China’s economy is transforming – not in secular decline

To be clear, China’s economy faces significant challenges, not least of which is the necessary deleveraging of many of the country’s cities and provinces as well as some of the country’s state-owned banks and insurers. Cities and provinces became overly dependent on land sales (or long-term leases) to property developers to fund their budgets, while state-owned lenders and financing vehicles directed too much credit toward fixed asset investments. Now that both asset classes stopped performing, the bill has come due.

As the central government is forced to direct resources to bail out its cities and provinces, this will limit its ability to provide much of the fiscal stimulus many investors have been demanding. Additionally, the country has significant demographic challenges, a limited safety net, and now a self-inflicted crisis of consumer confidence. And China’s protectionist and mercantilist practices have put it at odds with some of its largest trading partners, especially the US and the EU, both of whom are partially diversifying their supply chains away from the country.

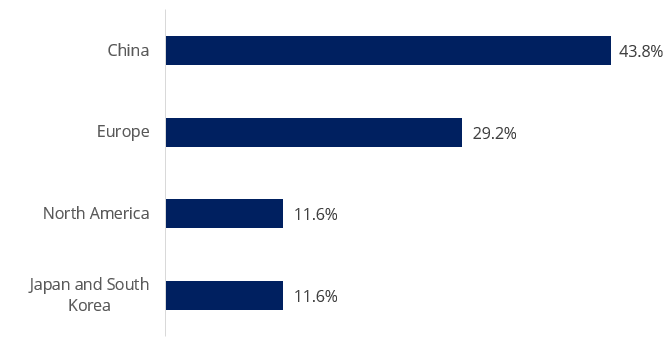

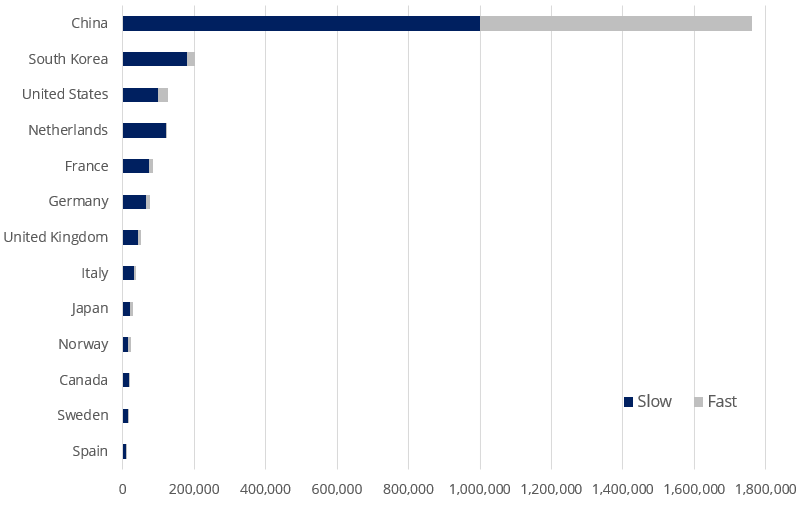

On the other hand, significant parts of China’s domestic economy are prospering, especially those related to the country’s drive towards automation, technological self-sufficiency, and the move up the manufacturing value chain. And while these trends are unquestionably supported by the central government, it is the private sector that has taken the lead role in transforming China’s economy into a technology powerhouse. Case in point is the country’s auto sector, now the world’s leading manufacturer of electric vehicles. According to IHS Markit, by 2027 China will account for 44% of the world’s electric vehicle production, almost twice as much as North America, Japan, and South Korea combined (Exhibit 1). And today the country has 1.8 million electric vehicle charging stations publicly available, almost a million more than the rest of the world combined (Exhibit 2).

Exhibit 1. Electric vehicle production by region – 2027

Source: IHS Markit

Exhibit 2. Number of publicly available electric vehicle chargers in 2022, by country and type

Source: IEA

On the manufacturing front, China’s image as simply a low-cost producer of commoditised products is increasingly a thing of the past. The country’s manufacturing sector has been investing in automation and industrial digitalisation for years, allowing it to move up the value chain to produce advanced machinery, semiconductors, robots, and similar high value-added goods at scale.

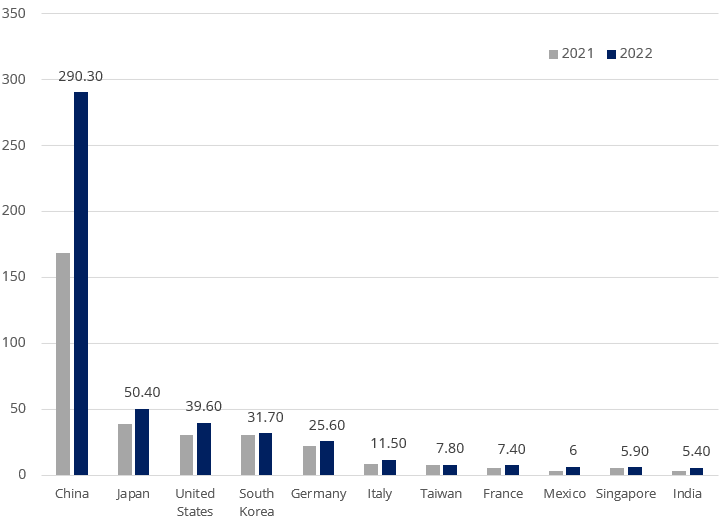

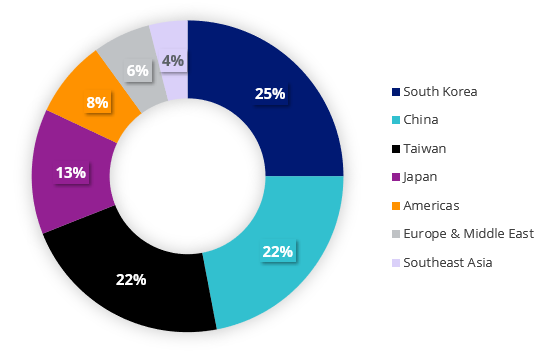

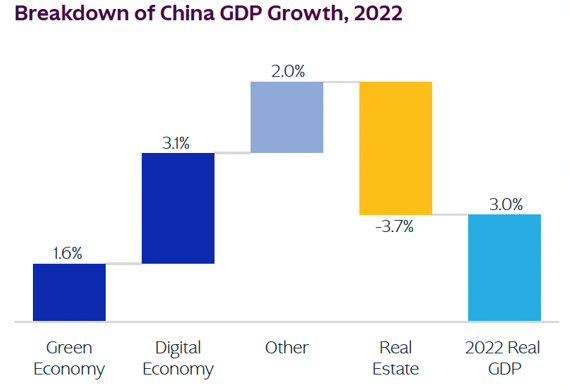

In 2022, China’s factories had almost twice as many industrial robot installations as Japan, the US, South Korea, and Germany combined (Exhibit 3). And despite all the rhetoric about China’s designs on Taiwan’s semiconductor manufacturing sector, the country has now matched Taiwan’s semiconductor fabricating capacity and trails only South Korea’s (Exhibit 4). A recent KKR report sums up this trend nicely, arguing that China’s “green and digital economy” will soon offset the drag on GDP growth from fixed investment, including the country’s saturated housing market (Exhibit 5).

Exhibit 3. Industrial robot installations worldwide 2022, by region (in 1,000 units)

Source: IFR (International Federation of Robotics)

Exhibit 4. Distribution of global semiconductor fabricating capacity in 2022, by location

Source: SEMI 300mm Fab Outlook to 2026

Exhibit 5. “China’s green and digital economy will soon fully offset the slowdown in fixed investment, including a saturated housing market.”

Source: KKR Global Macro & Asset Allocation Analysis, “Thoughts From the Road | Asia | October 2023”

The consumer confidence crisis – real but temporary

An important anchor of our “new economy” investment thesis is the size and purchasing power of China’s middle class, which is not only the world’s largest in absolute terms (approximately 700 million people), but also accounts for 40% of global middle-class wealth1. Furthermore, by 2030 China’s middle class is projected to account for more than one-fifth of global middle-class consumption. And while Chinese consumers have historically been avid buyers of foreign branded goods, recent consumer surveys reveal that two-thirds now prefer local brands over foreign ones2, while almost 9 out of 10 have stated that, after COVID-19, their willingness to buy Chinese rather than foreign brands increased or remained the same3. All of which suggests that for investors to benefit from these trends, it is no longer enough to own foreign manufacturers selling into the Chinese consumer market. For perspective on the opportunity, consider that in 2021 Chinese retail sales of consumer goods totaled US $6.5 trillion.

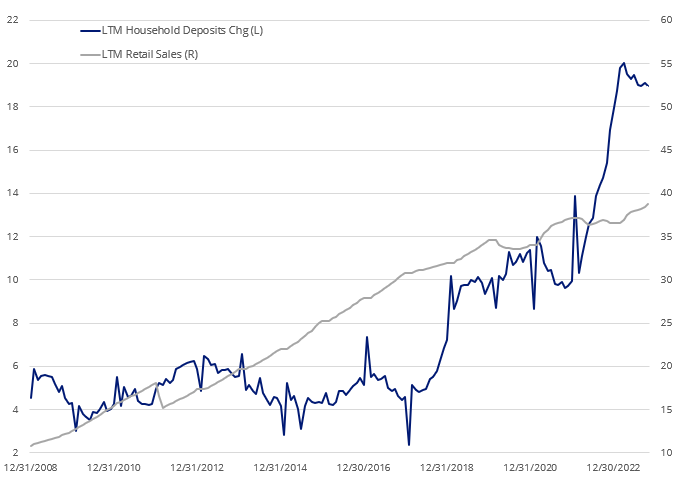

Yet Chinese consumers are not consuming as much as economists projected when the country exited its draconian COVID lockdown. We attribute this to two factors. First is the concern that the country’s real estate crisis will lead to widespread default by developers, rendering many unable to deliver units for which millions of Chinese have already made considerable cash deposits. The second factor is a series of clumsy government measures aimed at reining in the private sector, specifically many of the country’s most successful tech companies. Both factors have seriously dented consumer confidence, leading to a slump in consumption relative to a buildup in personal savings as seen in Exhibit 6. Yet the bottom line when it comes to the Chinese consumer is that although household balance sheets are largely in good shape, consumer confidence might not return until there is greater clarity whether the government will protect home buyers from developer defaults. Once consumer confidence returns, we expect that the benefit will accrue largely to domestic brands over foreign ones and that expenditures will concentrate on experiences over things, given how much Chinese consumers have changed since before COVID.

Exhibit 6. Household deposits vs. retail sales in China, 2008-2023 (RMB trillions)

Source: National Bureau of Statistics of China

In conclusion, China’s economy is transforming in ways not always appreciated by foreign investors. The country has upgraded both its manufacturing capabilities and its consumption patterns, which will make it look more like developed markets in a few years than the emerging market it has been for the last four decades. Investors wanting to partake in the benefits of this transformation should be willing to own domestic Chinese equities, especially those focused on the ongoing upgrade of the country’s technology sector, on the continued growth of domestic consumer brands, and on the overall purchasing power of the Chinese consumer.

Sources

1Allianz Global Wealth Report 2021

2Alix Partners, 3rdAnnual Singles’ Day

3Ipsos ; Tsinghua Qingdao Academy of Arts and Science; Trends Group

Published: 15 December 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.