Pivot for bank divid(end)s

Banks’ operations have been severely impacted by COVID-19, rates are at record lows and a recession is probable. Given these challenges, it is important your core Australian equities exposure is well diversified beyond financials. For those clients who depend on equities to boost their income, it will be vital to gain exposure across the Australian economy, not just a few sectors.

National Australia Bank surprised the market last week when it became the first bank to slash its dividend payments by 64 per cent. The announcement coincided with a capital raising and according to the Sydney Morning Herald, “Had the bank not raised money it would not have been able to declare even its token dividend.”

This was followed by ANZ’s announcement that it would be deferring its dividend in the face of a 60% decline in profits and anticipation of bad loans. It was a similar story for Westpac, announcing it is deferring its interim dividend as profits have slumped and in light of mounting issues around money laundering and tax reporting.

Banks’ operations have been severely impacted by COVID-19, rates are at record lows and a recession is probable.

Given these challenges, it is important your core Australian equities exposure is well diversified beyond financials. For those clients who depend on equities to boost their income, it will be vital to gain exposure across the Australian economy, not just a few sectors.

The bank yield party is over – for now

Recently we had sombre reminders that payouts from banks are far from guaranteed. Over the past few years, despite low earnings growth, pressure on households, pressure on their own margins and record remediation payouts, the big four banks could be relied upon for their dividends. While those issues persist into 2020, COVID-19 has all but destroyed dividends, so its likely investors will only be able to depend on ‘token’ dividends like the dividend that NAB announced last week, if there is any dividend at all, for the foreseeable future.

Once the economy starts to recover the Australian financial sector will have to adapt their operations to a recession economy.

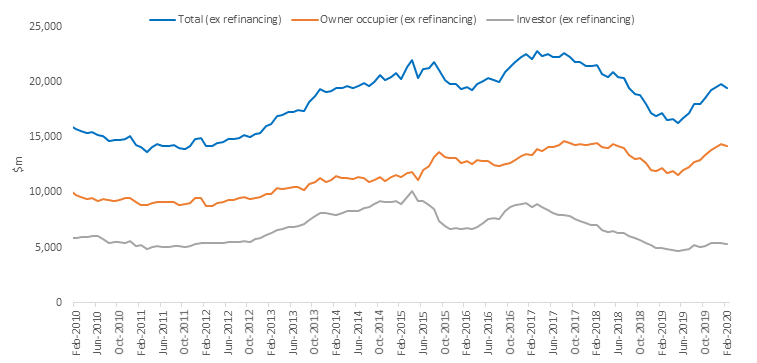

Bank shares fell immediately after NAB’s announcement last Monday morning, but the headlines mask other issues facing the banking sector over the short to medium term. Demand for mortgages has dropped sharply, in line with the demand for housing, which will impact house prices. ANZ’s results last Thursday confirm this trend with the bank setting aside $1 billion for bad loans and the results indicating a significant slowdown in mortgages. The most recent ABS data (to February 2020) shows that the value of new lending commitments for housing fell in February. March’s figures will be released on May 12 and we expect it to drop below its 2019 levels. The reduced number of residential mortgages banks write is on a sharp downward run and is likely to further curb banks’ profitability.

New loan commitments, total housing (seasonally adjusted)

Source: ABS

The worst is to come for households

There are two significant issue households face that impact banks. The first is employment. As unemployment starts to rise, households will spend less. In addition, mortgage stress and defaults are likely to rise. Rising unemployment is a feature of a recessionary economy and it has been nearly 30 years since Australian banks have operated in such an environment. As a cyclical stock, financials are among the most impacted by any slowdown in the economy.

The other issue is the decline in house prices. It has been estimated in the past that there is a six-month lag between the negative wealth effects of falling property values and the erosion of consumption. This time consumption drops are coinciding with property falls as we spend less observing COVID-19 social distancing and stay-at-home rules. As property losses are mounting, then not only will mortgage demand fall even further, but household spending will come under even greater pressure. Some households may struggle to repay their mortgages, as debt levels climb relative to the value of household assets.

As household debt continues to climb, debt servicing costs will increasingly detract from demand for credit in other areas like credit cards and personal loans, further hurting banks’ businesses. Economic growth will be under pressure as consumer spending accounts for a significant portion of economic activity and economic activity drives banks’ profits.

These headwinds are problematic for bank shares and for the many Australian investors whose portfolios have significant exposure to the big four banks. They don’t bode well for dividends in the short term. The four pillars (CBA, Westpac, ANZ and NAB) represent about 20% of the S&P/ASX 200. In other words, if you hold a blue chip portfolio or are invested in an active or passively managed Australian equity fund that tracks or benchmarks to the S&P/ASX 200, $1 out of every $5 is likely to be invested in banks and therefore vulnerable to the risks they face. Your dividends too, are likely to be impacted by this exposure as these material cuts will have a greater impact on what you receive.

Getting a balanced exposure to the Australian economy

As investors ponder these headwinds for banks, it pays to reassess allocations to bank shares. The S&P/ASX 200 is dominated by the big four banks. They collectively make up 19.29% of the index, as at 31 March 2020. This means that if you invest in a fund that tracks the S&P/ASX 200, almost one out of every five dollars will be invested in the big four.

Conversely, taking an ‘equal weight’ approach to the S&P/ASX 200 can provide true diversification across securities and market sectors, reducing concentration risk to the banks. We’ve written a lot about the importance and benefits of taking an ‘equal weight’ approach, where the same weight, or importance, is given to each stock, reducing concentration risk.

As an example, the VanEck Vectors Australian Equal Weight ETF (ASX: MVW) invests in over 80 of the largest and most liquid ASX-listed companies using an equal weight approach. MVW’s exposure to the big four banks is less than 5%. This dramatically reduces investors’ exposure to the big four, reducing concentration risk and reducing the impact of dividend declines. MVW is close to 2 ½ times more diversified than the S&P/ASX 200, as measured by the Herfindahl Index*.

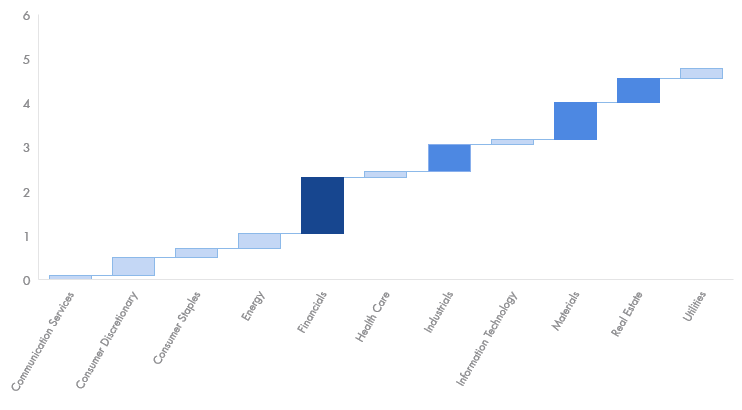

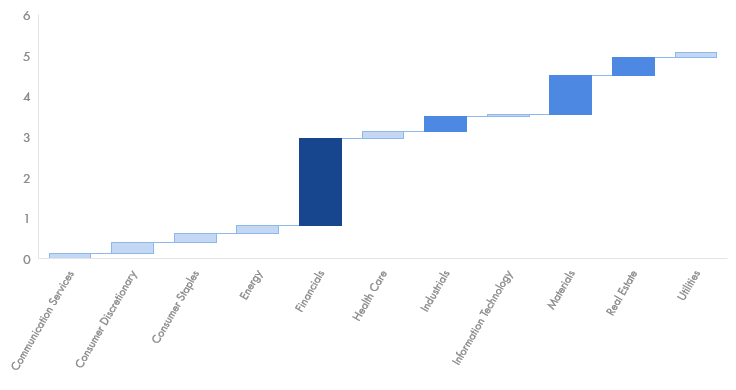

MVW’s more broad exposure to the Australian economy means that it is less dependent on the financial sector to maintain its dividend yield. You can see from the below the more diversified equal weight portfolio is far less reliant on financials that the S&P/ASX 200 portfolio which gets around 45% of its dividends from financials.

GICS Sector Contribution to dividends: MVW

GICS Sector Contribution to dividends: S&P/ASX 200

Source: VanEck, Bloomberg, Factset, as at 9 April 2020

Find out more about MVW.

*Find more information on the Herfindahl Index

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of the VanEck Vectors Australian Equal Weight ETF (‘Fund’). Nothing in this content is a solicitation to buy or an offer to sell shares of any investment in any jurisdiction including where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. This information contains general advice only about financial products and is not personal advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision in relation to the fund, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the Fund.

Published: 06 May 2020