Why should we care about COP26?

The “most important international meeting of the century” is taking place in Glasgow, with the world’s energy supply in firm focus. Signs are pointing to a further acceleration of global investment into clean energy, and clean energy technologies and innovation. Investors, take note.

World leaders from more than 100 countries have come together in Glasgow for the 26th UN Climate Change Conference of the Parties (COP26). It has been called the “most important international meeting of the century”, aiming to put the world on a path to aggressively cut greenhouse gas emissions and slow Earth's warming.

With the burning of fossil fuels for energy responsible for the bulk of emissions, attention is firmly on the global energy complex. Leaders will be presenting updates to their emissions-cutting plans first shared at the Paris Accord six years ago.

…

"Our addiction to fossil fuels is pushing humanity to the brink. We face a stark choice: Either we stop it — or it stops us" - United Nations Secretary-General, António Guterres at GOP26.

…

While COP is scheduled to happen every five years, COP26 is marked as a critical juncture as projections now show the world is just ten years away from breaching the 1.5 degree “danger line” for global warming. This makes COP26 the last opportunity to bring forward policy changes and initiatives to prevent that from happening.

COP26 has the following goals for countries:

- accelerate the phase-out of coal

- curtail deforestation

- speed up the switch to electric vehicles

- encourage investment in renewables

The transition away from fossil fuels toward clean, renewable sources of energy is being propelled ahead faster than ever.

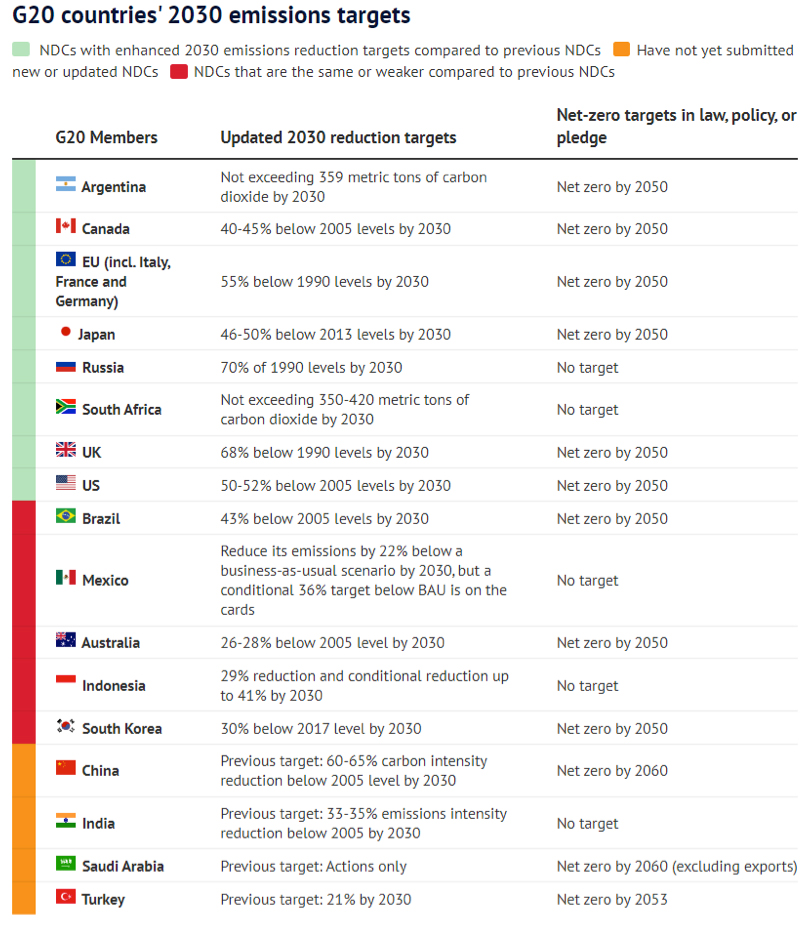

While many countries have been full-steam ahead in adopting clean energy and developing clean energy technologies, not everyone has taken a seat on the express bus. After last week’s G20 summit, the headlines spoke of a deep divide between the big economies. Broadly, Russia, India and China did not agree to net-zero emissions by 2050 and instead set a target for 2060 or 2070. (Unsurprisingly, Australia supported these delayed targets although Prime Minister Morrison did commit Australia to net zero by 2050.) While this didn’t bode well for COP26 discussions or keeping global warming within 1.5 degrees, it does still reinforce the global shift to clean, renewable energy. And that shift will see more and more invested into clean energy and clean energy technologies.

Sources: wri.org, smh.com.au, abc.net.au. NDC – National determined contributions.

Note: India has now set a target of net zero emissions by 2070. Russia announced a net zero emissions target of 2060 in the lead up to COP26, however President Putin did not attend the Conference.

The gap and the opportunity

We’ve written at length about harnessing the biggest global megatrend of our time and the energy revolution. The world invested an unprecedented $500 billion in decarbonisation in 2020. Many more billions have already been allocated by the UK, US and many other economies around the world to increase clean energy capacity, energy storage and increase efficiencies in clean energy production. However, it is important for investors to note that despite the significant funding that has already flowed into this sector, we’re only at the beginning of this global rotation away from fossil fuels. We’re also at the beginning of this long-term investment opportunity.

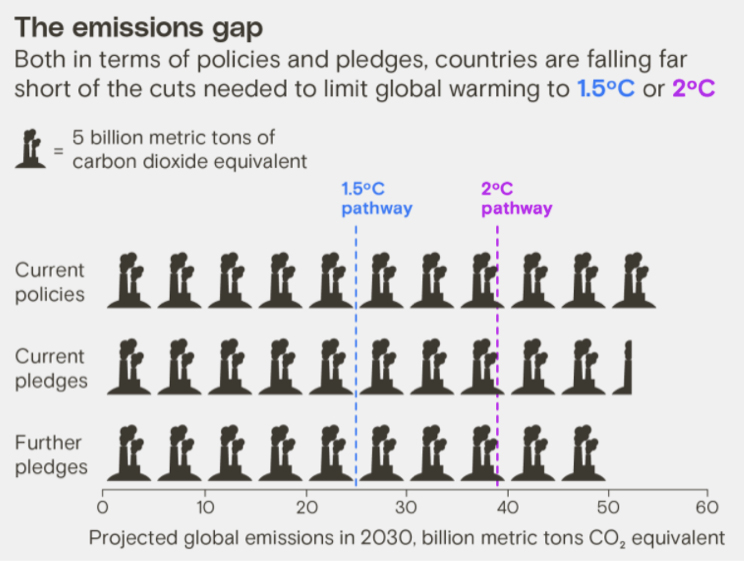

The gap between the latest commitments for emissions reductions and what is required for the world to avoid the most catastrophic version of climate change illustrates this future opportunity. A significant increase in climate funding and restrictions on carbon emissions will be required.

Source: UNEP, illustration from Clayton Aldern/Grist. Current pledges refer to unconditional nationally determined contributions. Further pledges refer to conditional nationally determined contributions. Warming targets imply a 66% chance of success.

At the time of writing, COP26 was still in progress, generating mixed headlines. There has been a multi-billion-dollar pledge to help developing countries transition to clean energy, another pledge to slash methane emissions by 30 per cent by 2030 which was signed by 90 countries. There has also been a lot of commentary around the lack of tangible commitments and action, and lack of global consensus. Regardless, there is wide-ranging commitments to the transition to clean, renewable energy, and agreement that further funding will be directed to building clean energy infrastructure and increasing clean energy production.

…

"To confront the climate crisis head-on, countries need to transition to clean energy as quickly as possible. This will not only prepare them for the future, but also make them healthier places to live right now, and help grow their economies.” - Michael R. Bloomberg, UN Special Envoy for Climate Ambition Solutions; Founder of Bloomberg Philanthropies and Bloomberg L.P. at GOP26

…

You can gain a targeted exposure to 30 of the largest global companies involved in the production of clean energy, and clean technology and equipment businesses via Australia’s first Global Clean Energy ETF (ASX code: CLNE).

Published: 05 November 2021

VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’) is the responsible entity and issuer of units in the VanEck Global Clean Energy ETF (CLNE). This is general advice only, not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Read the PDS and speak with a financial adviser to determine if the fund is appropriate for your circumstances. The PDS is available here. The Target Market Determination is available here.

An investment in CLNE carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, emerging markets, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details. No member of the VanEck group of companies guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.