California carbon price to lead growth

While volatility may remain in 2024 in the European carbon market, the regulators will be on the lookout for the oversupply of allowances. One imminent action is to review the distribution of free allowances in the industrials and aviation sector for the upcoming allowance allocation period from 2026 to 2030, ultimately addressing the legacy issue of overallocation in these protected sectors moving forward.

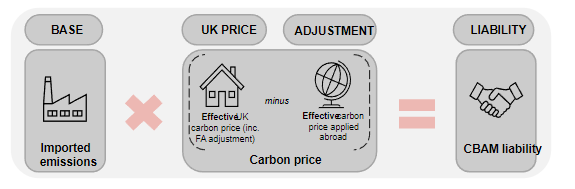

The UK Emissions Trading Scheme (ETS), followed the steps of EU ETS to set up its own version of Carbon Border Adjustment Mechanism (CBAM) in December 20231. The mechanism is set such that carbon leakage (i.e., moving the manufacturing capacity from one jurisdiction to another due to different carbon price levels) are prevented, while pushing for acceleration of global decarbonisation efforts. Once implemented, foreign producers would need to pay for the price differential between the UK carbon allowance price and the carbon prices in that jurisdiction for the carbon emissions produced in certain sectors.

Source: GOV.UK

On the other hand, California’s carbon price (CCAs) had a stellar year with over 30% growth in 2023. The record-high carbon price has been primarily driven by the State’s strong climate ambitions. Following the emission reduction scenario analysis done by the California Air Resources Board (CARB) in November, Bloomberg NEF now estimates that the price could climb to US$93/Mt 2030 in the 48% emissions cut scenario2.

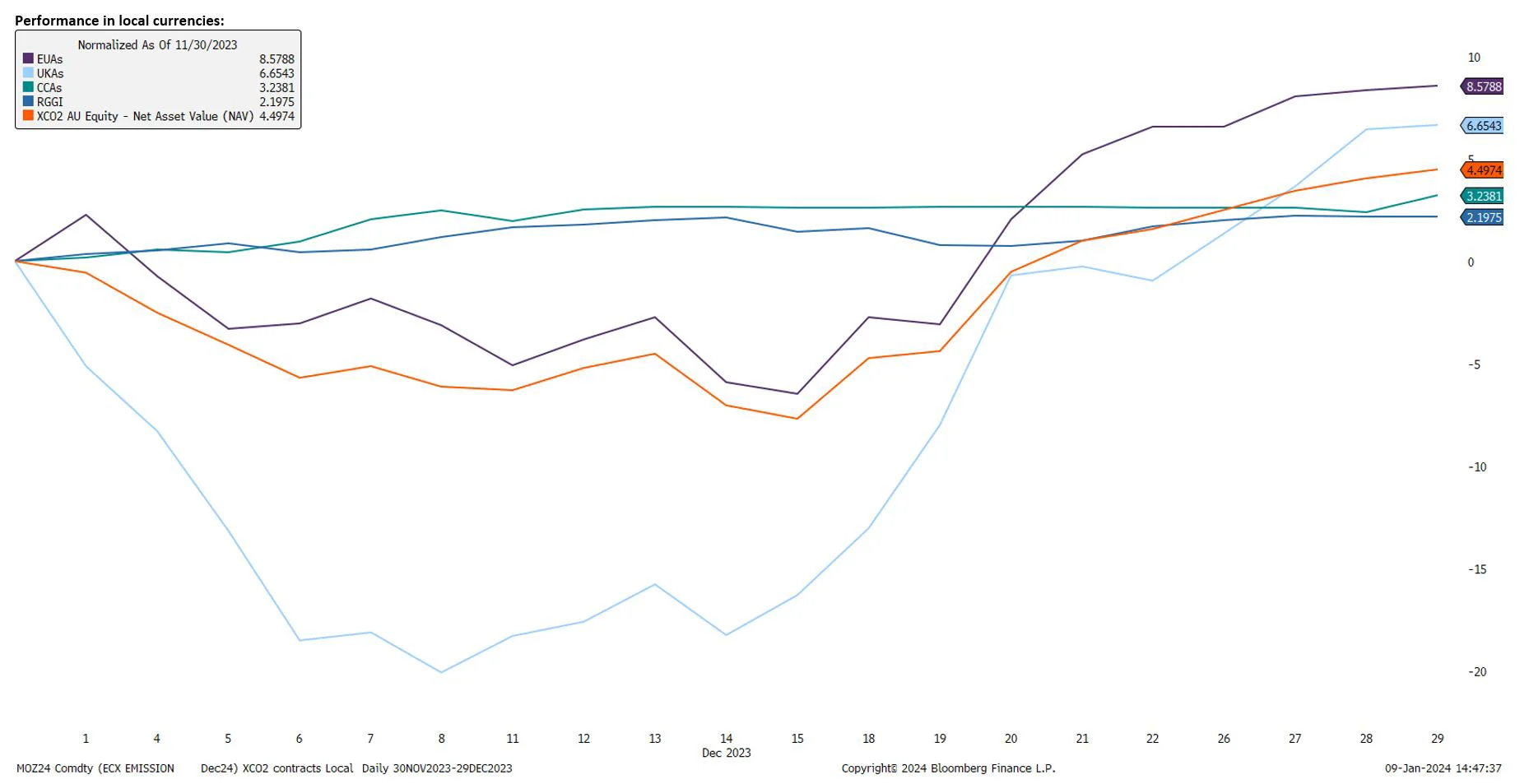

December performance in local currencies:

Source: Bloomberg. Past performance is not indicative of future performance.

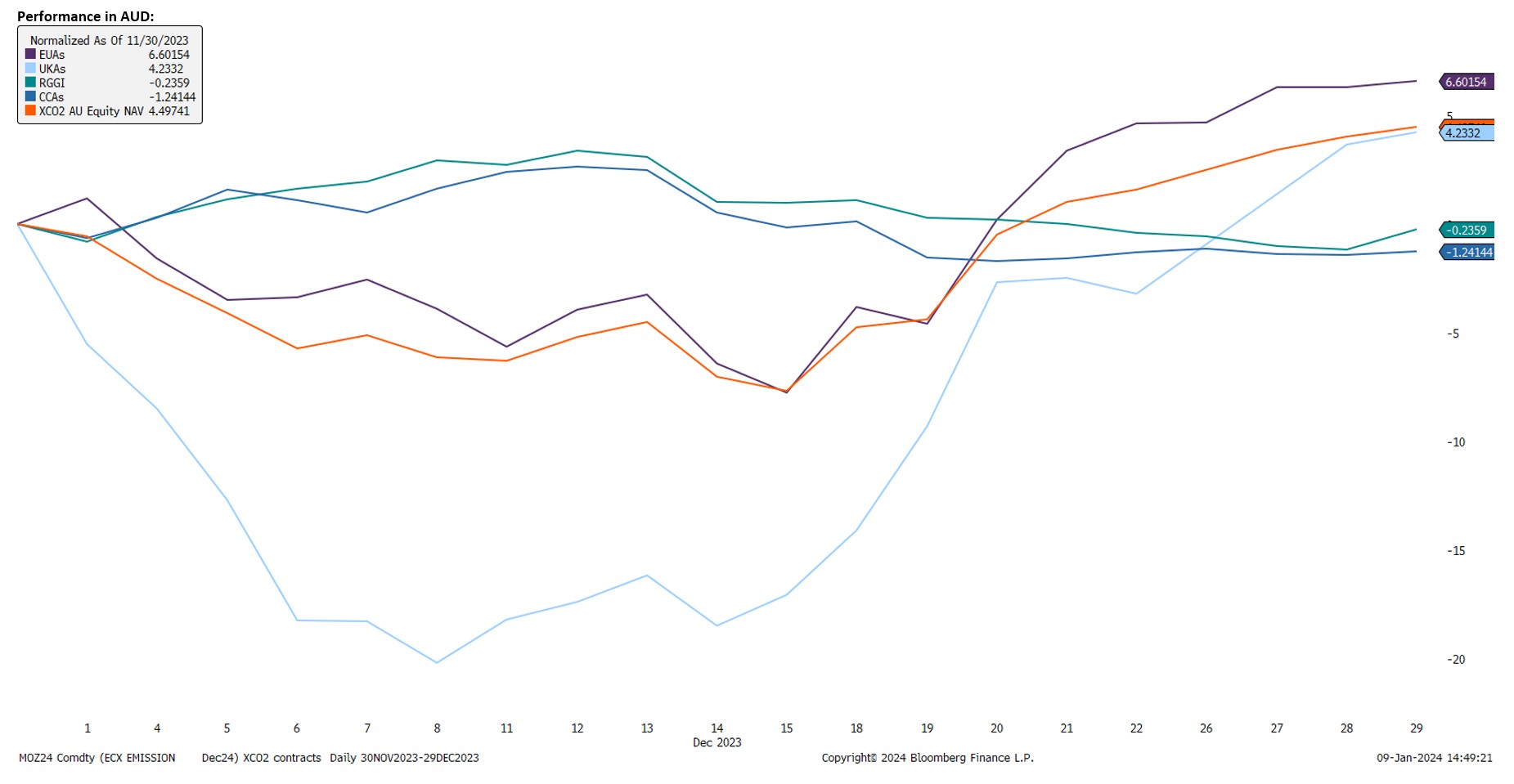

December performance in AUD:

Source: Bloomberg. Past performance is not indicative of future performance.

Key risks: An investment in the XCO2 carries risks associated with: ASX trading time differences, market risk, concentration risk, futures strategy risk, cap and trade risk, currency risk, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

1GOV.UK. Consultation outcome factsheet: UK Carbon Border Adjustment Mechanism

2BloombergNEF. California Reforms Could Double Carbon Price By 2030.

Published: 17 January 2024

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.