Emerging market equities well positioned post recovery

There are a number of indicators supporting emerging market (EM) equity growth in the second half of 2021.

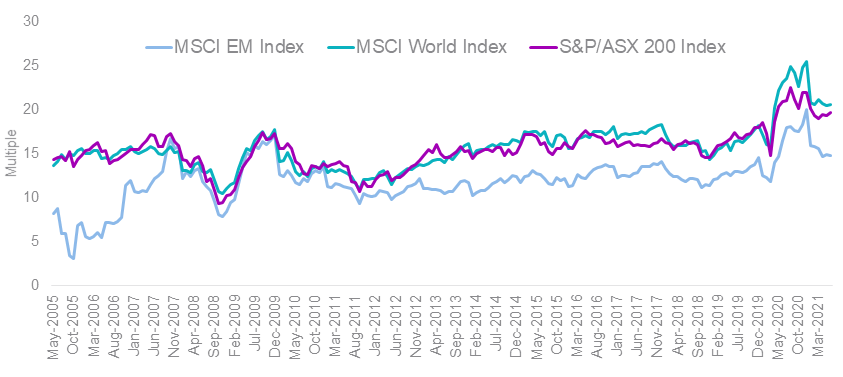

1. Relatively attractive valuations. Data compiled by Bloomberg shows the 12-month forward P/E ratio is 14x for emerging markets and over 20x for developed markets (DM). Also, the 5-year average forward P/E ratio of EM against DM is currently sitting at 0.74, indicating that EM stocks are cheaper than their DM peers.

Chart 1: P/E ratios of EM versus DM

Source: Bloomberg as of 31 May 2021

3. Value prevails. The Value factor has been a dominant force in EM equities for the past 6 months. Traditionally Value stocks, for example, Materials, Energy and Financials, have outperformed coming out of a recession.

Chart 2: Active Factor Returns in EM

|

Factor |

1 Month |

3 Months |

6 Months |

1 Year |

3 Years (p.a.) |

5 Years (p.a.) |

10 Years (p.a.) |

15 Years (p.a.) |

|

Growth |

-1.52% |

-3.32% |

-4.34% |

0.72% |

3.21% |

2.86% |

2.33% |

1.03% |

|

Momentum |

-0.71% |

-2.67% |

-1.11% |

7.72% |

6.10% |

4.84% |

3.44% |

2.66% |

|

Multi-Factor* |

0.08% |

4.61% |

5.08% |

-0.88% |

-3.04% |

-0.75% |

0.70% |

1.87% |

|

Quality |

2.05% |

3.95% |

3.32% |

0.90% |

1.38% |

-1.25% |

0.96% |

1.90% |

|

Value |

1.57% |

3.55% |

4.70% |

-0.88% |

-3.49% |

-3.08% |

-2.48% |

-1.17% |

* MSCI Emerging Markets Diversified Multiple-Factor Index. Source: Bloomberg as of 31 May 2021.

VanEck’s MSCI Multifactor Emerging Markets Equity ETF (ASX code: EMKT) tracks the MSCI Emerging Markets Diversified Multiple-Factor Index. The index targets exposure to Value, Momentum, Low Size and Quality factors.

Published: 17 June 2021

An investment in EMKT carries risks associated with: emerging markets, financial markets generally, individual company management, industry sectors, ASX trading time differences, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

No member of the VanEck group of companies guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.