Constructive outlook for the US carbon markets

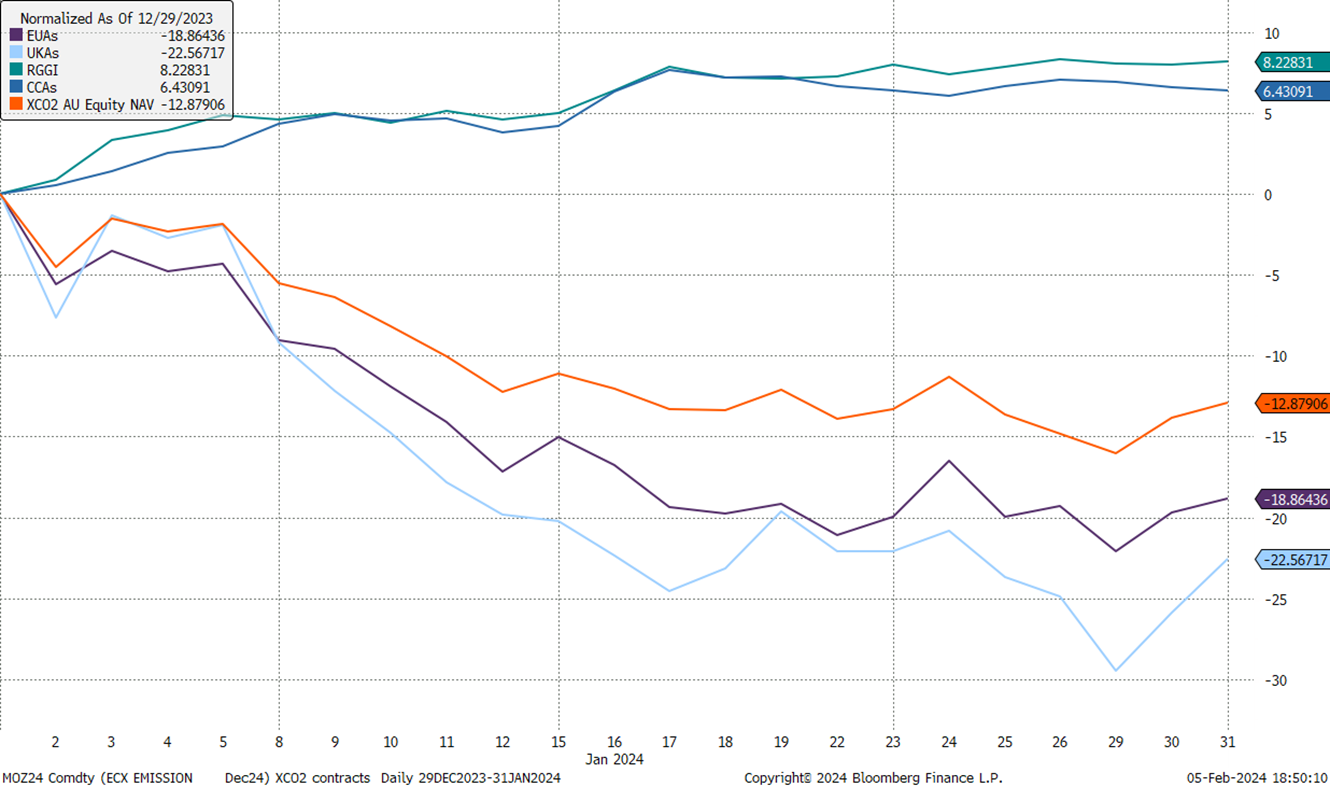

The start of 2024 continued to see divergence of the carbon price movement – RGGIs and CCAs’ rally in 2023 extended into the new year, whereas EUAs and UKAs struggled to find its footing.

The strong price momentum from the two US carbon markets is driven by their increased climate target, supported by a reduction in annual caps on total greenhouse gas emissions.

RGGIs, in particular, hit a record high mark of US$16.98/short ton at the end of January. With the first auction of carbon allowances coming up in March for the new year, we expect there will be a full clearance again, as is the case since March 2013. Given the current level of the futures price, the expected auction settlement price is very likely to be higher than the Scheme’s Cost Containment Reserve (CCR) trigger price of US$15.92 for 2024. What this means is that some level of allowances set aside in the CCR will be sold to the market, to prevent prices shooting up drastically.

Beginning in 2021, the RGGI regulator also introduced the Emissions Containment Reserve (ECR) which will withhold allowances from circulation to secure additional emissions reductions if prices fall below an established trigger price. The ECR trigger price is set at $7.35 this year and acts as a price floor. Both the CCR and ECR trigger prices increase by 7% per year, which provides a free inflation hedge for investors.

In Europe, both the mild weather and increased renewables capacity coming back online reduced the power demand, hence a shrinking demand for carbon credits. According to BloombergNEF forecast, the total EUA allowances for the year are expected to only be 1% lower than in 2023, despite reforms to tighten supply on previously commercially protected sectors such as industrials and aviation. The other factor that keeps the supply of carbon allowances high is the EU’s REPowerEU plan which front-loads future allowance volumes in order to raise revenues to transition away from Russian energy. There is still a silver lining, however, to be bullish on the EUAs prices, provided that the macroeconomic conditions improve in the EU bloc with a recovery in power consumption, and increased power generation from coal.

Performance in AUD:

Source: Bloomberg as at 31 January 2024. Past performance is not indicative of future performance.

Abbreviation used: EUA = EU emission allowance futures; UKA = UK emission allowance futures; RGGI = Regional Greenhouse Gas Initiative; CCA = California Carbon Allowance.

Key risks

An investment in XCO2 carries risks associated with: ASX trading time differences, market risk, concentration risk, futures strategy risk, cap and trade risk, currency risk, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.

Published: 18 February 2024