A reluctant investor’s guide to understanding bitcoin

Among the list of sweeping changes Trump has promised when he is sworn in as the next President of the United States are specific initiatives that support bitcoin, including retaining bitcoin as a government-held reserve. Accordingly, the price of bitcoin has been breaking records, and surpassed the US$100,000 mark. Regardless of your previous thoughts on bitcoin, it’s worth understanding the basics, as it is clearly here to stay.

Many investors have, understandably, given bitcoin a wide berth, with its price ascension, volatility and lack of intrinsic value conjuring allusions to tulip mania and other speculative bubbles. However, the SEC ruling in the US earlier this year provided a crucial turning point for the cryptocurrency, establishing bitcoin as a legitimate asset, and paving the way for a flurry of bitcoin ETFs in the US and locally on the ASX. We could now be at the dawn of another pivotal moment for bitcoin, along with the broader asset class known as digital assets, with the forthcoming Trump presidency.

How did we get here?

Currencies have undergone a number of evolutions in the last 100 years. It wasn’t all that long ago that the world relied on physical gold - up until the 1940s, countries tied the value of their currency to the amount of gold they physically held. And it was only in the 1970s that the world moved to floating currencies, whereby value was determined by supply and demand. Following the creation of the euro zone, we saw the first region-based rather than country-based currency. And now we have global currencies via cryptocurrencies.

The digitisation of the world has completely transformed almost every aspect of our lives, so it should be no surprise that currencies and money are also being transformed.

Cryptocurrencies are digital currencies and can be used to pay for goods and services, just like we do with paper-based money, and as a store of value, like gold. A unit of cryptocurrency is known as a “token” or “coin”, and these are stored in an online “wallet”. In the same way we use specific exchanges for trading shares and ETFs, like the ASX and the NYSE, you can buy and sell units of various cryptocurrencies via specific online exchanges.

An important differentiator of cryptocurrencies is that they are “decentralised”, meaning they operate independently of any government or bank. Traditional currencies are managed by a country or region’s central bank, which influences its value via changes in interest rates, and supply controls via monetary policy. Cryptocurrency prices are not beholden to such influences.

Relying on an encrypted peer-to-peer system of exchange, cryptocurrency is derived from the word cryptography - the process of coding information so only the person intended to receive said information can decipher it. However, while we’ve come a very long way since The Enigma Code, investors should be mindful of the risk of crypto wallets and exchanges being raided and assets stolen. According to reports, hackers stole in excess of US$2 billion in cryptocurrency in 2024.

Bitcoin 101

Bitcoin is the most established and accepted cryptocurrency. It has become a significant currency both on- and offline and currently has a market capitalisation in excess of US$1.8 trillion1, which is higher than Berkshire Hathaway and Tesla2.

Now, more than ever, merchants and businesses are accepting bitcoin as a form of payment and infrastructure has been built to make it more convenient for the average person to use. Users can now buy and pay for items using bitcoin wherever PayPal is accepted. The development of user-friendly wallets, exchanges, and marketplaces has removed the technical barriers to entry that existed in bitcoin’s early years.

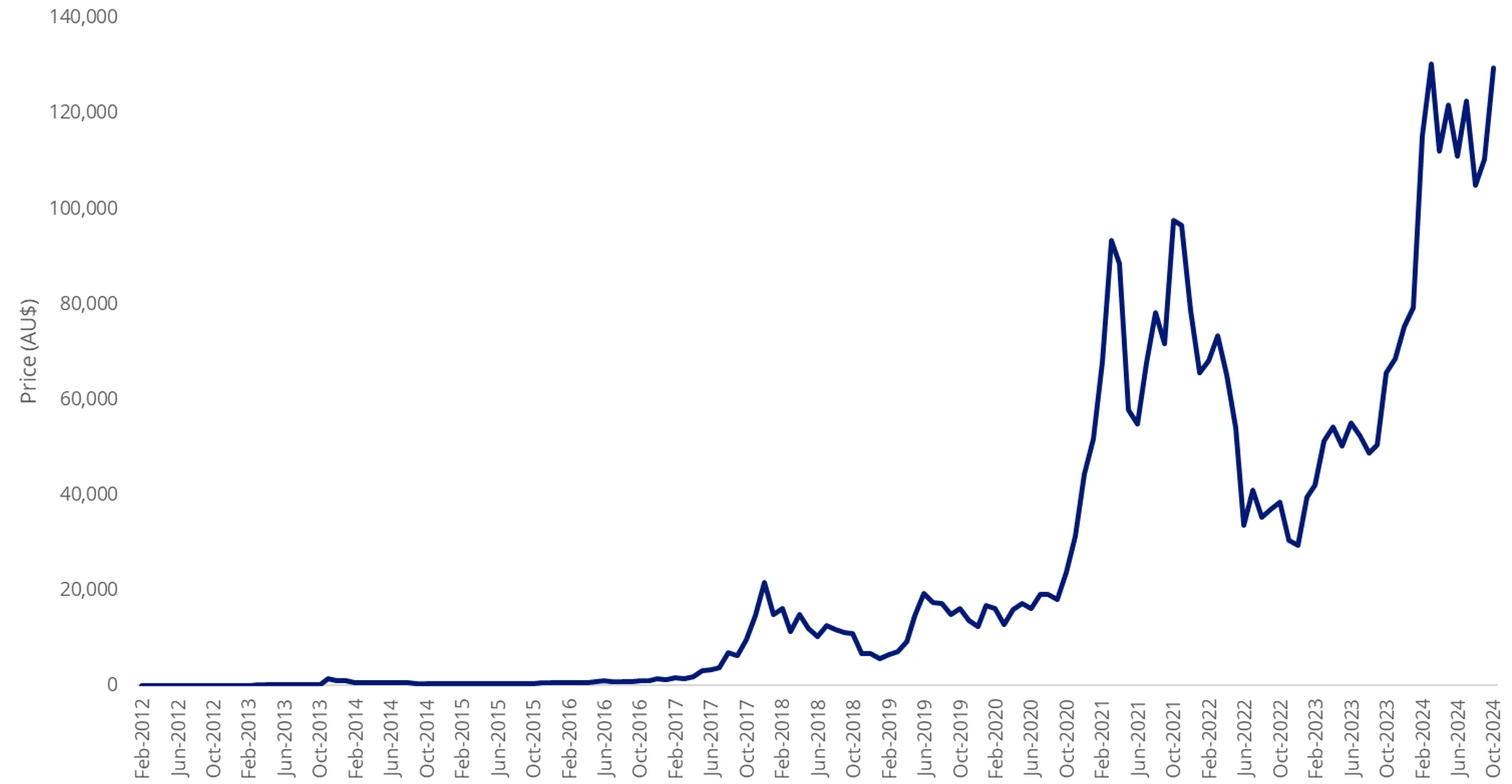

Since inception in 2009, bitcoin’s increase in value has been extraordinary. From trading below the US$500 mark in its early years, its current value hovers around US$98,000. Bitcoin’s historical performance can be characterised as extremely volatile yet upward trending.

Chart 1: Since 2013, bitcoin’s price has experienced dramatic highs and lows

Source: VanEck, Morningstar as at 31 October 2024. Representing the price of bitcoin is the MarketVector™ Bitcoin Benchmark Rate. Past performance is not indicative of future performance.

Like gold, bitcoins are produced via “mining”. Only, instead of using specialised mining equipment such as drills, explosives, longwalls and excavators, bitcoin miners use hyper sophisticated computers to compete to solve complex mathematical problems. Bitcoins are the reward.

There will only ever be 21 million bitcoins in existence. This supply cap was designed intentionally and is one of the primary characteristics of bitcoin.

Furthermore, bitcoin has “halvings” programmed into it. At each halving, bitcoin miners will earn half as many bitcoins as they did prior to the halving event. Halvings occur roughly every four years and result in a slowdown in the rate at which new bitcoins are introduced into circulation over time until it eventually reaches zero (estimated to occur around the year 2140). The last halving occurred on 20 April 2024. Historically, the price of bitcoin has rallied leading up to and following a halving.

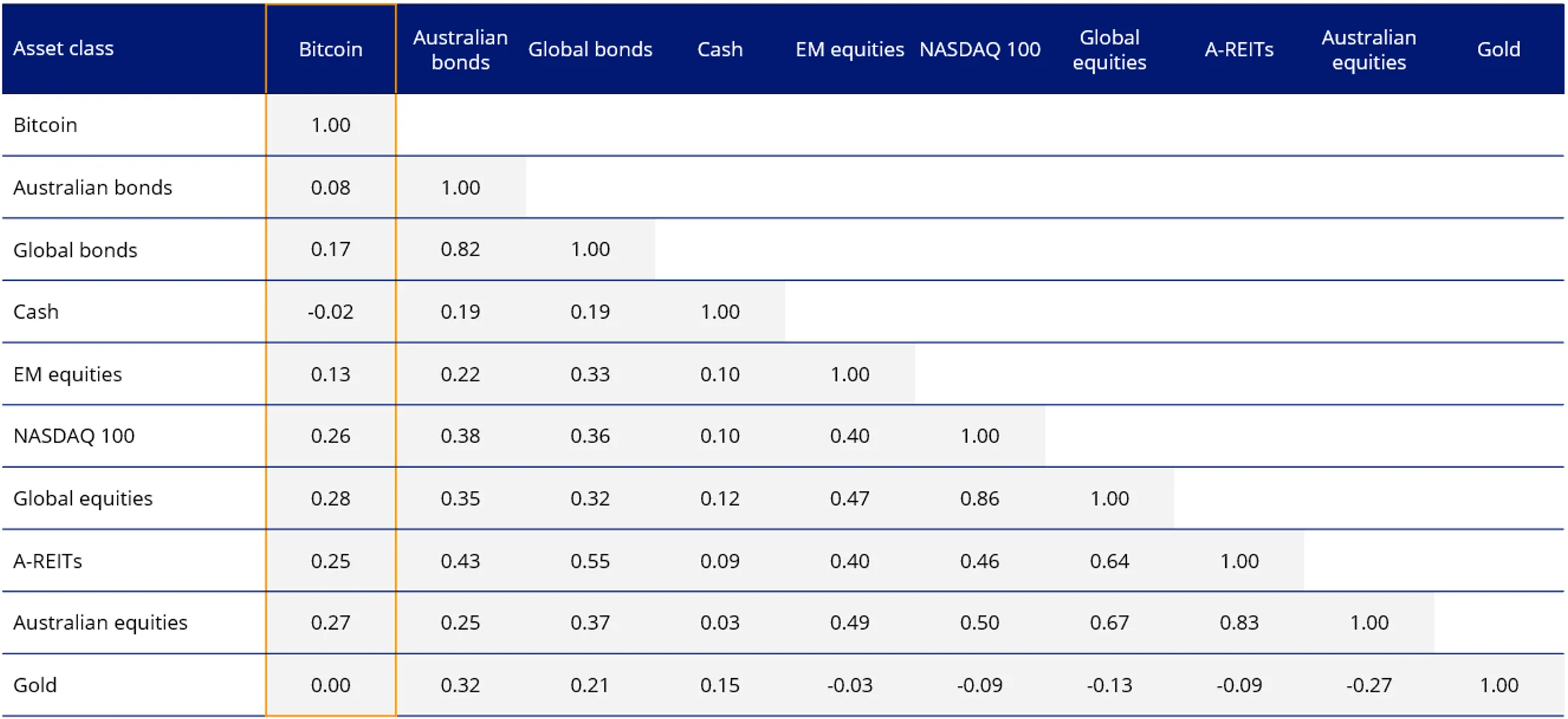

While increasing scarcity can lead to increased value, investors have also been attracted to bitcoin as a portfolio diversifier. Bitcoin has a low correlation to traditional asset classes.

Chart 2: Bitcoin’s correlation to traditional asset classes

Source: Morningstar Direct, Ten year correlation, 31 October 2024. Indices used: Australian Bonds is Bloomberg AusBond Composite 0+Y Index, Global bonds is Bloomberg Global Aggregate TR Hdg AUD Index, Bitcoin is MarketVector Bitcoin PR Index, Cash is AusBond Bank Bills Index, EM equities is MSCI Emerging Markets Index, Global equities is MSCI World ex Australia Index, A-REITs is S&P/ASX 200 A-REIT Index, Australian equities is S&P/ASX 200 Index, Gold is LBMA Gold Price PM.

Bitcoin as a mainstream asset class

The approval of bitcoin ETFs by the SEC and ASX has enabled the wealth management community and individuals to access bitcoin via a regulated and insured investment vehicle, opening up the asset class to institutional investors including hedge funds, sovereign wealth funds, pension funds, and registered investment advisors. The Trump administration plans to further solidify the cryptocurrency as a mainstream asset.

Trump was the first Presidential candidate to brand himself “pro-crypto”. Among his pledges were:

- A strategic national crypto stockpile;

- A change in direction, in terms of approach to regulation and from the aggressive stance taken under the previous administration;

- Ensure the US is the global centre of bitcoin mining; and

- Fed rate cuts, which have historically boded well for bitcoin.

According to our latest Australian Investor Survey, more than 1 in 10 respondents are considering investing in a bitcoin ETF in the next 12 months. Meanwhile 95% Australian financial advisers would consider allocating to a bitcoin ETF, according to the 2024 VanEck Smart Beta Survey.

The VanEck Bitcoin ETF (ASX: VBTC) offers investors exposure to the price of bitcoin while providing institutional-grade protection of the bitcoin investment.

Key risks:

An investment in VBTC involves extremely high risk and the potential for loss of all capital invested. Investors should actively monitor their investment as frequently as daily to ensure it continues to meet their investment objectives. Risks associated with an investment in VBTC include those associated with pricing risk, regulatory risk, custody risk, immutability risk, ASX trading time risk, concentration risk, environmental risk, currency risk, operational risk, underlying fund risk and forking risk. See the VanEck Bitcoin ETF PDS and TMD for more details.

Sources:

1Coindesk, as at 19 November 2024

2Bloomberg, as at 19 November 2024

Last Updated On: 19 December 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is not personal advice and is general in nature, and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.