Keep on truckin'

Inflation is soaring while interest rates remain at near historic lows. This means the real interest rate is as far below zero as it has ever been. This bodes well for infrastructure because it means that the replacement costs of these assets is high, while at the same time making the income they generate attractive, relative to bonds.

Infrastructure has been one of the few asset classes to experience positive returns so far in 2022. In the current economic environment global infrastructure securities tend to benefit from:

- the steady and reliable income stream they produce from services that exhibit inelastic demand;

- the stability of long lived assets, that are protected by high barriers to entry;

- diversification away from other core asset classes; and

- regulated pricing mechanisms that often protects against inflation, movements in interest rates and other contingencies.

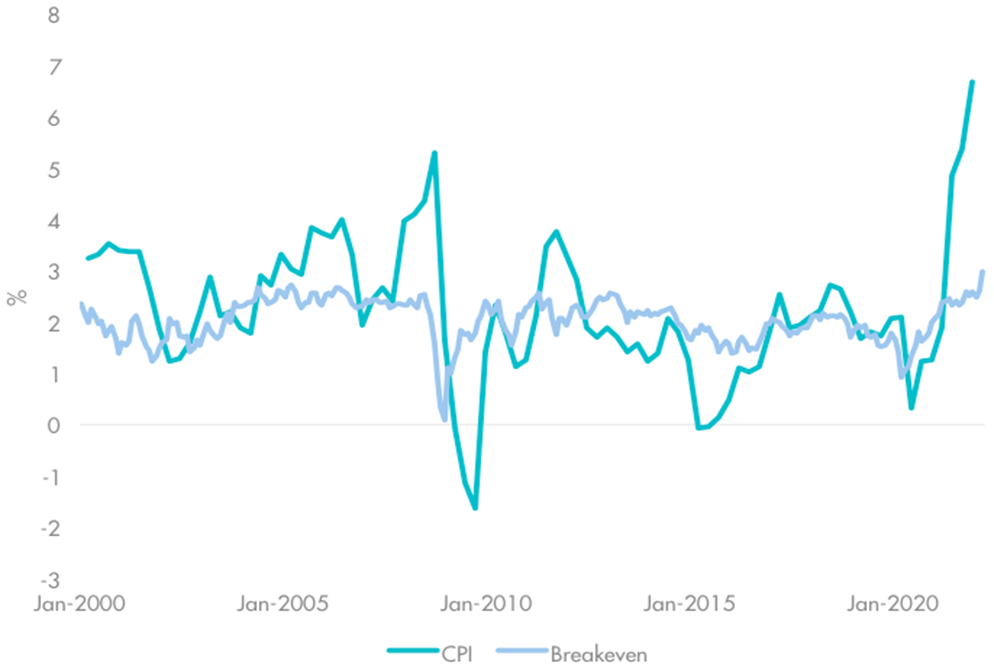

Negative real rates

Soaring commodity prices, increasing labour costs and supply chain disruptions means that replacing or competing with existing infrastructure assets is more expensive and difficult than ever. This increases the pricing power of existing infrastructure assets, providing another barrier to entry for an asset class characterised by its near-monopolistic securities.

On top of that, the low interest rates mean that the relative value of the income generated from infrastructure assets is higher, and often rises in line with inflation. While it is likely that interest rates will continue to rise through 2022, central bankers are mindful of massive public and private sector debt burdens so will be limited in how far they can raise interest rates without the risk of crashing the economy. Facing record inflation, and rates that cannot go to high, real rates remain negative. The ten-year breakeven rate is the highest it has been so far this century.

Figure 1: US CPI versus 10-year breakeven

Source: Bloomberg

The chances of the Fed managing a soft-landing is low and infrastructure assets are relatively recession proof. The level of demand for essential infrastructure assets does not tend to fluctuate with economic activity, shutdowns notwithstanding, so the impact of a recession following a rate hiking cycle is not as bad for infrastructure as it is for goods and services with elastic demand.

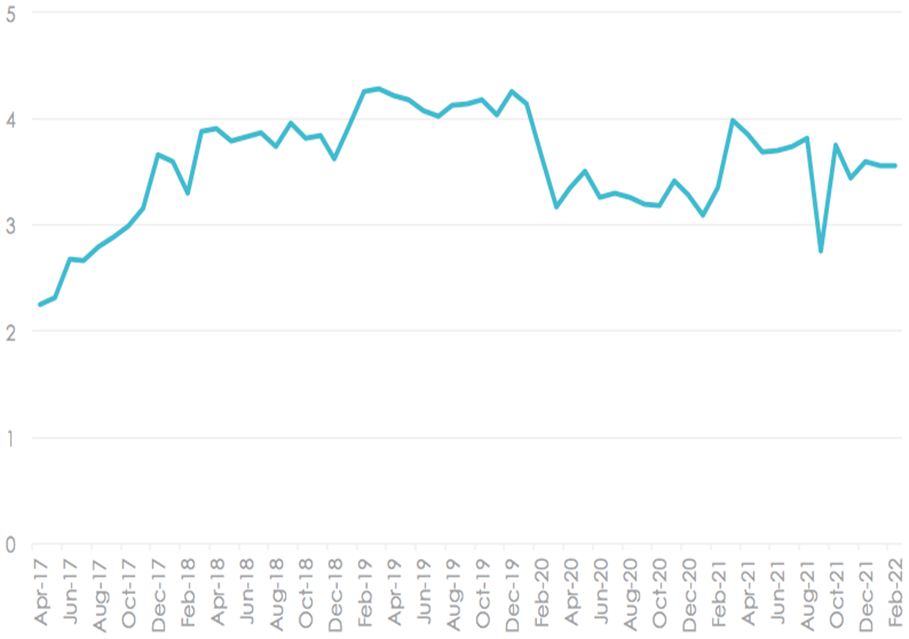

The dividend yield for IFRA is relatively high at 3.56% as at 28 February 2022. As always, current and past dividend yield is not a guarantee of future dividends by IFRA.

Figure 2: IFRA 12 month trailing dividend yield

Source: VanEck. Current or past dividend yield is not a guarantee of future dividends by IFRA.

An advantage IFRA has over many of its peers is how it utilises tax rules to smooth income, with income being one of the reasons many investors consider infrastructure.

Stable income advantage

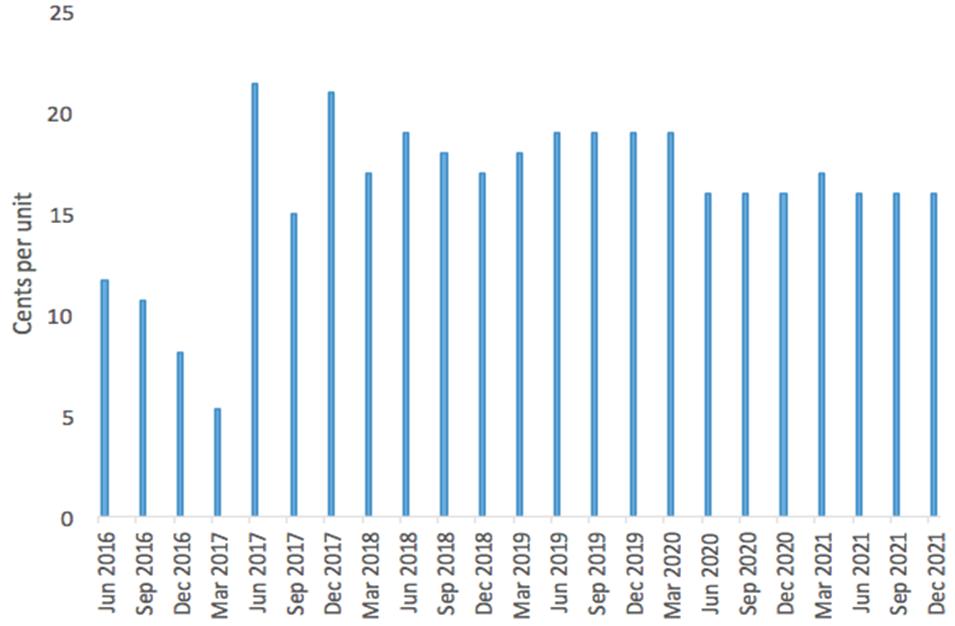

IFRA is hedged into Australian dollars to limit the impact that currency movements could have on income. IFRA, unlike most global listed infrastructure funds, also adopts ‘Taxation of Financial Arrangements’ (ToFA) currency hedging rules. The rules enable smooth income to be maintained over time. VanEck’s unique tax strategy gives IFRA the ability to offer stable income.

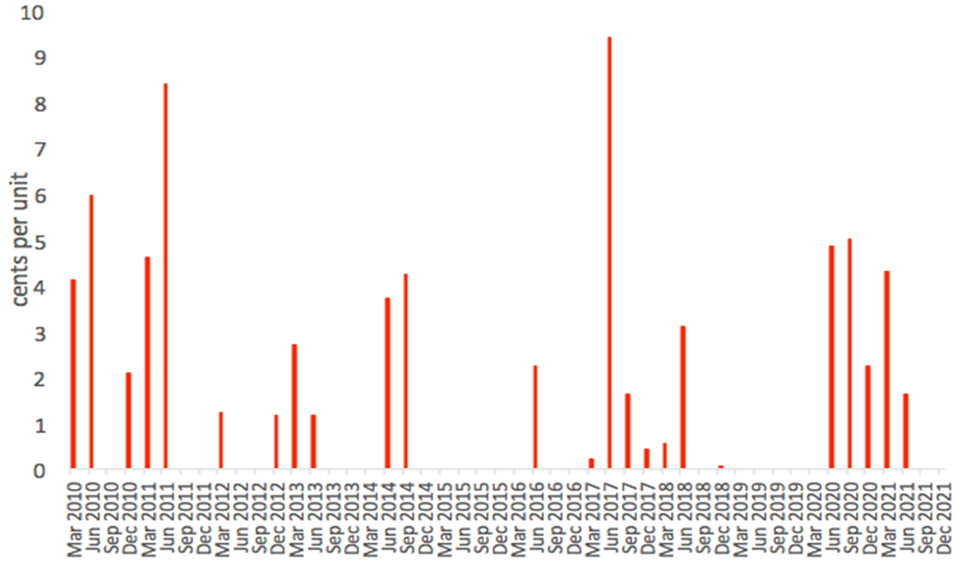

Not all fund managers utilise this strategy. Below on the left is a hedged infrastructure example from a widely regarded fund manager, on the right is IFRA. Note that the example Australian dollar hedged unlisted managed fund made no distributions between September 2014 and 30 June 2016, nor did they distribute throughout 2019 and they did not pay income for the past two quarters. IFRA, on the other hand, has maintained a steady income. This issue recently gained prominence as investors in a number of hedged funds, that do not implement the rules as VanEck does, paid very lumpy dividends at year end.

Figure 3: Unlisted Managed Fund: Dividend Payment History (cpu)

Figure 3 source: Fund Manager website accessed 23 March 2022. Past performance is not a reliable indicator of future performance.

Figure 4: IFRA: Dividend Payment History (cpu)

Figure 4 source: VanEck. IFRA inception date is 29 April 2016. Past performance is not a reliable indicator of future performance. IFRA dividend payment history (cpu) is not a guarantee of future dividends payable from IFRA.

Long term case for infrastructure

In addition to its income, there are also long term tailwinds supporting the case for investing in infrastructure:

- The global infrastructure deficit – With an estimated US$2.5 trillion annual global infrastructure investment shortfall in which 663 million people still lack access to clean water, 1.1 billion people lack access to reliable electricity, and 2.4 billion people lack access to basic sanitation, there is significant need to invest in infrastructure.1

- Privatisation of infrastructure – Government debt to GDP has soared during the COVID-19 outbreak and as a result, co-investments with private companies to fund infrastructure projects is increasing, as is the sale of infrastructure assets that were previously wholly owned by governments.

- Increasing climate change policy – Governments around the world are recognising that to avoid the worst effects of global climate change, they need to start taking stock of our existing infrastructure and ensuring that its impact on the environment is as minimal as possible. This is resulting in increased expenditure and potential upgrades to existing infrastructure.

- Shifting demographics – This is a tailwind for infrastructure in two ways:

- A growing global population requires not only more investment in infrastructure but also doing more with less.

- An aging population in developed markets that requires stable income to fund retirements will put a premium put on income generating assets, especially if interest rates remain near the lower end of the historical spectrum.

One trade access to 134 Global Listed Infrastructure securities

VanEck provides investors with the opportunity to access a portfolio of 134 global infrastructure securities simply via a single trade on ASX in the VanEck FTSE Global Infrastructure (Hedged) ETF (ASX: IFRA). IFRA was the first global infrastructure ETF on ASX.

With one trade on ASX IFRA gives investors access to:

- A portfolio of 134 of the world’s largest infrastructure securities providing international diversification that replicates the well regarded market benchmark for global listed infrastructure, the FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index.

- Stable income paid quarterly; IFRA’s 12 month trailing dividend yield is 3.56% (as at 28 February 2022), as always current or past dividend yield is not a guarantee of future dividends by IFRA.

- A cost effective strategy with a management cost of 0.52% p.a., which is around a third of the cost of an equivalent active Global Listed Infrastructure strategy.

1 United Nations Department of Economic and Social Affairs: Sustainable Development Goals

Published: 30 March 2022