What do increasing interest rates mean for bonds and equities?

Rates and asset prices have been in the news lately. Rates impact prices of bonds and equities. We explain how and where we think it will lead.

Rates and asset prices have been in the news lately. Rates impact prices of bonds and equities. Here we explain how and where we think it will lead.

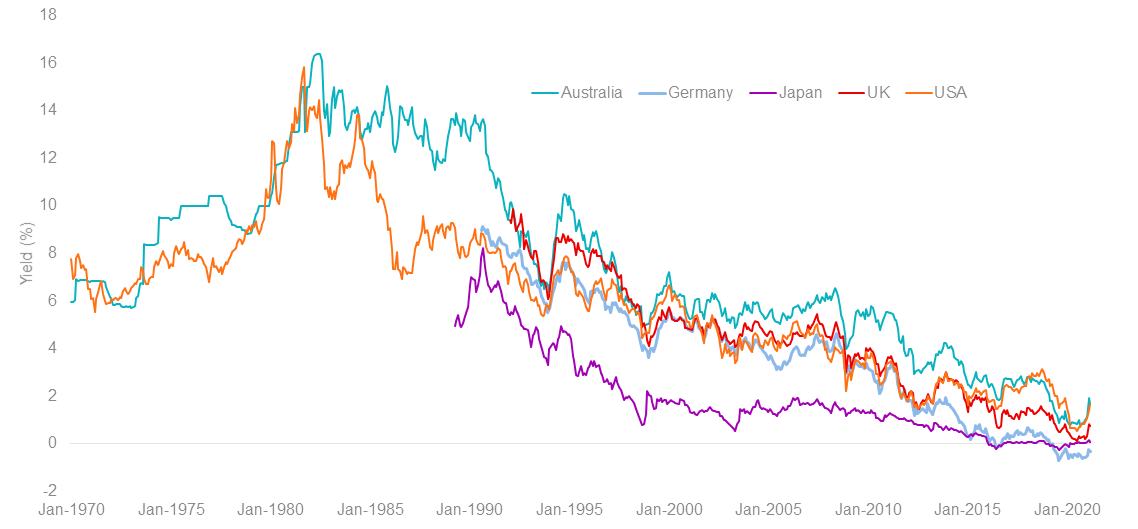

Interest rates have been on a steady decline globally since the 1990’s. In 1990 the Australian 10 year Government bond yield was 13% and the RBA cash rate was 14% and of course at that time inflation was also much higher at 7%.

Since the beginning of the year we have seen the 10 year Australian Government bond yield increase from 1.06% to 1.69% and the big question on investors’ minds is whether rates are going to keep increasing and what does that mean for bond and equity investments? The 10 year Australian Government bond yield is representative of which direction the market thinks rates are headed.

Figure 1: 10-year government bond yields since 1970

Source: Bloomberg, February 1970 to February 2021

Bond prices have an inverse relationship with yields. When bond yields rise the market value of the underlying bond falls. An investment in a 10-year Australian Government bond on 1 January 2020 has reduced in value by about 8% in just three months to the period ending31 March 2021, which is relatively large in historic terms.

Rising bond yields in the current low interest environment are indicative of investors having concerns about long term inflation. Inflation and interest rates usually rise when the economy is expanding.

However there are conflicting signals out there at the moment.

Firstly the RBA has no intention of raising interest rates. The RBA currently has a target yield of around 0.1% p.a. on the 3-year Australian Government bond and it will continue to purchase government bonds to keep achieving this target.

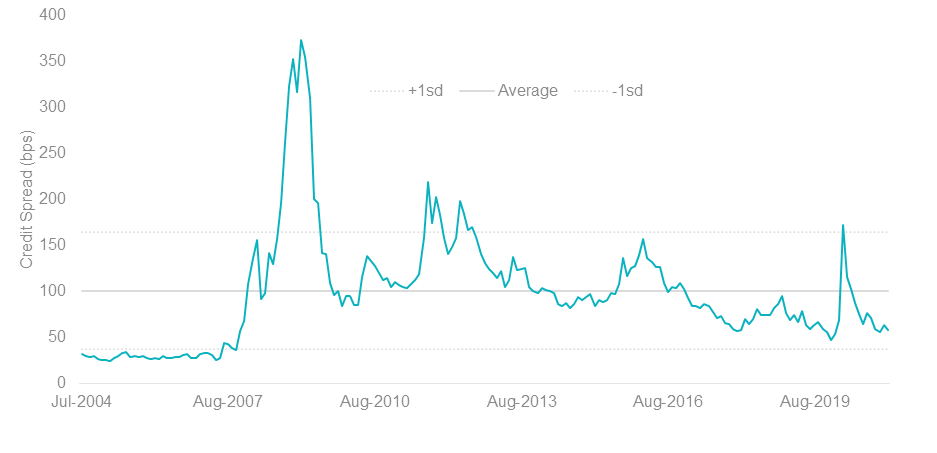

Secondly narrowing of credit spreads, which has continued to occur this year, are usually late in the economic cycle; that is not during an economic expansion. Credit spreads represent the premium that bond investors are paid over and above the risk free rate which is usually measured as the yield on a government bond with a similar maturity. Lower credit spreads generally mean that the market is expecting less companies to default on their bonds.

Figure 2: Credit spreads: Australian credit default swap credit spread (Markit iTraxx Index)

Source: Bloomberg, Markit From 1 July 2004 to February 2021

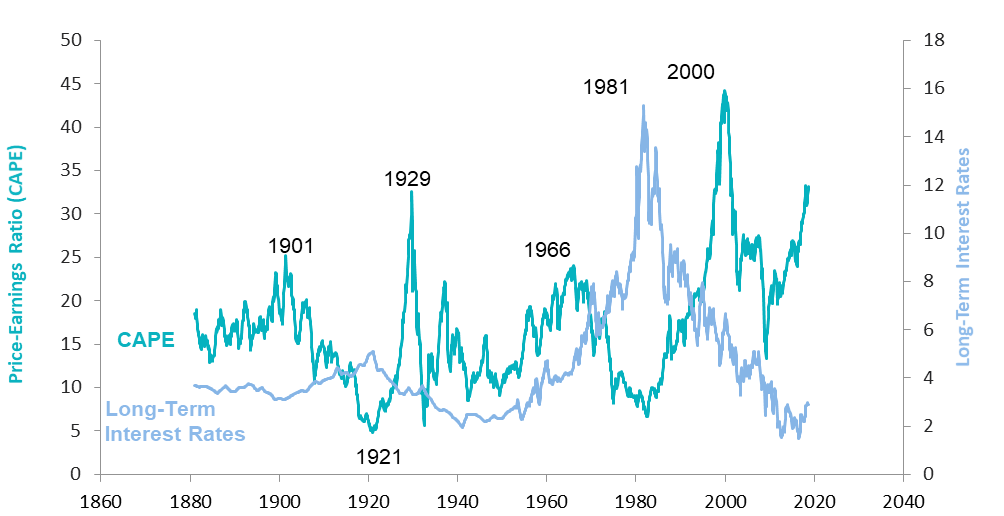

Bond yields is also an important factor to be taken into account when considering equity valuations. Generally, when bond yields rise equities tend to fall and when rates fall (as they have been doing for many years), equity valuations tend to rise. It does not always happen in the short term but it tends to follow a pattern in the longer term as shown in the graph below

Figure 3: The inverse correlation between bond yields and equities

The timing and extent of an equity market fall will be dependent on whether and how quickly long term interest rates move upwards. Downward pressure on equity valuations will also be offset if earnings continue to increase.

Our current view is that with short term interest rates set to remain low for the medium term and our expectation that earnings will continue to increase, it is unlikely that the increase in long term interest rates will trigger an equity market fall.

Published: 01 April 2021

Important information

VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’) is the responsible entity and issuer of units in VanEck ETFs. This is general advice only, not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Read the PDS and speak with a financial adviser to determine if a fund is appropriate for your circumstances.