Expert Analysis: International Sustainable Equity

ESG (Environmental, Social, and Governance) investing is receiving an increasing amount of attention from investors. The problem for ASX investors is that it is difficult to know how ‘green’ their investment is. You may have heard the term “greenwashing”, which was coined in the 1980s to describe outrageous corporate claims. Four decades later the phrase is having a renaissance, now used to describe mislabelled managed funds. Here we provide some insightful analysis of our popular of VanEck MSCI International Sustainable Equity ETF (ESGI) which tracks an innovative index that, in addition to screening out companies, also targets the leading ESG performers in each sector.

Sustainable investing is not new.

From the 18th Century, the Quakers and Methodists advocated certain standards of behaviour and treatment, including the abolition of slavery, fair employment conditions, and avoiding alcohol and gambling. This informed the investment values of both groups.

In the 1960s, the Vietnam War prompted thousands of people in the US to boycott companies that produced weapons used in the war. Meanwhile, the civil rights movement prompted people to voice concerns about investing in companies not recognising human rights.

In the 1980s, environmental concerns gained more attention as global warming became a greater focus. Disasters such Exxon Valdez forced people to realise just how much harm corporations could do if they did not act responsibly to human life, the community, animal life and environment.

Greenwashing

In response to the environmental disasters of the 1980s, many companies started to promote their commitment to the environment. Oil company Chevron, for example, launched its award winning “People Do” advertising campaign which showcased Chevron protecting wildlife, even though these promoted programs were mandated by law. While running the ads, Chevron was found guilty of spilling oil into wildlife refuges.

Greenwashing became the phrase that describes such ads. The phrase encapsulated the environmental corporate messaging that promoted one thing, while the company did another.

The term greenwashing is coming to the fore again, this time in the world of investing. There are many funds claiming to be environmentally conscious, but the label does not match the reality and it may not reflect investor’s values.

Aligning investor’s values with their investment objectives

There is no doubt, sustainable investing is evolving as an approach that drives positive social or environmental impacts alongside long-term financial results.

It does this by taking environmental, social, governance (ESG) factors, and ethical considerations into account when making investment decisions, to better assess and manage risk with the aim of generating sustainable, long-term returns from socially responsible investments (SRI).

The result is an alignment of investor values with their investment objectives.

Incorporating socially responsible investing (SRI)

SRI, if we apply it like the early Quakers and Methodists did, generally involves ‘negative screens’ by excluding investments in companies involved in such business activities as gambling or pornography or the production of tobacco, alcohol, military weapons and civilian firearms and gambling.

These screens are quantitative. It is relatively easy to identify whether a company is involved in these activities from publicly available data such as annual reports. Companies deriving income from these sources can be excluded from a portfolio. Many portfolios only exclude companies because of such anti-social or irresponsible activities. This may not be enough.

Incorporating environmental, social, and corporate governance (ESG)

This is the hard part because considering ESG factors in investment decision-making is both quantitative and qualitative.

An example of a quantitative approach when considering the environment is assessing fossil fuel reserves and carbon emissions. Investors are now interested in a company’s carbon dioxide emissions (CO₂e) and reserves of fossil fuels. Like SRI, these are identifiable and measurable.

Harder to quantify are environmental, social, governance factors. Factors such as labour standards, workplace diversity, efficient use of scarce resources, risk controls, management competency and environmental impacts are difficult to identify from annual reports. Therefore, qualitative analysis is required so that investors can identify:

- companies that are ESG leaders, that should be considered for investment and

- companies that are laggards, that should be avoided.

ESG analysis can help investors avoid controversies, such as the infamous Volkswagen emissions scandal, by only investing in ESG leaders. Avoiding Volkswagen in portfolios not only had a social impact, it protected people’s investments when Volkswagen’s share price crashed.

Many active fund managers incorporate ESG factors into their risk analysis. However, the challenge for many investors has been combining the inclusion of ESG leaders, exclusion of fossil fuels and carbon criminals and the exclusion of companies involved in anti-social or irresponsible activities into one portfolio. Many investments do only one or two of these. It has been particularly hard for passive managers, who track indices, to include effective qualitative ESG research.

Enter MSCI, one of the world’s largest index providers. MSCI is also one of the world’s leading ESG research providers. MSCI has a team of over 200 analysts worldwide assessing all of the stocks in its global index universe on a ‘AAA’ to ‘CCC’ scale according to their exposure to industry specific ESG risks and their ability to manage those risks relative to peers.

As an index provider, MSCI is also able to assess and retain data on each company’s fossil fuel reserves and CO2 impact as well as its business activities.

VanEck collaborated with MSCI to create a state-of-the-art index that combines all of MSCI’s ESG research and data to create the MSCI World ex Australia ex Fossil Fuel Select SRI and Low Carbon Capped Index (ESGI Index).

The result is the most comprehensive, in depth, dark green index in MSCI’s ESG family. The VanEck MSCI International Sustainable Equity ETF (ASX: ESGI) tracks the ESGI Index.

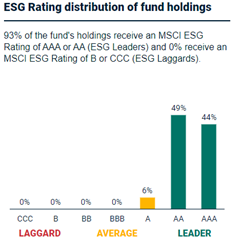

ESGI leads with AAA holdings

MSCI data shows that ESGI has 93% exposure to ESG leaders (AAA and AA rated companies as determined by MSCI) and no exposure to ESG laggards (B and CCC rated companies).

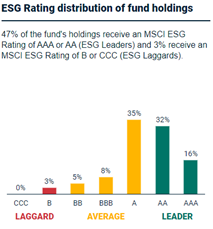

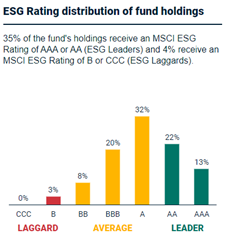

This is more impressive when you compare ESGI’s holdings to the portfolios of the other two global international ethical or sustainable ETF peers on ASX. ETF 1 has just 47% exposure to ESG leaders while ETF 2 has 35%.

ESGI

ETF 1

ETF 2

Source: MSCI, Accessed from https://www.msci.com/esg-fund-ratings 20 April 2022. MSCI ESG Fund Ratings are for informational purposes only and are subject to the Notice & Disclaimer found at: https://www.msci.com/notice-and-disclaimer; and MSCI Inc’s and MSCI ESG Research LLC’s terms of use at: https://www.msci.com/terms-of-use and additional-terms-of-use-msci-esg-research-llc.

You can view this information here: https://www.msci.com/esg-fund-ratings

(hint: use the full fund name).

It is not only MSCI that rate ESGI highly. ESGI has received a Morningstar Sustainability Rating™ of five globes, its highest rating. ETF 1 also achieves this rating, while ETF 2 only earned four globes.

Morningstar and MSCI also measure carbon intensity. As mentioned above, CO₂e is an important consideration for ESG investors, and carbon intensity measures the level of emissions produced compared to revenue. You can see below that ESGI and ETF 1 have low carbon intensity. ETF 2’s carbon intensity is similar to the benchmark.

|

Fund |

Carbon Intensity |

|

|

t CO2e / $M Sales |

|

ESGI |

16.0 |

|

ETF 1 |

11.7 |

|

ETF 2 |

147.7 |

|

MSCI World ex Australia Index |

151.0 |

Sector diversification

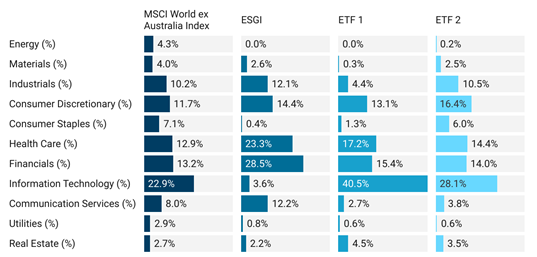

By targeting the top 15% ESG-rated companies by market cap in each sector, ESGI maintains diversification across sectors and avoids concentration in any particular sector.

Below we show the sector positions that ESGI and its peers have compared to the MSCI World ex Australia Index. ESGI’s largest exposure is in financials and healthcare.

ETF 1 displays a significant exposure to the information technology sector and therefore the risks of that sector.

Source: MSCI, VanEck, ETF 1 and ETF 2 websites. Data as at 31 March 2022

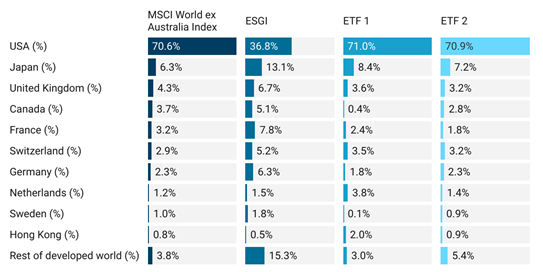

Country diversification

ESGI is well diversified by country. It is currently significantly underweight the US, but overweight Europe compared to the MSCI World ex Australia Index.

Source: MSCI, VanEck, ETF 1 and ETF 2 websites. Data as at 31 March 2022

Approaches to ESG and responsible investing vary significantly as to do investment outcomes and alignment to investor’s values. Every ESG Investor should look under the bonnet of their ESG fund to ensure it aligns with their values and investment goals.

Here are three steps we suggested in the past to find an ESG fund – click here.

The above is not a recommendation. Please speak to your financial adviser or stock broker.

For further information you can email us or call on us on +61 2 8038 3300.

Key risks

An investment ESGI carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.

Published: 21 April 2022

ESGI is indexed to a MSCI index. ESGI is not sponsored, endorsed or promoted by MSCI, and MSCI bears no liability with respect to ESGI or the MSCI Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and ESGI.

© 2022 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘class service’ have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Refer to our Financial Services Guide (FSG) for more information at www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable the relevant Product Disclosure Statement (Australian products) or Investment Statement (New Zealand products) before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a professional financial adviser. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782 ("ASXO").