ALFA: Engineered for performance

We are pleased to reveal that our newest and upcoming ETF is the VanEck Australian Long Short Complex ETF (ASX: ALFA) — the first of its kind on the ASX. This actively managed ETF harnesses the evolution in technology and data science to take tactical long and short positions with the aim of outperforming the S&P/ASX 200 over the medium to long-term (after fees and costs).

Building on our legacy of innovation

VanEck has a distinguished history of harnessing technological advancement and advanced analysis to identify and unlock opportunities for Australian investors. For over a decade we have pioneered smart beta ETF strategies in Australia, with a vast number of our smart beta ETFs being the first of their kind on the ASX, offering investors the ability to construct portfolios with a targeted outcome in mind.

Rapid advancements in technology are revolutionising investment management. Systematic approaches are mitigating variability and enhancing the quality of portfolio management decisions. Harnessing the combination of an agile investment approach and computational power is now critical in giving portfolios an investing edge. With the VanEck Australian Long Short Complex ETF (ASX: ALFA), investors can now access this transformative strategy.

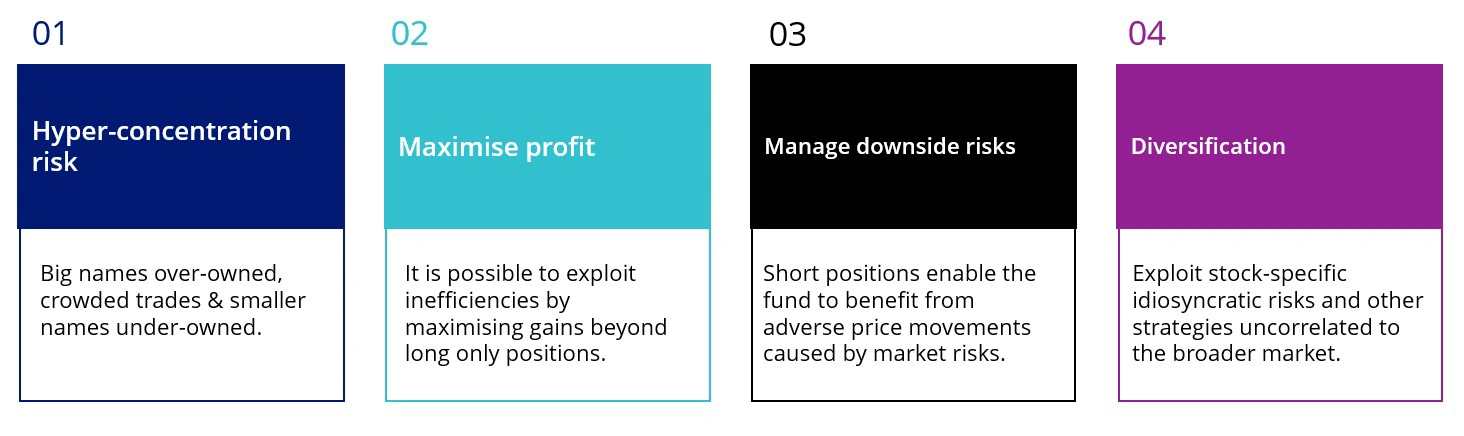

Why long short Australian equities

Source: VanEck. Short positions allow the fund to benefit from price declines but come with risks. Unlike long positions, losses on short positions are theoretically unlimited if the security's price rises, potentially increasing the fund's risk of loss. Short selling may also leverage the fund, amplifying potential losses.

Systematic strategies combine the best of both traditional alpha and beta strategies.

Source: VanEck.

ALFA key points:

- High conviction long short strategy

Unconstrained high conviction Australian equity portfolio that targets long and short positions.

- Active systematic approach

A dynamic quantitative stock selection approach utilising sophisticated computations and programmed learning designed to be agnostic of market cycles and style rotations.

- Outperformance potential

Alternate Australian equity strategy that aims to deliver excess returns over the medium to long-term.

|

ASX code: |

ALFA |

|

Investment objective: |

Outperform the S&P/ASX 200 Accumulation Index over the medium to long-term (after fees and costs) |

|

ASX commencement1: |

23 January 2025 |

|

Management fee: |

0.39% p.a.* |

|

Performance fee: |

20% of Fund’s return above the Benchmark, subject to a high watermark |

*Other costs may apply. Please refer to the PDS.1Target listing date.

ALFA brings lower cost investing to Australian investors with a management fee of approximately 1/3 of the average charged by comparable Australian equity long short strategies.

To learn more about ALFA, register for a webinar with our experts here.

Key risks: An investment in the Fund carries risk. The Fund is considered to have a higher investment risk than a comparable fund that does not engage in short selling and leverage. Investors should actively monitor their investment as frequently as daily to ensure it continues to meet their investment objectives. Risks associated with an investment in the fund include those associated with short selling risk, leverage risk, prime broker risk, counterparties risk, concentration risk, operational risk and material portfolio information risk. See the VanEck Australian Long Short Complex ETF PDS and TMD for more details.

Published: 17 January 2025

IMPORTANT NOTICE

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.