What do White Lady Funerals and Bunnings have in common?

It may sound like a joke but it is a serious question. Morningstar rates the owner of each business as a wide moat company. InvoCare, the holding company for White Lady Funerals, and Bunnings’ owner Wesfarmers, are both included in the Morningstar® Australia Dividend Yield Focus Index.TM

The term moat, when referring to companies was coined by Warren Buffett - as he described competitive advantages. According to Buffett’s medieval metaphor, a moat reflects a company’s ability to withstand rivals—the same function a moat serves in protecting a castle. “The key to investing,” Buffett wrote in a celebrated 1999 article in Fortune magazine, “is determining the competitive advantage of any given company, and, above all, the durability of that advantage. The products or services that have wide, sustainable moats around them are the ones that deliver rewards to investors.”

Morningstar assigns each company it analyses an Economic Moat™ Rating of ‘wide’, ‘narrow’ or ’none’. Companies assigned a wide moat rating are those in which Morningstar has very high confidence that excess returns will remain for 10 years, with excess returns more likely than not to remain for at least 20 years. Companies with a narrow moat rating are those Morningstar believes are more likely than not to achieve normalised excess returns for at least the next 10 years. A firm with either no sustainable competitive advantage or one that Morningstar thinks will quickly dissipate is assigned a moat rating of ‘none’.

The hurdle is high for earning a Wide Moat rating. Despite scouring the ASX, Morningstar have only assigned Wide Moat ratings to a handful of Australian companies. Here are two:

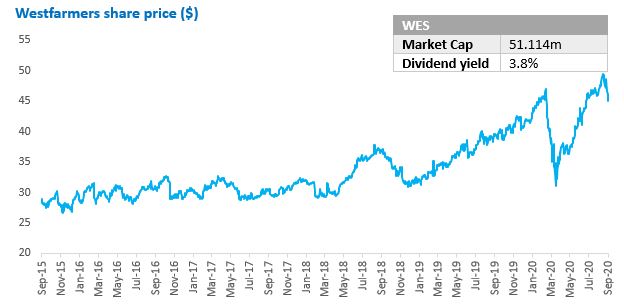

Wesfarmers (ASX: WES)

Source: Bloomberg to 9 September 2020

According to Morningstar Wesfarmers conglomerate has two components to its wide moat, first, its cost advantage and second, its intangible asset, the Bunnings brand. Across Australia and New Zealand, Bunnings is huge and the premier hardware supplier. Its customers are households, builders, commercial tradespeople and the housing industry. Bunnings employs 43,000 people, with revenue of $15.0 billion over the year to 30 June, 2020, with 378 retail locations.

This scale allows Bunnings to generate significant and enduring cash flow and to enjoy significant bargaining power with its suppliers and landlords. The hardware chain passes along the savings and operating efficiencies it can achieve to its customers. Bunnings' strategy has been to grow volumes over profit margins, broadening its range, investing in service and cutting prices to grab market share and build a loyal customer base.

What’s more, the nature of hardware helps Bunnings to fend off online rivals. The high weight and value of many of the products it sells makes shipping hardware expensive and the specialised knowledge of Bunnings staff is hard to replicate.

InvoCare (ASX: IVC)

Source: Bloomberg to 9 September 2020

While InvoCare’s share price has been hit recently, it has maintained its dividends. Similar to Wesfarmers, InvoCare has built a competitive advantage based on the intangible asset of its brand. InvoCare’s network of funeral homes, cemeteries and crematoria spans Australia, New Zealand and Singapore. This network comprises more than 290 funeral locations and 16 cemeteries and crematoria. InvoCare is the market leader in Australia.

As well as brand power and reputation, InvoCare has pricing power. The company has reached the point where it can effectively segment the market with a number of service-level offerings at various price points. Consider its flagship brand, White Lady Funerals. It is a unique, all-female service with an emphasis on emotional support. This premium service costs around 25 per cent more than a traditional InvoCare funeral.

The intangible assets are the primary reason approximately 70 per cent of InvoCare's business comes grieving family members who have used the service before or from customer referrals. The emotional connection with funeral directors from prior experiences, makes it difficult for new entrants or competitors to gain market share.

Investors are now able to access these companies as well as other wide and narrow moat companies by investing in the VanEck Vectors Morningstar Australian Moat Income ETF (ASX Code: DVDY) which tracks the Morningstar® Australia Dividend Yield Focus Index.TM

With interest rates expected to remain at historic lows for a very long time, DVDY is expected to appeal to investors seeking yield, as well as capital growth. DVDY invests only in companies with strong balance sheets in the position to pay high dividends. The ETF is powered by Morningstar's rigorous equity research, which selects 25 Australian companies based on their quality, strong financial health and dividend payouts.

Apart from Wesfarmers and InvoCare, DVDY holds household quality names such as ASX and Woolworths, which enjoy strong cash flows and sustainable competitive advantages, providing the ability to pay relatively high income and potential for capital gain even during these recessionary times.

Published: 10 September 2020

Issued by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (“VanEck”). This is general advice only, not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Read the PDS and speak to a financial adviser to determine if the fund is appropriate for your circumstances. The PDS is available here and details the key risks.

The Morningstar® Australia Dividend Yield Focus Index™ was created and is maintained by Morningstar, Inc. Morningstar, Inc. does not sponsor, endorse, issue, sell, or promote DVDY and bears no liability with respect to DVDY or any security. Morningstar®, Morningstar® Australia Dividend Yield Focus Index™, and Morningstar Economic Moat™ are trademarks of Morningstar, Inc. and have been licensed for use by VanEck by Morningstar Australasia Pty Ltd (ABN:95 090 665 544, AFSL:240892).

No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from the fund.

© 2020 Van Eck Associates Corporation. All rights reserved.