Why you're missing out if you only invest in Australian property

Most Australian investors’ portfolios include Australian property, Australian equities and international equities. But international property is underrepresented. Investors may be missing out.

Now is the time to consider if you have the proper(ty) allocation.

Australia was one of the pioneers of listed real estate investment trusts (REITs). World leading names including Westfield, General Property Trust and Mutliplex, drove the Australian market in which property once accounted for 25% of the local market index.

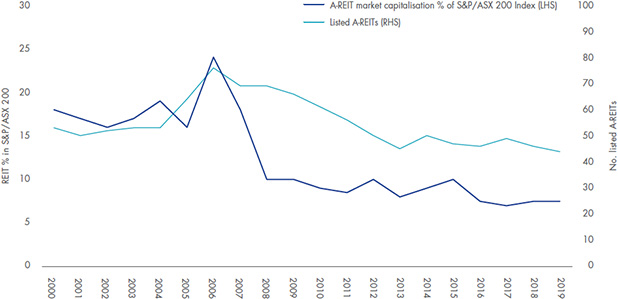

Since the beginning of the century, the proportion of the S&P/ASX 200 represented by Australian REITs (A-REITs) has fallen to just 8%, down from a peak of 25% in 2006 as illustrated in Chart 1. One of the major reasons for this has been corporate actions and mergers and acquisitions. In 2006 there were a record 71 listed A-REITs, today there are 44. Some A-REITs have been sold to offshore investors, a number have merged while others have been restructured. For example, Westfield and its various entities have experienced several corporate actions consolidating, spinning off and finally being taken over by Unibail Rodamco for $32 billion (the Australian shopping centres branded as Westfield and held by Scentre were not acquired by Unibail). You can see the impact of these changes to the A-REIT market in the chart below.

Chart 1. A-REIT’s diminishing importance on ASX

Source: Factset, ASX, VanEck 2000 to 2019.

For those investors still holding A-REITs, the Australian market is dominated by a few big trusts, where the top 10 A-REITs accounted for over 90% of the S&P/ASX 200 A-REIT Index as at June 2019. That contrasts with listed property assets offshore which are better diversified and include some sectors that are not readily available in Australia such as healthcare property trusts, hotel and resorts, specialised REITs such as data centres and residential property trusts. Investing offshore can broaden investors’ property opportunities and increase their diversification significantly.

A new research paper, The proper(ty) allocation, from VanEck reveals that a portfolio including international REITs not only brings greater diversity, but delivered superior risk-adjusted returns compared to a portfolio without international property over five years.

Superior risk-adjusted returns

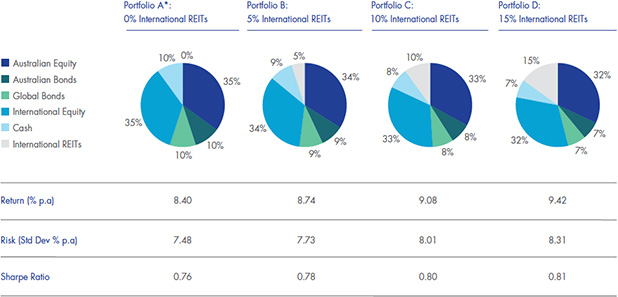

Below we have constructed a hypotheical balanced fund with and without an allocation to international listed REITs. This is based on ASIC’s MoneySmart balanced investment option which “invests around 70% in shares or property and the rest in fixed interest and cash.”

Our analysis reveals that a portfolio including international REITs produces a historically higher annualised portfolio return than a portfolio without international REITs, and without incurring significant incremental risk as measured by standard deviation. The table below also shows that the portfolios with a greater international REIT allocation had a higher Sharpe ratio, or superior risk-adjusted returns.

Chart 2. Including International REITs in a balanced portfolio over 5 years

* Portfolio A based on MoneySmart balanced portfolio.

Source: Morningstar Direct, five year performance 1 September 2014 – 31 August 2019. Results are calculated monthly and assume immediate reinvestment of all dividends. The hypothetical performance does not include management costs and expenses and excludes brokerage and bid/offer spreads incurred when investors buy/sell. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

Indices used to approximate investments Cash – RBA target cash rate, International Bonds – Barclays Global Aggregate Bond Index A$ Hedged; Australian Bonds – Bloomberg AusBond Composite 0+ years; International Equities – MSCI World ex Australia Index; Australian Equities – S&P/ASX 200; International Property - FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged.

Access the proper(ty) allocation

Traditionally the domain of large institutions, investors of all sizes can now access international REITs via managed funds or ASX-listed exchange traded funds (ETFs).

VanEck Vectors FTSE International Property (Hedged) ETF (ASX: REIT) is listed on ASX. REIT aims to track the FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged Index by fully replicating it. In a single trade, REIT gives investors a portfolio of international REITs providing international diversification and defence. To add appeal for investors, recent changes to Australian tax laws and VanEck’s tax expertise allows REIT to pay a smoother flow of dividends each quarter than would have been possible in the past.

You can read the research paper here - The proper(ty) allocation

IMPORTANT NOTICE

This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of the VanEck Vectors FTSE International Property (Hedged) ETF (‘Fund’). This information contains general advice only about financial products and is not personal advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision in relation to the fund, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the Fund.

The Fund is not in any way sponsored, endorsed, sold or promoted by FTSE International Limited or the London Stock Exchange Group companies (‘LSEG’) (together the ‘Licensor Parties’) and none of the Licensor Parties make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to (i) the results to be obtained from the use of the FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged (‘Index’) upon which the Fund is based, (ii) the figure at which the Index is said to stand at any particular time on any particular day or otherwise, or (iii) the suitability of the Index for the purpose to which it is being put in connection with the Fund. None of the Licensor Parties have provided or will provide any financial or investment advice or recommendation in relation to the Reference Index to VanEck or to its clients. The Reference Index is calculated by FTSE or its agent. None of the Licensor Parties shall be (a) liable (whether in negligence or otherwise) to any person for any error in the Reference Index or (b) under any obligation to advise any person of any error therein. All rights in the Reference Index vest in FTSE. “FTSE®” is a trademark of LSEG and is used by FTSE and VanEck under license.

Published: 20 September 2019