There are significant opportunities in China (if you know where to look)

Here is the evidence for backing Chinese investments.

While you may not know it, the bulk of China’s economic growth - and over a quarter of the world’s economic growth - will in the future come from what is referred to as China’s ‘new economy’. That’s according to a new paper from MarketGrader which is backed up by some convincing numbers.

The sectors which make up China’s new economy are quickly growing, underpinned by government support. They are the technology, healthcare, consumer discretionary and consumer staples sectors. The earnings and profits of companies doing business in these sectors are quickly expanding, driven higher by China’s economic transformation and increasingly wealthy and numerous consumers.

The Government’s ‘Made in China’ program has also propelled these new economy sectors ahead of ‘old’ economy sectors, which include agriculture and heavy manufacturing.

Made in China revolution

The Made in China 2025 (MIC 2025) initiative is a ten-year plan announced by China’s Government in 2015. The goal of the plan is to provide a comprehensive national policy for the upgrading of Chinese industry into a global leadership role in advanced manufacturing. This plan has nurtured the development of China’s technology sector.

That’s because MIC 2025’s primary focus is on ‘smart manufacturing’ and connecting all elements of the country’s new industrial base to the internet. As such, much of the underlying architecture of this new manufacturing drive will be built on advanced technologies such as artificial intelligence, fifth-generation internet networks (5G), cloud computing and robotics, according to the paper.

An important aspect of MIC 2025 is the plan’s focus on what it calls “indigenous innovation,” which aims to promote Chinese technology, intellectual property and brands. Likewise, MIC 2025 extends to the healthcare sector and supporting the development of locally produced medical devices and capabilities in health innovations, including the development of biomedicines in China.

The MIC 2025 plan is therefore very much about promoting the development and growth of new economy sectors.

As the MarketGrader paper puts it: “the government’s stated desire to become a leading global force in advanced manufacturing and technology, combined with a rising middle-class and a consumer-driven economy will unquestionably result in greater opportunities for ‘new economy’ sectors over ‘old economy’ ones.” These include manufacturing, construction and agriculture, which are diminishing in relative importance.

Likewise, domestic technology and high value-added manufacturing companies, companies producing pharmaceuticals, biomedicines and medical devices, all rank highly in the Government’s list of companies and industries that it wants to lead the country’s development in the next decade.

Investment opportunities grow

The good news is that now is a good time to invest with Chinese equities now trading at their highest discounts in years compared to developed market equities, according to MarketGrader.

Following a sell down in Chinese equities this year, high quality, publicly traded Chinese companies are trading not only at historically low multiples of earnings and book value but at their highest discount in years in comparison to companies within developed market equities, the paper says.

“As any good investor may tell you, no other factor has a bigger incidence on long-term capital appreciation of an investment than the price paid for it. By this metric, now is as good a time as there has ever been to own a piece of the Chinese new economy.”

Many new economy companies are listed on mainland China's two main stock exchanges, the Shanghai and Shenzhen exchanges. The number of listed companies in the technology, healthcare, consumer staples and consumer discretionary sectors totals almost 1,400. That’s a huge investment opportunity in an important stock market. Combined, those exchanges form the second largest share market in the world after the US.

Standalone asset allocation needed

Given China’s relatively quick growth and its huge size, an allocation to Chinese equities should sit separately from an investor’s emerging markets allocation.

“Not only is China’s economy too big to be grouped with all other emerging markets in a single category, but also the country’s massive foreign exchange reserves, deep savings base and position as net creditor to the world allow it to march to the tune of its own drum,” the MarketGrader paper says.

“Thus, an allocation to Chinese equities, in our view, should stand separate from an investor’s emerging markets allocation”.

Investment opportunities open

The difficulty for Australian investors wanting to invest in this growth opportunity is gaining access. Many of the Chinese companies in the new economy aren’t available via other countries’ exchanges and only trade on the mainland Shanghai and Shenzhen stock exchanges.

As a holder of a Renminbi Qualified Foreign Institutional Investor (RQFII) quota, VanEck can trade these shares and for the first time we are offering Australian investors a way to step into tomorrow’s prosperity today via an ETF on ASX.

The VanEck Vectors China New Economy ETF recently listed on the ASX (ASX: CNEW). CNEW is an Australian first and enables Australian investors to access a diversified portfolio of China A-shares with the best growth prospects via a single trade on the ASX.

The ETF tracks the CSI MarketGrader China New Economy Index, which is a smart beta strategy that targets the most fundamentally sound Chinese companies from the technology, healthcare, consumer discretionary and consumer staples sectors.1The Index selects only China A-shares based on 24 fundamental indicators across four analytical categories: growth; value; profitability; and cash flow.

“The CSI MarketGrader China New Economy Index was developed over four years ago as a tool to help investors harness the powerful trends described in this paper as China’s ‘new economy’ without abandoning important, time-tested principles of traditional equity investing,” says MarketGrader.

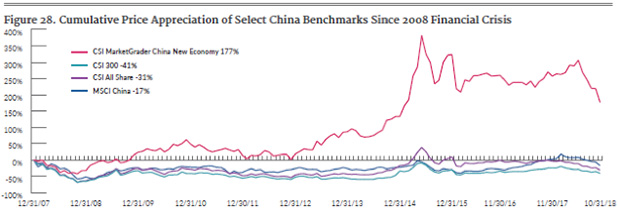

“While not devoid of the volatility inherent in China’s equity market, the results so far have proven promising”.

Source: Bloomberg. Chart uses price-only returns through Oct. 31, 2018. New Economy Index in AUD, all other benchmarks in local currency.

The chart show past performance of CSI MarketGrader China New Economy Index from its Base Date. Index performance shown prior to 20 March 2015 (its launch date) is simulated based on the current Index methodology. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. Past performance is not a reliable indicator of future performance.

MarketGrader has created the best of both active and passive investing.

“More specifically, we believe marrying some of the best attributes of both approaches may yield the most optimal results when thinking about ‘buying into’ the China new economy story.”

Investors can now easily access the potential for strong investment returns that these new economy companies offer which is being brought about by the Chinese economic revolution.

You can read the MarketGrader paper - here.

IMPORTANT NOTICE – FOR USE BY FINANCIAL SERVICES PROFESSIONALS ONLY

This information is prepared in good faith by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as the responsible entity and issuer of VanEck Vectors China New Economy ETF (the Fund). This information is general in nature and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision investors should read the product disclosure statement and with the assistance of a financial adviser consider if it is appropriate for their circumstances. A copy of the PDS is available at www.vaneck.com.au or by calling 1300 68 38 37.

An investment in the Fund is subject to various risks that may have the effect of reducing the value of the Fund, resulting in a loss of capital invested and a lack of income from the Fund. Chinese securities have heightened risks compared to investing in the Australian market. These risks include currency risks from foreign exchange fluctuations, ASX trading time differences, foreign laws and regulations including taxation, potential difficulties in enforcing contractual obligations, changes in government policy, expropriation, economic conditions including international trade barriers, restrictions on foreign ownership, securities trading restrictions, restrictions on repatriation and restrictions on currency conversion. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from the Fund.

1Sector classification is based on CSI’s 1stlevel sector classification

Published: 22 November 2018