Most managers don't understand 'income'

Recent tax changes can have a significant impact on the level of income you receive from your managed funds. The first change to the tax laws is known as ‘AMIT’, generally pronounced ”ay-mit”, which stands for the Attribution Managed Investment Trust rules. The other, slightly older, change is known as ‘ToFA’, generally pronounced similar to ”tofu”. This stands for the Taxation of Financial Arrangements

You could be missing out if your fund manager hasn’t modernised for these changes. To find out there are only two simple questions you have to ask.

One reason people invest in fixed income, property and infrastructure is that they are looking for relatively stable income that can surpass inflation.

But when you access fixed income, property or infrastructure securities through a managed fund, the cash flow you receive can be disappointingly unstable and low.

Client focussed fund managers are adopting new tax treatments to smooth out fund distribution cash flows to maximise the reliability of income for their investors.

So if it’s income you’re after, it’s very important to carefully consider not only the fund, but also the fund manager, to ensure that it’s income you’ll be receiving rather than disappointment.

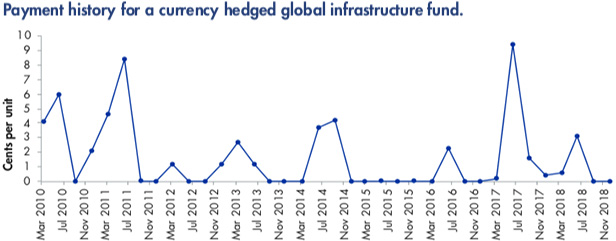

Below is a chart of the quarterly payment history of another fund manager’s Australian dollar hedged global infrastructure securities fund. This fund is managed by one of the world’s most respected fund managers. It may even be in your portfolio.

Source: Fund Manager’s website, March 2019

Pity the investors who bought into this fund for stable income at inception. Since March 2010, out of 36 quarters, investors received no payment 17 times. Almost half. Through late 2014 to early 2016, investors received no income at all for six quarters in a row. That’s a year and a half with no income from their ‘income fund’. That is more than just disappointing for these investors in infrastructure, who were probably expecting a cheque in those 17 quarters. Instead, they got nothing.

When investors think of income, they imagine receiving a regular deposit into their bank account of a consistent amount that grows slowly with inflation. It’s hard for many of them to manage day-to-day living expenses when nothing turns up.

Don’t let them confuse you

A lot of the discussion about income gets confused. The word ‘income’ means different things to different people.

Fund managers spend too much time talking about what happens inside a fund. Investors, however, don’t care which items in a fund’s financial statements are income and which are capital. The investor only cares about the cash they actually receive in their bank account.

For an investor with bills to pay and groceries to buy, ‘income from my portfolio’ always means what they receive. It’s about the cash flow. Many of the biggest fund managers in Australia are yet to wake up to this fact and see things from an investor’s point of view.

The distinction between something that is taxed as income and something that is taxed as a capital gain isn’t relevant to investors. Tax consequences are important for fund managers but they take a back seat to investors’ concerns about cash flow.

Sometimes they blame the law

In the complicated world we live in, laws made for good reasons often have secondary outcomes that are bad. The volatile payments shown in the chart above follow from a rule introduced to make the tax system more equitable.

No-one wants to read a long explanation of the tax law. So suffice to say it is timing rules in the taxation of trusts which have forced funds into payment flows that have jumped all over the place.

It has been even worse for international funds that hedge their currency exposure. The tax law, until recently, didn’t recognise hedging. The hedging instrument would be taxed at a completely different time to when the asset would be taxed, creating a mismatch that distorted the cash flow even further.

But all that is now in the past. Or at least it should be.

Parliament has modernised the tax rules, including introducing currency hedging rules. The bizarre disconnect between the investors’ cash flow and the tax timing rules has been removed. The Federal Government specifically did this so that funds can operate the way their investors want them to. The problem is no longer the laws. It is that most fund managers don’t have the skills to take advantage of the changes.

Not all fund managers have modernised

Despite the Government doing its part, most investors are yet to see any benefit. The new tax laws empower funds to pay a cash flow that meets their investors’ needs but so many funds have just continued the poor practices of the past.

In particular, fund managers have found the hedging fixes in the tax law to be too difficult. Most managers who should be using them are avoiding them, even though those managers are being paid to provide expertise.

No-one’s breaking the law but fund managers are failing to use the new laws in the way their investors need them to.

The good news is that some fund managers, like VanEck, have been more diligent. We have put in a lot of effort to adapt our systems to approach things in the new way with the intention of giving our investors smoother income.

So be choosy – be sure to pick the right fund manager

If you want stable income you can’t just trust that you have chosen the right asset class. You also have to make sure that you choose the right fund manager as well as the fund that delivers the cash flow you need.

So it is important to ask the right questions.

The key change to the tax laws is known as ‘AMIT’, generally pronounced ‘ay-mit’, which stands for the Attribution Managed Investment Trust rules. This is the change that removes the restrictions on cash flow.

So, the first question to ask a fund manager is whether they are using AMIT to smooth the flow of payments you will receive.

The other slightly older change is known as ‘ToFA’, generally pronounced similar to ‘tofu’. This stands for the Taxation of Financial Arrangements rules, of which the hedging rules are a small subset.

AMIT can be used to smooth income payments without ToFA but ToFA is still powerful. ToFA smooths the tax liabilities for investors in a hedged fund. Without it, hedging can lead to tax shocks.

While you have the fund manager’s attention, ask whether they are using ToFA to smooth the tax liabilities caused by hedging.

If you ask VanEck these questions, the answers for our ETFs will be an emphatic YES and YES.

Published: 28 March 2019