The blueprint for the next five years

Possibly the one event that will have more impact on markets over the next five years occurred in the past few weeks. It wasn’t the US election, nor was it RBA’s historic rate cut and its version of quantitative easing. China unveiled its “14th Five-Year” Plan. Investors should be aware of what China, the soon to be biggest economy in the world, has in store.

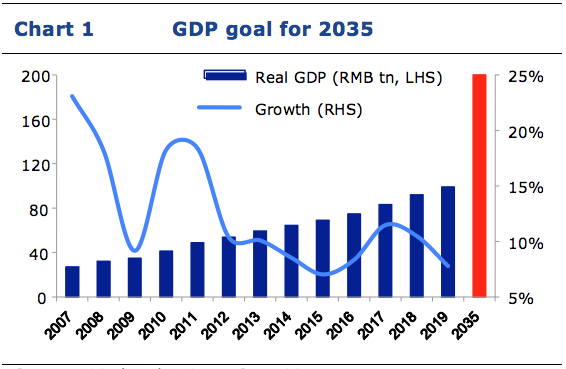

China’s leaders met at the end of October to formulate its five-year plan, the 14th since the 1950s. This “14th Five-Year” period marks the start of China’s march towards long-range objectives set for 2035 which will either, double GDP or per capita income over the next 15 years. China will do this by transforming into a modern socialist country from the perspectives of economic strength, technological strength and national comprehensive strength.

Source: Wind and Haitong Securities

The highlights of the 14th Five Year Plan are presented below in 12 fields including technology independence and self-reliance, expansion of domestic demand, new urbanization, green development and security outlook. The impact of the plan is also discussed in more detail below.

|

Table 1 Key points of the Proposals |

||||||||||||||||||||||||||

|

Source: www.gov.cn and Haitong Securities

Building an innovation and technology driven nation

The Plan stresses science and technological innovation in the modernisation and development of the country.

Since 2018 China has fought a trade war that has hindered the development and growth of China’s science and technology industry. Restrictions by the US administration on the export of semiconductors and other components on which China is reliant for its technology exposed the weakness in China’s core technology development, in particular in integrated circuits and other high-end technology equipment manufacturing. Technology independence and self-reliance is a focus, already China is making huge investment in research and development to improve its manufacture and quality of high-end components.

Remedying this is a focus that can drive economic growth, as China continues to evolve from a manufacturing based economy to a services and innovation based economy.

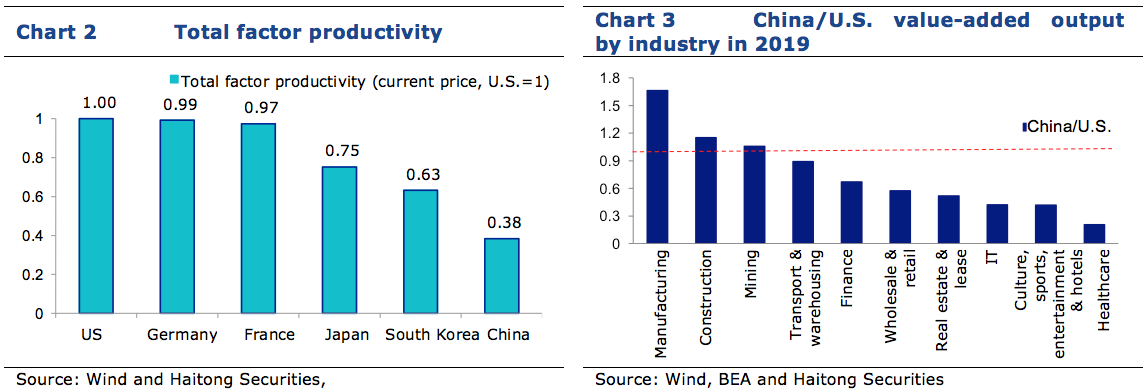

According to Harvard Business School1, Total Factor Productivity (TFP) is the portion of output not explained by the amount of inputs used in production. It is an important measure of growth, fluctuations and development as well as likely future directions of research.

China’s TFP has been increasing as technology progresses and as it becomes self-reliant but the Total Factor Productivity of China still has huge upside.

According the University of Groningen in the Netherlands, the benchmark of Total Factor Productivity is the US = 1. China is only 0.38, while Japan and Germany have reached 0.75 and 0.99.

For investors, China’s economic growth will be driven more by innovation, science and technology. There is greater room for economic development in China as it becomes as efficient as other developed economies, including ones driven by these technological drivers such as the US, German and Japanese economies.

Expanding domestic demand and building a strong domestic market

The Plan focuses on forming a strong domestic market and expanding domestic demand.

In order to facilitate this the Plan proposes to optimise the supply structure by:

- improving the quality of supply;

- advancing and developing efficiencies between the financial and real estate sectors and the real economy;

- promoting coordination among the agriculture, manufacturing, service and energy and resources sectors; and

- encouraging global resources as inputs into the production process to promote and stimulate internal and external cycles.

Currently, domestic demand in China is insufficient. In 2019, China contributed around 16.3% of the global GDP despite its population. In 2019, China’s GDP per capita exceeded US$10,000 for the first time. Based on what has happened in other developing nations, as the Chinese population pursues a higher economic standard of living, upgraded consumption will become a major driving force of domestic demand. Against the backdrop of consumption upgrading, home grown brands will have to improve their design, technique and functionality to meet international standards and better match the medium and high-end demand in China.

China is attaching great importance to the active role of these emerging consumption patterns in domestic demand. For example, livestreaming e-commerce is booming. According to Nielsen’s estimates, China’s livestreaming e-commerce market will be worth RMB961 billion (A$200 billion) in 2020, accounting for 10% of China’s entire e-commerce market; and the number of e-commerce livestreaming users will reach 265 million, occupying 47.3% of all livestreaming users. These types of industry developments will propel the consumer segments.

Promote green development and low carbon economy

The 14th Five-Year Plan includes goals in green development and low carbon. These include:

- protection of land and space;

- ambitions in the ‘green’ transformation of production and lifestyle;

- increased utilisation and energy efficiency;

- decrease in the total discharge of major pollutants; and

- improvement in the ecosystem.

The urban and rural living environment will be significantly improved, and an action plan for China's carbon emissions to top out by 2030 has been formulated. As a result the country is going to continue promoting new-energy industries such as solar (photovoltaics) and electronic vehicles.

Automobiles are an important direction for China to achieve green development. The Plan for the Development of the New Energy Vehicle Industry (2021-2035) released on 2 November 2020 includes a requirement to reduce the average power consumption of new electric passenger vehicles and to raise the ratio of new electronic vehicles sold to around 20% of total new vehicles sold by 2025.

Build a new type of urbanization that suits people’s needs

At the end of 2019, 60.6% of the population in China lived in urbanised areas. This has grown significantly, but there is still a big gap between the urbanisation level of more than 80% in developed countries such as the United States and Japan.

During the 14th Five-Year Plan period, China is planning to enter a stage of high-quality development. It is focused on people-centric development and by learning from experiences overseas as well as domestically to create a positive urbanisation experiences and living areas.

There are policies aimed at improving the financial transfer payments, urban construction and the urbanisation process for rural residents relocating to urban areas.

Further deepening social reforms such as equitable access to basic public services such as healthcare and education will support sectors like healthcare.

China to lead in 2021

China’s economy is forecast to be the only one that grows in 2020 among large and developed nations. For 2021, the IMF predicts China’s economy will grow by 9.2 percent, leading all major economies. China’s response to COVID-19 has been among the most successful and with production and work returning to normal in the mainland, the market may continue to trend higher while investor sentiment is robust.

China A-share companies, that is, those listed on mainland China stock exchanges, in the consumer, healthcare, and technology-related sectors, which source the bulk of their profits and revenues from the domestic market, look well placed to benefit from the economic expansion and the 14th Five Year Plan.

There are limited ways through which Australian investors can acquire China A-shares. VanEck has two ETFs that provide investors with a way to participate in what may be the next growth phase for A-share investments.

- VanEck Vectors FTSE China A50 ETF (CETF): Australia's only dedicated China A-shares market benchmark exposure. It is the most cost effective exposure to China A-shares in the Asian region.

- VanEck Vectors China New Economy ETF (CNEW): Gives investors easy access to China A-shares and the enormous potential growth opportunities in what are described as China’s ‘New Economy’ sectors.

- Technology;

- Healthcare;

- Consumer discretionary; and

- Consumer staples.

CNEW Invests in 120 fundamentally sound and attractively valued companies assessed on 24 fundamental indicators across four analytical categories:

- Growth;

- Value;

- Profit; and

- Cash flow.

For more information please visit our website at www.vaneck.com.au and speak to your financial adviser.

Published: 13 November 2020

Issued by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’). Nothing in this content is a solicitation to buy or an offer to sell shares of any investment in any jurisdiction including where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. It does not take into account any person’s individual objectives, financial situation or needs. Read the PDS and speak with a financial adviser to determine if either fund is appropriate for your circumstances.. The PDSs are available here. An investment in CETF or CNEW carries risks associated with: China; financial markets generally, individual company management, industry sectors, ASX trading time differences, foreign currency, sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.

© 2020 Van Eck Associates Corporation

1https://www.hbs.edu/faculty/Pages/item.aspx?num=30762