Ready player one: Diversifying your tech exposure

Just in time for the end of year, video gaming companies have lined up a number of releases, among them Halo Infinite and Final Fantasy XVI, this follows the release of Call of Duty: Vanguard. For most investors, they may be missing access to this opportunity. Most investors have exposure to technology via the FAANGM stocks however recent volatility, concerns about corporate image and the shifting regulatory environment has highlighted investor’s apprehensions about overpaying. One way to diversify your technology exposure is to look beyond the mega cap tech stocks and consider the investment opportunity pertaining to video gaming and esports.

Esports have entered the mainstream. Recently the eastern seaboard print mastheads of Nine, SMH and the Age, ran an article in its sports pages: “Can a video game be sport? Almost 7 million fans can’t be wrong” which reported the global audience for the ‘Counter Strike’ tournament in Stockholm. Close to three million people watched the world’s best 24 teams compete… in a video game. The rise of video gaming and esports is irrefutable. And, it’s a potential opportunity for investors.

Long-term structural trends favour the growth of video gaming and esports companies, as players and spectators flock to digital games. Global pandemic lockdowns too have supported crowds and the growth profile of listed game developers and console producers. The industry’s growth has been phenomenal. Since 2019, video game revenues have grown at an annualised rate of 7.2%. By 2023, video game revenues could hit US$200 billion[1]. More than 85% of industry revenue comes from free-to-play games. [2]

Investors can gain exposure to opportunities in this thriving industry via the VanEck Video Gaming and Esports ETF (ASX: ESPO). ESPO offers a pure play and targeted exposure to leading video gaming and esports companies, including publishers Tencent, Nintendo, Electronic Arts and Activision Blizzard. Not only has ESPO performed better than the broader US and global stock markets, its valuation looks attractive compared to other investment strategies providing technology growth exposure.

Long-term growth story

The spike in video gaming during the COVID-19 pandemic entrenched a trend underway for several years. Electronic sports and video game engagement metrics have been setting records across several platforms, including broadcast TV, online viewership of gaming and player numbers.

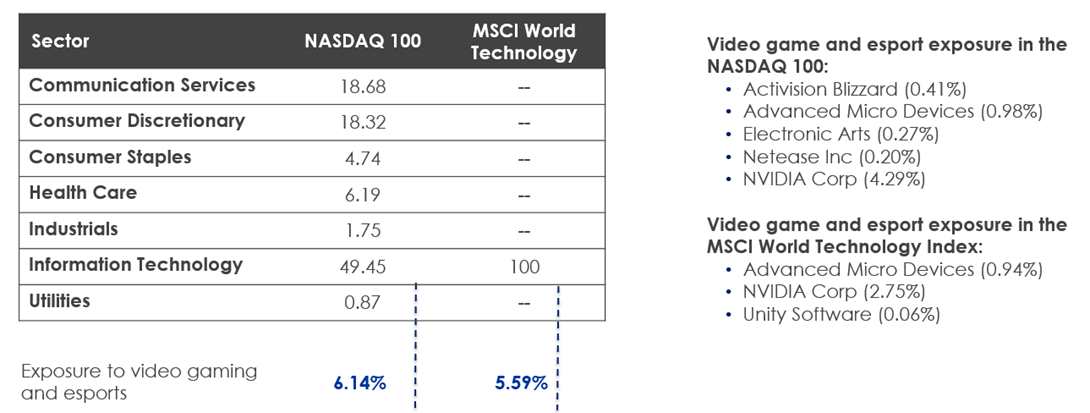

There are now around 3 billion gamers globally[3], which is more than Facebook users, Apple devices and Netflix subscribers. Yet most investors have limited exposure to this sector because esports and video game companies make up only 6.14% of the NASDAQ 100 and only 5.59% of MSCI’s Information Technology sector.

Figure 1: Exposure to video gaming and esports

Source: FactSet, as at 31 October 2021.

This makes the video gaming sector an attractive diversifier to the FAANGM giants, Facebook (now Meta), Amazon, Apple, Netflix, Microsoft and Google owner, Alphabet. While FAANGMs, as they were known, powered the returns of the S&P 500 and NASDAQ in recent years, recent volatility, concerns around corporate performance and the evolving regulatory environment have stoked fears that their momentum could falter.

However, we believe the uptick in video gaming and esports in the wake of COVID-19 shows no signs of slowing. Since we launched ESPO in September 2020 it has returned 22.17% p.a. (to 24 November 2021).

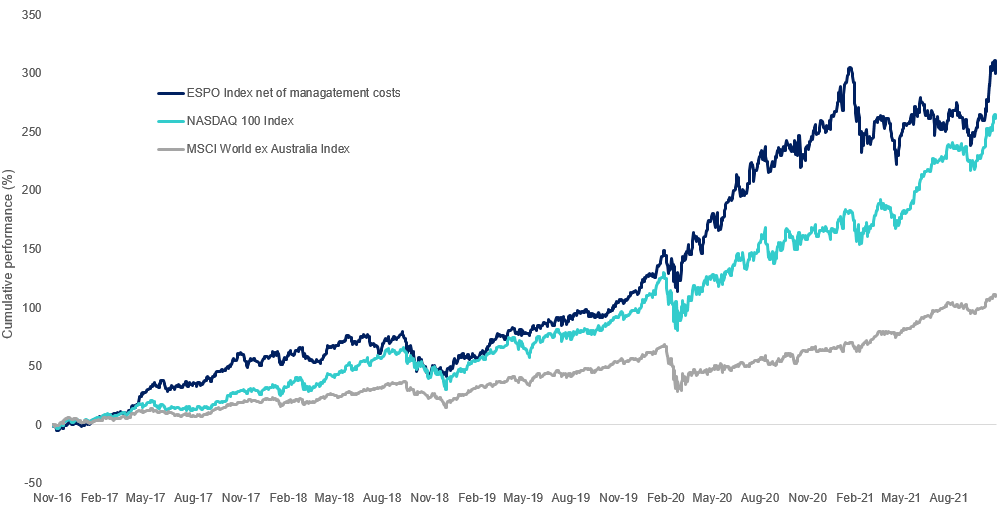

Video game companies have been benefiting from unprecedented growth for a number of years. Based on hypothetical back-testing after fees, the video game sector, as represented by the MVIS Global Video Gaming & eSports Index (ESPO Index net of management cost) has outpaced the broader global equity market and the tech-heavy NASDAQ 100 index over the past five years.

Chart 1: Hypothetical cumulative performance: ESPO Index after fees1vs major global indices

|

1 month (%) |

3 months (%) |

6 months (%) |

YTD (%) |

1 Year (%) |

Since ESPO Inception2(% p.a.) |

3 Years (% p.a.) |

5 Years (% p.a.) |

Since ESPO Index base date3(% p.a.) |

|

|

|

10.30 |

9.06 |

15.38 |

13.77 |

20.14 |

22.17 |

|

|

|

|

ESPO Index (net of management cost)1 |

|

|

|

|

|

|

40.77 |

32.13 |

35.07 |

Chart 1 and Table 2 Source: VanEck, Morningstar, Bloomberg as at 24 November 2021. Past performance is not a reliable indicator of future performance. The comparison in chart 1 to the MSCI World ex Australia Index (“MSCI World ex Aus”) and the NASDAQ 100 is shown for illustrative purposes only, as they are widely recognised benchmarks international and technology benchmarks. ESPO’s index measures the performance of companies involved in video game development, eSports, and related hardware and software globally. ‘Click here for more details’.

1ESPO Index results are net of ESPO’s 0.55% p.a. management costs, calculated daily but do not include brokerage costs or buy/sell spreads of investing in ESPO. You cannot invest in an index.

2ESPO inception date is 8 September 2020 and a copy of the factsheet is here.

3ESPO’s Index base date is 31 December 2014. ESPO Index performance prior to its launch in August 2020 is simulated based on the current index methodology.

VanEck Video Gaming and esports ETF (ASX: ESPO)

ESPO is an Australian first. It offers investors the unique opportunity to invest in the largest pure-play video gaming and esports companies in the world. ESPO tracks the MVIS Global Video Gaming & eSports Index which includes companies which generate at least 50% of their revenues from video gaming and/or esports.

When compared against the NASDAQ 100, ESPO exhibits favourable historical Earnings per Share (EPS) and Sales Growth as well as notably cheaper valuations. The fund’s Price/Earnings (P/E) ratio of about 31 times which is lower than the NASDAQ’s 38 times. It also has a lower Price to Book (P/B). Considering ESPO against the FAANGM, ESPO is cheaper, while also retaining its favourable growth characteristics.

|

Fundamentals |

NASDAQ 100 |

FAANGM's |

ESPO |

|

3Yr EPS Growth (%) |

31.9 |

47.9 |

48.4 |

|

3Yr Sales Growth (%) |

17.3 |

21.5 |

26.3 |

|

Price to Earnings (P/E) (x) |

33.9 |

41.4 |

30 |

|

Price to Book (P/B) (x) |

9.18 |

17.98 |

5.55 |

|

Price to Sales (P/S) (x) |

6.43 |

10.33 |

6.85 |

|

Market Capitalisation (A$m) |

1,487,887 |

2,344,806 |

242,155 |

You can find more dedicated resources on esports - click here.

We also wrote a research paper - click here that is summarised here.

Past performance is no guarantee of future performance. The above is not a recommendation. Please speak to your financial adviser or stock broker.

For further information you can contact us at +61 2 8038 3300.

Key risks

An investment in ESPO carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details. No member of the VanEck group of companies guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.

[1] Newzoo. Global Games Market Report, April 2021. Projected revenues for 2023.

[2] Fortunly, 2020

[3] Newzoo insights 2021

Published: 25 November 2021