New ETF launching soon: Access global carbon markets

The decarbonisation of the world is happening. In 2021, the top three carbon futures markets grew 165% by trading volume and traded US$683 billion futures market value. Growth opportunities exist as more countries move toward carbon markets and the transition to net zero. Learn about this exciting investment opportunity.

The decarbonisation of the world is happening.

In 2021, the top three carbon futures markets grew 165% by trading volume and traded US$683 billion futures market value.

More than 190 countries have committed to the Paris Agreement’s net zero emissions by 2050 and limiting global temperature rises this century to be well below 2 degrees Celsius.

Growth opportunities exist as more countries move toward carbon markets and the transition to net zero, and existing carbon markets continue to evolve in order to incentivise changes in production and consumption patterns toward decarbonisation.

We are pleased to announce that we will soon be launching, subject to ASX and final regulatory approval, a new ETF:

XCO2 - VanEck -Global Carbon Credits ETF (Synthetic)

The rationale for a carbon price and carbon credits: The efficient path to decarbonisation

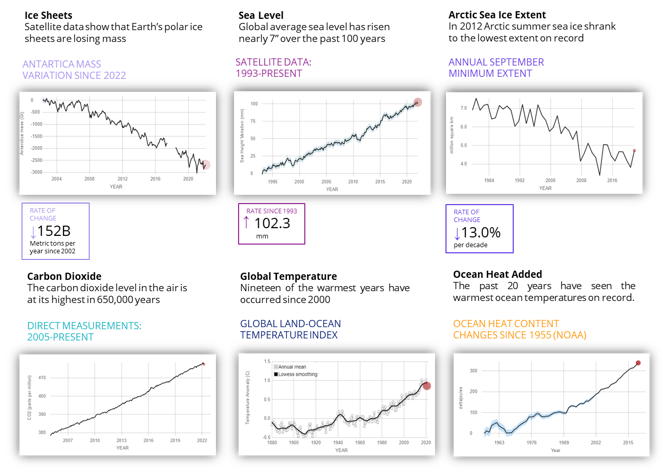

Identified as the most significant challenge of our time, the changing climate is forcing governments around the world to consider their approach to CO2 emissions.

Sources: climate.nasa.gov. [Top LHS] Data source: Ice mass measurement by NASA’s GRACE satellites. Gap represents time between missions. Credit NASA. [Top MIDDLE] Data source: Satellite sea level observations. Credit NASA’s Goddard Space Flight Centre. [Top RHS] Data source: Satellite observations. Credit: NSIDC/NASA. [Bottom LHS] Data source: Monthly measurements (average seasonal cycle removed). Credit NOAA. [Bottom MIDDLE] Data source: NASA’s Goddard Institute for Space Studies (GISS). [Bottom RHS] Data source: Observations from various ocean measurement devices, including conductivity-temperature-depth instruments (CTDs). Argo profiling floats, and eXpendable Bathy Thermographs (XBTs). Credit: NOAA/NCEI World Ocean Database.

According to an ongoing temperature analysis led by scientists at NASA’s Goddard Institute for Space Studies, the average global temperature on Earth has increased by at least 1.1° Celsius (1.9° Fahrenheit) since 1880. The majority of the warming has occurred since 1975, at a rate of roughly 0.15 to 0.20°C per decade.

Forced to act, Governments treaties, summits, negotiations and accords culminated in the Paris Climate Agreement. The Paris agreement aims to hold the rise in global average temperature “well below 2 degrees Celsius above pre-industrial levels and to pursue efforts to limit the temperature increase even further to 1.5 degrees Celsius.”

To achieve this the world needs to de-carbonise.

Economists widely agree that introducing a carbon price is the single most effective way for countries to reduce their emissions.

Carbon pricing threads climate change costs into economic decision-making, incentivising changes in production and consumption patterns toward decarbonisation.

Right now, there are 64 carbon pricing instruments in operation and 22% of the world’s greenhouse gases are covered by a carbon price.

- To meet the 2 degree temperature goal of the Paris Agreement carbon price needs to be US$40 to US$80/tCO2e

- Currently only around 4% of global emissions are covered by a carbon price at and above this range.

- Even higher prices will be needed over the next decade to reach the 1.5C target

In addition to the long-term requirement for the price of CO2 to rise for the world to achieve its temperature goals, there are short term drivers that impact the price of carbon:

- Changes in current and expected future scarcity of allowances;

- Variations in general economic conditions; eg GDP

- Revisions to the rules of the systems (including those governing offsets and market stability mechanisms);

- Interactions with other climate and energy policies.

VanEck is allowing investors the ability to access this opportunity via the VanEck -Global Carbon Credits ETF (Synthetic) (ASX: XCO2).

The ETF is in the final stages of preparation.

Published: 04 October 2022

Important information:

This information is prepared in good faith by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of units in VanEck ETF’s traded on the ASX. Units in XCO2 are not currently available. XCO2 has been registered by ASIC and is subject to ASX and final regulatory approval. The PDS is available at VanEck. The Target Market Determination will be available at vaneck.com.au.

You should consider whether or not any VanEck fund is appropriate for you. Investing in ETF’s has risks, including possible loss of capital invested. See the relevant PDS for details. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.

View Index provider disclaimers. Index providers for VanEck funds do not sponsor, endorse or promote the funds.

© 2022 Van Eck Associates Corporation. All rights reserved.