Pivoting for the Omicron storm, or storm in a teacup

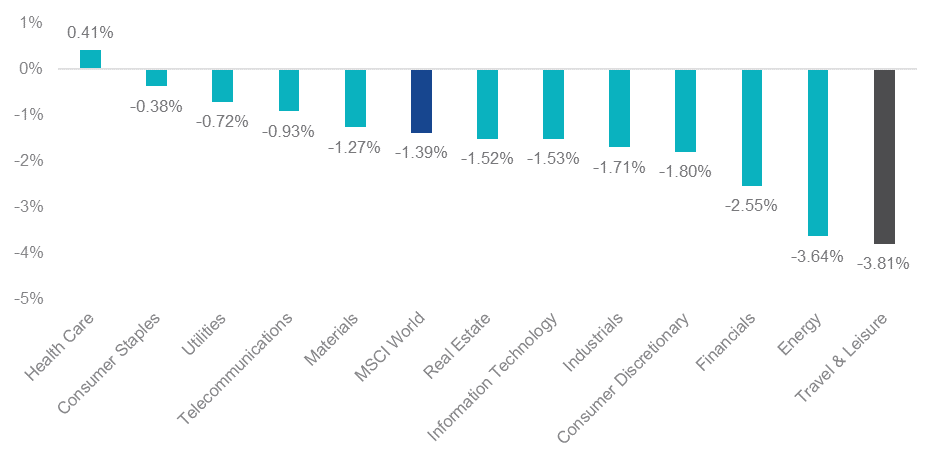

Traditional value sectors, financials and energy stocks were worst hit reflecting a dampened economic outlook whereas health care was the only sector that reported positive returns after vaccine and related medicine demand prospects were elevated.

Chart 1 – Global Sector Performance – Friday 26 November 2021

Source: Bloomberg. AUD terms. MSCI World sector indices. Travel & Leisure as STOXX Global 3000 Travel & Leisure index.

Preliminary evidence suggests transmissibility is two times the Delta variant, although symptom severity is yet to be determined and likely won’t be confirmed for at least another two weeks. According to Citi, the anticipated timeline for Omicron data is summarised below.

- Determine whether Omicron outcompetes Delta in high Delta prevalence countries (2-3 weeks).

- Are previous COVID patients being re-infected with the new variant (2-4 weeks).

- Real world data to determine rates of hospitalisation and death (c. 6-8 weeks).

Until recently, investor mindsets had shifted to a ‘living with COVID’ mentality, supported by abundant stimulus and expectations that vaccines would keep the virus in check. Yet, the market reaction to the latest coronavirus variant discovery has left many investors questioning how to position their portfolio going forward.

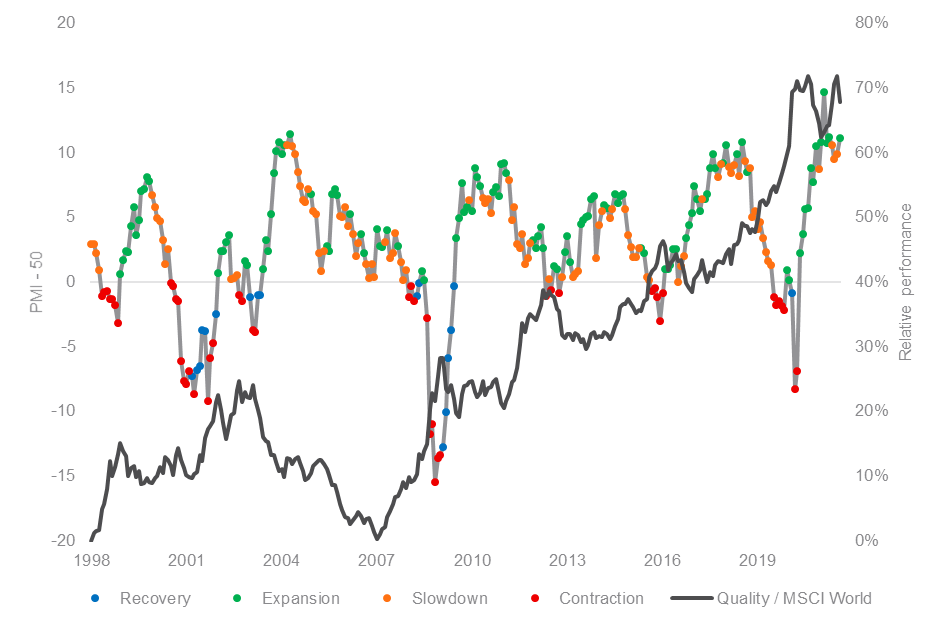

If the global economic recovery falters it could benefit quality companies, as they tend to offer investors protection during weaker economic environments and heightened market volatility.

Chart 2 illustrates how quality companies typically outperform when manufacturing activity (a proxy for economic activity) decelerates (orange) and/or contracts (red).

According to world-leading index provider MSCI, quality companies are those with: high return on equity (ROE), stable year-on-year earnings growth and low financial leverage.

Quality stocks have outperformed over the past six months as US manufacturing activity has slowed.

Chart 2 – US ISM Manufacturing PMI Index and MSCI World Quality versus MSCI World performance

Source: Bloomberg. MSCI. Past performance is not a reliable indicator of future performance.

VanEck offers:

Published: 29 November 2021