US election results boost US healthcare stocks

While the outcome of the US election remains uncertain, the Democratic sweep didn’t eventuate. Specifically, a Democratic majority in the Senate looks less likely.

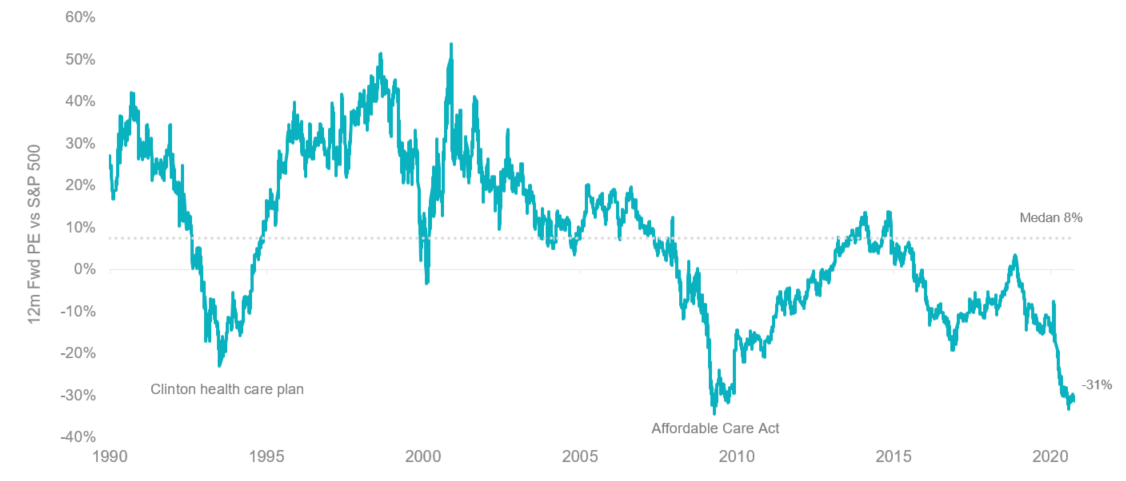

With health policy perceived to be a major legislative focus for the Biden administration, valuations in the healthcare sector have already been pricing in major concerns. On the eve of the election, the healthcare sector had been trading at a 15.6x NTM P/E, representing a 23% discount to the S&P 500.

Healthcare sector P/E premium / (discount) vs S&P 500

Source: Bloomberg, as at 12 November 2020. Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance. Healthcare Sector is represented by S&P 500 Health Care Index.

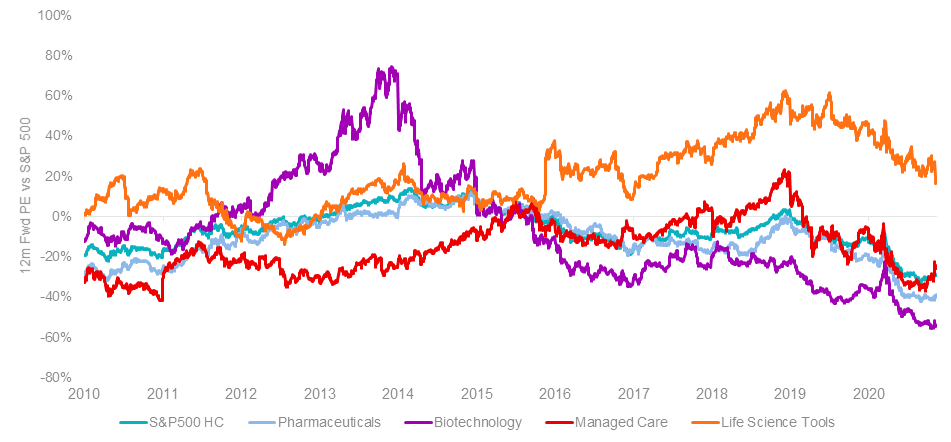

As context, since the polls first started to shift in late September to show the increasing odds of a blue wave, outperformance within the healthcare sector has come from managed care (on expectations of a watered down Biden public option) as well as hospitals. Pharmaceuticals and biotech have struggled the most in that time period (down 5-8%) as the market has had to contend with both the impact of a Democrat legislative agenda (drug pricing risks, Medicare negotiations) as well as the expected reflationary macro environment with a large stimulus from Biden's fiscal policies.

Healthcare sub -sector P/E premium / (discount) vs S&P 500

Source: Bloomberg, as at 12 November 2020. Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance. Indices used: S&P500 HC – S&P 500 Healthcare Index , Pharmaceuticals - S&P 500 Pharmaceutical Index, Biotechnology - S&P 500 Biotechnology Index, Managed Care - S&P 500 Managed Care Index, and Life Science Tools - S&P 500 Life Sciences Index.

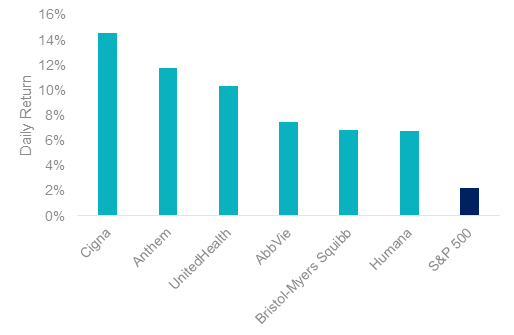

The reduced likelihood of a blue-wave with a Biden win and split congress removes the most uncertain outcome for the sector. As a result healthcare companies skyrocketed on 4 November 2020.

One Day Price Change on 4 November 2020

Source: Bloomberg

There are now positive expectations across most healthcare sectors:

- Pharmaceuticals should benefit the most as it has had the most significant underperformance due to Biden’s proposal for Medicare drug pricing negotiations which now with an expected split congress will be difficult to implement.

- It is similarly positive for biotech given the diminished risk on sweeping drug pricing reforms and lower probability of tax increases. M&A sentiment is also likely to improve and in the past biotech has shown the sharpest recovery from re-election underperformance.

- Managed care should also benefit under a split government with reduced risk of a large, progressive public option. However recent performance has been positively correlated with the likely changes to the Affordable Care Act being approved by the Supreme Court. If the conservative majority strikes down the entire law, the industry would face considerable upheaval after spending the past decade incorporating the law into their businesses. Hospitals will be most affected.

VanEck recently launched the VanEck Vectors Global Healthcare Leaders ETF (ASX code: HLTH) on ASX. HLTH is a portfolio of global healthcare leaders comprising the most fundamentally strong companies.

Published: 19 November 2020

Issued by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’). This is general advice only, not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Read the PDS and speak with a financial adviser to determine if the fund is appropriate for your circumstances. The PDS is available here. An investment in HLTH carries risks associated with: financial markets generally, individual company management, industry sectors, ASX trading time differences, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details. No member of the VanEck group of companies guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from the fund.