New global income opportunity on ASX

Introducing global capital securities.

With interest rates near all-time lows, investors are looking for regular income paying securities with less capital volatility than equity markets. Subsequently, Australian investors have been attracted to ASX listed hybrids for additional income in recent years.

However most Australian investors already own bank shares and exposure to Australian bank hybrids simply increases concentration risk - enter global capital securities.

Historically a domain of institutional investors, with a universe of opportunities that dwarfs Australia’s, there is over $1.4 trillion in issuance across more than 225 issuers and 1,000 issues. The challenge however has been access. Until now.

VanEck together with leading credit & fixed interest specialists Bentham Asset Management have created a global capital securities opportunity on ASX.

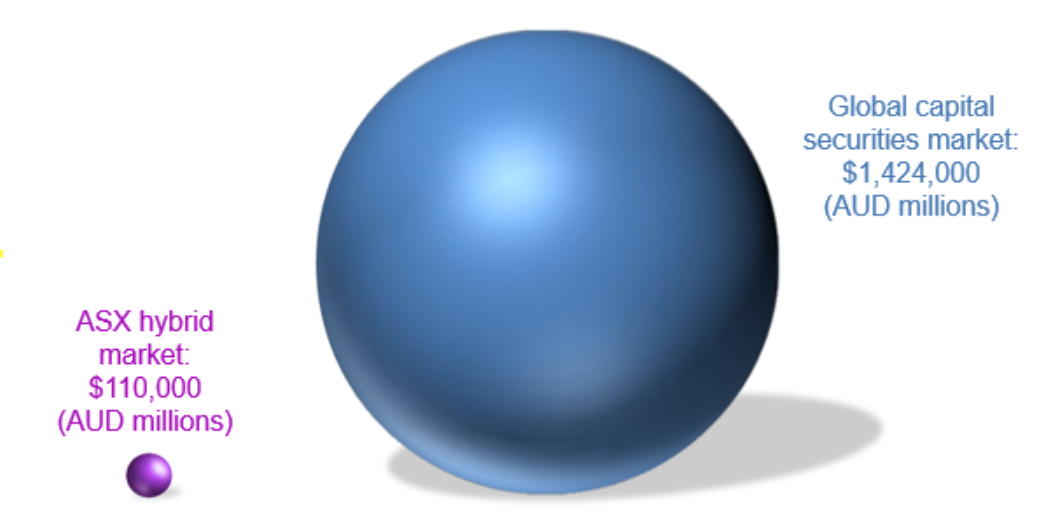

Market size differential: ASX listed hybrids versus offshore

The global capital securities market is 13 times larger than the Australian hybrid market. Australian Major Banks account for roughly 75% of all domestic ASX listed hybrid issuance, spread across only 4 issuers and 19 securities. This is dwarfed by the opportunity set offshore.

The ASX listed hybrid market tends to attract domestic and retail investors, because franking credits are a key driver of valuations and not valued by offshore investors. This limited buyer base means that the market pricing and liquidity is sensitive to local demand. Further, by having overlapping exposures to Australian banks via both shares and hybrids (for income) many investors portfolios exhibit unnecessary concentration risk that can be mitigated by investing globally.

Chart 1: Bigger universe equals greater opportunities: Global Capital Securities Market

Source: Bentham, Bloomberg, as at 22 July 2021. Global Capital securities includes select currencies: (USD, GBP, CAD, EUR and AUD) EU/UK Bank CoCos (>$350m issue), Large Cap US Bank Tier 1 (> 500m issue) ($1000 par only), Bank Tier 2 (globally) (>500m issue), Insurance Tier 2 (globally) (>500m issue). The ASX market includes hybrids and subordinated debt.

Current spreads offer attractive relative value

The current spreads offshore are attractive relative to liquid investment grade and high yield credit at present, particularly given the structural improvement in offshore banks’ balance sheets. Importantly, COVID-19 showed that bank dividends can be cut or stopped while global capital securities coupons remained fully and timely paid.

As an example, Westpac has an ASX listed hybrid, WBCPJ, that has a yield to worst (YTW) of 2.58% (fully franked) to March 2027. This compares to Westpac 5% USD at 2.92% YTW (Baa2/BBB-) to September 2027, Rabobank EUR 4.375% (Baa3/BBB) at 3.12% YTW to June 2027 and Lloyds GBP 7.875% (Baa3/BB-/BBB-) with a YTW of 3.8% to June 2029.

These offshore securities sit on the same part of the capital structure as WBCPJ and have similarities in key terms around coupons and capital trigger events.

Table 1: Capital securities comparison

|

|

ASX Listed Hybrid - WBCPJ |

Westpac USD 5% |

Rabobank EUR 4.375% |

|

ISIN |

AU0000114837 |

US96122UAA25 |

XS2202900424 |

|

Capital Structure |

Additional Tier 1 |

Additional Tier 1 |

Additional Tier 1 |

|

Coupons/ Distributions |

Discretionary & Non-Cumulative |

Discretionary & Non-Cumulative |

Discretionary & Non-Cumulative |

|

Franking Credits |

Distributions are quoted on a grossed up basis including franking credit |

n/a |

n/a |

|

Convertibility |

Converts to equity or written off if directed by APRA if Common Equity Tier 1 Capital Ratio falls to or below 5.125% |

Converts to equity or written off if directed by APRA of Common Equity Tier 1 Capital Ratio falls to or below 5.125% |

Temporary write down if directed by regulator or Common Equity Tier 1 Capital Ratio falls below 5.125%. Notes can be written back up again subject to applicable regulatory restrictions. |

|

Scheduled Conversion Clause |

Yes (March 2029) (2 years after the first call date) |

No |

No |

|

Dividend Stopper |

Yes |

Yes |

n/a (unlisted entity) |

|

Call Date |

March 2027 |

September 2027 |

June 2027 |

|

Credit Rating |

Not Rated |

Baa2/BBB-/BBB |

Baa3/BBB |

|

Maturity |

Perpetual |

Perpetual |

Perpetual |

|

Yield to Worst |

2.58% (Fully Franked) |

2.92% |

3.12% |

As at 30th July 2021. Source: Bentham. Depending on their terms, global capital securities may have higher levels of maturity or extension risk which is the risk that issuers will defer redemption due to market conditions. ASX hybrids have generally exhibited lower levels of price volatility than offshore hybrids. The yield to worst (YTW) is a measure of the lowest possible yield that can be received assuming the security does not default. YTW does not account for fees or taxes. YTW is not a forecast, and is not a guarantee of, the future return of the fund which will vary from time to time.

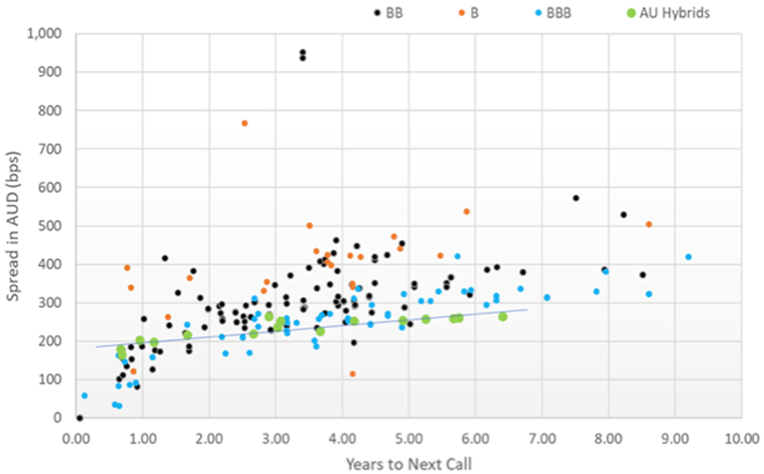

Chart 2 below presents ASX listed hybrids, shown by the light green dots, versus the European and UK bank Contingent Convertibles (CoCo) universe.

Chart 2: Spreads and years to next call - ASX listed hybrids vs offshore capital securities

Source: Bentham, Bloomberg, 22 July 2021.

With interest rates near all-time lows, global capital securities have a role to play in adding diversification to existing fixed income portfolio allocations.

At present, they offer relative attractive yields and provide exposure to a global banking universe. Since the global financial crisis the global banking universe has improved its fundamentals through higher capital ratios and balance sheet de-risking.

With its broad and deep market size, global capital securities offer opportunities for active management through the investment cycle.

VanEck Bentham Global Capital Securities Active ETF

(Managed Fund) (ASX: GCAP)

To take full advantage of the opportunities within global capital securities, it is necessary to take an active approach to identify mispricing opportunities.

GCAP is an actively managed high conviction portfolio of global capital securities selected based on a top-down and fundamental credit analysis by Bentham who have a 18-year track record in managing this asset class.

UPCOMING WEBINAR

Join us for a special online masterclass to learn more about global capital securities and GCAP.

Thursday 12 August from 11am AEST.

Register here to watch the livestream or the replay.

Visit the GCAP product page for all the fund details.

Published: 04 August 2021

IMPORTANT NOTICE

VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’) is the responsible entity and issuer of units in the VanEck Bentham Global Capital Securities Active ETF (Managed Fund) (ASX: GCAP). Nothing in this content is a solicitation to buy or an offer to sell shares of any investment in any jurisdiction including where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. This is general advice only, not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Read the PDS and speak with a financial adviser to determine if the fund is appropriate for your circumstances. The PDS is available here. An investment in GCAP carries risks associated with: subordination in the capital structure, bond markets generally, interest rate movements, derivatives, currency hedging, below Investment Grade securities, country and issuer concentration, liquidity, and issuer default. See the PDS for details. No member of the VanEck group of companies guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.