Trump enters office, bitcoin runs. Where to now?

The Trump administration appears to be advancing its pro-crypto agenda. Understand the latest developments, plans and their potential impact.

President Trump has wasted no time implementing his second-term agenda. The impact of the raft of changes Trump signed into law on his first night in office was that the price of bitcoin rose to over US$107,000 from the previous day’s low of US$100,935.

On Friday morning (our time), Trump signed an executive order creating a cryptocurrency working group tasked with proposing a new regulatory framework for digital assets and exploring the creation of a cryptocurrency stockpile.

The much-anticipated action also ordered that banking services for crypto companies be protected, and banned the creation of central bank digital currencies which could compete with existing cryptocurrencies.

The immediate impact of that order was a spike in the price of bitcoin from US$101,520 to US$105,044. It subsequently fell below US$103,000 at the end of the day in the US.

As expectations build that Trump could create a US bitcoin reserve, bitcoin ‘bulls’ anticipate further appreciation of the price of bitcoin, but that could be a way off. It’s worth looking at what else President Trump could do for digital assets as he settles into the White House.

Since Trump’s re-election, bitcoin has been one of the best performing asset classes. Investors and digital asset enthusiasts were bracing for what could be a transformative period as his administration prepared and signalled shifts in regulatory priorities and economic strategies.

The promises and the appointments are pro-bitcoin

At the Nashville Bitcoin Conference, Trump floated the idea of creating a federal bitcoin reserve, a policy that could legitimise bitcoin's role as a global asset. His administration's pro-business ethos suggests a potential reduction in regulatory friction, fostering a more favourable environment for cryptocurrency innovation.

This shift aligns with recent market movements, where Trump's re-election triggered a surge in meme coins in November 2024, reflecting renewed investor confidence. His pro-crypto cabinet appointments, including Vice President JD Vance, National Security Advisor Michael Waltz, Commerce Secretary Howard Lutnick, Treasury Secretary Scott Bessent, Securities and Exchange Commission (SEC) Chair Paul Atkins and Federal Deposit Insurance Corporation (FDIC) Chair Jelena McWilliams, have further fueled optimism about Bitcoin's future in a regulatory-friendly environment.

Regulatory clarity

Given the early flurry upholding campaign promises, the Trump administration seems to be making good on its pro-crypto agenda. The new working group could establish a clear national framework for cryptocurrency regulation, creating consistency across federal and state jurisdictions.

Future executive orders could:

- Propose tax incentives for blockchain-based businesses and mining operations to encourage innovation and domestic growth.

- Mandate a review of current SEC and CFTC oversight structures to streamline approvals for cryptocurrency-based financial products, such as ETPs.

- Launch public-private partnerships to accelerate blockchain research and development, with a focus on enhancing US competitiveness in the global digital economy.

The potential impact of a Federal bitcoin reserve

One of the most intriguing possibilities under Trump's presidency could be the establishment of a federal bitcoin reserve. Proposed by influential figures like Senator Cynthia Lummis, this policy envisions the US Treasury acquiring Bitcoin to bolster its balance sheet. Advocates argue that this move could solidify bitcoin's role as a strategic reserve asset, similar to gold.

While ambitious, such a plan would face logistical and political challenges, including global market reactions and potential accusations of dollar manipulation.

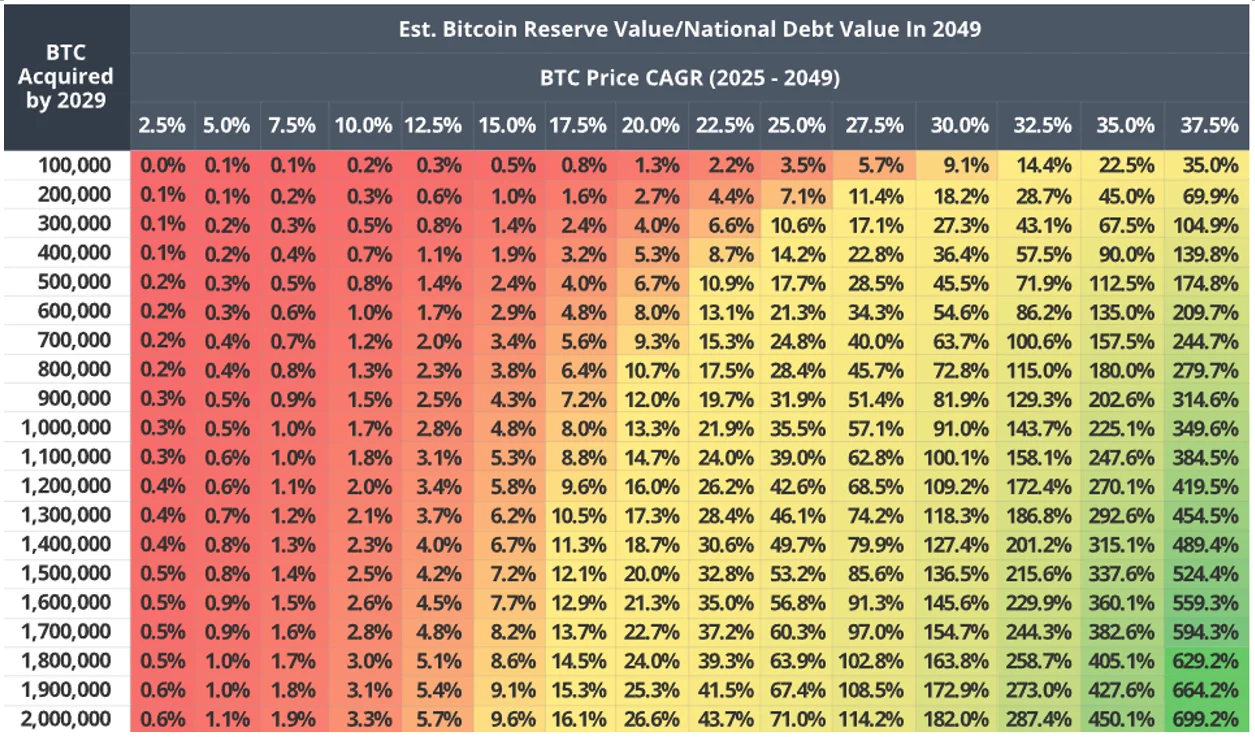

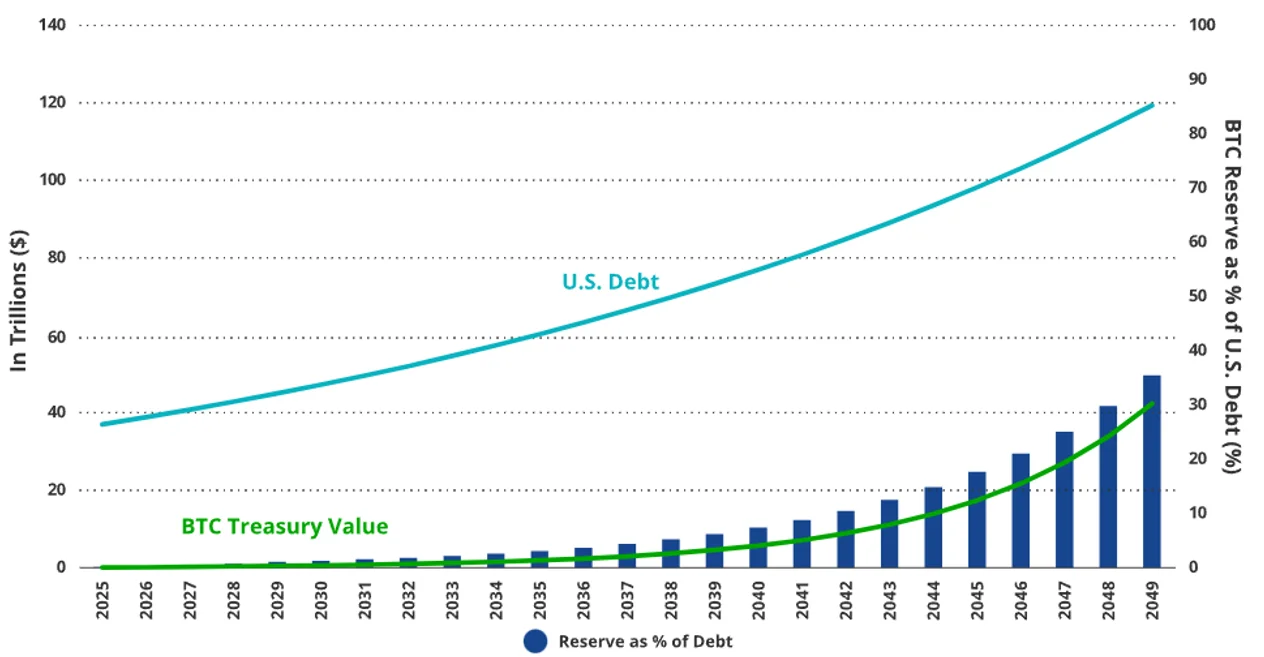

It is worth considering the potential for a US bitcoin reserve to be used to offset national debt. According to projections, if the US acquires 1 million BTC by 2029 and bitcoin grows at a compound annual growth rate (CAGR) of 25%, bitcoin could represent 35.5% of the national debt by 2049. This strategy assumes bitcoin acquisition at $200,000 per coin and a deceleration of debt growth from its recent CAGR of 7% to 5%. Emphasising this assumption ensures transparency in the calculation methodology.

Importantly, such a strategy would increase bitcoin’s importance in global finance.

Chart 1: Bitcoin reserve value versus US national debt in 2049

Chart 2: Estimated US Debt versus BTC reserve growth

Source: VanEck research as of December 2024. Past performance is no guarantee of future results. Any information, valuation scenarios, or price targets/projections presented on Bitcoin are not intended as financial advice, a recommendation to buy or sell Bitcoin, or any call to action. There may be risks or other factors not accounted for in these scenarios that may impede the performance of Bitcoin; actual future performance is unknown and may differ significantly from the projections herein. Any projections, forecasts or forward-looking statements included herein are the results of a simulation based on our research, are valid as of the date of this communication and subject to change without notice, are for illustrative purposes only, and are those of the author(s), but not necessarily those of VanEck or its other employees. Please conduct your own research and draw your own conclusions.

The reality is that no one knows what the digital currency policy mix will be. There is no doubt, however, that bitcoin has been a “Trump Trade’. Should Trump implement his pro-crypto agenda, having some exposure to this asset class could be a consideration for investors seeking growth and are tolerant of extreme risks. As we have seen in the past, the price of bitcoin can fall as quickly as it rises.

VanEck Bitcoin ETF (ASX: VBTC) is a way to gain exposure to the price of bitcoin on ASX.

VanEck has been a pioneer of digital assets, since 2017 we have been investing across the spectrum of this emerging frontier.

Key risks

An investment in the fund involves extremely high risk and the potential for loss of all capital invested. Investors should actively monitor their investment as frequently as daily to ensure it continues to meet their investment objectives. Risks associated with an investment in the fund include those associated with pricing risk, regulatory risk, custody risk, immutability risk, ASX trading time risk, concentration risk, environmental risk, currency risk, operational risk, underlying fund risk and forking risk. See the VanEck Bitcoin ETF PDS and TMD for more details.

Published: 23 January 2025

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.