Infrastructure keeps on truckin'

Global infrastructure assets are also being used to provide stable income for investors in substitution for traditional high-yielding blue-chip Australian equities in light of the potential changes to the franking credits system.

Now is an ideal time to consider an allocation to Global Infrastructure to your clients’ portfolios.

Infrastructure resolute through October volatility

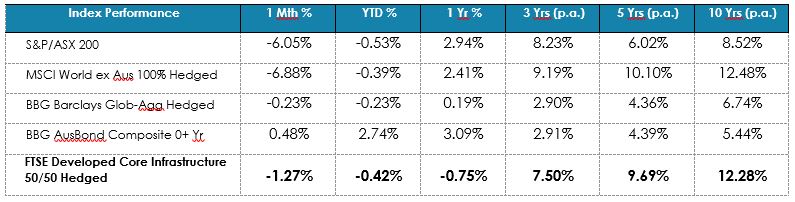

Global Infrastructure outperformed developed market equities in October demonstrating its defensive characteristics. It fell only 1.27%, compared to 6.88% for the MSCI World ex Australia $A Hedged Index and 6.05% for the S&P/ASX 200 Index. Australian and International Fixed Income indices delivered 0.48% and -0.23% respectively, as represented by the Bloomberg AusBond Composite Index and the Bloomberg Barclays Global Aggregate Total Return Index $A Hedged.

These numbers only relate to one month and cannot be extrapolated to longer periods but they show what happened when volatility hit recently.

Over the year to 31 October 2018, Global Infrastructure has also outperformed Australian shares. While the S&P/ASX 200 Index is down 0.53%, Global Infrastructure is down only 0.42%. The table below shows returns over longer periods.

Index Performance Comparison (to 31 October 2018)

Source: Bloomberg. You cannot invest in an index. Past performance is not a reliable indicator of future performance of the indices or IFRA.

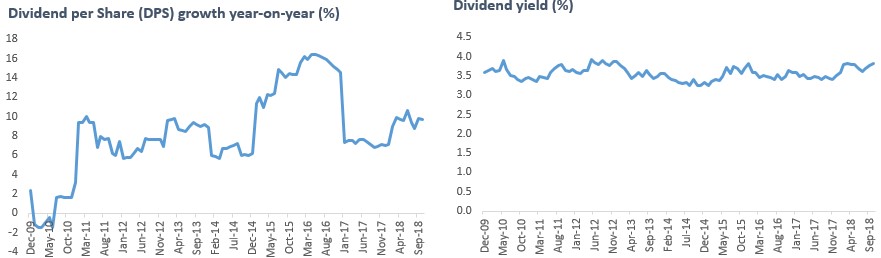

Global Infrastructure has performed steadily despite the year’s share market volatility. In times of volatility, infrastructure securities typically fall less than the overall share market given their defensive characteristics. Infrastructure assets enjoy steady cash flows often linked to inflation and protected by government regulation. Income from global infrastructure assets is stable and with increased spending, profit margins have been increasing, as indicated by the graphs below.

Source: FTSE to 31 October 2018. Data is the FTSE Developed Core Infrastructure 50/50 Hedged to AUD Index. You cannot invest in an index. Past performance is not a reliable indicator of future performance of the index or IFRA.

Travelling smoothly through down markets

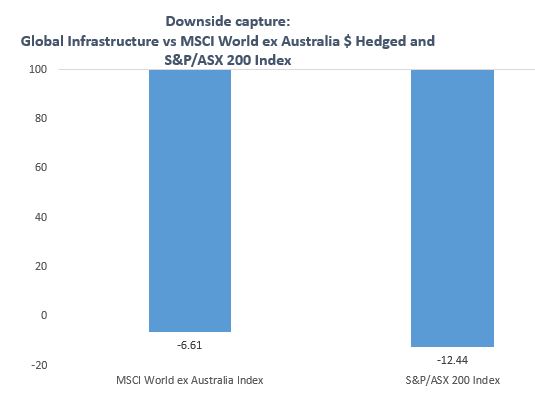

Despite rising interest rates, the global infrastructure sector could continue to outperform. In times of volatility, investors flock to defensive stocks and that’s exactly what infrastructure aims to provide: defence against a downturn. This is evidenced by Global Infrastructure’s downside capture ratio compared to developed market equities. Downside capture ratio is a statistical measure of an investment’s performance in down markets. It is used to evaluate how well an investment performed relative to a benchmark during periods when that benchmark fell. The ratio is calculated by dividing the performance of the index by the performance of the benchmark it is being compared to, during down markets and multiplying by 100. A score less than 100 indicates outperformance when the benchmark fell. The lower the ratio the better.

The downside capture ratio of Global Infrastructure compared to the MSCI World ex Australia $A Hedged and S&P/ASX 200 Indices is demonstrated below.

Source: Bloomberg, Morningstar, 2010 to 2018

Historically Global Infrastructure’s downside capture ratio has been well below 100 compared to developed market equities, reinforcing its relative defensive nature during market downturns.

Broad income sources through diversified assets

Infrastructure operators are typically large with little competition and protected by high barriers to entry. Global infrastructure represents a range of assets from toll roads to airports, from broadcasting towers to railways. Investors can reap income that adjusts throughout economic cycles and different interest rate environments.

Some infrastructure companies’ revenues are linked to economic activity, such as railway operators and airports which usually benefit from increased traffic. Others, such as toll roads, have income linked to inflation. Utilities that provide electricity, gas or water typically have earnings that are regulated based on their costs. As those costs rise, so do their revenues.

A well-diversified portfolio of infrastructure securities will therefore continue to generate consistent income throughout the market cycle. Institutional investors, such as large super funds, have used infrastructure for years as an alternative to traditional assets such as equities and bonds.

IFRA - One trade access to a portfolio of 145 global infrastructure securities

VanEck provides investors with a simple way to access a portfolio of 145 global infrastructure securities via the VanEck Vectors FTSE Global Infrastructure (Hedged) ETF (ASX: IFRA). IFRA was the first global infrastructure ETF on ASX.

IFRA tracks the FTSE Developed Core Infrastructure 50/50 Hedged to AUD Index which is the most highly regarded market benchmark for global listed infrastructure. It provides a broad sector and geographic exposure and is hedged to AUD removing the risk of adverse impacts on the income stream due to foreign exchange fluctuations.

For further insight and analysis on IFRA please click here

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of the VanEck Vectors FTSE Global Infrastructure (Hedged) ETF (‘Fund’). This is general information only and not financial advice. It is intended for use by financial services professionals only. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision in relation to the Fund, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the Fund.

IFRA invests in international markets. An investment in IFRA has specific and heightened risks that are in addition to the typical risks associated with investing in the Australian market. These include currency/foreign exchange fluctuations, ASX trading time differences and changes in foreign regulatory and tax regulations.

The Fund is not in any way sponsored, endorsed, sold or promoted by FTSE International Limited or the London Stock Exchange Group companies (‘LSEG’) (together the ‘Licensor Parties’) and none of the Licensor Parties make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to (i) the results to be obtained from the use of the FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index (with net dividends reinvested) (‘Index’) upon which the Fund is based, (ii) the figure at which the Index is said to stand at any particular time on any particular day or otherwise, or (iii) the suitability of the Index for the purpose to which it is being put in connection with the Fund. None of the Licensor Parties have provided or will provide any financial or investment advice or recommendation in relation to the Reference Index to VanEck or to its clients. The Reference Index is calculated by FTSE or its agent. None of the Licensor Parties shall be (a) liable (whether in negligence or otherwise) to any person for any error in the Reference Index or (b) under any obligation to advise any person of any error therein. All rights in the Reference Index vest in FTSE. “FTSE®” is a trade mark of LSEG and is used by FTSE and VanEck under licence.

Published: 30 November 2018