Being smart-er with beta

A flood of money has rushed into smart beta ETFs in recent years, which now hold a total of US$800 billion in assets globally as of year-end 2018, according to Morningstar data. This represents a growth rate of roughly 30% per year since 2012. The challenge for investors is to do it smarter.

Many investors diversify across asset classes in designing their portfolios to attain a future need. In the 1986 article “Determinants of Portfolio Performance”, Brinson et al, demonstrated that the asset allocation decision was responsible for 93.6% of a diversified portfolio's return pattern over time. Subsequent studies have confirmed this (Donaldson et al, 2013). The asset allocation decision is responsible for around 90% of portfolio movements, while the remaining 10% comes from security selection and market-timing.

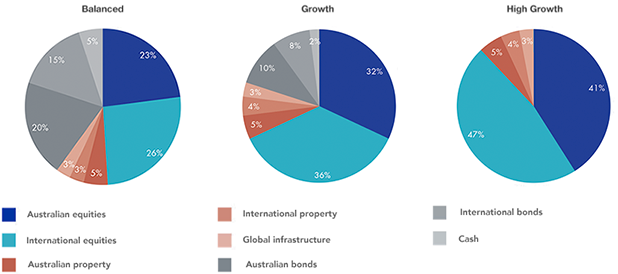

An informed understanding of risk and return of the various asset classes is important to the portfolio construction process. The Australian Government (moneysmart.gov.au) has provided investors with a practical guide to investing called “Investing between the flags” which highlights typical investment portfolios including ‘balanced’ and ‘growth’ mixes based on desired return outcomes, having regard to investors’ different timeframes and levels of risk. Portfolios targeting high growth have 100% allocated to growth assets. ASIC defines defensive assets as cash or government bonds, so for the purposes of the below defensive assets are: Australian bonds, international bonds and cash. This means the growth assets below are: Australian equities, international equities, Australian property, international property and global infrastructure.

Below is an example of typical asset allocation in balanced, growth and high growth portfolios.

Warning: This is general advice only about financial products and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making any asset allocation or investment decision, you should seek personal financial advice from a licensed financial adviser to determine your risk profile and financial products that are appropriate for your personal circumstances.

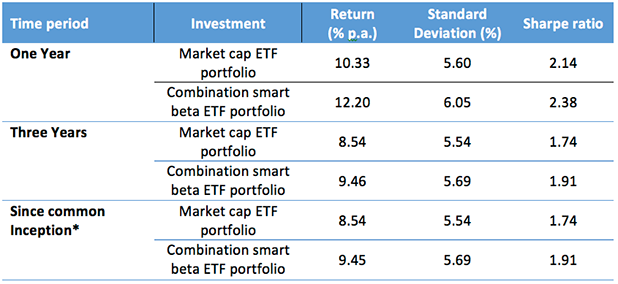

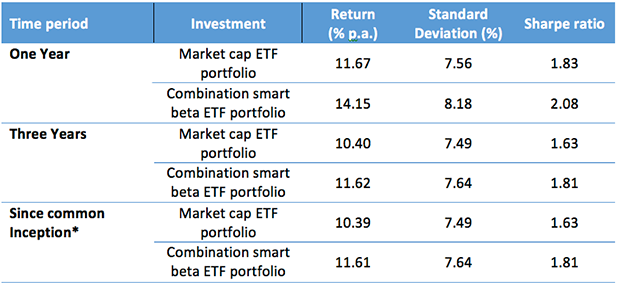

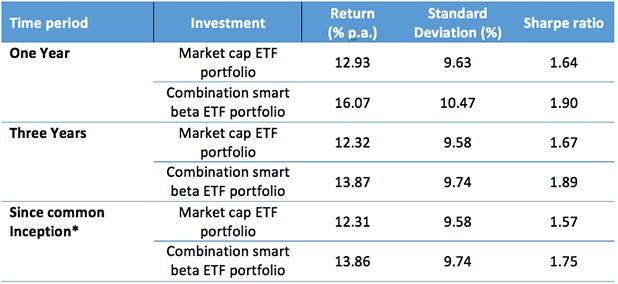

Tables 1, 2 and 3 show the returns of hypothetical portfolios based on the asset allocations outlined above. We use ETFs that track traditional market cap weighted benchmark indices to represent the returns of each asset class within the portfolio. Then we replace the Australian equities, international equities and Australian property ETFs with smart beta ETFs. In each instance the portfolio with smart beta outperforms, however this generally comes with marginally higher standard deviation. Standard deviation is a common measure of the volatility of a portfolio.

The Sharpe ratio combines the return measure with a volatility measure to quantify the relationship between the returns and risk. It provides a measure of risk-adjusted performance. In each of the examples below, the portfolio with the smart beta has a higher Sharpe ratio. The results show using smart beta in a diversified portfolio delivers better returns without excessive risk.

Table 1. Balanced Portfolio (60% Growth / 40% Defensive assets)

Table 2. Growth Portfolio (80% Growth / 20% Defensive assets)

Table 3. High Growth Portfolio (100% Growth assets)

*Inception is the ASX listing date of VanEck Vectors FTSE Global Infrastructure (Hedged) ETF which was 29 April 2016

Source: Morningstar Direct, Performance period ending 30 April 2019. Results are calculated daily to the last business day of the month and assume immediate reinvestment of all dividends. Results are net of management costs but do not include brokerage costs of investing in the ETFs. Performance on is not a reliable indicator of future performance. Assume rebalanced at the end of each calendar year. The RBA cash rate is used for cash.

ETFs used for Traditional ETF portfolios: International Bonds – Vanguard International Fixed Interest Index ETF (Hedged), Australian Bonds – iShares Core Composite Bond ETF, International Equities – Vanguard MSCI Index International Shares ETF, Australian Equities – SPDR S&P/ASX 200 ETF, International Real Estate - SPDR Dow Jones Global Real Estate ETF, Global Infrastructure -VanEck Vectors FTSE Global Infrastructure (Hedged) ETF, Australian Property – Vanguard Australian Property ETF.

ETFs used for Combination smart beta ETF portfolios: International Bonds – Vanguard International Fixed Interest Index ETF (Hedged), Australian Bonds – iShares Core Composite Bond ETF, International Equities – Vanguard MSCI Index International Shares ETF, Australian Equities – VanEck Vectors Australian Equal Weight ETF, International Real Estate - SPDR Dow Jones Global Real Estate ETF, Global Infrastructure -VanEck Vectors FTSE Global Infrastructure (Hedged) ETF, Australian Property – Vanguard Australian Property ETF.

Warning: This is general advice only about financial products and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. The ETFs are named for illustrative purposes only and this does not constitute a recommendation of any financial products or product issuers. Before making any asset allocation or investment decision, you should seek personal financial advice from a licensed financial adviser to determine your risk profile and financial products that are appropriate for your personal circumstances and read the PDS.

Putting in into practice: Disrupting active management

The above analysis assumes most investors achieve their exposure to different asset classes via passive index funds. In practice most investors will use active funds to gain some of these exposures.

The issue for active managers in Australia, however, has been that most have been underperforming the cap weighted benchmark over time. Every six months, S&P Dow Jones Indices release its SPIVA® Australia Scorecard (SPIVA is an acronym for Standard & Poor’s Indices Versus Active) and the most recent reported that over one, three, ten and 15 years, over 85% of Australian equity active funds were outperformed by the S&P/ASX 200. Over five years 79% of Australian equity funds were outperformed by the market cap weighted index.

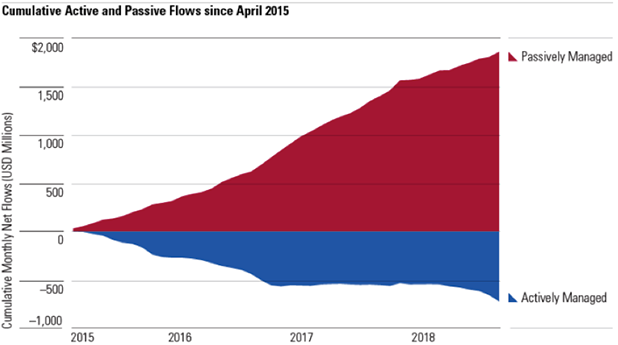

This has been one of the reasons that passive investments such as ETFs have grown in popularity. Investors no longer want to pay high fees for poor performance. Morningstar recently highlighted this trend.

Source: Morningstar Direct. Data as of 31 March 2019

Smart beta is another threat to active managers. Smart beta has been identified as:

“a disruptive financial innovation with the potential to significantly affect the business of traditional active management. They provide an important component of active management via simple, transparent, rules-based portfolios delivered at lower fees.” (Kahn and Lemmon, 2016)

Savvy investors are flocking to smart beta, attracted by their targeted outcome, lower fees relative to active, ease of use and their ability to be a part of most diversified portfolios.

Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’). VanEck is the responsible entity and issuer of units in the VanEck Vectors ETFs traded on ASX. This is general advice only about financial products and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision, you should read the relevant PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. VanEck PDSs are available at www.vaneck.com.au or by calling 1300 68 38 37. PDSs of other issuers' ETFs are available from their websites. No member of VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return of any funds. Past performance is not a reliable indicator of future performance.

Published: 23 May 2019