Looking into the crystal ball

Several factors are combining to create the perfect storm for many fund managers – not just in Australia, but around the world. VanEck predicts a shakeup of the Australian funds management industry with three inevitable outcomes.

The Australian funds management industry is set for a shake up. Several factors are combining to force fund managers to evolve. Looking into the future, VanEck predicts three inevitable outcomes.

1 – Listed products will proliferate

ASX and Chi-X are fast becoming supermarkets for all investors’ needs. A one-stop-shop for all types of investments and investors. As a platform, they offer an easy and efficient way to trade, with live pricing throughout the trading day and no paper work to complete. Their growth as a trading platform for diversified funds is demonstrated by the rapid rise of exchange trade products (ETPs).

In March 2014, according to ASX data, there were just 96 ETPs representing $10.7 billion dollars under management. Five years later the ASX reported 241 ETPs representing $47.1 billion dollars. Of these funds 191 are exchange traded funds (ETFs) including 50 smart beta ETFs. A more recent innovation has been active ETPs and there are currently around 30 of these.

We predict that as more and more funds flow into the sector, the number and variety of ETFs and active ETPs in the market will grow significantly. We expect more active fund managers to utilise ASX and Chi-X as a distribution channel. We also expect existing and new ETF issuers to launch more products. In the coming years there will be a proliferation of listed products.

2 – Smart beta will disrupt active management

Smart beta is the intersection between active and passive management seeking to achieve targeted investment outcomes at low cost. Examples of smart beta strategies include: equal weighting; fundamental weighting; and factor-based strategies such as growth, value, momentum, volatility and quality.

In a paper published in the CFA journal by Ronald Kahn and Michael Lemmon, The Asset Manager’s Dilemma: How Smart Beta is Disrupting the Investment Management Industry, the authors state: “We believe that smart beta is a disruptive innovation with the potential to significantly affect the market for investment products, particularly traditional active products.”

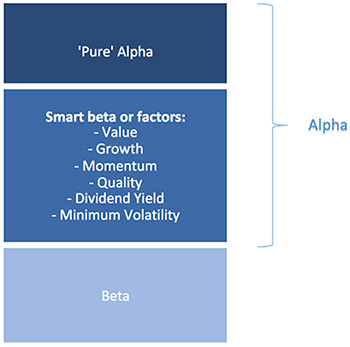

In their paper Kahn and Lemmon compared, what they called, ‘pure alpha’ being generated by global active managers to the fees they were charging. ‘Alpha’ is financial industry jargon for outperformance above the market benchmark. The ‘pure alpha’ the authors refer is the alpha that cannot be explained by smart beta factors.

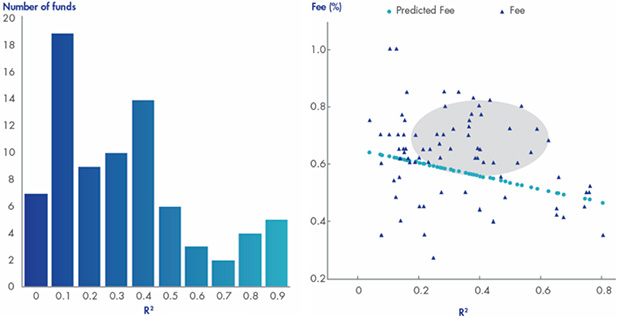

Kahn and Lemmon examined 79 global managers whose funds were benchmarked to either the MSCI World Index or the MSCI ACWI Index. What they found is presented below. The bar chart shows the proportion of the outperformance above the benchmark that can be explained by the smart beta factors. The closer to zero, the more ‘pure alpha’ that is generated.

Source: The Asset Manager’s Dilemma: How Smart Beta is Disrupting the Investment Management Industry. Financial Analysts Journal

We can draw the following conclusions from the above bar chart:

- There is a large variance between managers in performance;

- For the average manager, 33% of active return that is over and above the MSCI World Index can be explained by smart beta factors; and

- For 30% of the managers, more than 40% of the return can be explained by smart beta factors.

The scatter diagram above on the right, combines the data in the bar graph with the actual fees being charged (the dark blue dots) and predicted fees (the light blue dots). The predicted fees represent what the authors of the paper think investors should be charged based on the amount of ‘pure alpha’ being produced.

The blue dots are downward sloping, showing lower fees should be paid for smaller amounts of alpha. The highlighted area, according to the authors, shows roughly those funds that are most likely to be disrupted by smart beta. There are 29 out of 79 in the sample. That is over 30% of global equity managers, according to Kahn and Lemmon that will be disrupted by smart beta.

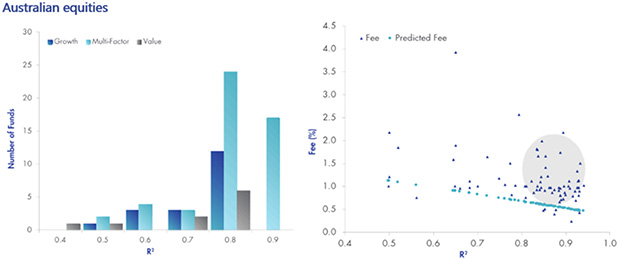

When VanEck conducted a similar analysis on active Australian equity managers, as the Australian Financial review reported on May 17 2019 in an article titled Fundies face an existential threat, “the results were far more damning”. The results of VanEck’s analysis are presented below:

Source: VanEck, March 2019

By coincidence, there were also 79 managers in the Australian sample. These were the funds benchmarked to the S&P/ASX 200. This time the grey highlighted area in the scatter diagram on the right covers 51 out of the 79 managers, or 65%. These are the managers that are likely be disrupted by smart beta.

Active managers need to evolve. Kahn and Lemmon recommend that in order for active managers to evolve, they must assess their smart beta performance and the pure alpha they offer and charge fees accordingly. Alternatively they can innovate and offer their own factor products. This leads us to prediction number three.

3 – Fund Managers to become factor factories

Asset owners and fund managers will expand their offerings to include the factors which make up their current processes. As a fund manager’s outperformance can be broken down as follows:

It is possible to ‘port-out’ that part of performance which can be explained by factors to create investible product solutions to compete with existing providers that do the same. These innovative solutions will be the fund manager’s version of factors, providing differentiation based on their skill and experience. It may even include mechanisms that adapt to the economic cycle or idiosyncrasies between sectors and locations.

We have already seen some asset owners and fund managers taking this approach. Existing smart beta providers will be forced to respond. Innovation will drive investment offerings and the factor factory will continue to grow

We think these predictions will help create an investor’s paradise so they can tailor portfolios and fee and risk budgets. Overall this will lead to investors having greater choice, greater transparency and lower costs.

Sources:

Kahn, Ronald N., and Michael Lemmon, 2016. “The Asset Manager’s Dilemma: How Smart Beta Is Disrupting the Investment Management Industry.” Financial Analysts Journal Vol. 72, no. 1

Shapiro Jonathan, “Fundies face an existential threat.” Australian Financial Review 17 May 2019

VanEck, “When are fees to high? The potential impact of smart beta to disrupt active Australian equity strategies.” May 2019

Published: 07 June 2019