Greed and fear

As one of the world’s most revered economist’s from the 20th century said, “Markets can remain irrational longer than you or I can remain solvent." As if to prove John Keynes right, gold, traditionally a safe haven, has not been immune to the market sell-off – you could say, irrationally.

As one of the world’s most revered economist’s from the 20th century said, “Markets can remain irrational longer than you or I can remain solvent."

As if to prove John Keynes right, gold, traditionally a safe haven, has not been immune to the market sell-off – you could say, irrationally.

In past market shocks however gold has recovered as investors seek its safety, after having initially been sold off by some to pay margin calls rather than realising losses on equities. We expect gold and its miners to recover faster than the broader market, as they have done in the past. We explain the traditional drivers of gold's performance in our Investors Guide to Gold.Volatility back past 2008 highs

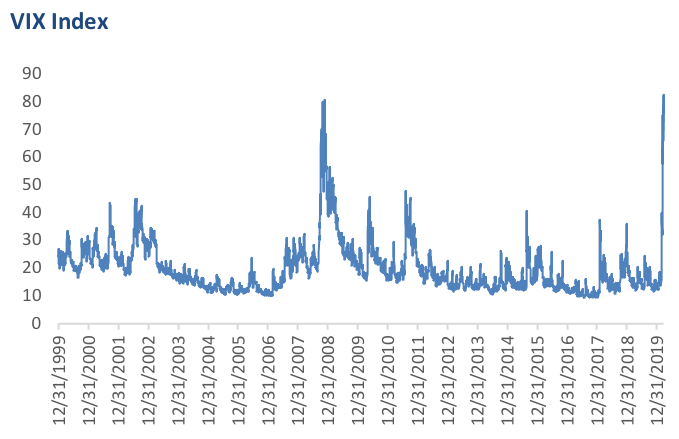

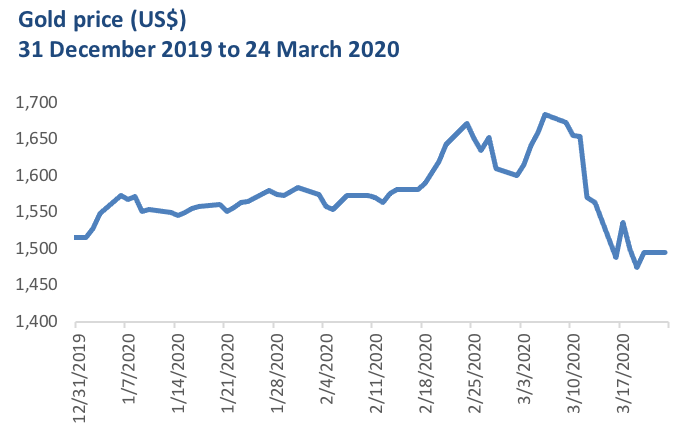

Fears on the stock market have risen to record levels, the CBOE VIX volatility gauge jumped 82.69 on the 16thMarch, its highest ever level. Markets tumbled and, while usually a safe haven, gold has not been spared. The gold price peaked at US$1,685 on March 4 before dropping to below US$1,500.

Source: Bloomberg, Gold price is LBMA PM price.

There are two reasons gold has been under pressure:

- Some large funds and institutional investors have been unwinding hedged positions they have in risk parity and other volatility-strategy portfolios – Gold, commodity, and fixed income investments are typically leveraged in risk parity models (based on their underlying volatility relative to equities), so substantial liquidations in these funds have led to outsized, forced selling of these assets.

- Liquidations to raise cash – Selling to meet margin calls and raising cash to cover stock market losses, especially among leveraged funds, is commonplace during market sell-offs.

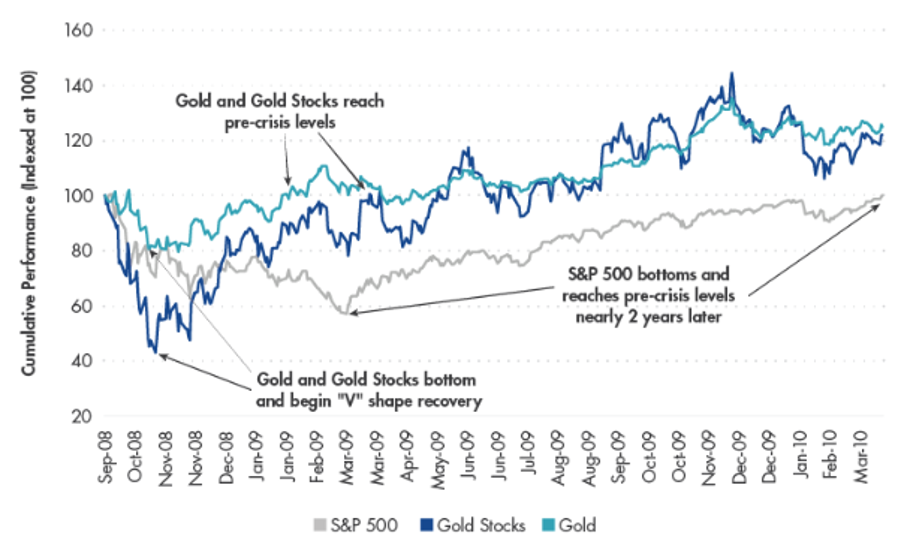

Historically gold bullion/gold stocks tend to recover faster than the broader markets following crises.

During the 2008 financial crisis, gold and gold stocks bottomed and recovered much earlier than the S&P 500 – recouping losses at/around the time the S&P reached its lows in February/March 2009. The S&P 500 took nearly two years to reach its pre-crisis levels again.

Gold and gold stocks recovered before S&P 500 during 2008 financial crisis

Source: VanEck, Bloomberg. Data as of March 2020. “S&P 500” represented by the S&P 500 Index TR (SPXT). “Gold Stocks” represented by the NYSE Arca Gold Miners Index Net Total Return (GDMNTR). “Gold” represented by gold spot prices.

Gold equities when compared to the Gold price appear to have been oversold. An analysis of the ratio of Gold equities relative to the Gold price shows it has dropped to its 2016 low.

Ratio of the cost of gold miners to the gold price

Source: Bloomberg; as at 24 March 2020

Since the GFC, gold companies have been implementing changes to address mistakes of the past which, in our opinion, should lead to outperformance relative to bullion in a gold bull market. We expect no credit problems in these companies, while the lengths to which companies have gone to, to reduce costs and capital expenditures could translate to an additional near 40% increase in free cash flow, on average, for a gold price move from $1,600 to $1,800 (for seniors and mid-tiers).

Investors can access this opportunity on ASX with VanEck Vectors Gold Miners ETF (GDX).

IMPORTANT NOTICE:

Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’). This is general information only about financial products and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision, you should read the relevant PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. PDSs are available at www.vaneck.com.au or by calling 1300 68 38 37.

VanEck is the responsible entity and issuer of units in the VanEck Vectors ETFs traded on ASX. All investments carry some level of risk. Investing in international markets has specific risks that are in addition to the typical risks associated with investing in the Australian market. These include currency/foreign exchange fluctuations, ASX trading time differences and changes in foreign regulatory and tax regulations.

NYSE Arca Gold Miners Index is a trademark of ICE Data Indices, LLC or its affiliates (“ICE Data”) and has been licensed for use by VanEck in connection with the US Fund. Neither the Trust nor the Fund is sponsored, endorsed, sold or promoted by ICE Data. ICE Data makes no representations or warranties regarding the Trust or the Fund or the ability of the NYSE Arca Gold Miners Index to track general stock market performance.

ICE DATA MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE NYSE ARCA GOLD MINERS INDEX OR ANY DATA INCLUDED THEREIN. IN NO EVENT SHALL ICE DATA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

Published: 31 March 2020