Gold rallies after brief pause

After reaching a new all-time high in May, offsetting forces kept gold unchanged during June. Gold traded as high as US$2,376 per ounce on June 6. On June 7, gold closed at its monthly low of US$2,294 per ounce following news that China's central bank did not buy any gold bullion in May. Global central bank gold buying has been one of the main drivers of this year’s gold rally, with the Chinese central bank behind a large percentage of those purchases. The People’s Bank of China has reported bullion purchases since November 2022. The pause in buying has raised concern among gold market participants that this important driver of gold demand could weaken. In contrast, gold investment demand has been declining since April 2022, but in June, global holdings of gold bullion-backed exchange traded products finally registered inflows, albeit small, after 12 consecutive months of net outflows. This could mean that western investment demand, which has historically been the main driver of gold rallies, is staging a comeback.

Chinese central bank gold bullion purchases lagged in June, contributing to flat prices for the month. Agnico Eagle's Ontario, Canada mine may emerge as a promising prospect for the gold industry.

Gold also gathered some support from inflation readings that included May’s CPI and PCE. Markets interpreted these figures as increasing the likelihood of interest rate cuts by the US Federal Reserve. At the end of June, the market was pricing in two 25 basis point cuts in 2024, compared to only one 25 basis point cut being priced in at the end of May. Lower real interest rates have historically been supportive of higher gold prices. Gold closed at US$2,326.75 per ounce on 28 June, unchanged from its 31 May close of US$2,327.33 per ounce.

Rally in gold miners stalls, despite positive outlook

Gold stocks did not fare as well as the metal in June. The NYSE Arca Gold Miners Index fell 4.11%. The lack of investor interest in gold, as an asset class, in recent years has led to gold stocks underperforming the metal. This has not only been during a declining gold price environment, but also during periods of flat or sideways gold price action. There were no sector-wide results or updates, nor any events that explain the underperformance across the sector. In contrast, many companies provided project updates in June that we viewed as positive.

We took the time to catalogue the announcements, news and updates released by the companies in our gold mining universe in June. Our original assessment, deeming the news flow positive, was supported by our classification of each release as having the potential of being positive/neutral or negative to the outlook of the company. We classified over 40 updates as positive/neutral and only 4 as negative. For reference, the negative news included short-term production guidance downgrades due to weather and geotechnical-related disruptions; and a serious incident at a single asset, junior miner that halted its operations. In our view, any signs of trouble or weakness were outweighed by signs of strength and health of the sector.

A closer look at Agnico Eagle’s Detour Lake mine

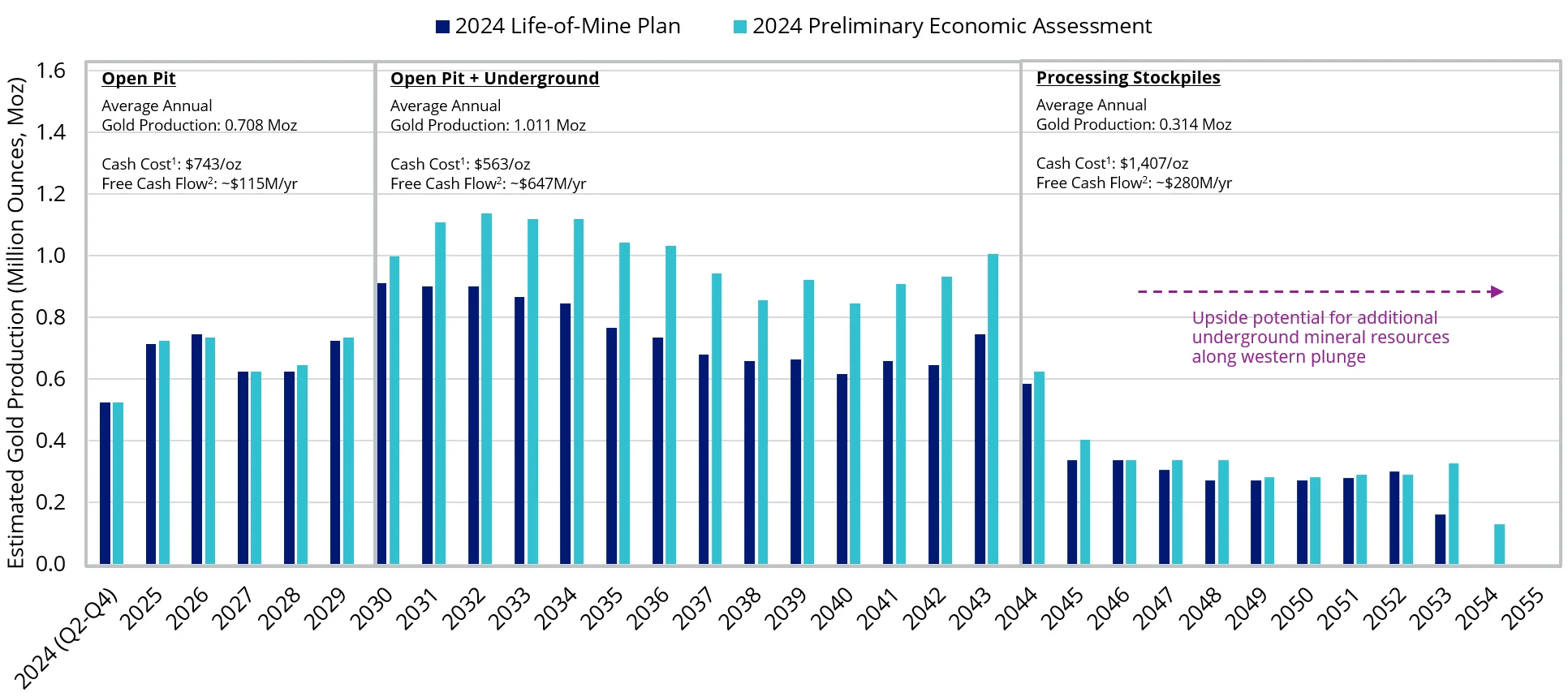

We had the opportunity to visit Agnico Eagle’s Detour Lake mine in Ontario. The mine and its potential can be highlighted as a bright spot for the gold industry. Overall, our impressions were positive. The mine, the plant and the team showed well. The site visit followed the release of a new life of mine plan and underground project for the asset. Ahead of the site visit the company also hosted a two-hour technical session to review the details of the new plan and project. The 2024 plan updates the existing open pit mine production profile and incorporates updated costing. The company has also completed a preliminary economic assessment for a proposed underground mining and mill throughput optimisation project, demonstrating the potential to increase the Detour Lake mine's overall production to an average of one million ounces of gold per year over a 14-year period, starting in 2030.

Annual production is expected to increase to one million ounces per year from 2030 to 2043. This is an increase of approximately 43% or 300,000 ounces of gold annually, when compared to average annual production from 2024 to 2029. From 2044 until 2054, the mine is planned to process stockpile material, producing an average of about 300 thousand ounces of gold per year. Additional exploration has the potential to add ounces to the mine plan in future years and extend the life of the mine beyond 2054. With costs declining as production increases over the next twenty years, the cash flow generation of Detour Lake is expected to expand (see chart below). With a pathway to one million ounces, Detour Lake has the potential to move from being one of the 10 largest gold mines in the world, to being one of the top 5 gold mines in the world, in one of the most attractive mining jurisdictions. All these points solidify the case behind its historical valuation premium relative to its peers.

Chart 1: Anico Eagle’s cash flow generation expected to expand

Anico Eagle’s "Pathway to one million ounce producer"

1Higher Cash Cost in stockpile reclaim period reflects drawdown of long-term low-grade stockpiles, lower head grade, and re-handling costs. Open Pit feed offset by Underground to Stockpile Reclaim period is 52Mt at 0.5g/t.

2Free cash flow (FCF) represents the cash that a company generates after accounting for cash outflows to support operations and maintain its capital assets, and is non-GAAP measure.

Source: Agnico Eagle. Data as of June 2024.

Published: 14 July 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (‘VanEck’) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.