Time to break your concentration

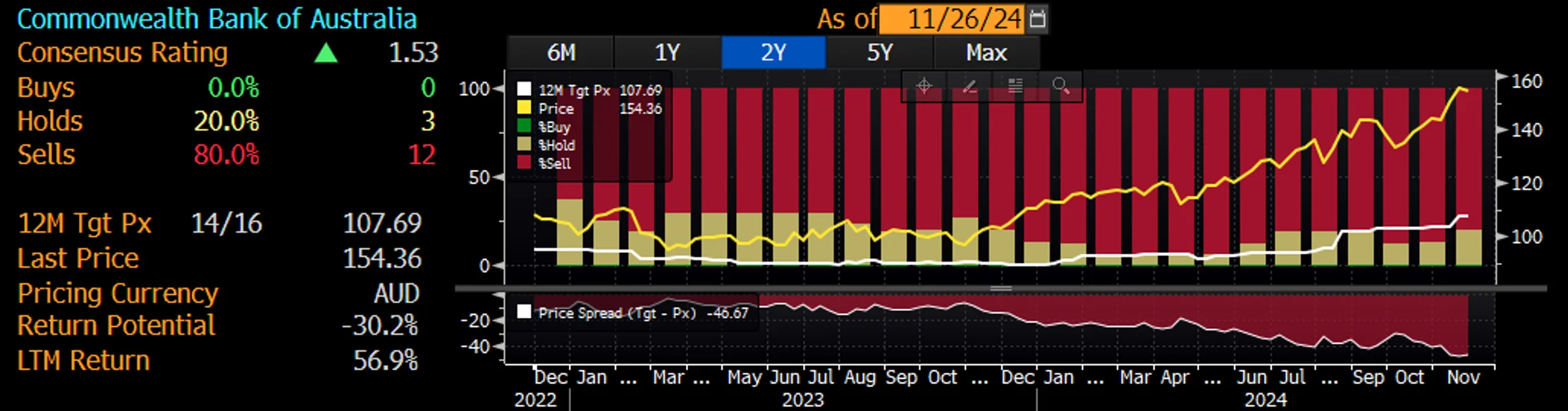

The share price march of Commonwealth Bank (CBA) so far in 2024 has been impressive. Its price rise has confounded many sell-side analysts and fund managers, who have been warning the shares are overvalued.

Earlier this month, CBA announced its Q1 2025 profit, which was flat year-on-year. The bank flagged the continued impact of cost-of-living on economic growth as a pressure, and while its results met market expectations, its share price slid on the day of the announcement. Notwithstanding the flat earnings, CBA has since rallied to hit $160 on the 25 November, over 50% higher than the year before. It is the most expensive bank in the world, as it has been for some time, and now represents more than 10% of the S&P/ASX 200. Some have mistakenly blamed CBA’s price rise on the waves of passive investment (we prove that wrong here), the Australian Financial Review also posited the real reason why CBA shares keep rising is steady buying from a loyal band of retail investors (which we think is more believable) and the (tax) cost of divesting.

Many sell-side analysts still have CBA as a ‘sell’ recommendation.

Chart 1: CBA sell-side price recommendations

Source: Bloomberg, as at 26 November 2024. Not a recommendation to act.

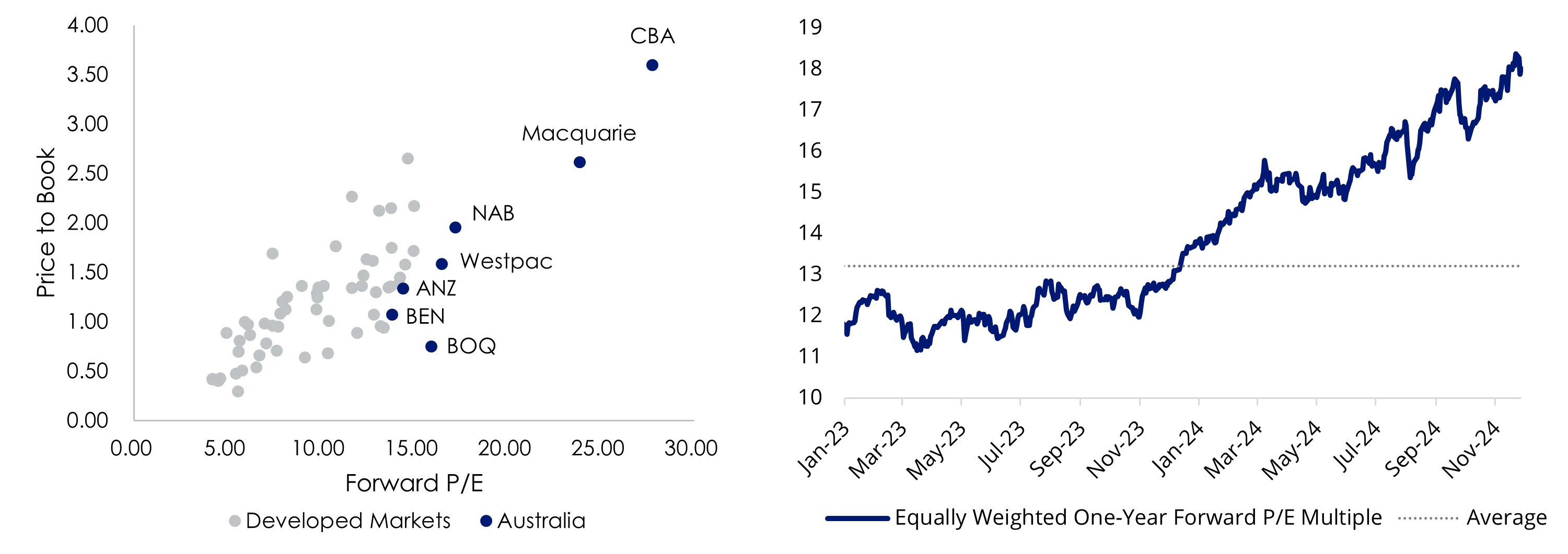

This is not only a CBA story. Australia’s banks have all had a strong year, in terms of share price returns, and there is no doubt that Australia’s biggest banks valuations are stretched and are among the highest globally.

Charts 2 and 3: Global bank valuation; average big 4, price to earnings

Charts 2 and 3 source: Bloomberg, VanEck 26 November 2024.

But it’s not just the sky-high valuations that are causing alarm for analysts. Banks also face headwinds. A review of the analysts' reports cites cost headwinds, with persistent and upward pressure on investment spending, increased competition and slowing or stalled credit growth.

It is worth noting that, despite rates being as high as they were in 2010 (and expected to stay at that level through to at least the second half of 2025) the banks’ net interest margins have not increased to the level they were in 2010, as investors may have expected with a return to higher rates. Major banks’ NIMs are more than 20% lower than in 2010, dropping below 2%, as competitive pressures squeeze margins.

Chart 4: Major banks’ Net Interest Margin* (domestic, half-yearly)

Released on 6 November 2024 (data updated to 31 October 2024)

* Data for a given period relate to banks’ public profit reports released in that half; IFRS basis from 2006, AGAAP prior, excludes St George Bank and Bankwest prior to the first half of 2009.

Sources: Banks’ financial reports; RBA.

This impacts the banks’ earnings. A review of recent estimated earnings per share (EPS) growth highlights that there are no expected material earnings upgrades for the big four banks. With share prices already at a premium, estimated EPS growth will further pressure the banks’ share prices.

Table 1: Big four banks - EPS growth YoY%

Source: FactSet, 25 November 2024. Not a recommendation.

Another headwind that Australia’s banks must navigate is the economic outlook. Slowing credit growth and the expectations that rates will be higher for longer – increasing the potential for arrears – will also put pressure on lenders.

The problem for most Australian investors is that Australian portfolios, especially those that track or are benchmarked to the S&P/ASX 200, have a significant exposure to banks, as these make up over 20% of the Australian benchmark index.

Should valuations move to be in line with global valuations and thus better reflect the economic outlook, it could disproportionately impact many Australian portfolios.

Such sector bias makes sense if you are bullish on the sector but given the well-noted pressures on banks remain, with margins under pressure, an economic outlook not conducive to growth and defaults potentially rising given that rates are now not expected to fall until well into 2025, a less concentrated approach to Australian equities may be prudent.

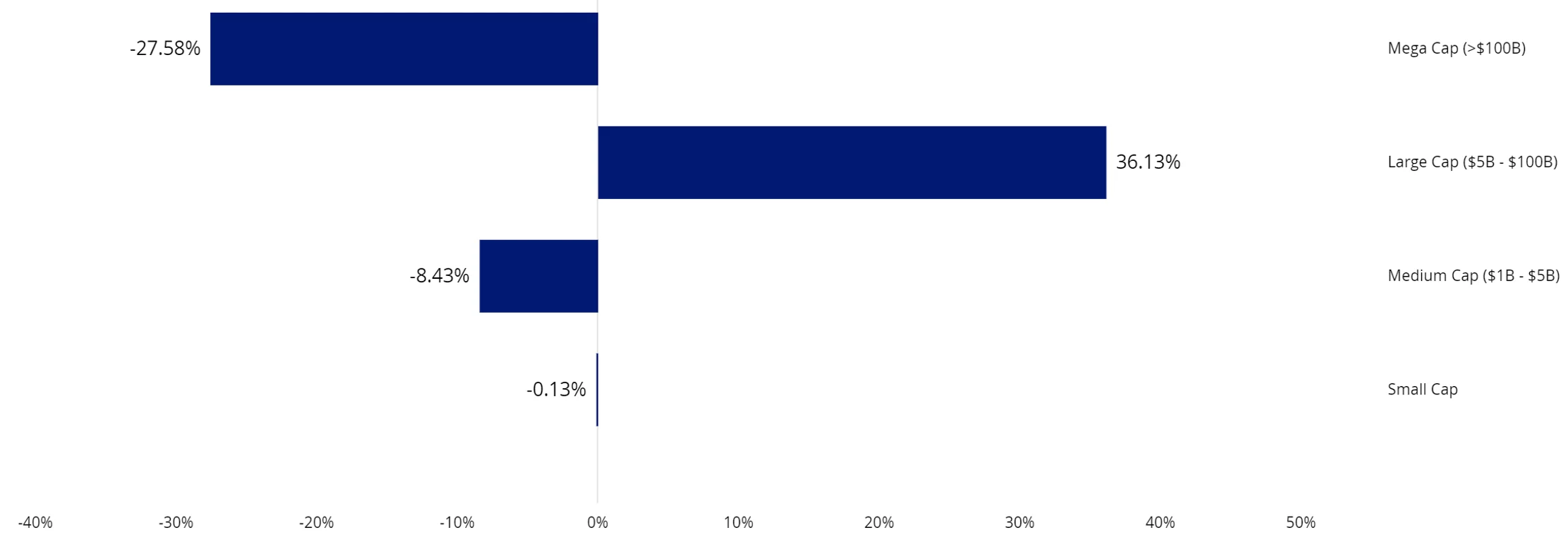

A solution for managing mega-cap exposure with alternative weighting

The VanEck Australian Equal Weight ETF (MVW) is a portfolio construction solution that reduces concentration risk to banks. It can be deployed to de-risk and diversify a portfolio, with no one security or sector dominating, providing a more balanced exposure to Australian equities.

MVW equally weights the largest and most liquid stocks on the ASX at each rebalance. Because of this, at the last rebalance, no company was more than 1.39%. MVW has less exposure to the mega-caps that dominate the S&P/ASX 200 Index compared to many Australian equity portfolios. MVW is underweight mega cap companies and overweight those large companies outside the mega-caps.

Chart 5: Market cap weight differential: MVW vs S&P/ASX 200

Source: VanEck, FactSet; as at 31 October 2024.

Calculated by subtracting S&P/ASX 200 market cap bin weights from respective MVW market cap bin weights; positive differentials indicate greater MVW weight in the bin

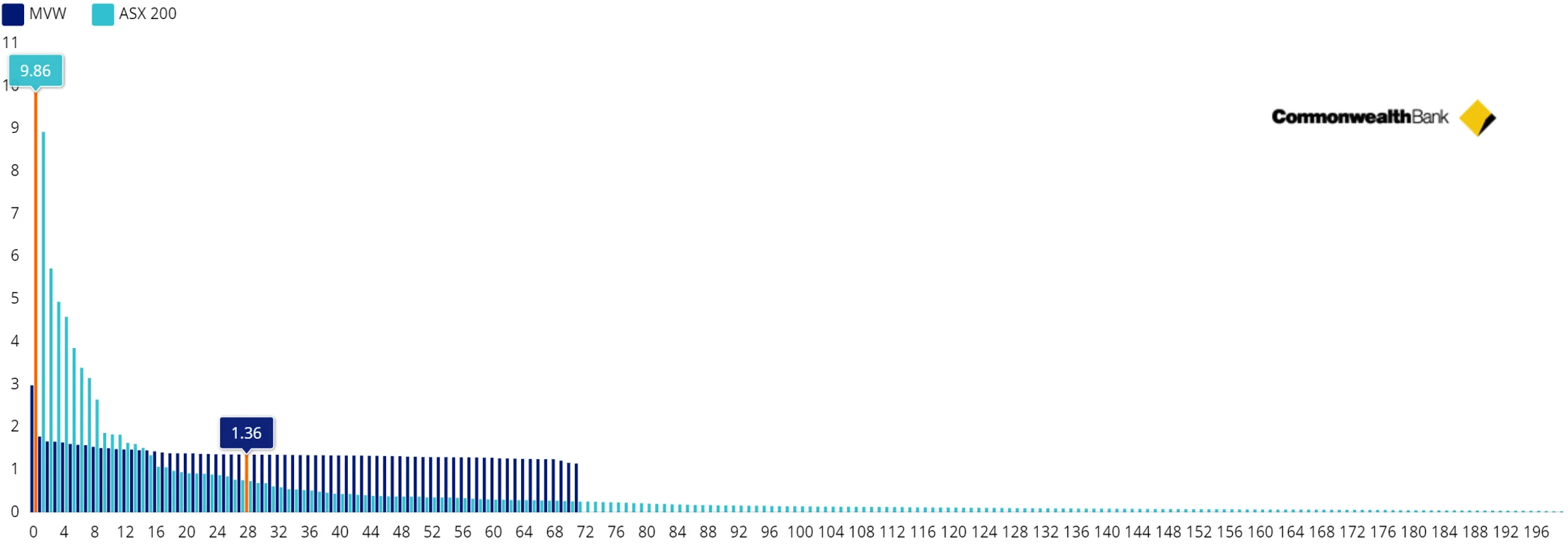

You can see below, relative to the S&P/ASX 200, MVW has a higher weighting to stocks outside the top 15. As at the end of October 2024, the big four banks represented 23.24% of the S&P/ASX 200 but only 5.41% of MVW.

Chart 6: S&P/ASX 200 and MVW company weightings (%)

Source: FactSet, 31 October 2024

Many advisers and their investors are already using MVW as their core Australian equity allocation, around which they can add high-conviction satellite ideas.

MVW’s resurgent November

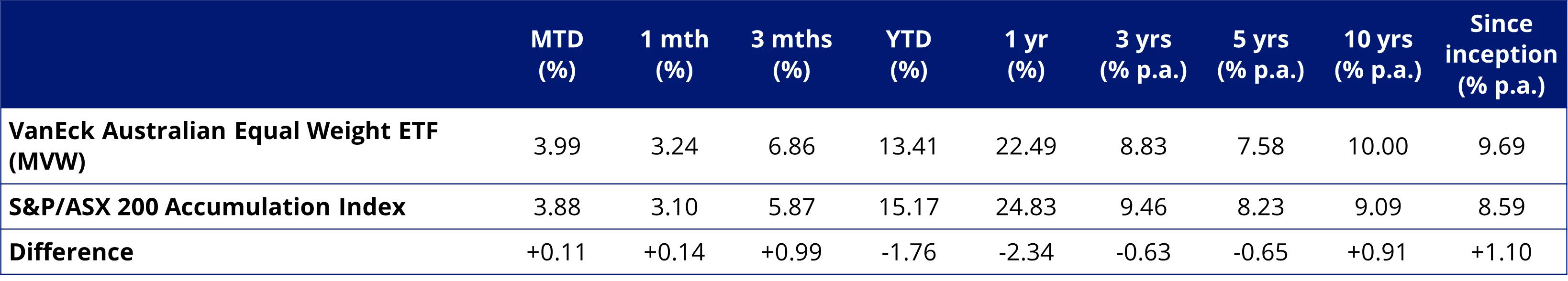

We have seen the dynamics noted above playing out in MVW’s recent performance. During the recent bout of market volatility over the past three months, MVW outperformed the S&P/ASX 200 by 0.99%, noting of course that past performance cannot be relied upon for future performance.

Table 2: Trailing performance to 28 November 2024

* MVW Inception date is 4 March 2014 a copy of the factsheet is here.

Table 2 source: Morningstar Direct, VanEck. The table above shows past performance of MVW and of the S&P/ASX 200. You cannot invest directly in an index. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. MVW results are net of management fees and other costs incurred in the fund, but before brokerage fees and bid/ask spreads incurred when investors buy/sell on the ASX. Returns for periods longer than one year are annualised. Past performance is not a reliable indicator of future performance. The S&P/ASX 200 Index is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of the broad Australian equities market. It includes the 200 largest ASX-listed companies, weighted by market capitalisation. MVW’s index measures the performance of the largest and most liquid ASX-listed companies, weighted equally at rebalance. MVW’s index has fewer companies and different industry allocations than the S&P/ASX 200. Click here for more details.

In addition to MVW, another way to take advantage of the current market dynamics is our recently launched VanEck Geared Australian Equal Weight Fund (Hedge Fund) (GMVW).

Key risks

An investment in the ETF carries risks. These include risks associated with financial markets generally, individual company management, industry sectors, fund operations and tracking an index. GMVW borrows money to increase the amount it can invest. While this can result in larger gains in a rising market, it can also magnify losses in a falling market. The greater the level of gearing in the Fund, the greater the potential loss of capital. The Fund is considered to have a higher investment risk than a comparable fund that is ungeared. See the PDS for details.

Published: 02 December 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.