about geopolitical issues affecting global markets. |

The price of gold miners may rise if investors are uncertain, however, they may also fall, especially if the geopolitical risk directly affects the gold miner or its mines. |

While each gold strategy has its merit for portfolio inclusion, you should assess all the risks and consider your investment objectives.

Past performance is no guarantee of future performance. The above is not a recommendation. Please speak to your financial adviser or stock broker.

For further information you can contact us via email or on +61 2 8038 3300.

Key risks

An investment in the GDX carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.

[i] World Gold Council (2011). Liquidity in the global gold market

Published: 24 March 2022